Fashion Design and Production Software Market Size (2025 – 2030)

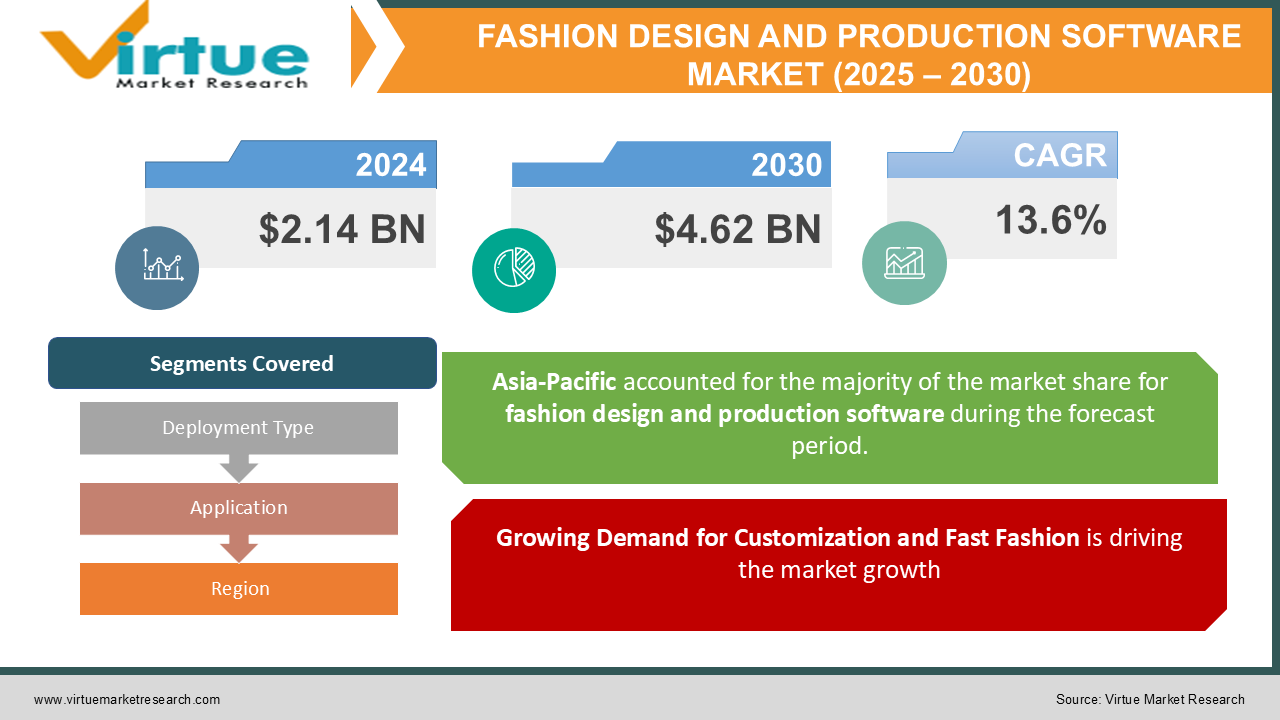

The Global Fashion Design and Production Software Market was valued at USD 2.14 billion in 2024 and is expected to grow to USD 4.62 billion by 2030, registering a CAGR of 13.6% during the forecast period (2025–2030).

This market encompasses software solutions used in designing, prototyping, and managing the production of fashion items such as apparel, footwear, and accessories.

Technological advancements, including AI-driven design tools and cloud-based solutions, are reshaping the fashion industry's workflow. The growing demand for fast fashion, customization, and sustainable production practices is further driving the adoption of these software solutions.

Key Market Insights

-

Cloud-based deployment dominated the market in 2024, accounting for over 55% of the total revenue, driven by scalability and remote accessibility.

-

Apparel design remained the largest application segment, holding more than 40% of the market share, owing to the rising demand for digitization in the fashion industry.

-

The Asia-Pacific region emerged as the largest market, with a 35% share in 2024, supported by growing textile production and increasing adoption of design tools.

Global Fashion Design and Production Software Market Drivers

Growing Demand for Customization and Fast Fashion is driving the market growth

The fashion industry is undergoing a transformation as consumers increasingly demand personalized and trend-responsive designs. This shift has necessitated the adoption of advanced software solutions that streamline the design-to-production process.

Fashion design software enables quick prototyping, virtual fitting, and design optimization, allowing brands to meet fast fashion timelines without compromising quality. Additionally, AI-powered tools analyze consumer preferences, creating personalized experiences that enhance customer satisfaction and brand loyalty.

Rise of Sustainable Fashion Practices is driving the market growth

Sustainability is a growing focus in the fashion industry, driven by environmental concerns and consumer preferences. Advanced design software helps reduce waste through digital prototyping and efficient material usage planning.

