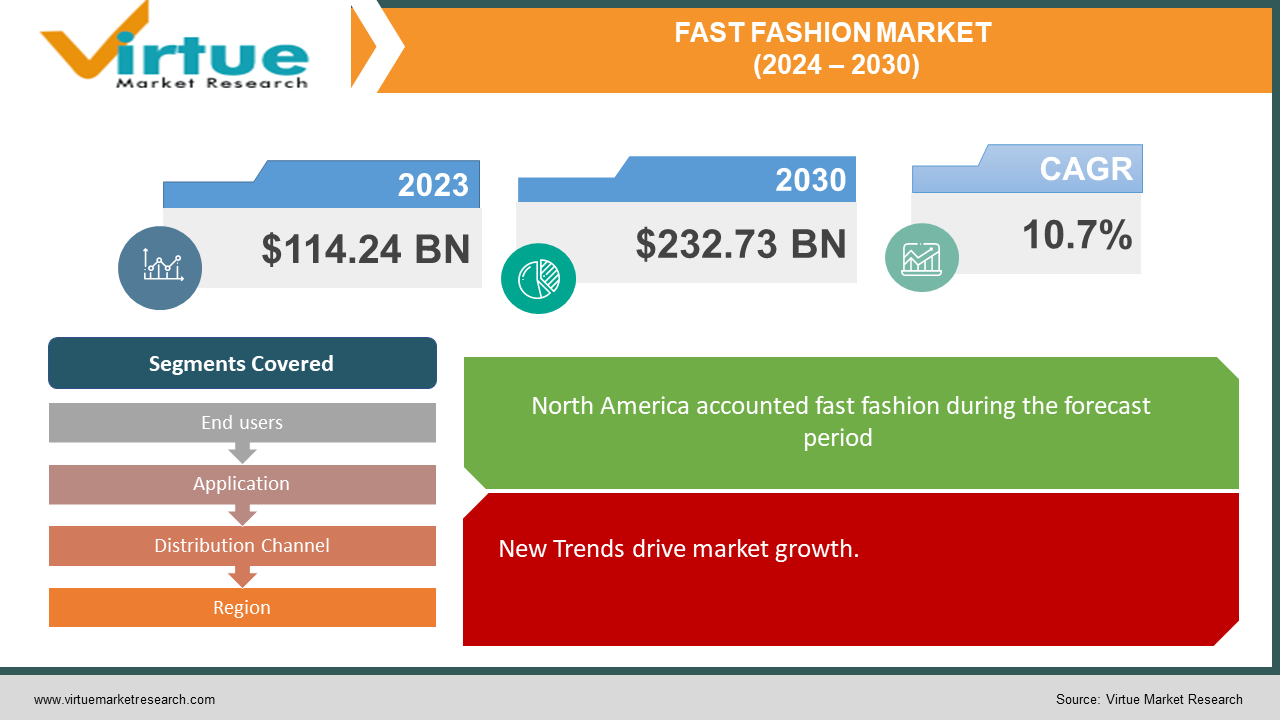

Fast Fashion Market Size (2024 – 2030)

The Fast Fashion Market was valued at USD 114.24 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 232.73 billion by 2030, growing at a CAGR of 10.7%.

Key Market Insights:

Big players in the fast fashion market frequently invest in expanding their physical retail presence, with annual reports highlighting the opening of new stores in key markets and strategic locations, demonstrating a commitment to broadening their customer base. In the last decade the number of such retail outlets have tripled as when compared to that in the early 2000s.

Alongside physical stores, Zara has witnessed a significant surge in online sales in recent years, with e-commerce revenue often showing substantial 20% year-over-year growth in their financial report, 2022, reflecting changing consumer shopping habits and the importance of digital channels in their business strategies.

Fast Fashion Market Drivers:

New Trends drive market growth.

Fast fashion epitomizes a ubiquitous term in contemporary fashion, representing a burgeoning business model that transcends geographical boundaries. The essence of fast fashion lies in its agility within the industry, revolving around the swift conception, production, and dissemination of garments and accessories. Its core mission is to promptly address the evolving desires of consumers and the transient trends pervasive in the fast fashion realm.

Fast fashion brands serve as dynamic entities, akin to lightning bolts, endeavoring to narrow the chasm between haute couture and everyday attire within a remarkably condensed timeframe, a feat previously inconceivable within the conventional fashion cycle. The driving force propelling this phenomenon is affordability, enabling fashionable attire to be within reach for a wide spectrum of consumers.

This affordability hinges upon the judicious utilization of economical materials, labor, and manufacturing techniques, all while vigilantly monitoring the trends emanating from esteemed designers' haute couture collections. It constitutes a captivating interplay between high fashion and cost-effectiveness, with the consumer emerging as the ultimate beneficiary.

