GLOBAL FEATHER MEAL MARKET (2023 -2030)

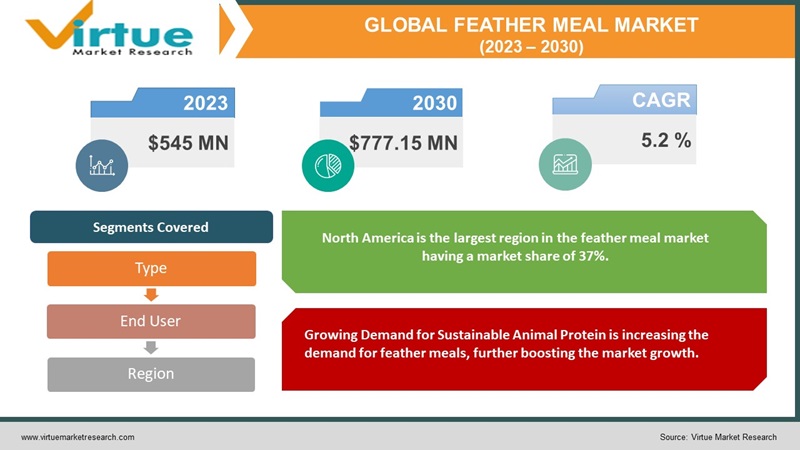

The Global Feather Meal Market was valued at USD 545 Million in 2023 and is projected to reach a market size of USD 777.15 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.2%.

The feather meal market is a niche segment of the animal feed and fertilizer industries, characterized by the processing of poultry feathers into a valuable protein-rich and nitrogen-rich product. Feather meal is a sustainable source of amino acids and can be used as a protein supplement in animal feeds, particularly for livestock and aquaculture. It also serves as an organic fertilizer due to its high nitrogen content. The market is influenced by the growing demand for high-quality animal protein, the increasing adoption of organic farming practices, and the emphasis on sustainable agricultural inputs. Regulatory shifts toward eco-friendly and sustainable agriculture are expected to drive the expansion of the feather meal market, fostering innovations in processing technologies and product applications.

Key Market Insights:

In 2021, Asia boasted the largest poultry population, totaling 2.37 billion birds. This growth has spurred the development of an increasingly organized poultry processing industry to ensure the safety of chicken meat for consumers. Today, modern broiler processing plants can handle anywhere from 200,000 to 1,000,000 birds per day, resulting in the generation of substantial waste materials. Notably, feather meal, an often overlooked protein source in the region, is gaining recognition for its potential to contribute to meeting the global protein demand and reshaping pricing dynamics.

Feather meal fertilizers are now replacing synthetic liquid fertilizers in organic horticultural practices, offering a reliable source of nitrogen to enhance plant growth. This shift towards high-quality feather meal products is particularly favored by growers cultivating organic vegetables, such as corn, which require significant nitrogen inputs. Increasing awareness among farmers about the nutritional advantages of both plant and animal-based fertilizers, as well as their positive impact on soil health through the promotion of earthworms and other microbial activities, is driving the adoption of organic fertilizers. The growing demand for organic farmland is fueling the need for organic fertilizers and feather meal, setting the stage for market expansion in the coming years.

Feather Meal Market Drivers:

Growing Demand for Sustainable Animal Protein is increasing the demand for feather meals, further boosting the market growth.

With the global population on the rise and increasing awareness of the environmental impact of conventional animal agriculture, there is a growing demand for sustainable and alternative protein sources. Feather meal, being a byproduct of the poultry industry, offers a valuable and sustainable source of protein for livestock and aquaculture feeds. As consumers and producers alike seek more eco-friendly and ethical sources of animal protein, the demand for feather meal is likely to increase.

Emphasis on Organic and Sustainable Agriculture is a significant factor in driving the growth of the feather meal market.

There is a growing trend towards organic and sustainable farming practices. Feather meal is considered an organic fertilizer due to its high nitrogen content, making it a sought-after input for organic farming. As regulations and consumer preferences continue to favor organic and sustainable agricultural methods, the feather meal market stands to benefit from this shift in the industry, with increased adoption in both conventional and organic farming systems.

Feather Meal Market Restraints and Challenges:

Regulatory Compliance and Environmental Concerns associated with the making of feather meal might pose problems for this market.

