Facial Clay Mask Market Size (2025-2030)

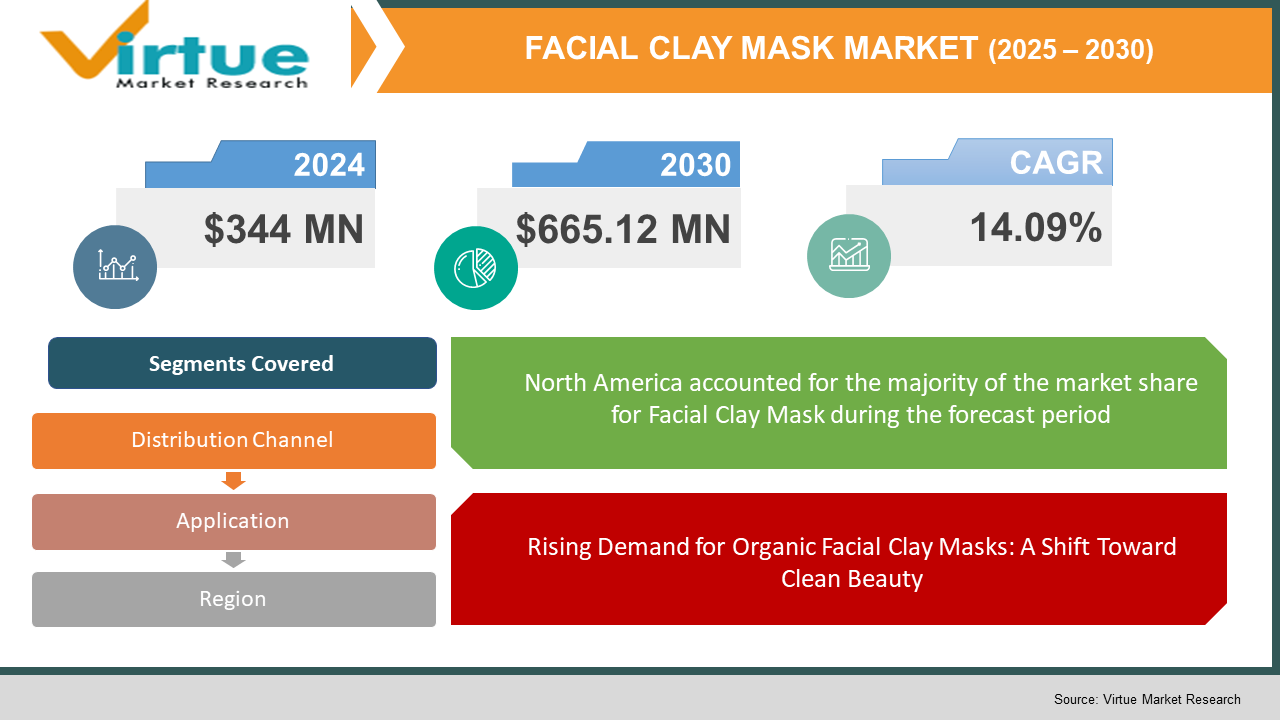

The Facial Clay Mask Market was valued at USD 344 million and is projected to reach a market size of USD 665.12 million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 14.09%.

The facial clay mask market refers to the widely used skincare product that provides increased quality of improved skin by providing nourishment and other health benefits to the skin. In recent years, as the wider public has become more aware of these products, the demand has increased rapidly. There is also the case of an increase in demand for organic products as consumers have become more aware of what they are using and have demanded better quality products. Social media platforms such as TikTok and Instagram have played a significant role in shaping beauty trends, with influencer-driven marketing boosting sales of popular clay mask brands. Product innovation is a major driver in the facial clay mask market. Brands are experimenting with hybrid formulations, such as clay masks infused with hydrating agents like aloe vera, hyaluronic acid, and essential oils, to address concerns about over-drying. The growing interest in natural beauty remedies and Ayurvedic or herbal formulations has further contributed to the market’s expansion, with brands leveraging organic and eco-friendly ingredients to attract health-conscious buyers.

