GLOBAL FETA CHEESE MARKET (2023 -2030)

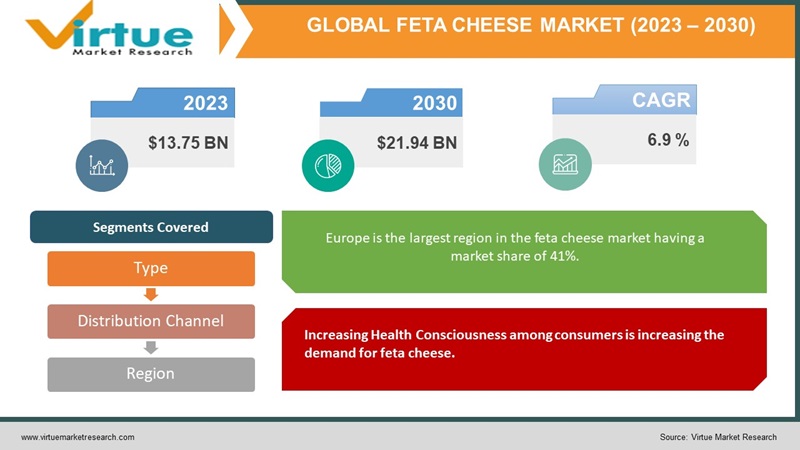

The Global Feta Cheese Market was valued at USD 13.75 Billion in 2023 and is projected to reach a market size of USD 21.94 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.9%.

The feta cheese market has experienced steady growth in recent years, driven by its increasing popularity as a versatile and flavorful dairy product. Favored for its crumbly texture and tangy taste, feta cheese has found its way into a wide range of culinary applications, from salads and sandwiches to Mediterranean and international dishes. Factors such as the rising demand for convenient, ready-to-eat foods, a growing interest in Mediterranean cuisine, and an expanding global food service industry have all contributed to the expansion of the feta cheese market. The increasing consumer focus on health and wellness, as well as the adoption of vegetarian and flexitarian diets, has further fueled the demand for feta cheese as a protein-rich and calcium-packed dairy option. As a result, the feta cheese market is poised for continued growth, with product innovation and diversification playing a significant role in its expansion.

Key Market Insights:

The segment with the most rapid CAGR during the projected period is expected to be sheep milk, primarily due to its superior attributes when compared to cow, goat, and buffalo milk. The increasing preference for sheep milk in the production of high-quality and high-yield cheese is propelling market expansion. Moreover, the utilization of genetically modified sheep to enhance milk production addresses issues like seasonal milking and milk supply shortages, further contributing to market growth.

In 2019, the French Feta cheese was the most popular in terms of both how much it was worth and how much was sold, and it's expected to stay on top in the future. The reason for its success is that it's easy to find in many places. Bulgarian feta is emerging as the fastest-growing feta variety during the forecast period due to its milder flavor and increasing adoption by cheese enthusiasts worldwide.

Another reason why Feta cheese is so popular in the United States is that it's an important part of the Mediterranean diet, which is known for being good for health. The key components of the traditional Greek diet, renowned as one of the healthiest globally, have garnered substantial attention among American consumers for their positive impact on overall well-being.

Feta Cheese Market Drivers:

Increasing Health Consciousness among consumers is increasing the demand for feta cheese.

Growing awareness about the importance of a healthy diet and the nutritional benefits of feta cheese is driving market growth. Feta cheese is a good source of calcium and protein, making it appealing to consumers seeking healthier food options. It also aligns with the preferences of those following vegetarian or flexitarian diets, as it can be a protein-rich meat substitute in various dishes. As health-conscious consumers seek out nutritious and balanced food choices, feta cheese is well-positioned to meet these demands, contributing to market expansion.

With growing ethnic and international food trends globally, the market of feta cheese is poised to grow significantly.

The rising popularity of ethnic and international cuisines, particularly Mediterranean and Middle Eastern dishes, has spurred the demand for feta cheese. Feta is a key ingredient in Greek and Mediterranean cuisine and is increasingly incorporated into various international recipes, including salads, wraps, and pasta. Consumer’s willingness to experiment with different flavors and global cuisines has driven the integration of feta cheese into their daily meals, boosting its market presence. As people seek diverse and authentic culinary experiences, the feta cheese market benefits from this trend.

Feta Cheese Market Restraints and Challenges:

Supply Chain Disruptions and Price Volatility in this market could affect the availability and growth of the feta cheese market.

The feta cheese market heavily relies on a consistent supply of milk, primarily from sheep and goats, and the production of high-quality milk can be affected by various factors such as weather conditions, animal health, and feed availability. Supply chain disruptions, including fluctuations in milk production, transportation challenges, and the impact of climate change on grazing lands, can lead to price volatility and affect the overall availability and cost of feta cheese. These disruptions can make it challenging for manufacturers and retailers to maintain stable prices and meet consumer demand.

Regulatory and Trade Barriers in many regions might slow down the growth of the feta cheese market.

