Fertilizers Market Size (2024 – 2030)

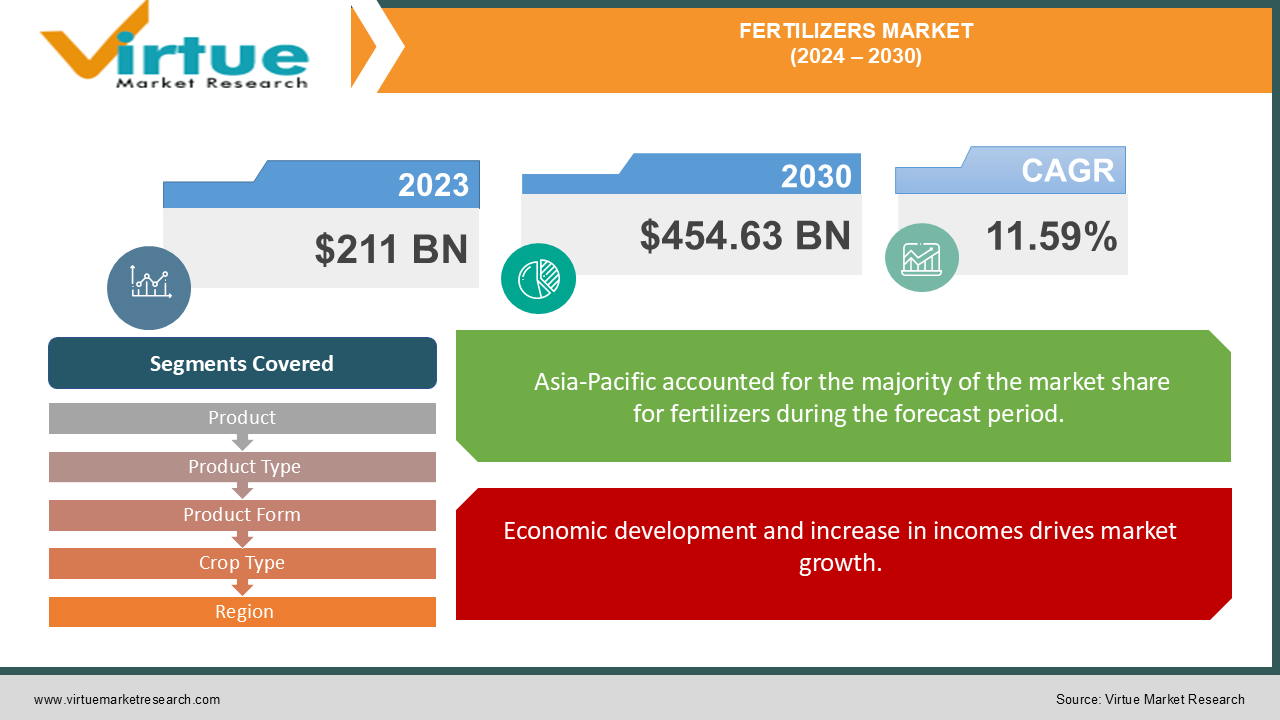

The Fertilizers Market was valued at USD 211 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 454.63 billion by 2030, growing at a CAGR of 11.59%.

Fertilizers are essential in modern agriculture for enhancing soil fertility and increasing crop productivity. With the rising global demand for food, fertilizers provide vital nutrients such as nitrogen, phosphorus, and potassium, which are critical for optimal plant growth. They support farmers in achieving higher yields, addressing the growing food needs, and overcoming environmental challenges. By significantly contributing to sustainable and eco-friendly farming practices, fertilizers play a key role in supporting a growing population and ensuring global food security amid the evolving climatic and demographic challenges faced in contemporary agricultural practices.

Key Market Insights:

Nitrogen-based fertilizers, phosphates, and potash are fundamental products fueling this market, serving diverse crops and soil conditions. Emerging economies with growing agricultural industries play a significant role in the expansion of this market. Nevertheless, environmental issues such as nutrient runoff and greenhouse gas emissions from fertilizer use have prompted a greater emphasis on sustainable and precision agriculture methods. The market is currently experiencing advancements in nutrient formulations and technologies to tackle these challenges. As the agricultural landscape continues to evolve, the market remains a dynamic field, adjusting to the increasing demands of a transforming global environment.

Fertilizers Market Drivers:

Economic development and increase in incomes drives market growth.

