Feed Anti Caking Agents Market Size (2024 – 2030)

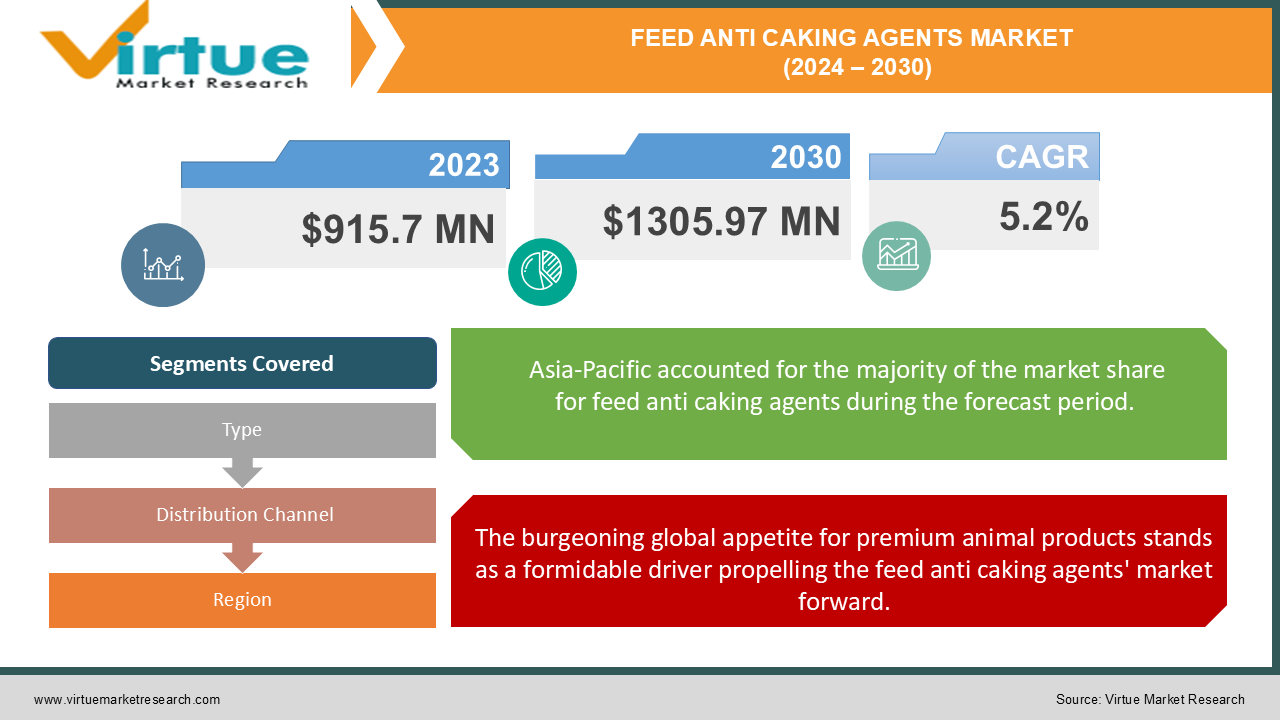

The Global Feed Anti Caking Agents Market was valued at USD 915.7 Million in 2023 and is projected to reach a market size of USD 1305.97 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.2%.

The Feed Anti Caking Agents Market is a dynamic and evolving sector within the animal nutrition industry. These specialized additives play a crucial role in maintaining the quality and flowability of animal feed, ensuring optimal nutrition delivery to livestock and poultry. As the global demand for meat and dairy products continues to rise, the importance of efficient feed management has never been more pronounced. Feed anti caking agents are unsung heroes in the complex world of animal husbandry. They work tirelessly behind the scenes, preventing the clumping and caking of feed ingredients that can lead to reduced nutritional value and increased waste. By maintaining the free-flowing nature of feed materials, these agents facilitate easier handling, storage, and transportation of animal feed products. The market for these essential additives is characterized by a diverse range of products, each tailored to meet specific needs within the feed industry. From natural mineral-based agents to synthetic compounds, the variety of options available to feed manufacturers is extensive. This diversity reflects the complex nature of feed formulations and the varied environmental conditions under which feed must remain stable. Innovation is a driving force in this market, with researchers and manufacturers constantly seeking new formulations that offer improved performance, cost-effectiveness, and environmental sustainability. The push towards natural and organic feed additives has spurred the development of novel anti caking agents derived from plant-based sources, catering to the growing demand for clean-label animal products.

