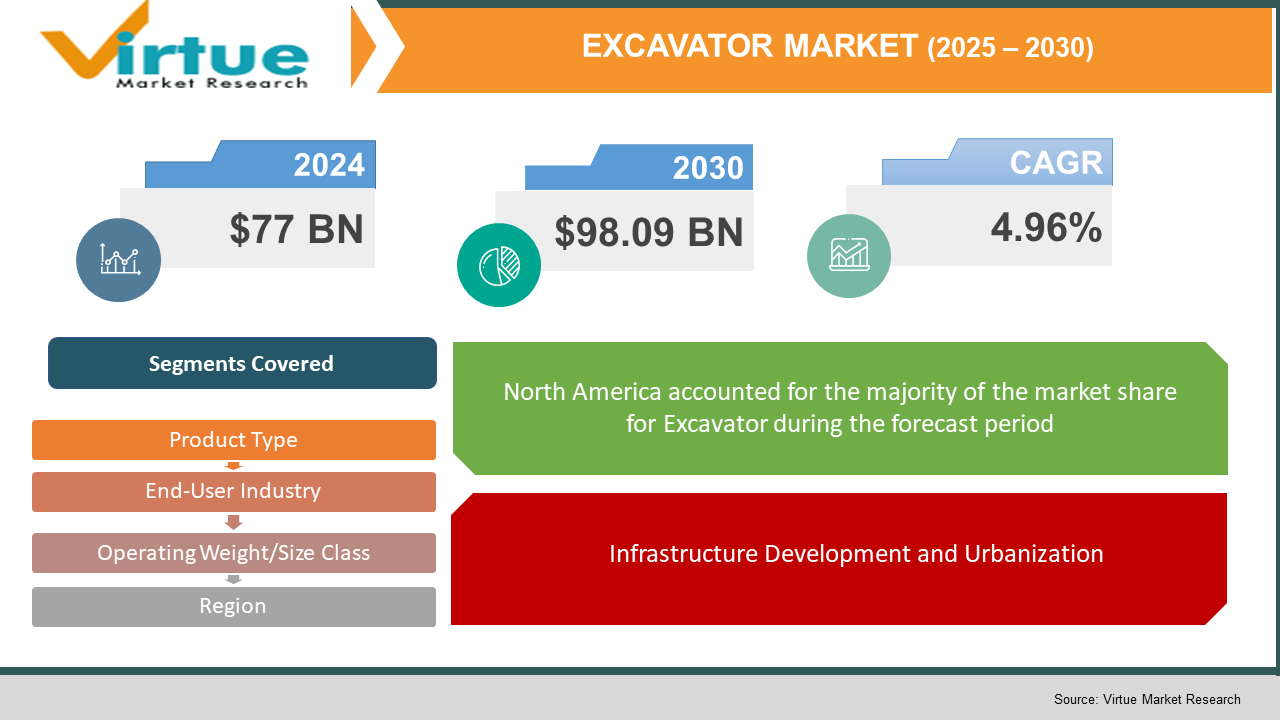

Excavator Market Size (2025-2030)

The Excavator Market was valued at USD 77 billion in 2024 and is projected to reach a market size of USD 98.09 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 4.96%.

The excavator market is a critical segment of the global construction and heavy machinery industry. Excavators are versatile machines used across a wide range of sectors, including construction, mining, forestry, and infrastructure development. These machines are primarily designed for digging and earthmoving tasks but are also used for demolition, lifting, material handling, and trenching. The market includes various types of excavators, such as crawler, wheeled, mini, dragline, and suction models, each tailored to specific operational needs. Technological advancements have led to the development of more efficient, environmentally friendly, and intelligent excavators.

In addition to traditional models, the market is seeing a rise in electric and hybrid excavators, reflecting changing regulatory and environmental considerations.

Key Market Insights:

In the U.S., excavators over 46 metric tons made up 38.3% of revenue in 2023, showing preference for heavy-duty equipment. The up to 250 HP engine class led revenue, reflecting demand in general construction. Projections indicate the U.S. excavator market could reach USD 13.86 billion by 2030.

Crawler excavators were valued at USD 46.67 billion in 2024 and are projected to hit USD 47.97 billion in 2025. Their steady growth rate affirms their dominance in mining and industrial tasks. With consistent year-over-year performance, they remain the backbone of the excavator market.