One of the primary challenges is complying with increasingly stringent environmental regulations. The process of rendering poultry feathers into feather meals can release odorous compounds and contribute to environmental pollution if not properly managed. Meeting environmental standards while maintaining cost-effectiveness is a delicate balance that producers must navigate. Stricter regulations can also lead to increased operational costs, potentially affecting the overall profitability of the industry.

Competition and Raw Material Availability can fluctuate the market growth.

The feather meal market faces competition from alternative protein sources and fertilizers. As consumers become more health-conscious, the demand for alternative protein options such as plant-based proteins and sustainable fish feeds grows, potentially reducing the demand for feather meal in animal feeds. Additionally, the availability and cost of raw materials, namely poultry feathers, can be influenced by factors such as poultry production volumes and the poultry industry's economic health. Fluctuations in the availability and cost of feathers can impact the feather meal market's stability and pricing.

Feather Meal Market Opportunities:

The feather meal market presents several promising opportunities. As the world's population continues to grow, the demand for animal protein, especially poultry, remains strong. Feather meal offers a sustainable and protein-rich ingredient for animal feeds, positioning it well to cater to this increasing demand while reducing the environmental footprint of animal agriculture. The rising trend of organic and sustainable farming practices creates opportunities for feather meal as an organic fertilizer. Its nitrogen-rich composition is valuable for enhancing soil fertility without synthetic chemicals. Ongoing research and development efforts are exploring new applications for feather meal in industries like cosmetics, pet food, and biofuel production, expanding its potential market reach. There is room for technological advancements in feather meal production, leading to improved quality, cost-effectiveness, and environmental sustainability, further boosting its market potential.

GLOBAL FEATHER MEAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.2 % |

|

Segments Covered |

By Type, End Use and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

K-Pro U.S., JG Pears, FASA Group, Darling Ingredient, Kleingarn Agrarprodukte |

Feather Meal Market Segmentation:

Feather Meal Market Segmentation: By Type:

-

Conventional

-

Organic

The largest segment by type in the feather meal market is the conventional feather meal having a market share of 84%. This is because conventional feather meal is more widely produced and consumed due to its cost-effectiveness. It is derived from standard poultry processing and offers a protein-rich and nitrogen-rich source for animal feed and fertilizers. While the demand for organic products is growing, the conventional feather meal segment remains dominant as it caters to a broader consumer base and is often more competitively priced, making it the preferred choice for many traditional agricultural and industrial applications. The fastest-growing segment by type in the feather meal market is the Organic feather meal growing at a CAGR of 23.5%. Organic feather meal aligns with the global trend toward eco-friendly and sustainable farming practices, as it serves as a natural and organic source of nitrogen and amino acids for both animal feed and fertilization. Consumers are willing to pay a premium for organic products, driving the adoption of organic feather meal among poultry producers, livestock farmers, and organic crop growers.

Feather Meal Market Segmentation: By End-Use:

-

Animal Feed

-

Organic Fertilizers

-

Biodegradable Plastics

-

Cosmetics and Personal Care

-

Biofuels

-

Others

The largest segment by end-use application in the feather meal market is Animal Feed holding a revenue share of 76%, due to the significant demand for protein-rich ingredients in livestock and poultry feeds. Feather meal, with its high protein content, serves as an economical and sustainable source of essential amino acids for animals, enhancing their growth and health. As the global population continues to grow and the demand for animal protein rises, the use of feather meal in animal feeds remains pivotal in meeting these demands, making it the largest and most essential application segment within the market. The fastest-growing segment by end-use application is Biodegradable Plastics anticipated to grow with a CAGR of 16.4%. This growth is attributed to the increasing global concern about plastic waste and the urgent need for sustainable alternatives. Feather meal's high protein content can be incorporated into biodegradable plastics, improving their environmental sustainability. As governments and consumers alike seek to reduce plastic pollution, the demand for biodegradable plastic materials is on the rise. Feather meal's potential to enhance the biodegradability and sustainability of plastics positions it as a key driver for the rapid growth of this segment.

