Family Entertainment Centers Market Size (2024 – 2030)

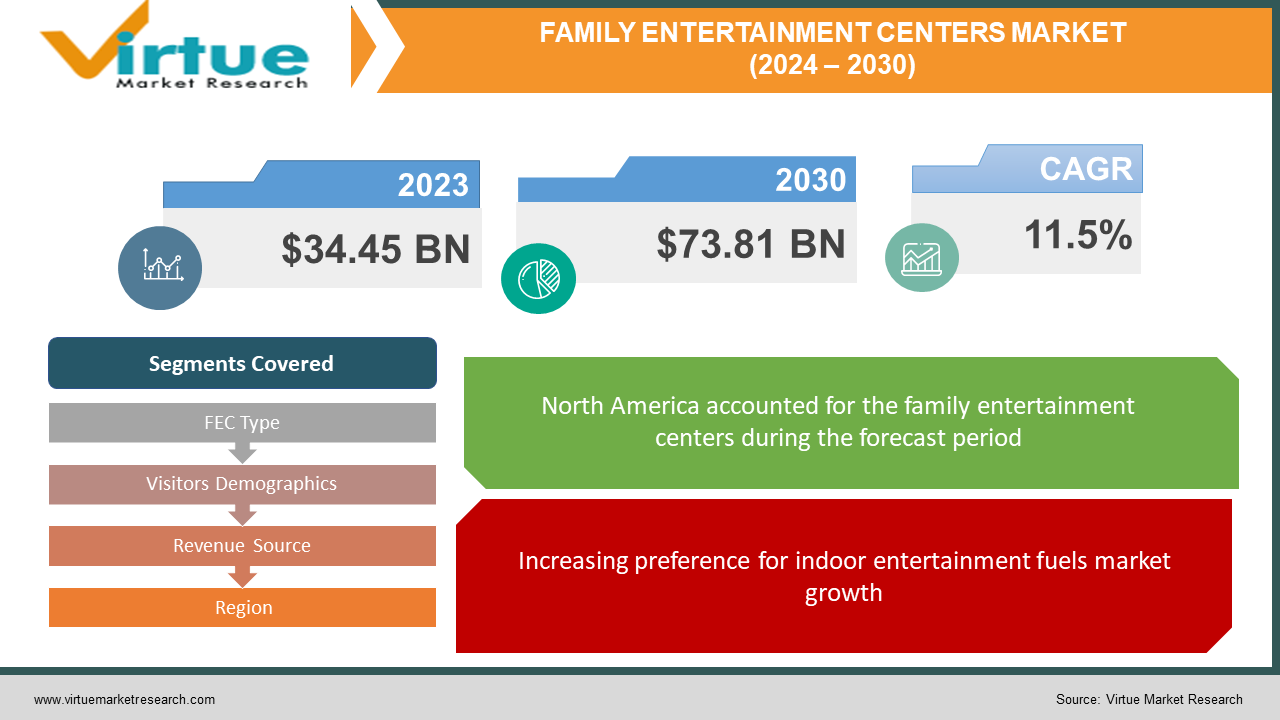

The Family Entertainment Centers Market was valued at USD 34.45 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 73.81 billion by 2030, growing at a CAGR of 11.5%.

A family entertainment center, commonly referred to as an FEC within the entertainment sector, or recognized as an indoor amusement park, family amusement center, family fun center, or simply a fun center, represents a compact amusement facility targeted at families with young children through to teenagers, typically situated indoors. These establishments primarily serve sub-regional segments within larger metropolitan locales. In contrast to expansive amusement parks, FECs maintain a smaller footprint with a reduced number of attractions, offering consumers a comparatively lower per-person per-hour expenditure than traditional amusement parks. While they may not draw significant tourist traffic, FECs sustain themselves through local patronage.

Key Market Insights:

A family indoor entertainment center, known as FEC, is an indoor venue offering diverse activities and attractions suitable for families and individuals across all age groups. These centers typically feature a spectrum of entertainment options including arcade games, mini-golf, laser tag, trampoline parks, bowling, and virtual reality experiences. FECs are purposefully crafted to provide secure and enjoyable environments where families can bond and create enduring memories. They often integrate interactive and immersive encounters, leveraging technologies such as augmented and virtual reality to deliver captivating and thrilling experiences. Additionally, FECs provide a comprehensive entertainment experience by offering a variety of food and beverage choices, ranging from snack stands to full-service restaurants and bars.

Moreover, FECs cater to a broad spectrum of ages and interests, rendering them a favored destination for families, birthday celebrations, corporate gatherings, and social outings. They furnish families with an opportunity to engage in both entertaining and stimulating activities while spending quality time together. Furthermore, the FEC industry remains dynamic, continually introducing new attractions and experiences to align with evolving consumer preferences.

Family Entertainment Centers Market Drivers:

Increasing preference for indoor entertainment fuels market growth.

