Fiber Cement Market Size (2024 – 2030)

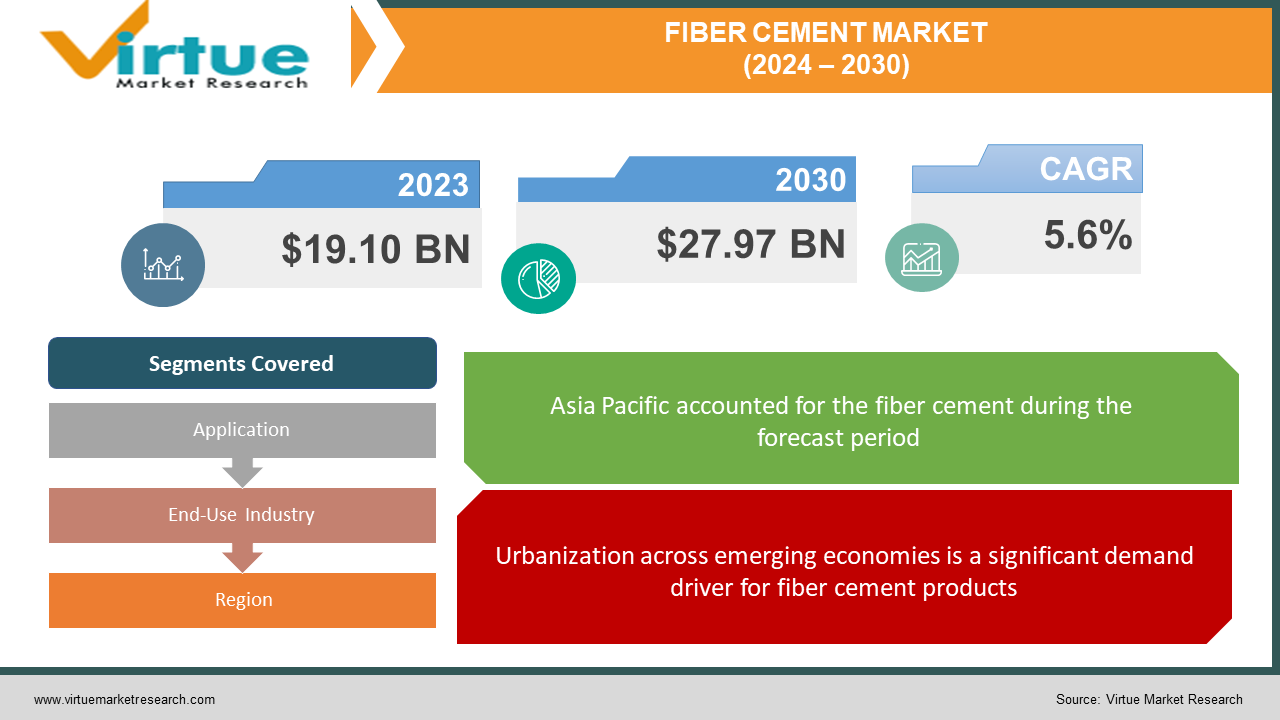

The fiber cement market was valued at USD 19.10 billion in 2023 and is projected to reach a market size of USD 27.97 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.6%.

The global demand for fiber cement is on an upward trajectory, fueled by expanding construction activity and infrastructure modernization initiatives across both developed and emerging economies. Fiber cement refers to a versatile composite building material composed of sand, cellulose pulp, white cement, and specialized additives that improve moisture resistance and durability. Initially invented as a durable, asbestos-free alternative building material, fiber cement usage has expanded considerably beyond exterior siding and roofing applications. Today, manufacturers offer fiber cement solutions for interior floors and walls, under sheathing, exterior fascia, trim exterior ceilings, soffits, fences, and decks. The material delivers an optimal balance of strength, moisture tolerance, fire resistance, and thermal performance—properties that traditional building materials cannot match. The Asia-Pacific region currently dominates the global fiber cement market in terms of volume and revenue share. The large-scale transition towards urbanization occurring in China, India, Indonesia, Malaysia, and other emerging Asian countries is generating massive demand for affordable and sustainable building materials. Investments in smart city projects and transportation infrastructure in these nations are further fueling market growth.