The production and sale of feta cheese are subject to geographical indications and naming rights. Feta cheese, for example, can only be called "feta" if it is produced in specific regions of Greece. This has led to trade disputes and regulatory challenges, as some non-European producers also produce and market feta cheese under the same name. These legal and regulatory barriers can limit market access for producers outside these regions and create uncertainty in international trade. Navigating these regulations and protecting the authenticity of feta cheese can be a persistent challenge for both domestic and international players in the market.

Feta Cheese Market Opportunities:

The feta cheese market presents promising growth opportunities, driven by evolving consumer preferences and dietary trends. Increased consumer awareness of the nutritional benefits of feta cheese, such as its protein and calcium content, aligns with the growing interest in healthier food options. The rising popularity of Mediterranean and global cuisine, as well as the demand for convenient, ready-to-eat products, offers avenues for product innovation and diversification. As consumers continue to explore new flavors and textures in their culinary choices, the feta cheese market can capitalize on these opportunities by developing new product variants, expanding into emerging markets, and promoting its use in a wide range of culinary applications, thereby fostering continued market expansion.

FETA CHEESE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.9% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arla Foods, FAGE, Lactalis Group, Groupe Bel, TheKraftHeinzCompany, Fonterra, DODONI SADAFCO, President Cheese, Cloverleaf Cheese |

Feta Cheese Market Segmentation:

Feta Cheese Market Segmentation: By Type:

-

Traditional Feta Cheese

-

Reduced-Fat Feta Cheese

-

Organic Feta Cheese

-

Plant-Based/Vegan Feta Cheese

The largest segment by type of feta cheese is Traditional Feta Cheese having a market share of 56%. This is primarily because traditional feta cheese has a long-established reputation for its authentic taste and texture, rooted in its centuries-old production methods and cultural significance, especially in Greece. Consumers often prefer the genuine and distinctive flavor of traditional feta cheese over other variants. Traditional feta cheese is the benchmark against which other types are often compared, making it the default choice for many consumers seeking the classic feta experience. While reduced-fat, organic, and plant-based feta cheeses are growing in popularity, the traditional variety remains the dominant choice due to its rich heritage and widely recognized taste. The fastest-growing segment in the feta cheese market is the Plant-Based/Vegan Feta Cheese growing at a CAGR of 21.2%. This growth can be attributed to the increasing demand for dairy-free and vegan alternatives among consumers who are lactose intolerant, follow vegan or vegetarian diets, or simply seek more sustainable and ethical food choices. Plant-based feta cheese offers a close approximation to the taste and texture of traditional feta cheese while catering to these dietary preferences. As awareness of health, environmental, and animal welfare concerns continues to rise, the plant-based feta cheese segment is experiencing robust growth and innovation, making it a prominent driver in the evolving feta cheese market.

Feta Cheese Market Segmentation: By Distribution Channel:

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online Retail

-

Specialty Cheese Shops

-

Others

The largest segment by distribution channel in the feta cheese market is Supermarkets and Hypermarkets having a market share of 56%. This dominance can be attributed to the convenience and accessibility offered by these retail outlets, which have extensive shelf space and reach a broad consumer base. Supermarkets and hypermarkets are favored by consumers for their one-stop shopping experience, providing a wide variety of dairy products, including feta cheese, making it a convenient choice for consumers to purchase their groceries. During the COVID-19 pandemic, consumers leaned towards trusted, established retail channels like supermarkets, contributing to the sustained prominence of this segment in the feta cheese distribution network. The fastest-growing segment in the feta cheese market by distribution channel is Online Retail growing at a rate of 25.6%. This growth is primarily driven by the increasing trend of e-commerce and the convenience it offers to consumers. Online retail provides a convenient and efficient way for consumers to access a wide variety of feta cheese products, especially during the COVID-19 pandemic when there was a surge in online shopping for groceries. The ability to explore and purchase specialty or international feta cheese varieties not readily available in local stores contributes to the popularity of online retail channels. As digital shopping continues to gain traction, the online retail segment is poised for sustained growth in the feta cheese market.

Feta Cheese Market Segmentation: Regional Analysis:

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe is the largest region in the feta cheese market having a market share of 41%. This is primarily due to the historical and cultural significance of feta cheese in Mediterranean and Eastern European cuisines. The demand for feta cheese remains robust in these regions, where it is a staple ingredient in salads, pastries, and other traditional dishes. Additionally, the growth of the European food service industry and exports of feta cheese to various global markets contribute to the prominence of Europe in the feta cheese market. Greece is particularly renowned for its high-quality feta cheese production, and this regional heritage further solidifies Europe's leading position in the market. The fastest-growing region in the feta cheese market is Asia-Pacific anticipated to grow at a CAGR of 24.6%. The growth in this region can be attributed to changing dietary habits, an increasing awareness of international cuisines, and a growing middle-class population with higher disposable incomes. Consumers in Asia-Pacific are increasingly adopting Mediterranean and Western-style diets, incorporating feta cheese into their culinary choices. The rising popularity of healthier food options and the growth of the food service sector in countries like China and India contribute to the expanding market for feta cheese.