Key Market Insights:

- Consumers are shifting towards organic and clean beauty products, favouring brands that use minimal artificial ingredients and natural extracts. Younger demographics, particularly Millennials and Gen Z, dominate the market and are more inclined toward sustainable, cruelty-free, and eco-friendly skincare options. Moreover, personalization is becoming a major trend, with AI-driven skin care analysis recommending masks tailored to individual skin types.

- A survey revealed that 42% of American women prefer facial masks containing clay, making it the most popular ingredient, followed by apple cider vinegar and probiotics.

- The market in the Asia-Pacific region is expected to grow substantially, driven by increasing urbanization, rising disposable incomes, and a growing beauty-conscious population.

- The facial clay mask market is highly competitive, with established beauty giants such as L'Oréal, The Body Shop, GlamGlow, and Innisfree leading the industry. However, indie brands and clean beauty startups are gaining popularity due to the increasing demand for natural and minimal-ingredient formulas. The influence of Korean beauty (K-beauty) and Japanese beauty (J-beauty) continues to drive innovation, with unique formulations like volcanic clay masks and matcha-infused masks capturing consumer interest.

- The rise of DTC (direct-to-consumer) models and e-commerce platforms is revolutionizing the market. Online marketplaces such as Amazon, Sephora, and specialty skincare websites are driving sales, while subscription-based skincare services are growing in popularity.

Facial Clay Mask Market Drivers:

Rising Demand for Organic Facial Clay Masks: A Shift Toward Clean Beauty

Consumers today are increasingly conscious of the ingredients in their skincare products, leading to a growing demand for organic and natural facial clay masks. This shift is driven by concerns over skin health, ingredient transparency, and ethical sourcing, particularly among Millennials and Gen Z. These younger consumers actively seek products that are free from parabens, sulphates, artificial fragrances, and synthetic chemicals, favouring formulations enriched with botanical extracts, essential oils, and superfoods like turmeric and green tea. Meanwhile, the beauty business is changing to become more environmentally friendly and sustainable. Customers are choosing companies that reduce their carbon footprint by using waterless formulas, refillable containers, and biodegradable packaging as a result of growing environmental consciousness. Nowadays, a lot of businesses sell powdered clay masks that consumers must mix with water at home to cut down on water use and emissions from transportation. Furthermore, manufacturers now prioritize ethical ingredient sourcing, making sure that raw ingredients like bentonite clay and kaolin are farmed using fair-trade and sustainable methods. These trends have been further exacerbated by social media platforms like YouTube, Instagram, and TikTok, where influencers encourage customers to make more sustainable decisions and promote eco-friendly, clean beauty routines.

As disposable incomes in emerging market economies have risen over time, there has been a rise in demand in the facial clay mask market.

The rise in disposable incomes across emerging market economies has significantly contributed to the increasing demand for facial clay masks. As consumers in countries like India, China, Brazil, and Southeast Asian nations experience greater financial stability, they are allocating more of their income to self-care and premium skincare products. With improved purchasing power, more people can afford high-quality, natural, and organic beauty products, shifting from basic skincare to specialized treatments like clay masks that offer detoxification, oil control, and hydration. Additionally, urbanization and changing lifestyles have exposed consumers to global beauty trends, leading them to invest in skincare routines influenced by K-beauty and Western skincare innovations. Another major driver of this growth is the expansion of e-commerce and beauty retail chains in emerging markets, making premium skincare products more accessible than ever. Platforms like Amazon, Nykaa, Tmall, and Shopee have allowed international and local brands to tap into a digitally savvy consumer base eager to explore new skincare solutions.

Facial Clay Mask Market Restraints and Challenges:

There is stiff market challenge from similar facial mask products of different materials such as sheet masks and gel masks, Also, there is difficulty in sourcing the organic material required.