Families are increasingly favoring indoor entertainment centers as their go-to choice for leisure and entertainment, as opposed to outdoor alternatives. This preference is driven by the desire to ensure that environmental factors and unpredictable weather changes do not impede the enjoyment of customers' recreational experiences. Additionally, companies are capitalizing on this trend by providing a comprehensive range of services, including food and other amenities, within the confines of indoor entertainment centers. This consolidated offering under a single roof serves as a significant incentive for customers to visit FECs. Consequently, this factor is anticipated to fuel the growth of the FEC market region throughout the forecast period.

Family Entertainment Centers Market Restraints and Challenges:

High ticket prices hampering the market growth.

Family Entertainment Centers (FECs) are presently encountering a plateau in income among the middle-class demographic. This stagnation is projected to have a direct impact on consumer expenditure allocated to FECs. Moreover, the constant escalation of ticket prices at entertainment centers, influenced by diverse economic factors, further compounds the issue. Additionally, the variation in ticket prices based on the geographical location of FECs poses another challenge, hindering revenue growth within the FEC market over the forecast period.

Customer retention is becoming a constraint task for family entertainment centers.

Family entertainment centers are grappling with the challenge of attracting repeat visitors, primarily stemming from their inability to swiftly adapt and modify their offerings. The considerable investment required for altering their offerings serves as a major deterrent in this regard. Additionally, FECs face limitations in introducing or updating new rides due to constraints related to land availability and costs. This formidable challenge significantly constrains the long-term revenue growth potential of FECs.

Family Entertainment Centers Market Opportunities:

As Family Entertainment Centers (FECs) continue to integrate new technologies and introduce novel attractions, the associated cost of visiting these establishments has risen. This escalation in expenses could potentially dampen demand, particularly among families operating within constrained budgets. Moreover, the increasing popularity of home and mobile gaming represents a significant restraining factor for the market.

Conversely, the upsurge in investments directed toward developing new games and attractions presents a notable opportunity for the family indoor entertainment center market. FECs that allocate resources towards innovative and captivating attractions stand poised to draw in more visitors and retain their existing customer base. Such investments have the potential to set FECs apart from competitors, offering a distinctive and memorable experience for visitors. Consequently, these strategic investments represent lucrative opportunities for the market in the forthcoming years.

FAMILY ENTERTAINMENT CENTERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.5% |

|

Segments Covered |

By FEC Type, Visitors Demographics, Revenue Source, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dave & Buster’s, Cinergy Entertainment, CEC Entertainment, Inc., KidZania, The Walt Disney Company, Scene 75 Entertainment Centers , Lucky Strike Entertainment , Smash Entertainment Pvt. Ltd., FunCity, LEGOLAND Discovery Center |

Family Entertainment Centers Market Segmentation: By FEC Type

-

Arcade Studios

-

VR Gaming Zones

-

Sports Arcades

-

Others

During the evaluation period, the arcade studios segment is anticipated to emerge as the most appealing segment within the global family entertainment centers market. Meanwhile, VR gaming zones are poised to exhibit a moderate year-on-year growth rate over the forecast duration. Regarding value, the VR gaming zones segment is forecasted to achieve a Compound Annual Growth Rate (CAGR) of 15.9% throughout the assessment period.

Family Entertainment Centers Market Segmentation: By Visitors Demographics

-

Families With Children (0–9)

-

Families With Children (9–12)

-

Teenagers (12–18)

-

Young Adults (18–24)

-

Adults (24+)

The teenagers (aged 12-18) segment currently dominates the market share of family entertainment centers (FECs), primarily due to the diverse array of game offerings available across numerous FECs. However, the segment comprising families with children aged 9 to 12 is projected to experience the highest growth rate over the forecast period. This trend can be attributed to the heightened emphasis placed by families with children in this age group on shaping their offspring's future through a combination of engaging activities, whether they be recreational or educational in nature.

Family Entertainment Centers Market Segmentation: By Revenue Source

-

Entry Fees & Ticket Sales

-

Food & Beverages

-

Merchandising

-

Advertising

-

Others

The entry fees and ticket sales segment currently holds the largest share of the Global Family Entertainment Center Market and is anticipated to maintain its leadership position throughout the forecast period. Nonetheless, the food and beverage segment is poised for significant growth during the same time frame.

Family Entertainment Centers Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America has dominated the family entertainment centers market size and is projected to maintain its prominence throughout the forecast period. This sustained leadership is attributed to the region's abundant presence of industry players and the burgeoning popularity of adventurous games and sports. With a growing number of malls across various cities in North America, consumers often frequent these establishments on weekends, primarily for shopping and dining experiences. The inclusion of entertainment centers within these malls provides an avenue for customers to enjoy quality time with their families and friends, engaging in games and indoor sports.

Consequently, entertainment centers are evolving into favored hangout destinations for families, offering a blend of shopping, dining, and recreational areas. The substantial influx of families to these entertainment centers is expected to positively influence the revenue growth of the market. On the other hand, Asia-Pacific is poised to witness significant growth during the forecast period, driven by the escalating number of malls in countries such as India, China, and other emerging economies.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has expedited the integration of digital technology within the indoor entertainment center market. Numerous businesses have embraced online booking systems, contactless payment methods, and virtual queuing systems to improve the customer experience while complying with social distancing protocols. Furthermore, the pandemic has stimulated innovation in hygiene and sanitation practices, prompting indoor entertainment centers to implement advanced cleaning technologies like UV sterilization and electrostatic spraying.