COVID-19 Impact Analysis on the Global Feta Cheese Market:

The global feta cheese market, like many other food sectors, experienced both challenges and opportunities due to the COVID-19 pandemic. Initially, the market faced disruptions in the supply chain, including issues with sourcing milk, labor shortages, and transportation constraints. As consumers increasingly cooked at home and sought comfort foods during lockdowns, there was a surge in demand for versatile and long-lasting dairy products like feta cheese. This demand boost, coupled with the rise in e-commerce and home deliveries, allowed feta cheese manufacturers to adapt and cater to changing consumer behaviors. As the pandemic emphasized health and wellness concerns, the protein-rich and calcium-packed attributes of feta cheese gained attention. The market is expected to maintain some of these shifts, with an increased focus on product convenience, health benefits, and e-commerce channels.

Latest Trends/ Developments:

One notable trend in the feta cheese market is the growing popularity of plant-based or vegan feta cheese alternatives. This trend is in line with the broader shift towards plant-based and dairy-free products, driven by concerns about health, environmental sustainability, and animal welfare. Plant-based feta cheese is typically made from ingredients like tofu, nuts, or soy and aims to replicate the taste and texture of traditional dairy-based feta cheese. These alternatives are increasingly appealing to consumers who follow vegetarian, vegan, or flexitarian diets and those with lactose intolerance. Manufacturers are investing in research and development to improve the flavor and texture of plant-based feta, and as consumer demand continues to rise, a wider variety of plant-based feta cheese products are entering the market. This trend reflects a shift in consumer preferences towards more sustainable and ethical food choices and is likely to continue shaping the feta cheese market in the coming years.

A significant development in the feta cheese market is the ongoing effort to protect and enforce geographical indications (GI) for feta cheese. Feta cheese has a long history, and it is closely associated with Greece, where it has been traditionally produced for centuries. In recent years, Greece has made efforts to secure and enforce GI status for feta cheese, which would mean that only cheese produced in specific regions of Greece can be labeled as "feta." This development has led to legal disputes and trade challenges, as non-European countries and producers have also been producing and marketing feta cheese under the same name. The protection of GI status is significant for Greek feta cheese producers as it ensures the authenticity and quality of their product while potentially limiting the market access of non-European producers. This ongoing development reflects the intersection of trade, legal, and cultural factors in the feta cheese market, and it continues to shape the industry's dynamics and market access.

Key Players:

-

Arla Foods

-

FAGE

-

Lactalis Group

-

Groupe Bel

-

The Kraft Heinz Company

-

Fonterra

-

DODONI

-

SADAFCO

-

President Cheese

-

Cloverleaf Cheese

In November 2023, the sale of Fonterra's and Nestlé's Dairy Partners Americas (DPA) Brazil joint venture to the French dairy company Lactalis was successfully concluded. By divesting DPA Brazil, Fonterra aims to concentrate on its New Zealand milk pool, emphasizing its commitment to businesses that align with its core strategic objectives. The DPA Brazil joint venture was held with a 51% ownership by Fonterra and a 49% stake by Nestlé.

Chapter 1. GLOBAL FETA CHEESE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL FETA CHEESE MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL FETA CHEESE MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL FETA CHEESE MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL FETA CHEESE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL FETA CHEESE MARKET – By Type

6.1. Traditional Feta Cheese

6.2. Reduced-Fat Feta Cheese

6.3. Organic Feta Cheese

6.4. Plant-Based/Vegan Feta Cheese

Chapter 7. GLOBAL FETA CHEESE MARKET – By Distribution Channel

7.1. Supermarkets and Hypermarkets

7.2. Convenience Stores

7.3. Online Retail

7.4. Specialty Cheese Shops

7.5. Others

Chapter 8. GLOBAL FETA CHEESE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL FETA CHEESE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Arla Foods

9.2. FAGE

9.3. Lactalis Group

9.4. Groupe Bel

9.5. The Kraft Heinz Company

9.6. Fonterra

9.7. DODONI

9.8. SADAFCO

9.9. President Cheese

9.10. Cloverleaf Cheese

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Feta Cheese Market was valued at USD 13.75 Billion in 2023 and is projected to reach a market size of USD 21.94 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.9%.

Increasing Health Consciousness among consumers and growing ethnic and international food trends are drivers of the Feta Cheese market.

Based on product type, the Global Feta Cheese Market is segmented into Traditional Feta Cheese, Reduced-Fat Feta Cheese, Organic Feta Cheese, and Plant-Based/Vegan Feta Cheese.

Europe is the most dominant region for the Global Feta Cheese Market.

Arla Foods, FAGE, Lactalis Group, Groupe Bel, Kraft Heinz Company, and Fonterra are a few of the key players operating in the Global Feta Cheese Market.