The facial clay mask market faces stiff competition from alternative facial mask products, such as sheet masks, gel masks, peel-off masks, and overnight masks, which offer convenience and cater to different skincare needs. In addition to competitive pressure, the sourcing of organic and sustainable ingredients poses a significant challenge for clay mask manufacturers. High-quality natural clays such as kaolin, bentonite, and rhassoul clay must be ethically sourced to ensure they remain free from contaminants and heavy metals, which adds to production costs. Furthermore, the demand for organic plant-based additives like aloe vera, green tea, and turmeric has surged, leading to supply chain constraints and price volatility.

Facial Clay Mask Market Opportunities:

There is significant potential for expansion into men’s skincare, as more male consumers seek simple yet effective skincare solutions. Brands that cater to this segment with oil-controlling and detoxifying clay masks could see strong growth. Another promising area is the development of waterless, powder-based clay masks, which align with sustainable beauty trends by reducing water consumption and plastic waste.

FACIAL CLAY MASK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

14.09% |

|

Segments Covered |

By APPLICATION, , Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

L'Oréal Paris , Estée Lauder Companies , Procter & Gamble (P&G) , Unilever , Shiseido Company , The Body Shop , Innisfree (Amorepacific Group) , Kiehl’s (L’Oréal Group) , Himalaya Herbals , Fresh (LVMH Group) |

Facial Clay Mask Market Segmentation:

Facial Clay Mask Market Segmentation By Application:

- Personal

- Beauty Salons

- Clinics

The facial clay mask market can be segmented by application into personal use, beauty salons, and clinics, each catering to distinct consumer needs and preferences. The personal use segment dominates the market, driven by the growing trend of at-home skincare routines and the influence of social media beauty trends. Consumers, particularly Millennials and Gen Z, are increasingly investing in self-care products, including clay masks, as part of their weekly skincare rituals.

Beyond personal use, beauty salons and skincare clinics represent a growing market for facial clay masks as professional skincare treatments become more sought after. Salons use clay masks as part of facials and deep cleansing treatments, catering to clients looking for instant skin rejuvenation and detoxification. Meanwhile, dermatology clinics and medspas integrate clay masks into specialized treatments for acne, pore refinement, and post-procedure skin soothing. These professional settings often prefer medical-grade or dermatologist-approved formulations, which contain higher concentrations of active ingredients and are marketed as premium skincare solutions.

Facial Clay Mask Market Segmentation: By Distribution Channel

- Specialty Stores

- Supermarkets

- Online

Specialty stores like Sephora, Ulta Beauty, and boutique skincare retailers are key players in the market, providing a carefully selected range of premium and niche skincare brands. These outlets appeal to skincare enthusiasts and beauty-conscious shoppers who value the opportunity to try products before making a purchase.

Supermarkets and hypermarkets provide a convenient and affordable option for consumers looking for readily available clay masks from mass-market and drugstore brands. Retail chains such as Walmart, Target, Tesco, and Carrefour stock a variety of clay masks, often featuring discounts and bundle deals, making them attractive to budget-conscious buyers. However, the online distribution channel has experienced the most significant growth, driven by the rise of e-commerce giants like Amazon, Nykaa, Tmall, and Sephora's online store. Online platforms offer consumers a wider selection, competitive pricing, and the convenience of doorstep delivery, making them the preferred choice for digital-savvy shoppers.

Facial Clay Mask Market Segmentation: By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

The North American and European markets are significant players in the facial clay mask industry, driven by high consumer spending on premium skincare, a strong preference for organic beauty, and an increasing focus on sustainability. The presence of well-established brands, along with a growing trend of self-care routines and clean beauty, has fueled demand in these regions.

The Asia-Pacific region is the fastest-growing market, fuelled by K-beauty, J-beauty, and traditional Ayurvedic skincare. Countries like China, India, South Korea, and Japan are seeing rising demand due to increasing disposable incomes, skincare awareness, and the influence of beauty influencers and digital marketing.