Key Market Insights:

-

Powdered feed formulations accounted for nearly 60% of the total feed anti-caking agent demand.

-

Over 70% of animal feed manufacturers incorporated anti-caking agents in their formulations in 2023.

-

40% of anti-caking agents in 2023 were used in feed additives such as vitamins, minerals, and amino acids.

-

Sodium aluminosilicate contributed to approximately 22% of the market's total revenue in 2023.

-

More than 50,000 metric tons of feed anti-caking agents were utilized in the production of compound feed in 2023.

-

The livestock sector was responsible for 65% of the demand for feed anti-caking agents in 2023.

-

The pet food industry accounted for around 12% of the market's total consumption of anti-caking agents in 2023.

-

Natural anti-caking agents gained 8% market share in 2023 due to the increasing demand for organic feed ingredients.

Feed Anti Caking Agents Market Drivers:

The burgeoning global appetite for premium animal products stands as a formidable driver propelling the feed anti caking agents' market forward.

This trend is deeply rooted in the evolving dietary preferences of an increasingly affluent global middle class, coupled with a growing awareness of the link between animal nutrition and the quality of end products such as meat, milk, and eggs. As consumers become more discerning, they are placing greater emphasis on the nutritional value, taste, and overall quality of animal-derived foods. This shift in consumer behavior has cascaded through the supply chain, placing intense pressure on livestock producers to optimize their animals' diets. Here, feed anti caking agents play a pivotal role by ensuring that carefully formulated feed maintains its integrity and nutritional profile from production to consumption.

The rapid pace of technological innovation in the realm of feed production and storage systems is emerging as a potent catalyst for the feed anti caking agent's market.

The rapid pace of technological innovation in the realm of feed production and storage systems is emerging as a potent catalyst for the feed anti caking agent's market. This driver is fundamentally reshaping the landscape of animal nutrition, creating new opportunities and challenges that are propelling the demand for more sophisticated and effective anti-caking solutions. At the heart of this technological revolution is the advent of precision livestock farming. This approach leverages advanced sensors, data analytics, and automation to optimize every aspect of animal husbandry, including feed management. As feed systems become more precise, the role of anti-caking agents becomes increasingly critical. These additives must perform consistently under a wide range of conditions to ensure that the carefully calibrated nutritional profiles of modern feed formulations are maintained from production to consumption.

Feed Anti Caking Agents Market Restraints and Challenges:

A primary challenge lies in the increasingly stringent regulatory environment surrounding feed additives. Globally, regulatory bodies are tightening controls on the use of synthetic substances in animal feed, driven by concerns over potential residues in food products and environmental impact. This regulatory scrutiny is particularly intense for certain types of anti-caking agents, such as those based on synthetic silica or aluminum compounds. Manufacturers are thus compelled to invest heavily in compliance measures and safety studies, which can significantly impact profit margins and slow the introduction of new products to market. The push towards natural and organic livestock production presents another significant hurdle. As consumer demand for organic meat and dairy products grows, feed producers are seeking alternatives to traditional synthetic anti caking agents. However, natural options often come with their own set of challenges, including higher costs, variable efficacy, and limited availability of raw materials. Balancing the desire for clean-label products with the performance requirements of modern feed systems is an ongoing struggle for the industry. Environmental sustainability is becoming an increasingly pressing concern, casting a shadow over certain aspects of the feed anti caking agent's market. The production of some commonly used agents, particularly those derived from mineral sources, can have significant environmental footprints in terms of resource extraction and energy consumption. As global efforts to combat climate change intensify, the industry faces mounting pressure to develop more sustainable production methods and explore eco-friendly alternatives.