Software tools also facilitate transparency in supply chains by tracking raw materials and production processes. Brands leveraging these technologies can adhere to sustainability standards and enhance their market positioning.

Technological Advancements in Design and Production Tools is driving the market growth

The integration of technologies like AI, augmented reality (AR), and 3D modeling has revolutionized the fashion design process. These tools enable designers to create realistic prototypes, perform virtual fittings, and automate repetitive tasks, improving efficiency and creativity.

Cloud-based platforms further enhance collaboration among global teams, making it easier for fashion houses to work on collections in real time. This digital transformation is enabling smaller brands to compete effectively with established players.

Global Fashion Design and Production Software Market Challenges and Restraints

High Initial Investment Costs is restricting the market growth

The adoption of fashion design and production software requires significant upfront investments in software licenses, hardware, and employee training. For small and medium-sized enterprises (SMEs), these costs can be a barrier to adoption.

Although subscription-based models and cloud-based solutions are alleviating cost pressures, the high initial setup costs remain a challenge, particularly in developing regions with limited budgets for technological upgrades.

Lack of Skilled Workforce and Technological Awareness is restricting the market growth

The effective use of advanced software solutions requires skilled professionals who understand both fashion design and technology. However, the availability of such talent is limited, particularly in emerging markets.

Additionally, many traditional fashion houses and SMEs are resistant to adopting digital tools due to a lack of awareness or fear of disrupting established workflows. Overcoming these barriers is crucial for the market to achieve its full potential.

Market Opportunities

The Global Fashion Design and Production Software Market is poised for substantial growth, driven by a confluence of emerging trends and untapped market potential. The rapid urbanization and rising disposable incomes in emerging economies are fueling the adoption of fashion technology, as consumers demand the latest trends and styles. Governments and industry associations in these regions are actively promoting digitization in the textile and apparel sectors, creating a favorable environment for software providers. The integration of augmented and virtual reality (AR/VR) technologies is revolutionizing the fashion industry. Virtual showrooms, AR-based fittings, and interactive consumer experiences are opening up new avenues for software providers to innovate and deliver immersive experiences. By leveraging these technologies, brands can create more engaging customer experiences, reduce physical sample production, and accelerate time-to-market. The increasing prevalence of remote work and global collaborations has spurred the demand for cloud-based collaborative design platforms. These platforms enable designers to work seamlessly across different time zones and locations, sharing and editing designs in real-time. Software providers can capitalize on this trend by offering intuitive, multi-functional platforms that streamline design processes and enhance team collaboration.

FASHION DESIGN AND PRODUCTION SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

13.6% |

|

Segments Covered |

By Deployment Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Adobe Inc., CLO Virtual Fashion Inc., Tukatech Inc., Autodesk Inc., Lectra S.A., Gerber Technology, Optitex (EFI), Browzwear International Ltd., SnapFashun Group, Corel Corporation |

Fashion Design and Production Software Market Segmentation - By Deployment Type

-

On-Premise

-

Cloud-Based

Cloud-based deployment emerged as the dominant delivery model in 2024, driven by its inherent flexibility, cost-efficiency, and support for remote collaboration. This model empowers users to access design software from any device with an internet connection, eliminating the need for local installations and reducing hardware costs. Cloud-based solutions offer seamless scalability, allowing businesses to adjust their computing resources as needed, making them particularly appealing to small and medium-sized enterprises (SMEs). By leveraging cloud infrastructure, SMEs can access powerful design tools without significant upfront investments, enabling them to compete effectively with larger organizations. Furthermore, cloud-based deployment facilitates remote collaboration, enabling designers and teams to work together seamlessly, regardless of their geographic location. This fosters efficient communication, accelerates design processes, and promotes global teamwork. As the fashion industry continues to embrace digital transformation, cloud-based deployment will remain a key driver of innovation, enabling designers to create cutting-edge designs and streamline their workflows.

Fashion Design and Production Software Market Segmentation - By Application

-

Apparel Design

-

Footwear Design

-

Accessories Design

-

Others

The apparel design industry has emerged as a dominant application of advanced design software, driven by the increasing complexity of modern fashion and the need for efficient and innovative design tools. The intricate patterns, diverse fabrics, and ever-evolving trends in the fashion industry demand sophisticated software solutions that can handle the complexities of garment design. These tools empower designers to create innovative and visually appealing designs, while also optimizing production processes and reducing costs. Advanced design software enables designers to experiment with various design elements, such as fabric patterns, color palettes, and silhouettes, to create unique and trendsetting garments. The ability to visualize designs in 3D allows for accurate fit and proportion assessments, minimizing the need for physical prototypes and reducing time-to-market. Moreover, these tools facilitate pattern making and grading, ensuring accurate sizing and fit across different body types. By automating repetitive tasks and streamlining the design process, designers can focus on creative aspects and bring their innovative ideas to life more efficiently. The integration of AI and machine learning technologies further enhances the capabilities of design software, enabling predictive analytics, trend forecasting, and personalized design recommendations. As the fashion industry continues to evolve, the demand for advanced design software will remain strong, driving innovation and shaping the future of apparel design.