COVID-19 Impact Analysis on the Facial Clay Mask Market:

During the initial phases of the pandemic, lockdowns, supply chain disruptions, and temporary store closures led to a decline in retail sales, particularly in specialty stores and supermarkets. Production and sourcing of natural ingredients, such as kaolin clay and botanical extracts, were also affected, causing supply shortages and price fluctuations. However, the pandemic also accelerated the growth of e-commerce and at-home skincare trends, benefiting the facial clay mask market. With people spending more time indoors, there was a surge in DIY skincare routines, leading to increased online sales of clay masks, organic skincare kits, and self-care products. The pandemic also heightened awareness about skin health, with more consumers focusing on natural, clean beauty products, further driving demand for organic and eco-friendly clay masks.

Trends/ Developments:

Brands are innovating by combining clay masks with hydrating, brightening, and anti-ageing ingredients such as hyaluronic acid, vitamin C, and probiotics, making them suitable for various skin types and concerns.

Consumers are prioritizing clinically tested, dermatologist-approved clay masks with targeted benefits such as acne control, oil regulation, and sensitive skin soothing, increasing demand for medical-grade formulations.

Estée Lauder has enhanced its digital presence by collaborating with beauty influencers and leveraging social media platforms to promote its clay masks. This strategy aims to engage tech-savvy consumers and boost online sales.

Key Players:

- L'Oréal Paris

- Estée Lauder Companies

- Procter & Gamble (P&G)

- Unilever

- Shiseido Company

- The Body Shop

- Innisfree (Amorepacific Group)

- Kiehl’s (L’Oréal Group)

- Himalaya Herbals

- Fresh (LVMH Group)

Chapter 1. FACIAL CLAY MASK MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. FACIAL CLAY MASK MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. FACIAL CLAY MASK MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. FACIAL CLAY MASK MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. FACIAL CLAY MASK MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. FACIAL CLAY MASK MARKET – By Distribution Channel

6.1 Introduction/Key Findings

6.2 Specialty Stores

6.3 Supermarkets

6.4 Online

6.5 Y-O-Y Growth trend Analysis By Distribution Channel

6.6 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 7. FACIAL CLAY MASK MARKET – By Application

7.1 Introduction/Key Findings

7.2 Personal

7.3 Beauty Salons

7.4 Clinics

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. FACIAL CLAY MASK MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Distribution Channel

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Distribution Channel

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Distribution Channel

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Distribution Channel

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. FACIAL CLAY MASK MARKET– Company Profiles – (Overview, Packaging Type Portfolio, Financials, Strategies & Developments)

9.1 L'Oréal

9.2 Estée Lauder

9.3 Procter & Gamble

9.4 Unilever

9.5 Shiseido Company

9.6 The Body Shop

9.7 Innisfree (Amorepacific Group)

9.8 Kiehl’s (L’Oréal Group)

9.9 Himalaya Herbals

9.10 Fresh (LVMH Group)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The facial clay mask market was valued at USD 344 million and is projected to grow to USD 665.12 million by 2030, with a CAGR of 14.09% over the forecast period (2025-2030).

The increasing demand for organic, natural, and clean beauty products, rising disposable incomes in emerging markets, the influence of social media marketing, and the shift toward eco-friendly skincare solutions are major growth drivers.

Online sales are growing rapidly due to the expansion of e-commerce platforms like Amazon, Nykaa, Tmall, and Sephora’s online store, offering a wider selection, competitive pricing, and home delivery convenience.

Competition from alternative mask formats (sheet masks, gel masks, peel-off masks), sourcing difficulties for high-quality organic ingredients, and supply chain constraints due to rising demand for sustainable beauty products.

The Asia-Pacific region is the fastest-growing market, driven by K-beauty, J-beauty, and Ayurvedic skincare trends, increasing disposable incomes, and rising awareness of skincare routines in countries like China, India, South Korea, and Japan.