Feed Anti Caking Agents Market Opportunities:

One of the most significant opportunities lies in the development of multi-functional anti caking agents. There is a growing demand for additives that not only prevent caking but also offer additional benefits such as improved palatability, enhanced nutrient absorption, or even probiotic properties. By creating products that serve multiple purposes within feed formulations, manufacturers can differentiate themselves in a competitive market and potentially command premium pricing for these value-added solutions. The trend towards natural and organic livestock production presents a substantial opportunity for innovation in plant-based anti-caking agents. As consumers increasingly seek out organic and clean-label animal products, there's a burgeoning market for anti-caking solutions derived from natural sources such as seaweed extracts, plant fibers, or microbial fermentation products. Companies that can develop effective, cost-competitive natural alternatives to synthetic agents stand to capture a growing segment of environmentally conscious feed producers and organic livestock farmers. Emerging markets in developing countries offer vast potential for market expansion. As livestock production intensifies in regions such as Southeast Asia, Africa, and Latin America, the demand for sophisticated feed additives, including anti caking agents, is set to surge. Companies that can tailor their products to meet the specific needs of these markets – such as heat stability in tropical climates or compatibility with local feed ingredients – can establish strong footholds in these high-growth regions.

FEED ANTI CAKING AGENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Evonik Industries AG, BASF SE, Kao Corporation, PPG Industries, Chemipol SA, Perstorp, Imerys, Huber Engineered Materials, Sweetener Supply Corporation, PQ Corporation, Bentonite Performance Minerals LLC, LignoTech USA, Inc., Clariant, Archer Daniels Midland Company, Agrium Inc. |

Feed Anti Caking Agents Market Segmentation: By Types

-

Calcium compounds

-

Sodium compounds

-

Silicon dioxide

-

Magnesium compounds

-

Aluminium silicate

-

Microcrystalline cellulose

-

Bentonite

-

Vegetable oil-derived products

-

Lignosulfonates

-

Others (including synthetic polymers and starch derivatives)

The segment of vegetable oil-derived anti caking agents is experiencing the most rapid growth within the market. This surge is primarily driven by the increasing demand for natural and sustainable feed additives. Derived from renewable resources such as soybean, palm, or coconut oils, these products align well with the clean-label trend in animal nutrition.

Silicon dioxide remains the most dominant type of anti-caking agent in the feed industry, commanding a significant market share. Its prevalence is attributed to several factors, including its high efficacy, cost-effectiveness, and versatility across various feed types. Silicon dioxide's inert nature makes it compatible with a wide range of feed ingredients without interfering with nutrient absorption.

Feed Anti Caking Agents Market Segmentation: By Distribution Channel

-

Direct sales

-

Distributors

-

Online retailers

-

Specialty feed stores

-

Cooperative purchasing organizations

The online retail channel is experiencing the fastest growth in the distribution of feed anti caking agents. This trend is driven by the increasing digitalization of the agriculture industry and the growing comfort of farm operators with e-commerce platforms. Online retailers offer convenience, competitive pricing, and access to a wide range of products, which is particularly appealing to small and medium-sized livestock operations.

Distributors remain the most dominant channel for the distribution of feed anti caking agents. Their strong position is maintained by their established relationships with feed manufacturers and livestock producers, extensive logistics networks, and ability to offer value-added services.

Feed Anti Caking Agents Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Asia-Pacific has emerged as the dominant region in the feed anti caking agents' market, driven by its massive livestock population and rapidly evolving animal husbandry practices. China and India, in particular, are powerhouses in this region, with their enormous demand for meat and dairy products fueling the need for high-quality animal feed.

While currently holding a smaller market share, Latin America is emerging as the fastest-growing region for feed anti caking agents. This growth is propelled by several factors that are transforming the region's livestock industry. Firstly, there's a rapid modernization of animal production systems across countries like Brazil, Argentina, and Mexico. As these nations position themselves as major global suppliers of meat and dairy products, there's an increasing focus on feed quality and efficiency. This shift is driving the adoption of advanced feed additives, including sophisticated anti caking agents.

COVID-19 Impact Analysis on the Feed Anti Caking Agents Market:

Initially, the pandemic caused significant disruptions in global supply chains. Lockdowns and travel restrictions impeded the movement of raw materials and finished products, leading to shortages and price volatility. Many manufacturers of feed anti caking agents faced challenges in maintaining consistent production schedules, particularly those reliant on international sourcing for key ingredients. This situation highlighted the vulnerability of global supply networks and prompted a re-evaluation of supply chain resilience within the industry. The livestock sector, a primary end-user of feed anti caking agents, experienced varied impacts across different segments. While the demand for poultry and eggs remained relatively stable or even increased in some regions due to their affordability and perceived health benefits, the beef and pork industries faced more significant challenges. The closure of restaurants and food service establishments led to a temporary drop in demand for certain animal products, indirectly affecting the feed additives market. However, the pandemic also accelerated certain trends that have benefited the feed anti caking agent's market. The increased focus on food safety and quality assurance in the wake of the health crisis has heightened awareness of the importance of feed hygiene. This has led to greater emphasis on the role of anti-caking agents in preventing feed spoilage and maintaining nutritional integrity, potentially driving increased adoption rates.

