Fermented Dairy Ingredients Market Size (2024 – 2030)

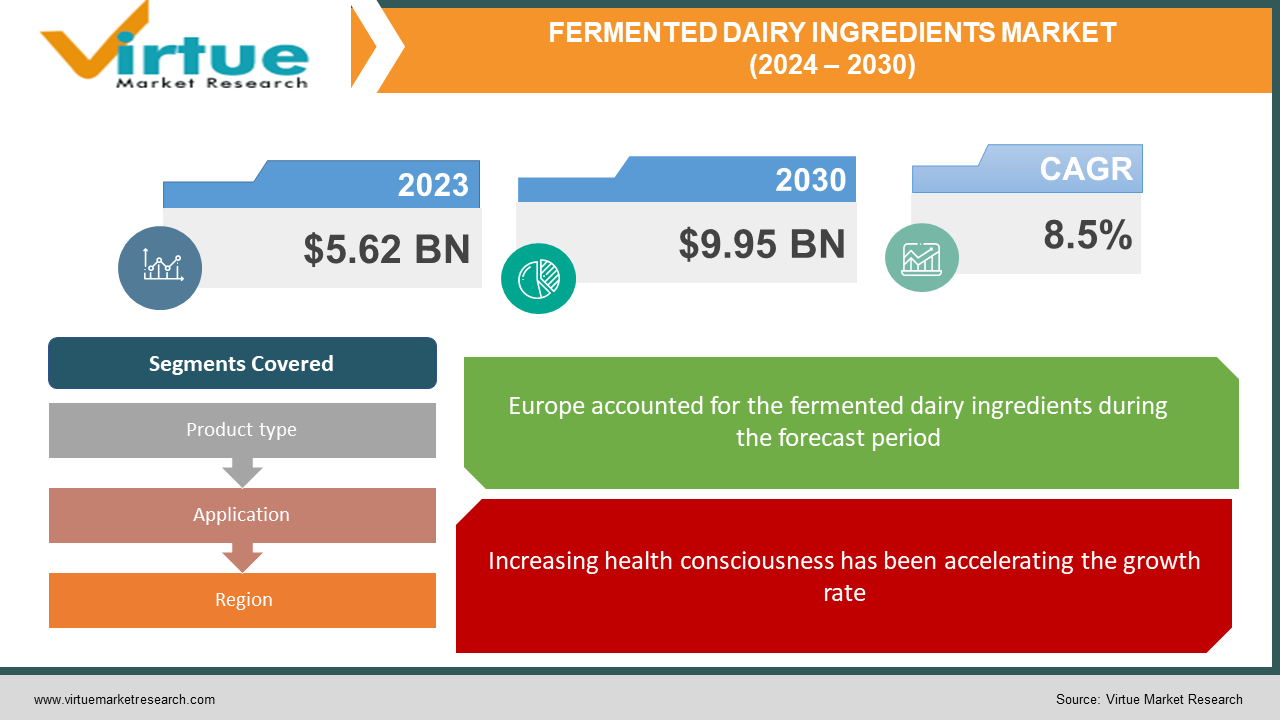

The global fermented dairy ingredients market was valued at USD 5.62 billion and is projected to reach a market size of USD 9.95 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.5%.

Dairy products that have undergone fermentation using lactic acid bacteria like Lactobacillus, Lactococcus, and Leuconostoc are known as fermented dairy products. During fermentation, lactose and other sugars are converted into acids and alcohol by bacteria, yeasts, or other microorganisms. In the past, these products were consumed in many households. However, the number of varieties was limited. Presently, the market has expanded significantly owing to its health benefits and scope. In the future, with a focus on technological innovations and product diversity, notable growth is anticipated.

Key Market Insights:

Probiotic yogurt accounts for 71% of the global market for probiotic products. With an estimated 10.55 million metric tonnes of cheese produced in 2022, the European Union (EU) will hold the top spot in the cheese-producing world. Over 6,000 metric tonnes of curd were exported from India in 2023, according to Statista. On their menus, 25.79% of eateries have sour cream. After infancy, around 65% of the human population has decreased lactose digestion capacity. To tackle this, lactose-free fermented foods like kombucha, miso, sauerkraut, etc. are being commercialized by the companies.

Fermented Dairy Ingredients Market Drivers:

Increasing health consciousness has been accelerating the growth rate.

Probiotics are good bacteria found in fermented dairy products that offer a range of health advantages. Probiotics can restore the balance of the gut's good bacteria, which helps enhance digestion. Secondly, taking probiotics can help protect our immunity. Thirdly, they can help with lactose digestion and thereby improve lactose tolerance. Moreover, pro-inflammatory cytokines can be inhibited by lactic acid. This leads to reduced inflammation. Furthermore, the high potential for antioxidants found in fermented dairy products can aid in the fight against oxidative damage. Apart from this, dairy products that have undergone fermentation are high in phosphorus, calcium, vitamin D, and vitamin K2. Research has indicated that fermented milk products help adults and those suffering from Alzheimer's disease with their cognitive performance.