Key Market Insights:

The global fiber cement market has registered impressive growth over the last decade, driven by the material's superior durability, moisture resistance, fire protection abilities, and thermal efficiencies over conventional building materials. Asia-Pacific has emerged as the largest as well as the fastest-growing regional market, accounting for over 55% of global fiber cement demand. The massive scale of construction activity and infrastructure build-out in China and India is fueling widespread adoption throughout residential and non-residential applications. Investments in large-scale urban redevelopment initiatives in other countries like Indonesia, Vietnam, and the Philippines provide additional avenues for growth. North America and Europe are relatively mature markets, witnessing steady adoption rates owing to rising spending on renovation & remodeling projects and stringent regulations promoting sustainable building materials. Fiber cement usage in exterior siding, facades, walls, soffits, and floors is gaining traction across the restoration of aging residential buildings and commercial spaces in these regions. Most commercially available fiber cement uses synthetic fibers such as polypropylene and nylon. However, manufacturers are increasing the adoption of cellulose fiber obtained from wood pulp and other plant sources. Compared to conventional reinforcements, cellulose fiber integration significantly improves tensile strength, moisture regulation, weathering properties, and overall product quality. The rising adoption of fiber cement products, supported by their green credentials and all-weather resilience, is expanding the market. Transitioning demand dynamics across both developed and emerging countries, coupled with a technological shift towards cellulose, presents lucrative prospects for incumbent companies and new entrants alike.

Fiber Cement Market Drivers:

Urbanization across emerging economies is a significant demand driver for fiber cement products.

The rate of urbanization is increasing, particularly in Asia, Africa, and Latin America, which is opening up profitable and long-term potential for the worldwide fiber cement market. By 2050, almost 70% of people on Earth will live in cities, up from 55% now, according to UN estimates. This shift is facilitating significant expenditures in infrastructure related to housing, transportation, healthcare, and education to handle the surge of people moving from rural to urban areas. Leading the charge in this unparalleled urban growth are nations like China, India, Nigeria, Indonesia, Mexico, and Brazil. In these developing economies, government urban development initiatives are concentrated on creating a comprehensive city infrastructure plan that includes housing, transportation, power utilities, IT connectivity, drinking water pipes, sanitation, and metro train networks. For example, India's Smart Cities Mission aims to convert 100 cities into world-class sustainable living environments. Similar urban renewal initiatives are being carried out in Vietnam, Malaysia, Thailand, and the Philippines. Such extensive development and renovation of urban infrastructure will inevitably result in a huge demand for building supplies such as fiber cement, metal, concrete, and finishes. Industry estimates indicate that the total backlog of housing units increases by over 7 million for every 1% increase in urbanization levels in developing nations. In mass housing projects, fiber cement is widely utilized for walls, floors, siding, facades, and interior furnishings, particularly in the inexpensive market. Its advantages over traditional brick, wood, and other external materials include lightweight, safety, weather resilience, and affordability.

The regulatory push and advocacy for this material are fueling growth.

With the global pivot towards sustainability across sectors, governments, corporations, and consumers are actively endorsing building materials with lower carbon footprints and higher renewable attributes. This transition towards green solutions aligns strongly with the eco-friendly credentials of fiber cement, lending a strong growth impetus. Policymakers across Europe and North America have implemented specific regulations, standards, and financial incentives to compel the adoption of recycled, non-toxic building materials within construction projects. These interventionist measures aim to curb emissions from resource-intensive legacy materials like steel, cement, and bricks. Several jurisdictions in Canada, France, and the UK also apply punitive taxes on certain conventional materials to improve the cost-competitiveness of alternatives like fiber cement. Regulatory measures are further supplemented by stricter quality benchmarks around recyclable content, lifecycle performance, and durability thresholds across public and private builds. Successfully meeting these criteria depends significantly on appropriate material selection. The existing and upcoming regulatory mechanisms related to sustainable construction across mature economies are compelling wider adoption of fiber cement substitutes. Backed by focused industry efforts to highlight the solution's green merits, this driver will sustain long-term market growth.

Fiber Cement Market Restraints and Challenges:

Affordability and adoption are the main issues that the market is currently facing.