Latest Trends/ Developments:

There's a growing demand for anti-caking agents derived from natural sources. This trend is fueled by consumer concerns about synthetic additives and the push for clean-label animal products. Manufacturers are exploring plant-based alternatives, such as rice hull silica, seaweed extracts, and microbial-derived products, to meet this demand. These natural solutions are not only appealing to organic and premium feed producers but are also gaining traction in conventional feed formulations. The application of nanotechnology in feed anti caking agents is an emerging trend with significant potential. Nanostructured materials offer enhanced surface area and reactivity, potentially providing superior anti caking performance at lower inclusion rates. This could address concerns about additive levels in feed while improving cost-effectiveness. Research is ongoing into nano-silica and other nanoparticle-based anti-caking agents, though regulatory approval and safety assessments remain critical hurdles. The industry is moving towards the development of anti-caking agents that offer additional functional benefits. These hybrid products may combine anti caking properties with other desirable attributes such as mycotoxin binding, improved pellet quality, or enhanced nutrient absorption. This trend aligns with feed manufacturers' desire to streamline formulations and reduce the total number of additives used.

Key Players:

-

Evonik Industries AG

-

BASF SE

-

Kao Corporation

-

PPG Industries

-

Chemipol SA

-

Perstorp

-

Imerys

-

Huber Engineered Materials

-

Sweetener Supply Corporation

-

PQ Corporation

-

Bentonite Performance Minerals LLC

-

LignoTech USA, Inc.

-

Clariant

-

Archer Daniels Midland Company

-

Agrium Inc.

Chapter 1. Feed Anti Caking Agents Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Feed Anti Caking Agents Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Feed Anti Caking Agents Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Feed Anti Caking Agents Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Feed Anti Caking Agents Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Feed Anti Caking Agents Market – By Types

6.1 Introduction/Key Findings

6.2 Calcium compounds

6.3 Sodium compounds

6.4 Silicon dioxide

6.5 Magnesium compounds

6.6 Aluminium silicate

6.7 Microcrystalline cellulose

6.8 Bentonite

6.9 Vegetable oil-derived products

6.10 Lignosulfonates

6.11 Others (including synthetic polymers and starch derivatives)

6.12 Y-O-Y Growth trend Analysis By Types

6.13 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Feed Anti Caking Agents Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct sales

7.3 Distributors

7.4 Online retailers

7.5 Specialty feed stores

7.6 Cooperative purchasing organizations

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Feed Anti Caking Agents Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Feed Anti Caking Agents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Evonik Industries AG

9.2 BASF SE

9.3 Kao Corporation

9.4 PPG Industries

9.5 Chemipol SA

9.6 Perstorp

9.7 Imerys

9.8 Huber Engineered Materials

9.9 Sweetener Supply Corporation

9.10 PQ Corporation

9.11 Bentonite Performance Minerals LLC

9.12 LignoTech USA, Inc.

9.13 Clariant

9.14 Archer Daniels Midland Company

9.15 Agrium Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global population's increasing demand for meat products is driving the expansion of the livestock industry.

Ensuring compliance with stringent food safety regulations, particularly those related to the use of additives in animal feed, can be complex.

Firms like Evonik Industries AG, with its focus on developing sustainable feed additives, and BASF SE, known for its extensive chemical solutions, have carved a significant niche. Other prominent players, such as Kao Corporation and PPG Industries, have diversified their portfolios to include feed additives, addressing a critical need in the animal feed sector. Companies like Chemipol SA, Perstorp, and Imerys have specialized in offering high-performance additives that enhance the flowability of feed.

Asia-Pacific is the most dominant region in the market, accounting for approximately 35% of the total market share.

Latin America is the fastest-growing region in the market.