Rising demand for natural and clean-label products has been enabling the development.

The market for natural and clean-label food items is expanding among customers who value minimal processing, transparency, and authenticity when making food selections. Since fermented dairy products are seen as natural, traditional meals with few additives, they fit in nicely with this trend. Foods that have preservatives and other chemical compounds are known to increase the prevalence of chronic illnesses like diabetes, cancer, and other heart diseases. Producers are satisfying customer demand by offering a variety of fermented dairy products made with immediately recognizable and basic ingredients. The business is expanding as a result.

Fermented Dairy Ingredients Market Restraints and Challenges:

Lactose intolerance, intense competition, and limited shelf life are the main issues that the market is currently facing.

A greater percentage of the population has lactose intolerance. Consuming products that have lactose can cause such individuals to have difficulties with digestion. Additionally, they might have mood swings, headaches, and diarrhea. This condition limits the consumption of fermented products. Secondly, veganism has gained immense popularity. Vegans consume plant-based diets. Plant-based fermented drinks are being promoted to reach a broader population base. This can cause losses for dairy products. Thirdly, fermented products have a short shelf life. As such, people cannot store them for a longer period. Maintaining freshness and quality can be a hurdle.

Fermented Dairy Ingredients Market Opportunities:

Ongoing health and wellness trends have been helping the market. People have become more aware of what they consume. These products are known for enhancing gut health. Gut bacteria are the most beneficial bacteria for the human body. They break down the food, turning it into nutrients that the body can use. Additionally, fermented dairy products have had a rich cultural significance for many centuries, which drives their growth. Secondly, developing plant-based alternatives provides many possibilities. Yogurt and cheese are being made using almond, soy, coconut, & oat milk. Offering these options can attract vegans, increasing revenue. Furthermore, functional ingredients are being added. This includes vitamins, minerals, omega-3 fatty acids, and other essential compounds. They help protect our immune systems. Apart from this, the demand for convenience and options is facilitating progress. Yogurt, cheese, and kefir are some of the popular products that are consumed as snacks. They are fulfilling and have a good nutritional profile. Gym trainers recommend them as pre- and post-workout meals to get more energy.

FERMENTED DAIRY INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Danone, Nestlé, Yakult Honsha Co., Ltd., Lactalis Group, General Mills, Inc., Fonterra Co-operative Group Limited, Kerry Group, Chr. Hansen Holding A/S, Arla Foods, FrieslandCampina |

Fermented Dairy Ingredients Market Segmentation: By Product Type

-

Yogurt

-

Cheese

-

Kefir

-

Sour Cream

-

Buttermilk

Based on product type, cheese is the largest category with the highest market share in 2023. Cheese has a lot of calcium, protein, and lipids that are both mono- and polyunsaturated. Vitamin B12, which is necessary for red blood cell production, DNA synthesis, and neuron function, is also present in it. Cheese is a good source of heart-healthy fats that provide long-lasting energy. Yogurt is the fastest-growing segment. The lactic acid produced during the fermentation of milk by bacteria gives yogurt its sour flavor and texture. Yogurt is a dairy product. The most popular type of milk used to create yogurt is cow's milk. It is a rich source of calcium, protein, and probiotics. Live bacteria, or probiotics, support healthy digestion, inhibit pathogenic microorganisms, and strengthen the immune system. Probiotics may potentially lower the risk of cancer and aid with weight management, according to some studies.

Fermented Dairy Ingredients Market Segmentation: By Application

-

Bakery

-

Dairy

-

Snacks

-

Others

The bakery segment is both the largest and fastest-growing application in 2023. This is because fermented dairy products are commonly used in baked goods, including bread and pastries. Dairy products that have undergone fermentation, including yogurt and buttermilk, contribute moisture, softness, and richness to baked goods, giving them a softer crumb and better texture. The acidity from dairy products that have undergone fermentation controls yeast fermentation and adds to the lighter, airier texture of yeast-raised bread. Bakery goods get richness, depth of flavor, and tang from the use of fermented dairy components. Fermented dairy products add valuable nutrients to baked foods by providing essential ingredients such as probiotics, calcium, vitamins, and protein. Fermented dairy components are in demand in this market sector as consumers look for bakery items with additional health advantages.