Despite the superior attributes of fiber cement over conventional building materials, significant logistical and installation costs continue to affect affordability and mainstream adoption potential. Fiber cement products are nearly 30% to 60% lighter than materials like concrete blocks, bricks, or timber. However, the panels, sidings, and planks supplied by manufacturers still represent sizable cargo volumes relative to value, particularly for exports. High fuel, freight, and handling charges involved with transportation via shipping and trucks remain unavoidable, forming a notable share of end-product costs. These logistical expenses are further compounded by the specialized resources needed during on-site installation. Cutting, drilling, and fitting fiber cement elements require specific precision tools to deliver finish quality and minimize damages associated with cracks and blowholes. The overall activity also remains relatively more labor-intensive than legacy materials like wood or plaster, relying heavily on manual application across surfaces. The resultant selling prices eventually prove cost-prohibitive across several developing markets where labor costs are much lower. Additionally, securing financing for wholesale fiber cement adoption within large-scale residential builds also faces budget constraints, especially for affordable housing projects. While sustainability merits receive growing impetus across the construction value chain, the higher upfront costs continue to pose an adoption barrier. Production inconsistencies such as irregular or substandard fiber dispersion, inferior waterproofing, and inadequate curing lead to wide variances in mechanical strength, moisture tolerance, dimensional stability, and visual appeal. In turn, these quality fluctuations result in cracked planks, water seepage, surface deterioration, and other costly repair requirements, diminishing the lifecycle cost advantages central to the category's value proposition. Furthermore, the lack of effective customer support and issue resolution avenues among such manufacturers causes user distrust, especially among those experimenting with fiber cement for the first time. Without assurance of consistent quality and responsive customer service, skepticism surfaces regarding products' reliability and fitness across high-performance applications like exterior walls and flooring. This makes restoring confidence an imperative priority for the broader industry.

Fiber Cement Market Opportunities:

Currently, fiber cement adoption is concentrated largely across developed regions like North America, Europe, and Oceania, which collectively account for over 60% of global demand. However, explosive construction activity across the emerging world's high-growth markets presents substantial expansion potential to augment geographical diversity. Countries like India, Indonesia, Mexico, Brazil, and the Philippines are rolling out unprecedented investments in urban housing and infrastructure upgrades. Additionally, favorable demographics, rising incomes, and easing access to construction financing are further aiding the uptake of industrial building materials. This relatively under-penetrated, high-volume environment offers an immediate revenue stream for global manufacturers to reduce reliance on mature Western economies. The incorporation of cellulose as a key reinforcing input is a potential game-changer, allowing manufacturers to consistently deliver higher quality and durability benchmarks. Compared to synthetic fibers, cellulose integration enhances tensile strength, impact resistance, weatherproofing, and longevity—properties crucial for exterior walls and flooring solutions. Under-penetration across high-growth emerging economies coupled with technology innovation helping to unlock premium applications represents two lucrative prospects for market players to fuel the next wave of industry expansion.

FIBER CEMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

James Hardie Industries, Etex Group, NICHIHA Corporation, SCG, Elementia, Cembrit Holding, Toray Industries, CSR Limited, Plycem |

Fiber Cement Market Segmentation: By Application

-

Siding

-

Roofing

-

Cladding

-

Molding and Trimming

-

Other Applications

Siding is the largest growing application in the fiber cement market. Homeowners and builders appreciate fiber cement siding due to its exceptional durability, mimicking the look of traditional wood without its inherent weaknesses. Fiber cement's resistance to weather, insects, and fire provides long-term protection, while its low-maintenance requirements offer ease for homeowners. Fiber cement moldings and trimmings are the fastest-growing category. These pieces provide transitions and decorative finishes, ensuring a polished look. Their durability and resistance to moisture make them particularly important in areas prone to wet exposure. Innovative uses of fiber cement are constantly emerging. This segment is likely to see the fastest growth in the future.

Fiber Cement Market Segmentation: By End-Use Industry

-

Residential Sector

-

Non-residential Sector

The non-residential sector is the largest growing end-user. This encompasses commercial buildings, offices, industrial facilities, warehouses, schools, hospitals, and other non-residential structures. In this sector, fiber cement is used for siding, cladding, roofing, interior walls, and more. It is valued for its resistance to fire, moisture, and impact damage. The residential sector is the fastest-growing segment. This includes individual houses, apartments, condominiums, and other forms of residential housing. Fiber cement's durability, attractive appearance, and ease of installation make it a popular choice for exterior siding, roofing, trim, and other elements in residential construction. It offers a wide range of styles and textures suited for various home designs, making it a flexible and appealing choice for homeowners. The growth in home improvement and remodeling projects contributes to the sustained demand for fiber cement as a replacement for older or damaged materials.

Fiber Cement Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific represents the largest and fastest-growing regional market for fiber cement, accounting for over 55% of the volume share. China, India, Australia, Thailand, and Indonesia are major demand hubs, supported by large-scale investments in residential & commercial real estate and rapid urbanization rates. Europe constitutes around 15% of the global fiber cement industry presently. France, the UK, Germany, and the Nordic countries are prominent regional markets. Rising adoption is underpinned by stringent EU regulations around sustainability thresholds and lifecycle performance for building materials. North America accounts for just below 30% of the value share, with over 85% of demand concentrated in the United States owing to higher product premiumization. Canada is backed by its sizable investments in new real estate and infrastructure projects. At present, Africa and Latin America constitute relatively smaller markets, limited to largely exterior siding applications and roofing solutions. However, with increasing investments towards affordable mass housing and public infrastructure modernization in countries like Mexico, Brazil, the UAE, Saudi Arabia, and South Africa, substantial room exists for fiber cement adoption to grow exponentially from a low base.