Manufacturers like Volvo, Tata Hitachi, and Kobelco introduced electric crawler excavators in 2024, especially in Asia. Komatsu's electric PC4000‑11E demonstrated up to 47% cost savings in early trials. These developments point to a growing shift toward zero-emission and hybrid excavators.

Asia-Pacific led the excavator market in 2023–2024 due to large-scale infrastructure projects in countries like China and India. The global market rose from USD 50.29 billion in 2023 to USD 53.22 billion in 2024, a 5.8% increase. Innovation, urbanization, and smart technologies are fueling ongoing regional growth.

Mini excavators are seeing rising demand due to their compact size and versatility in urban and residential projects. In 2024, this segment contributed significantly to overall unit sales, especially in Europe and North America. Their popularity is being driven by space-constrained construction zones and rental market growth.

Excavator Market Drivers:

Infrastructure Development and Urbanization

Ongoing investments in infrastructure—such as roads, railways, and smart cities—are a major driver of excavator demand. Rapid urbanization, especially in emerging economies like India, China, and Southeast Asia, is leading to increased construction activity. Governments are allocating large budgets to public infrastructure and housing projects. This sustained development fuels the need for heavy-duty earthmoving equipment like excavators.

Technological Advancements in Machinery

Modern excavators now come equipped with advanced features like GPS tracking, telematics, fuel efficiency optimization, and autonomous operation. These technologies not only enhance productivity but also reduce operational costs for contractors and fleet managers. The integration of AI and IoT is transforming excavators into smarter, data-driven machines. As a result, many companies are upgrading their fleets to benefit from improved performance and long-term ROI.

Growth in the Rental Equipment Market

The global trend toward equipment rental is positively impacting the excavator market. Renting offers flexibility, cost savings, and access to the latest machinery without the burden of ownership. Construction firms, particularly SMEs, prefer short-term rentals to manage project-specific needs. This shift is prompting rental companies to expand their excavator inventories, boosting market activity.

Excavator Market Restraints and Challenges:

High Initial Investment and Ownership Costs

Excavators involve substantial upfront costs, especially for advanced models with modern technologies. In addition to the purchase price, expenses related to maintenance, fuel, and operator training can be significant. This can deter small and medium construction firms from owning equipment outright. As a result, many potential buyers delay purchases or opt for used or rented machines instead.

Regulatory and Environmental Pressures

Tightening emissions standards and noise regulations are challenging manufacturers and end users alike. Compliance requires the adoption of costly technologies like hybrid systems, electric powertrains, and advanced filters. These changes can increase the overall cost of manufacturing and delay product launches. Non-compliance also risks penalties, limiting market access in environmentally regulated regions.

Volatility in Raw Material Prices and Supply Chain Disruptions

The production of excavators depends heavily on materials like steel, rubber, and electronic components. Fluctuations in raw material prices can raise manufacturing costs and squeeze profit margins. Global supply chain disruptions—caused by geopolitical tensions, pandemics, or shipping delays—can affect delivery timelines and availability. These uncertainties impact both manufacturers and buyers, slowing down procurement and project execution.

Excavator Market Opportunities:

The excavator market presents significant opportunities driven by increasing infrastructure investments worldwide. Emerging economies, particularly in Asia-Pacific and Africa, are focusing heavily on urban development and industrialization, creating robust demand for construction machinery. The growing trend toward electrification and hybrid power offers manufacturers a chance to innovate and capture environmentally conscious buyers. Additionally, the rise of smart construction technologies, including automation and IoT integration, opens avenues for advanced equipment with enhanced productivity. The rental equipment market is expanding as more companies seek flexible and cost-effective machinery access, boosting sales indirectly. There is also potential in after-sales services, such as maintenance and parts supply, which can generate steady revenue streams. Finally, growing awareness of sustainable construction practices encourages adoption of eco-friendly excavators, creating niche markets for green technology products.

EXCAVATOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.96% |

|

Segments Covered |

By Product Type, end user industry, operating weight, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery, Liebherr Group, Doosan Infracore, JCB (J.C. Bamford Excavators Ltd.), Hyundai Construction Equipment, Kobelco Construction Machinery, Sany Group etc. |

Excavator Market Segmentation:

Excavator Market Segmentation: by Product Type

- Crawler Excavators

- Wheeled Excavators

- Mini/Compact Excavators

- Dragline Excavators

- Suction Excavators

Crawler excavators are track-mounted machines designed for rough terrain and heavy-duty operations. They are widely used in mining, large-scale construction, and forestry due to their stability and powerful digging capabilities. Their tracked design allows them to maneuver over uneven or soft ground where wheeled excavators might struggle. Crawler excavators typically hold the largest market share, accounting for around 45-50% of the global excavator market.

Mini or compact excavators are smaller, lighter machines used primarily in tight spaces and smaller construction or landscaping projects. Their compact size allows for easy maneuverability and reduced ground damage in urban and residential environments. They are popular with rental companies and small contractors for their versatility and lower operational costs. This segment typically holds around 20-25% of the market share.

Excavator Market Segmentation: by End-User Industry

- Construction

- Mining

- Oil & Gas

- Forestry and Agriculture

- Utilities

The construction industry is the largest end-user of excavators, utilizing them for tasks such as site preparation, foundation digging, road building, and demolition. Excavators in this sector range from mini models for urban projects to large crawler types for heavy infrastructure development. Growth in residential, commercial, and public infrastructure projects drives continuous demand. Construction accounts for roughly 50-55% of the total excavator market.

Excavators assist forestry operations by clearing land, building access roads, and handling timber, while in agriculture they support irrigation, drainage, and land preparation. Specialized attachments like grapples and mulchers enhance excavators' utility in these fields. The demand in this segment is more seasonal and project-specific compared to others. Forestry and agriculture contribute about 8-10% of the market.

Excavator Market Segmentation: by Operating Weight/Size Class

- Mini Excavators (Below 6 tons)

- Medium Excavators (6–25 tons)

- Large Excavators (Above 25 tons)

Mini excavators are compact, lightweight machines designed for tight spaces and small-scale projects like residential construction, landscaping, and utility work. Their small size allows for easy transport and maneuverability, making them popular in urban and confined environments. They are highly favored by rental companies and small contractors due to their affordability and versatility. Mini excavators account for approximately 25-30% of the market.

Medium-sized excavators are the most versatile and widely used class, balancing power and mobility for a broad range of applications, from commercial construction to roadworks and small mining operations. They offer increased digging force and reach compared to mini models while still being transportable on standard trucks. This segment is the backbone of many construction fleets due to its adaptability. Medium excavators represent about 40-45% of the market.

Excavator Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America’s excavator market is driven by steady infrastructure investment, urban development, and mining activities. The region benefits from advanced construction technology adoption and strict environmental regulations pushing cleaner machinery. The U.S. and Canada are key contributors, with strong demand for both crawler and wheeled excavators. North America accounts for about 20-25% of the global excavator market.

Asia-Pacific is the largest and fastest-growing excavator market globally, fueled by rapid urbanization, industrialization, and government infrastructure projects in countries like China, India, and Southeast Asia. High demand for affordable, versatile machinery and the rise of electric excavators are notable trends. The region’s expansive construction and mining sectors create strong and sustained demand. Asia-Pacific holds approximately 40-45% of the market share.

Europe’s excavator market is characterized by stringent emission standards and a growing focus on sustainable, low-emission equipment. Infrastructure renewal and expansion projects across Western and Eastern Europe drive demand, along with rising investments in renewable energy sectors. The region shows increasing adoption of hybrid and electric excavators. Europe represents around 15-20% of the global market.

COVID-19 Impact Analysis on the Global Excavator Market:

The COVID-19 pandemic had a significant impact on the excavator market, causing disruptions across the supply chain and project timelines. Lockdowns and labor shortages led to delays and halts in construction and mining activities worldwide. Manufacturing plants faced temporary closures, resulting in reduced production and inventory shortages. Additionally, global logistics challenges increased lead times for raw materials and finished equipment.

However, government stimulus packages aimed at infrastructure development helped revive demand in the latter half of 2020 and into 2021. The pandemic also accelerated the adoption of digital technologies and remote monitoring to improve operational efficiency. Despite initial setbacks, the market began recovering as restrictions eased and construction projects resumed. Overall, COVID-19 underscored the importance of supply chain resilience and technological innovation in the excavator industry.