Fashion Design and Production Software Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific held the largest market share of 35% in 2024, supported by the region's position as a global hub for textile and apparel production. Countries like China, India, and Bangladesh are leading adopters of fashion technology to enhance production efficiency and quality. Additionally, the rising demand for premium fashion and the growth of e-commerce platforms are accelerating software adoption in the region. Government initiatives promoting Industry 4.0 practices are further driving market growth. North America and Europe are mature markets, characterized by high adoption rates of cloud-based solutions and strong focus on sustainable practices.

COVID-19 Impact Analysis

The COVID-19 pandemic accelerated digital transformation in the fashion industry as remote work and disrupted supply chains necessitated the adoption of cloud-based design and production tools. While the pandemic initially caused a slowdown in production and reduced consumer spending, the post-pandemic recovery has been characterized by increased investments in technology. Virtual fashion shows, digital design platforms, and e-commerce integrations have become the norm, supporting market growth.

Latest Trends/Developments

The fashion industry is undergoing a digital revolution, driven by technological advancements that are reshaping the way designers create, market, and sell their products. AI and machine learning are transforming the design process, enabling faster trend analysis, improved customer personalization, and automated pattern generation. By analyzing vast amounts of data, AI algorithms can identify emerging trends, predict consumer preferences, and generate innovative designs. 3D modeling and prototyping tools are revolutionizing the product development process, allowing designers to create virtual fittings and prototypes, reducing the need for physical samples and accelerating time-to-market. These tools empower designers to visualize and refine designs in a virtual environment, leading to faster and more efficient product development cycles. Sustainability is a growing concern in the fashion industry, and software providers are responding by integrating features to optimize material usage, reduce waste, and ensure compliance with sustainability standards. By leveraging AI and data analytics, designers can make informed decisions about material selection, production processes, and supply chain management, minimizing their environmental impact. Augmented and virtual reality technologies are further transforming the fashion industry, enabling brands to create immersive shopping experiences. Virtual stores and interactive try-on experiences allow customers to visualize products in different settings and on different body types, enhancing the shopping experience and driving sales. Additionally, subscription-based models are making advanced design tools more accessible to small and medium-sized enterprises (SMEs) and startups. By offering affordable, flexible subscription plans, software providers are empowering a wider range of designers to adopt cutting-edge technology and compete in the global fashion market. As the fashion industry continues to evolve, the integration of these technologies will drive innovation, sustainability, and personalized experiences, ultimately shaping the future of fashion.

Key Players

-

Adobe Inc.

-

CLO Virtual Fashion Inc.

-

Tukatech Inc.

-

Autodesk Inc.

-

Lectra S.A.

-

Gerber Technology

-

Optitex (EFI)

-

Browzwear International Ltd.

-

SnapFashun Group

-

Corel Corporation

Chapter 1. Fashion Design and Production Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fashion Design and Production Software Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fashion Design and Production Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fashion Design and Production Software Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fashion Design and Production Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fashion Design and Production Software Market – By Deployment Type

6.1 Introduction/Key Findings

6.2 On-Premise

6.3 Cloud-Based

6.4 Y-O-Y Growth trend Analysis By Deployment Type

6.5 Absolute $ Opportunity Analysis By Deployment Type, 2025-2030

Chapter 7. Fashion Design and Production Software Market – By Application

7.1 Introduction/Key Findings

7.2 Apparel Design

7.3 Footwear Design

7.4 Accessories Design

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Fashion Design and Production Software Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Deployment Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Deployment Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Deployment Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Deployment Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Deployment Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Fashion Design and Production Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Adobe Inc.

9.2 CLO Virtual Fashion Inc.

9.3 Tukatech Inc.

9.4 Autodesk Inc.

9.5 Lectra S.A.

9.6 Gerber Technology

9.7 Optitex (EFI)

9.8 Browzwear International Ltd.

9.9 SnapFashun Group

9.10 Corel Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 2.14 billion in 2024 and is projected to reach USD 4.62 billion by 2030, growing at a CAGR of 13.6%.

Key drivers include growing demand for customization, advancements in design tools, and the rise of sustainable fashion practices.

Segments include Deployment Type (On-Premise, Cloud-Based) and Application (Apparel Design, Footwear Design, Accessories Design).

Asia-Pacific dominates the market, accounting for 35% share in 2024, driven by strong textile production and growing adoption of design software.

Leading players include Adobe Inc., CLO Virtual Fashion Inc., Tukatech Inc., and Autodesk Inc.