Economic development and increasing incomes in emerging markets directly influence fertilizer usage. As these economies expand, living standards rise, resulting in altered dietary preferences and a higher consumption of varied food products. This shift, including increased meat consumption, leads to a greater demand for animal feed, thereby driving the need for fertilizers used in growing feedstock. Additionally, higher incomes allow farmers to invest in advanced agricultural methods, including the use of fertilizers, to boost crop yields and improve produce quality. This economic progress in emerging markets significantly contributes to the expansion of the global fertilizer market.

Fertilizers Market Restraints and Challenges:

Increase in Population restrains market growth.

The global agriculture sector is encountering a range of challenges. According to the United Nations, the world population is projected to surpass nine billion by 2050, placing significant pressure on the agricultural industry. This sector is already grappling with decreased productivity due to labor shortages and the reduction of farmland caused by rapid urbanization. The Food and Agriculture Organization forecasts that by 2050, over 70% of the global population will reside in urban areas. In response to the diminishing availability of arable land, farmers are increasingly relying on fertilizers to boost agricultural production.

Fertilizers Market Opportunities:

Government policies and subsidies create opportunities.

Government policies and subsidies play a crucial role in shaping the fertilizer market. Many nations establish agricultural policies designed to support and incentivize farmers, thereby enhancing agricultural productivity. These policies often include subsidies for fertilizers, making them more affordable and accessible. Additionally, governments may promote certain types of fertilizers to tackle specific agricultural issues or environmental concerns. Conversely, alterations in government policies, such as reductions or eliminations of fertilizer subsidies, can negatively impact the fertilizer market by affecting both demand and profitability. The interaction between government regulations and subsidies influences fertilizer usage and production on both regional and global levels.

FERTILIZERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.59% |

|

Segments Covered |

By Product, Product Type, Product Form, Crop Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Yara International ASA, CF Industries Holdings, Inc., Nutrien Ltd., The Mosaic Company, EuroChem Group AG, K+S Group, Coromandel International Limited, Sinofert Holdings Limited, Haifa Group, Israel Chemicals Ltd. |

Fertilizers Market Segmentation: By Product Type

-

Chemical Fertilizer

-

Biofertilizers

The chemical fertilizer segment is undergoing substantial growth, primarily fueled by the rising global population, which has heightened food demand and compelled farmers to implement advanced agricultural techniques to maximize crop yields. Chemical fertilizers are crucial for enhancing soil fertility and delivering essential nutrients to plants, thereby boosting agricultural productivity. Advances in agricultural technology and precision farming techniques have led to more efficient use of chemical fertilizers. In response to environmental concerns, there has been a shift towards developing eco-friendly and sustainable chemical fertilizers. Manufacturers are now focusing on creating formulations that reduce environmental impact while sustaining agricultural output. Additionally, government support through policies and subsidies has facilitated the widespread use of chemical fertilizers among farmers, further fueling market growth. Efforts to combat climate change and its effects on crop patterns and soil conditions are also driving research and innovation in chemical fertilizers, leading to more climate-resilient solutions in the market.

Fertilizers Market Segmentation: By Product

-

Straight Fertilizers

-

Nitrogenous Fertilizers

-

-

-

-

Urea

-

Calcium Ammonium Nitrate

-

Ammonium Nitrate

-

Ammonium Sulfate

-

Anhydrous Ammonia

-

Others

-

-

Phosphatic Fertilizers

-

Mono-Ammonium Phosphate (MAP)

-

Di-Ammonium Phosphate (DAP)

-

Single Super Phosphate (SSP)

-

Triple Super Phosphate (TSP)

-

Others

-

-

Potash Fertilizers

-

Muriate of Potash (MoP)

-

Sulfate of Potash (SoP)

-

-

Secondary Micronutrient Fertilizers

-

Calcium Fertilizers

-

Magnesium Fertilizers

-

Sulfur Fertilizers

-

-

Micronutrient Fertilizers

-

Zinc

-

Manganese

-

Copper

-

Iron

-

Boron

-

Molybdenum

-

Others

-

-

-

Complex Fertilizers

The straight fertilizers segment is witnessing significant growth, driven by the increasing global population and the resulting surge in food demand, which has intensified pressure on the agricultural sector to boost crop productivity. Straight fertilizers, including nitrogen-based types, deliver essential nutrients directly to the soil, fostering robust plant growth and higher yields. This trend is further supported by the growing adoption of modern agricultural techniques, such as precision farming, which has heightened the demand for straight fertilizers. Additionally, government initiatives and subsidies designed to support agriculture have encouraged the use of straight fertilizers among farmers. The expansion of agricultural land and the cultivation of high-value cash crops are also contributing factors to this growth. Moreover, advancements in fertilizer production technologies and innovations in product formulations have enhanced their effectiveness and attractiveness to farmers. Increased awareness of the role of straight fertilizers in ensuring food security and promoting sustainable agriculture is further driving their adoption.