For decades, fast fashion has wielded a formidable influence over the fashion landscape, owing to its remarkable adaptability to consumer preferences and its ability to furnish stylish garments at budget-friendly price points.

Fast Fashion Market Restraints and Challenges:

Newly designed clothes hinder market growth.

In contrast to the prevalent culture of overconsumption in modern times, the roots of fast fashion can be found in the period of World War II austerity. This era was defined by a merging of high design principles with utilitarian materials, marking the inception of the fast fashion concept. The foundation of fast fashion's business model rests upon the inherent desire of consumers for fresh clothing options. To cater to this demand, fast fashion brands offer competitively priced garments spanning a diverse array of styles reflective of the latest trends. However, this strategy inadvertently fosters a culture of excess consumption, as consumers are enticed to acquire a multitude of items, contributing to the overarching issue of overconsumption.

Fast Fashion Market Opportunities:

The rapid ascent of the fast fashion market is intricately tied to the evolving demands of consumers seeking the latest trends. At its essence, this demand stems from individuals' inherent desire to exude style, cultural resonance, and relevance. For many, staying abreast of the dynamic fashion landscape is not merely a pursuit but a shared passion, eagerly embracing each new trend as it unfolds. Clothing transcends mere functionality; it serves as a medium for self-expression, allowing individuals to articulate their unique tastes and identities.

In an era dominated by social media, the influence wielded by fashion icons and celebrities has reached unprecedented levels. These influential figures effortlessly showcase their ensembles and distinctive styles, captivating the attention and admiration of countless followers. Consumers, enthralled by the glamor and charisma of these fashion luminaries, aspire to emulate their looks and mirror their fashion sensibilities. This phenomenon significantly drives the demand for clothing items that reflect the attire of these icons.

Fast fashion brands adeptly capitalize on this phenomenon by swiftly producing garments inspired by the outfits adorned by celebrities. Consequently, the burgeoning appetite for trendy attire serves as a potent catalyst, propelling the growth of the fast fashion market to new heights.

FAST FASHION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.7% |

|

Segments Covered |

By End users, Application, distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Forever21 Inc., UNIQLO Co., Asos Plc, The Gap, New Look Retailer Limited, Primark Limited, H&M Hennes & Mauritz AB, Boohoo Group Plc, Industria de Diseño Textil, S.A., Fashion Nova |

Fast Fashion Market Segmentation: By End users

-

Adults

-

Teens

-

kids

The fast fashion market is delineated into distinct segments catering to adults, teenagers, and children. Notably, the adult segment has emerged as the most rapidly expanding sector, primarily driven by the preference of adult consumers for trendier clothing options. Among the trending garments tailored for the 18-24 age group are jeans, t-shirts, jackets, trousers, denim, and various other apparel items.

Consequently, numerous apparel manufacturing entities are directing their efforts towards curating fashion-forward clothing inspired by the latest trends showcased during fashion weeks. The burgeoning demand among adults for distinctive, trendy, and affordable attire serves as a lucrative revenue stream for the fast fashion industry, garnering significant traction across the globe.

Fast Fashion Market Segmentation: By Application

-

Men

-

Women

-

Children

Statistically, women exhibit a greater propensity for compulsive spending compared to men and children, often attributing higher value to the act of shopping. For many women, shopping transcends a mere necessity; it is regarded as a hobby fueled by a profound interest in fast fashion trends. The allure of staying abreast of the latest styles motivates frequent purchases.

Crucially, the shopping experience holds significant importance for women, with the emphasis placed less on cost and more on the enjoyment derived from acquiring new garments. While the expenditure associated with fast fashion clothing may be considerable, it is typically perceived as a worthwhile investment rather than a deterrent.

These dynamics contribute to the burgeoning demand for fast fashion applications within the industry, particularly among women who actively engage with and drive the trends shaping the market.

Fast Fashion Market Segmentation: By distribution Channel

-

Independent Retailer

-

Online Store

-

Brand Store

The fast fashion market statistics are categorized based on distribution channels, including Independent Retailers, online Stores, and brand Stores. Independent Retailers notably held a significant share of the market. Furthermore, the online Stores and brand Stores segments collectively accounted for approximately 35% of the global fast fashion market share.

Various factors have contributed to the exponential growth of online retail as the preferred distribution channel, including the ongoing pandemic, increased sales, growing demand for convenience, and the proliferation of discounts and offers. Fast fashion giants such as H&M, Zara, and Chanel have adopted digital strategies to broaden their consumer base, a trend expected to persist as revenues from online and overall e-commerce continue to surge in the forthcoming years.

Fast Fashion Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

During the forecast period, North America is poised to emerge as the largest fast fashion market, anticipated to command over 40% of the market share by 2023. This growth trajectory in North America is primarily attributed to high levels of disposable income and increased expenditure on fashion apparel among consumers in the region.