Feather Meal Market Segmentation:Regional Analysis:

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest region in the feather meal market having a market share of 37%. This prominence is due to the significant presence of the poultry industry, particularly in the United States. The region has a well-established market for feather meal, driven by the large-scale poultry production, creating a substantial source of poultry feathers for rendering. Consumer awareness of sustainable and organic farming practices is high in North America, bolstering the use of feather meal as an organic fertilizer and sustainable protein source in animal feed. The region's robust agricultural and livestock sectors, coupled with the demand for eco-friendly agricultural inputs, contribute to North America's leadership in the feather meal market. The fastest-growing region in the feather meal market is Asia-Pacific growing with a CAGR of 16.7%. This growth is fueled by the region's expanding poultry industry and the rising demand for animal protein. As countries in Asia-Pacific experience increasing urbanization and changing dietary habits, there is a higher demand for poultry products, which, in turn, boosts the need for sustainable and protein-rich animal feeds like feather meal. The focus on organic farming and environmentally friendly agricultural practices is driving the demand for feather meal as an organic fertilizer. The region's substantial population and economic growth make it a key driver of the feather meal market's rapid expansion.

COVID-19 Impact Analysis on the Global Feather Meal Market:

The global feather meal market experienced mixed impacts from the COVID-19 pandemic. While there was a temporary disruption in supply chains and processing facilities due to lockdowns and labor shortages, the essential nature of the food and agriculture sectors mitigated some of the adverse effects. With increasing health awareness, there was a growing interest in sustainable and organic food production, which benefited the feather meal market as an organic fertilizer and protein source. The economic challenges faced by some poultry producers and feed manufacturers may have influenced purchasing decisions, and consumer demand for certain poultry products fluctuated. The long-term impact is a continued shift toward sustainability and organic farming practices, potentially fueling growth in the feather meal market as it aligns with these trends.

Latest Trends/ Developments:

One prominent trend in the feather meal market is the increasing emphasis on sustainable sourcing and eco-friendly production methods. As consumers become more environmentally conscious, there is a growing demand for products that are produced with minimal ecological impact. Feather meal aligns with this trend as it is derived from poultry by-products that would otherwise go to waste, reducing the environmental footprint of poultry production. Manufacturers are exploring eco-friendly rendering processes that minimize waste, energy consumption, and emissions, further enhancing the market's sustainability. Sustainable certifications and labeling are becoming more important, making eco-friendly feather meals a key selling point for producers and a preferred choice for environmentally-conscious consumers.

A notable development in the feather meal market is the expansion of its applications beyond traditional use in animal feed and fertilizers. Researchers and businesses are exploring innovative applications for feather meal, including the development of biodegradable plastics, cosmetics, and biofuels. For example, feather meal can be incorporated into biodegradable plastics, making them more sustainable and reducing the reliance on petroleum-based plastics. Feather meal's high protein content is valuable in cosmetics as a natural and sustainable ingredient. These developments open new avenues for market growth and diversification, reducing the market's dependency on traditional uses and broadening its appeal across various industries.

Key Players:

-

K-Pro U.S.

-

JG Pears

-

FASA Group

-

Darling Ingredients

Kleingarn Agrarprodukte

Chapter 1. GLOBAL FEATHER MEAL MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL FEATHER MEAL MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL FEATHER MEAL MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL FEATHER MEAL MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL FEATHER MEAL MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL FEATHER MEAL MARKET – By Type

6.1. Convectional

6.2. Organic

Chapter 7. GLOBAL FEATHER MEAL MARKET – By End User

7.1. Animal Feed

7.2. Organic Fertilizers

7.3. Biodegradable Plastics

7.4. Cosmetics and Personal Care

7.5. Biofuels

7.6. Others

Chapter 8. GLOBAL FEATHER MEAL MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Type

8.1.3. By End User

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By End User

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By End User

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By End User

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Ret of MEA

8.5.2. By Type

8.5.3. By End User

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL FEATHER MEAL MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. K-Pro U.S.

9.2. JG Pears

9.3. FASA Group

9.4. Darling Ingredients

9.5. Kleingarn Agrarprodukte

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Feather Meal Market was valued at USD 545 Million in 2023 and is projected to reach a market size of USD 777.15 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.2%.

Growing Demand for Sustainable Animal Protein and Emphasis on Organic and Sustainable Agriculture are drivers of the Feather Meal market.

Based on type, the Global Feather Meal Market is segmented into conventional and organic.

North America is the most dominant region for the Global Feather Meal Market.

K-Pro U.S., JG Pears, FASA Group, Darling Ingredients, and Kleingarn Agrarprodukte are a few of the key players operating in the Global Feather Meal Market.