Fertilizers Market Segmentation: By Product Form

-

Dry

-

Liquid

Dry fertilizers are generally more cost-effective than liquid or organic alternatives, which appeals to farmers seeking greater cost efficiency in their agricultural practices. The growing use of precision agriculture techniques has also increased the demand for dry fertilizers, as these methods require accurate and controlled fertilizer application, and dry formulations provide improved precision in distribution. Furthermore, the rise in conservation tillage practices, which involve applying fertilizers directly to the soil surface, aligns well with the use of dry fertilizers, contributing to their growth. Environmental factors also influence the demand for dry fertilizers, as these formulations typically exhibit lower leaching and volatilization, resulting in a reduced environmental impact.

Fertilizers Market Segmentation: By Crop Type

-

Grains and Cereals

-

Pulses and Oilseeds

-

Fruits and Vegetables

-

Flowers and Ornamentals

-

Others

The grains and cereals segment is witnessing substantial growth, driven by the expanding global population, which has heightened the demand for staple food crops such as grains and cereals. Additionally, evolving dietary patterns and preferences, particularly in emerging markets, are boosting the consumption of these crops. Advancements in agricultural technology have notably improved productivity within the grains and cereals sector. Techniques such as precision farming, genetically modified crops, and enhanced irrigation methods have all contributed to increased yields and improved output. Concurrently, growing awareness of the nutritional benefits of grains and cereals has led to higher consumption, as these crops are rich in essential nutrients and play a crucial role in addressing malnutrition and promoting a healthy diet. Government policies and subsidies supporting the production of grains and cereals have further reinforced the industry's growth.

Fertilizers Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region leads the global fertilizer market and is projected to maintain its dominance throughout the forecast period. The region's growing agricultural practices and the increasing demand for high-quality agricultural produce are expected to drive the expansion of the nitrogenous fertilizers market. Major crops cultivated in Asia include rice, sugar beet, fruits and vegetables, cereals, and grains, with the region consuming 90 percent of the world's rice production. Countries such as Korea, China, Japan, and, more recently, Vietnam are utilizing high rates of nitrogenous fertilizers per hectare for both annual and perennial crops, resulting in a high demand for specialty fertilizers.

North America is the second-largest arable region worldwide, with farms producing a diverse array of crops, primarily focusing on field crops. Key crops in this region include corn, cotton, rice, soybean, and wheat, as reported by the USDA. In 2022, the United States accounted for 46.2% of North America's crop cultivation area. However, the country experienced a notable

decline in crop acreage, largely due to adverse environmental conditions, including severe flooding in areas such as Texas and Houston.

COVID-19 Pandemic: Impact Analysis

The fertilizer industry has faced substantial disruptions globally since the onset of COVID-19. During the initial lockdowns, the sector experienced significant setbacks, including shipment delays due to labor shortages and the temporary closure of several fertilizer plants within integrated chemical complexes. China, being the initial epicenter of the pandemic, was particularly affected in the early stages. However, as conditions in the country have improved, fertilizer production rates have rebounded. Consequently, the overall impact of COVID-19 on the fertilizer industry is now considered moderate. Travel restrictions during the pandemic led to increased stockpiling of fertilizers. Notably, Hubei province in China, a major producer of phosphoric acid and phosphate, played a key role during this period.

Latest Trends/ Developments:

In March 2023, Windfall Bio, an ag-tech company, secured $9 million in seed funding from UNTITLED and Mayfield. The company is developing the first methane-to-organic fertilizer solution, aimed at reducing harmful emissions and providing a sustainable alternative to conventional fertilizers.

In October 2023, Uterra, a prominent agriculture and real estate firm, announced a $20 million investment in Ras Al Khaimah, UAE. The investment includes acquiring a 33,000 m² plot to develop microbiological organic fertilizers aimed at improving crop health in agriculture.