Latest Trends/ Developments:

-

In April 2022, Cinergy Entertainment Group announced the inauguration of its eighth venue in the U.S., located in Amarillo, Texas. This new establishment boasts a range of attractions, including a ropes course, laser tag, and a virtual reality gaming area. Concurrently, KidZania has been actively expanding its global presence through strategic partnerships and franchise agreements.

-

In February 2022, Cinergy Entertainment Group unveiled a partnership with Grupo Sambil, a prominent shopping mall developer in Venezuela, to establish a new venue in Caracas. Additionally, the company has inked agreements to launch new venues in various countries such as Japan, Thailand, and Saudi Arabia. Meanwhile, Dave and Buster's, Inc. has concentrated on digital initiatives aimed at enriching the customer experience.

-

In March 2022, Cinergy Entertainment Group introduced a cutting-edge mobile app enabling customers to peruse menus, place orders, and settle payments for meals and games directly from their smartphones. The app also incorporates rewards and promotional offers to incentivize repeat patronage. These major market players in the family indoor entertainment center sector have adeptly implemented diverse strategies to adapt to evolving market dynamics and entice customers. These strategies encompass a spectrum of initiatives ranging from digital advancements to global expansion endeavors and innovative attraction offerings.

Key Players:

These are the top 10 players in the Family Entertainment Centers Market: -

-

Dave & Buster’s

-

Cinergy Entertainment

-

CEC Entertainment, Inc.

-

KidZania

-

The Walt Disney Company

-

Scene 75 Entertainment Centers

-

Lucky Strike Entertainment

-

Smash Entertainment Pvt. Ltd.

-

FunCity

-

LEGOLAND Discovery Center

Chapter 1. Family Entertainment Centers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Family Entertainment Centers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Family Entertainment Centers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Family Entertainment Centers Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Family Entertainment Centers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Family Entertainment Centers Market – By FEC Type

6.1 Introduction/Key Findings

6.2 Arcade Studios

6.3 VR Gaming Zones

6.4 Sports Arcades

6.5 Others

6.6 Y-O-Y Growth trend Analysis By FEC Type

6.7 Absolute $ Opportunity Analysis By FEC Type, 2024-2030

Chapter 7. Family Entertainment Centers Market – By Visitors Demographics

7.1 Introduction/Key Findings

7.2 Families With Children (0–9)

7.3 Families With Children (9–12)

7.4 Teenagers (12–18)

7.5 Young Adults (18–24)

7.6 Adults (24+)

7.7 Y-O-Y Growth trend Analysis By Visitors Demographics

7.8 Absolute $ Opportunity Analysis By Visitors Demographics, 2024-2030

Chapter 8. Family Entertainment Centers Market – By Revenue Source

8.1 Introduction/Key Findings

8.2 Entry Fees & Ticket Sales

8.3 Food & Beverages

8.4 Merchandising

8.5 Advertising

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Revenue Source

8.8 Absolute $ Opportunity Analysis By Revenue Source, 2024-2030

Chapter 9. Family Entertainment Centers Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By FEC Type

9.1.3 By Visitors Demographics

9.1.4 By Revenue Source

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By FEC Type

9.2.3 By Visitors Demographics

9.2.4 By Revenue Source

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By FEC Type

9.3.3 By Visitors Demographics

9.3.4 By Revenue Source

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By FEC Type

9.4.3 By Visitors Demographics

9.4.4 By Revenue Source

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By FEC Type

9.5.3 By Visitors Demographics

9.5.4 By Revenue Source

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Family Entertainment Centers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Dave & Buster’s

10.2 Cinergy Entertainment

10.3 CEC Entertainment, Inc.

10.4 KidZania

10.5 The Walt Disney Company

10.6 Scene 75 Entertainment Centers

10.7 Lucky Strike Entertainment

10.8 Smash Entertainment Pvt. Ltd.

10.9 FunCity

10.10 LEGOLAND Discovery Center

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Families are increasingly favoring indoor entertainment centers as their go-to choice for leisure and entertainment, as opposed to outdoor alternatives.

The top players operating in the Family Entertainment Centers Market are - Dave & Buster’s, Cinergy Entertainment, CEC Entertainment, Inc., KidZania, The Walt Disney Company, Scene 75 Entertainment Centers, Lucky Strike Entertainment, Smaaash Entertainment Pvt. Ltd., FunCity, LEGOLAND Discovery Center.

The COVID-19 pandemic has expedited the integration of digital technology within the indoor entertainment center market.

The upsurge in investments directed toward developing new games and attractions presents a notable opportunity for the family indoor entertainment center market. FECs that allocate resources towards innovative and captivating attractions stand poised to draw in more visitors and retain their existing customer base.

Asia-Pacific is poised to witness significant growth during the forecast period, driven by the escalating number of malls in countries such as India, China, and other emerging economies.