COVID-19 Impact Analysis on the Fiber Cement Market:

The COVID-19 pandemic outbreak and the lockdowns that followed produced supply and demand disruptions never seen in the fiber cement business globally. Manufacturers faced formidable obstacles due to plant closures, shortages of raw materials, a scarcity of main power, and a halt in construction activities. Chinese imports are a major source of vital inputs for the fiber cement industry, including wood pulp, additives, fibers, and silica. When the first viral outbreak in Wuhan forced a total halt to exports and industrial activities, input supplies were severely limited, even as operations in other regions continued. Due to these shortages of raw materials, James Hardie, a significant competitor in the sector, reported a YoY decline in volumes of 10%. In addition, manufacturers were unable to maintain production activity due to mandatory lockdowns implemented worldwide, resulting in capacity utilization rates falling below 30% for over half a year. Challenges related to workforce availability and on-site health issues arose during the restart. Due to the ensuing shortage of supply, fiber cement prices increased by 5% to 8%, and order deliveries were severely delayed. The short-term demand-supply dynamics and financials were severely damaged by the COVID crisis, but the fiber cement sector has proven resilient to outside shocks. Post-pandemic prospects appear promising because they are supported by the underlying long-term factors associated with urbanization and sustainability.

Latest Trends/ Developments:

Conventional fiber cement products use synthetic reinforcements like polypropylene and nylon fibers. However, manufacturers are increasingly adopting cellulose pulp derived from wood and agricultural waste. Compared to traditional fibers, cellulose integration significantly enhances tensile load capacity, moisture regulation, weather resistance, and longevity. Aesthetic flexibility and visual appeal remain crucial determinants for adoption across interior and exterior construction categories. Responding to customer preferences, companies now offer fiber cement planks and sidings with textured surfaces, multi-tonal finishes, and decorative patterns for enhanced visual depth. Manufacturers leverage advanced digital printing techniques for small-batch production of customized textures mimicking materials like wood, metal, granite, etc. This helps builders and homeowners achieve unique architectural styles aligned with their vision. New easy-to-install paneling solutions with interlocking and modular designs also aid in faster application. With global sustainability goals gaining prominence, communication initiatives by manufacturers are centered on quantifying the eco-merits of fiber cement substitutes over conventional materials on parameters like emissions, waste, and circularity across production and usage lifecycles. Investments in LCA studies help derive specific environmental payback periods by demonstrating pollution and energy savings through the adoption of greener building materials. Collaboration with certification agencies also helps position fiber cement's longevity, low maintenance needs, renewability, non-toxicity, fire resistance, and recyclability benefits against popular incumbents.

Key Players:

-

James Hardie Industries

-

Etex Group

-

NICHIHA Corporation

-

SCG

-

Elementia

-

Cembrit Holding

-

Toray Industries

-

CSR Limited

-

Plycem

Chapter 1. Fiber Cement Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fiber Cement Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fiber Cement Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fiber Cement Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fiber Cement Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fiber Cement Market – By End-Use Industry

6.1 Introduction/Key Findings

6.2 Residential Sector

6.3 Non-residential Sector

6.4 Y-O-Y Growth trend Analysis By End-Use Industry

6.5 Absolute $ Opportunity Analysis By End-Use Industry , 2024-2030

Chapter 7. Fiber Cement Market – By Application

7.1 Introduction/Key Findings

7.2 Siding

7.3 Roofing

7.4 Cladding

7.5 Molding and Trimming

7.6 Other Applications

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Fiber Cement Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-Use Industry

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-Use Industry

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-Use Industry

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-Use Industry

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-Use Industry

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Fiber Cement Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 James Hardie Industries

9.2 Etex Group

9.3 NICHIHA Corporation

9.4 SCG

9.5 Elementia

9.6 Cembrit Holding

9.7 Toray Industries

9.8 CSR Limited

9.9 Plycem

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Rapid urbanization and a regulatory push coupled with advocacy are the main market drivers.

Affordability and limited adoption are the main concerns in this market.

James Hardie Industries, Etex Group, NICHIHA Corporation, SCG, Elementia, Cembrit Holding, Toray Industries, CSR Limited, and Plycem are the major players.

Asia-Pacific currently holds the largest market share.

The forecasted period in the fiber cement market is from 2024 to 2030.