Meanwhile, Asia Pacific has historically held the largest market share and is expected to witness the highest compound annual growth rate (CAGR) during the forecast period. The dominance of Asia Pacific in the global fast fashion market is underpinned by several factors. The region boasts a sizable young population characterized by a propensity to embrace new trends and experimentation, driven by their educational background and exposure to technology and media. This demographic backdrop presents a significant opportunity for domestic consumption, characterized by organizational retail, branded behavior, and innovative product designs. As a result, the fast fashion market is anticipated to experience rapid growth in the Asia Pacific region in the near future, offering lucrative prospects for market expansion in the forthcoming years.

COVID-19 Pandemic: Impact Analysis

Lockdowns, restrictions, and factory closures in major manufacturing countries disrupted the global supply chain, leading to delays in production and distribution of fast fashion goods. This resulted in inventory management challenges for retailers and reduced availability of new products. With lockdown measures and social distancing protocols in place, consumers shifted towards remote work and leisurewear, reducing the demand for formal and occasion-based clothing. Fast fashion retailers had to adapt their product offerings to cater to the changing preferences, focusing more on comfortable and versatile pieces.

Overall, the COVID-19 pandemic forced fast fashion retailers to adapt to unprecedented challenges, accelerate digital transformation, and prioritize sustainability in response to evolving consumer behavior and market dynamics.

Latest Trends/ Developments:

-

In March 2022, H&M unveiled a fresh sustainable basics fashion line crafted from recycled materials, with the objective of offering eco-friendly everyday essentials. H&M Group, also known as H & M Hennes & Mauritz AB, is a multinational apparel company headquartered in Sweden, specializing in fast-fashion apparel.

-

As of June 23, 2022, H&M Group had a presence in 75 geographical markets, operating 4,801 stores under various brand names, with a workforce comprising 107,375 full-time equivalent positions.

-

In May 2022, Mango introduced an exclusive collection, Chufy x Mango, designed by Sofia Sanchez de Betak. Sofia, a fashion director, consultant, and the founder of the fashion label "Chufy", has collaborated with Mango for over four years. Additionally, Sofia has featured in various campaigns and notably attended the MET Gala in 2019 adorned in one of Mango's creations, marking the first instance of a Spanish brand's participation in the prestigious fashion event.

-

Furthermore, Mango expanded its offerings in April 2023 by launching its inaugural homeware collection, aiming to complement the lifestyle of its clientele by dressing not only their wardrobes but also their homes. Inspired by Mediterranean lifestyle and culture, this venture embodies the essence of the brand.

Key Players:

These are top 10 players in the Fast Fashion Market: -

-

Forever21 Inc.

-

UNIQLO Co.

-

Asos Plc

-

The Gap

-

New Look Retailer Limited

-

Primark Limited

-

H&M Hennes & Mauritz AB

-

Boohoo Group Plc

-

Industria de Diseño Textil, S.A.

-

Fashion Nova

Chapter 1. Fast Fashion Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fast Fashion Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fast Fashion Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fast Fashion Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fast Fashion Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fast Fashion Market – By end users

6.1 Introduction/Key Findings

6.2 Adults

6.3 Teens

6.4 kids

6.5 Y-O-Y Growth trend Analysis By end users

6.6 Absolute $ Opportunity Analysis By end users, 2024-2030

Chapter 7. Fast Fashion Market – By Application

7.1 Introduction/Key Findings

7.2 Men

7.3 Women

7.4 Children

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Fast Fashion Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Independent Retailer

8.3 Online Store

8.4 Brand Store

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Fast Fashion Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By end users

9.1.3 By Application

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By end users

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By end users

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By end users

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By end users

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Fast Fashion Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Forever21 Inc.

10.2 UNIQLO Co.

10.3 Asos Plc

10.4 The Gap

10.5 New Look Retailer Limited

10.6 Primark Limited

10.7 H&M Hennes & Mauritz AB

10.8 Boohoo Group Plc

10.9 Industria de Diseño Textil, S.A.

10.10 Fashion Nova

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Fast fashion epitomizes a ubiquitous term in contemporary fashion, representing a burgeoning business model that transcends geographical boundaries. The essence of fast fashion lies in its agility within the industry, revolving around the swift conception, production, and dissemination of garments and accessories.

The top players operating in the Fast Fashion Market are - Forever21 Inc., UNIQLO Co., Asos Plc, The Gap, New Look Retailer Limited, Primark Limited, H&M Hennes & Mauritz AB, Boohoo Group Plc, Industria de Diseño Textil, S.A., Fashion Nova.

Consumers, enthralled by the glamor and charisma of these fashion luminaries, aspire to emulate their looks and mirror their fashion sensibilities. This phenomenon significantly drives the demand for clothing items that reflect the attire of these icons.

Asia Pacific has historically held the largest market share and is expected to witness the highest compound annual growth rate (CAGR) during the forecast period. The dominance of Asia Pacific in the global fast fashion market is underpinned by several factors.