Fermented Dairy Ingredients Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe has the largest market share in 2023. Countries like the Netherlands, Germany, Italy, and France are in the lead. Yogurt, cheese, kefir, sour cream, and buttermilk are just a few of the fermented dairy products that European customers may choose from in a vast array of flavors, textures, and combinations. Traditional fermented dairy products are an essential component of everyday meals throughout the area and have their roots in the culinary legacy of Europe. The market for fermented dairy components is consistently driven by consumers' appreciation of the flavor, quality, and authenticity of traditional European dairy products. Growing interest in health and wellness trends in Europe has resulted in a rise in the use of functional foods and ingredients, such as fermented dairy products. Many fermented dairy products have a high probiotic content, which fits with customer expectations for goods that support gut health and general well-being. Asia-Pacific is the fastest-growing market, with countries like China, India, and Japan at the forefront. Rapid urbanization and economic growth in the Asia-Pacific area are changing consumer choices, lifestyles, and eating habits. Convenient, wholesome food options like fermented dairy products are in greater demand as urban populations grow and incomes rise. Customers are becoming more conscious of health and wellness and are looking for meals and substances that have practical health advantages. Due to their probiotic value and advantages for gut health, fermented dairy components are becoming more and more popular among health-conscious customers, which is driving market expansion. Fermented dairy products are more easily accessible and readily available throughout the Asia-Pacific area because of investments made in infrastructure, distribution networks, and retail channels.

COVID-19 Impact Analysis on the Global Fermented Dairy Ingredients Market:

The market had a mixed impact on the viral outbreak. Among the new norms were social isolation, movement restrictions, and lockdowns. This affected supply chain management, logistics, and transportation. Import-export activities suffered as a result. To stop the virus from spreading, all businesses and production facilities had to close. All restaurants and other food service eateries were closed. This resulted in the suspension of production and other activities. Remote work was prioritized to stop the virus from spreading. Because of the economic uncertainty, layoffs were common. A large number of people lost their jobs. The majority of the funds were used for healthcare-related applications. This caused delays in collaborations and launches. A lot of them learned the cruelties that were faced by the animal industry. As per a report by Food Manufacture, 25% of British millennials were inclined towards vegan diets. The number of people who followed veganism expanded during this period. On the other hand, people relied on home cooking. This helped increase the consumption of fermented dairy ingredients. According to a report by Statista, yogurt sales increased by 15% when the coronavirus epidemic struck the United States. The pandemic played a crucial role in highlighting the importance of health. Online retail helped manufacturers raise their profits.

Latest Trends/ Developments:

Customers are starting to place more value on sustainability and ethical sourcing methods. To stand out from the competition and appeal to environmentally concerned consumers, manufacturers are utilizing eco-friendly packaging, cutting carbon emissions, and introducing sustainable sourcing procedures.

Key Players:

-

Danone

-

Nestlé

-

Yakult Honsha Co., Ltd.

-

Lactalis Group

-

General Mills, Inc.

-

Fonterra Co-operative Group Limited

-

Kerry Group

-

Chr. Hansen Holding A/S

-

Arla Foods

-

FrieslandCampina

-

In January 2024, 21st.Bio declared that it would provide ingredient producers with access to its precision fermentation technology platform, therefore increasing the sustainability and competitiveness of dairy protein production. Unlike animal-derived approaches, the platform employs microorganisms to generate proteins, which lowers greenhouse gas emissions and the amount of water and land used.

-

In April 2023, the Plant Power Toolkit, a set of components for fermented plant-based dairy substitutes like yogurt, was introduced by Royal DSM. The goal of the toolkit is to enhance the flavor, texture, and nutritional value of these goods. It comes with four starting cultures and five consumer ideas. The toolkit also seeks to streamline the production of plant-based fermented goods, enabling manufacturers to provide high-quality goods to consumers more quickly.

-

In October 2022, BDF Ingredients launched its newest product, Lyoculture: LC DC413. This culture is helpful when making cream cheese. It's an excellent European recipe. Standardized and homogeneous fermented goods may be achieved by using LyoCulture in fermented dairy products.

Chapter 1. FERMENTED DAIRY INGREDIENTS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. FERMENTED DAIRY INGREDIENTS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. FERMENTED DAIRY INGREDIENTS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. FERMENTED DAIRY INGREDIENTS MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. FERMENTED DAIRY INGREDIENTS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. FERMENTED DAIRY INGREDIENTS MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Yogurt

6.3 Cheese

6.4 Kefir

6.5 Sour Cream

6.6 Buttermilk

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. FERMENTED DAIRY INGREDIENTS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Bakery

7.3 Dairy

7.4 Snacks

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. FERMENTED DAIRY INGREDIENTS MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. FERMENTED DAIRY INGREDIENTS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Danone

9.2 Nestlé

9.3 Yakult Honsha Co., Ltd.

9.4 Lactalis Group

9.5 General Mills, Inc.

9.6 Fonterra Co-operative Group Limited

9.7 Kerry Group

9.8 Chr. Hansen Holding A/S

9.9 Arla Foods

9.10 FrieslandCampina

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global fermented dairy ingredients market was valued at USD 5.62 billion and is projected to reach a market size of USD 9.95 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.5%.

Increasing health consciousness and rising demand for natural & clean-label products are the main factors propelling the global fermented dairy ingredient market.

Based on application, the global fermented dairy ingredient market is segmented into bakery, dairy, snacks, and others.

Europe is the most dominant region for the global fermented dairy ingredient market.

Danone, Nestlé, and Yakult Honsha Co., Ltd. are the key players operating in the global fermented dairy ingredient market.