Latest Trends/ Developments:

The excavator market is rapidly evolving with a strong focus on electrification and hybrid power as manufacturers respond to stricter emission regulations and demand for sustainable machinery. Advanced battery technologies are enabling longer operation times and faster charging, exemplified by new electric models like Volvo’s EC500. Smart technologies such as GPS, telematics, and machine control systems are increasingly integrated into excavators, improving operational efficiency, predictive maintenance, and fleet management. Autonomous excavation systems, powered by artificial intelligence and multi-sensor technologies, are also emerging, promising enhanced safety and productivity, especially in hazardous environments.

Environmental sustainability remains a priority, with eco-friendly designs, alternative fuel compatibility, and collaborations like Komatsu India’s biodiesel-powered excavators gaining traction. Multifunctional excavators equipped with modular attachments are in demand, allowing operators to perform multiple tasks efficiently and reduce costs. Safety features have advanced significantly, incorporating around-view cameras and object detection systems to minimize accidents.

Additionally, manufacturers are expanding their presence in emerging markets by localizing production and tailoring products to regional needs, as seen with Kobelco’s indigenized models in India. Lastly, the integration of smart technologies into excavator attachments is enhancing real-time monitoring and reducing downtime, further driving efficiency gains in the industry. Overall, these trends reflect a market that is increasingly tech-driven, sustainable, and adaptable to diverse applications worldwide.

Key Players:

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Liebherr Group

- Doosan Infracore

- JCB (J.C. Bamford Excavators Ltd.)

- Hyundai Construction Equipment

- Kobelco Construction Machinery

- Sany Group

Chapter 1. Excavator Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Excavator Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Excavator Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging TYPE Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Excavator Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Excavator Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Excavator Market – By Product Type

6.1 Introduction/Key Findings

6.2 Crawler Excavators

6.3 Wheeled Excavators

6.4 Mini/Compact Excavators

6.5 Dragline Excavators

6.6 Suction Excavators

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Excavator Market – By End User

7.1 Introduction/Key Findings

7.2 Construction

7.3 Mining

7.4 Oil & Gas

7.5 Forestry and Agriculture

7.6 Utilities

7.7 Y-O-Y Growth trend Analysis By End User

7.8 Absolute $ Opportunity Analysis By End User , 2025-2030

Chapter 8. Excavator Market – By Operating Weight/Size Class

8.1 Introduction/Key Findings

8.2 Straight Moving

8.3 Curve Moving

8.4 Y-O-Y Growth trend Analysis Operating Weight/Size Class

8.5 Absolute $ Opportunity Analysis Operating Weight/Size Class, 2025-2030

Chapter 9. Excavator Market Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Product Type

9.1.3. By Operating Weight/Size Class

9.1.4. By End User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Product Type

9.2.3. By Operating Weight/Size Class

9.2.4. By End User

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Product Type

9.3.3. By Operating Weight/Size Class

9.3.4. By End User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Operating Weight/Size Class

9.4.3. By End User

9.4.4. By Product Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Operating Weight/Size Class

9.5.3. By Product Type

9.5.4. By End User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Excavator Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Caterpillar Inc.

10.2 Komatsu Ltd.

10.3 Volvo Construction Equipment

10.4 Hitachi Construction Machinery

10.5 Liebherr Group

10.6 Doosan Infracore

10.7 JCB (J.C. Bamford Excavators Ltd.)

10.8 Hyundai Construction Equipment

10.9 Kobelco Construction Machinery

10.10 Sany Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Excavator Market was valued at USD 77 billion in 2024 and is projected to reach a market size of USD 98.09 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 4.96%.

Infrastructure Development and Urbanization, Technological Advancements in Machinery, Growth in the Rental Equipment Market are some of the key market drivers in the Excavator Market.

Crawler Excavators, Wheeled Excavators, Mini/Compact Excavators, Dragline Excavators, Suction Excavators are the segments by Product Type in the Excavator Market.

Asia-Pacific is the most dominant region for the Global Excavator Market.

Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery, Liebherr Group, Doosan Infracore, JCB (J.C. Bamford Excavators Ltd.), Hyundai Construction Equipment, Kobelco Construction Machinery, Sany Group etc.