In September 2023, SABIC Agri-Nutrients Company (SABIC AN) partnered with BiOWiSH Technologies and ADM to advance sustainable and cost-effective crop yield improvements. SABIC AN's new biologically-enhanced urea fertilizer, developed with BiOWiSH, is designed to reduce greenhouse gas emissions compared to traditional urea and has the potential to increase atmospheric carbon dioxide sequestration in the soil, promoting a more environmentally friendly agricultural practice.

In December 2022, Bunge Limited committed $550 million to a fully integrated facility for producing soy protein and textured soy protein concentrates. Expected to be operational by mid-2025, this facility aims to meet the growing demand for essential ingredients in pet food and feed products.

Key Players:

These are top 10 players in the Fertilizers Market: -

-

Yara International ASA

-

CF Industries Holdings, Inc.

-

Nutrien Ltd.

-

The Mosaic Company

-

EuroChem Group AG

-

K+S Group

-

Coromandel International Limited

-

Sinofert Holdings Limited

-

Haifa Group

-

Israel Chemicals Ltd.

Chapter 1. Fertilizers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fertilizers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fertilizers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fertilizers Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fertilizers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fertilizers Market – By Product Type

6.1 Introduction/Key Findings

6.2 Chemical Fertilizer

6.3 Biofertilizers

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Fertilizers Market – By Product

7.1 Introduction/Key Findings

7.2 Straight Fertilizers

7.3 Nitrogenous Fertilizers

7.4 Urea

7.5 Calcium Ammonium Nitrate

7.6 Ammonium Nitrate

7.7 Ammonium Sulfate

7.8 Anhydrous Ammonia

7.9 Others

7.10 Phosphatic Fertilizers

7.11 Mono-Ammonium Phosphate (MAP)

7.12 Di-Ammonium Phosphate (DAP)

7.13 Single Super Phosphate (SSP)

7.14 Triple Super Phosphate (TSP)

7.15 Others

7.16 Potash Fertilizers

7.17 Muriate of Potash (MoP)

7.18 Sulfate of Potash (SoP)

7.19 Secondary Micronutrient Fertilizers

7.20 Calcium Fertilizers

7.21 Magnesium Fertilizers

7.22 Sulfur Fertilizers

7.23 Micronutrient Fertilizers

7.24 Zinc

7.25 Manganese

7.26 Copper

7.27 Iron

7.28 Boron

7.29 Molybdenum

7.30 Others

7.31 Complex Fertilizers

7.32 Y-O-Y Growth trend Analysis By End-Use

7.33 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 8. Fertilizers Market – By Product Form

8.1 Introduction/Key Findings

8.2 Dry

8.3 Liquid

8.4 Y-O-Y Growth trend Analysis By Product Form

8.5 Absolute $ Opportunity Analysis By Product Form, 2024-2030

Chapter 9. Fertilizers Market – By Crop Type

9.1 Introduction/Key Findings

9.2 Grains and Cereals

9.3 Pulses and Oilseeds

9.4 Fruits and Vegetables

9.5 Flowers and Ornamentals

9.6 Others

9.7 Y-O-Y Growth trend Analysis By Crop Type

9.8 Absolute $ Opportunity Analysis By Crop Type, 2024-2030

Chapter 10. Fertilizers Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Product

10.1.3 By Product Form

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Product

10.2.4 By Product Form

10.2.5 By Crop Type

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Product

10.3.4 By Product Form

10.3.5 By Crop Type

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Product

10.4.4 By Product Form

10.4.5 By Crop Type

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Product

10.5.4 By Product Form

10.5.5 By Crop Type

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Fertilizers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Yara International ASA

11.2 CF Industries Holdings, Inc.

11.3 Nutrien Ltd.

11.4 The Mosaic Company

11.5 EuroChem Group AG

11.6 K+S Group

11.7 Coromandel International Limited

11.8 Sinofert Holdings Limited

11.9 Haifa Group

11.10 Israel Chemicals Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

As the agricultural landscape continues to evolve, the market remains a dynamic field, adjusting to the increasing demands of a transforming global environment.

The top players operating in the Fertilizers Market are - Yara International ASA, CF Industries Holdings, Inc., Nutrien Ltd.

The fertilizer industry has faced substantial disruptions globally since the onset of COVID-19.

Government policies and subsidies play a crucial role in shaping the fertilizer market. Many nations establish agricultural policies designed to support and incentivize farmers, thereby enhancing agricultural productivity.

North America is the second-largest arable region worldwide, with farms producing a diverse array of crops, primarily focusing on field crops.