Event and Exhibition Market Size (2024 – 2030)

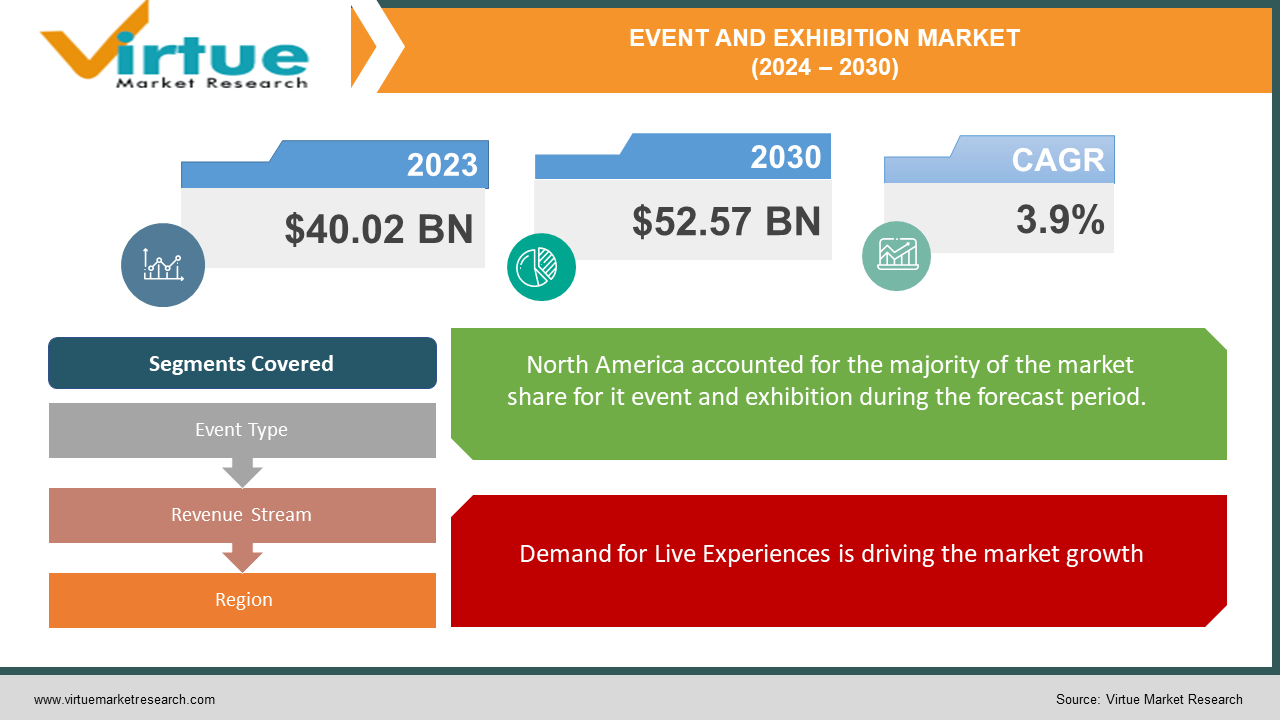

The Global Event and Exhibition Market was valued at USD 40.02 billion in 2023 and will grow at a CAGR of 3.9% from 2024 to 2030. The market is expected to reach USD 52.57 billion by 2030.

The event and exhibition market encompasses the business of organizing and hosting events that bring people together. This includes trade shows, conferences, product launches, consumer shows, festivals, and more. It caters to both B2B and B2C interactions, with revenue generated through exhibitor fees, sponsorships, entrance fees, and additional services. The market is driven by the need for face-to-face networking, brand promotion, and lead generation, and is constantly evolving to embrace technology and adapt to trends like hybrid events and sustainability practices.

Key Market Insights:

Hybrid events combining physical and virtual elements are becoming increasingly popular, even post-pandemic.

Increasing corporate spending on marketing and branding is fueling the market growth.

North America reigns supreme. It boasts the largest market share, accounting for around 32% of the global industry.

Technological advancements are enhancing event experiences, attracting more participants

Globalization is expanding the reach and scale of events, contributing to market growth.

Global Event and Exhibition Market Drivers:

Demand for Live Experiences is driving the market growth

In a world increasingly dominated by digital screens, the allure of live experiences is experiencing a powerful resurgence. People crave the human connection and shared energy that only comes from face-to-face interaction. Events and exhibitions capitalize on this desire, fostering a unique atmosphere where attendees can engage with brands on a deeper level. Unlike virtual interactions, live events allow for product demonstrations with all senses, fostering a more memorable and impactful connection. The chance to network with fellow attendees and industry professionals sparks meaningful conversations, idea exchanges, and potential collaborations. This fosters a sense of community and belonging, leaving a lasting impression far exceeding what a virtual experience can offer. From the excitement of a bustling trade show floor to the shared laughter at a conference session, live events provide an unparalleled platform for connection, making them an essential tool for brands and attendees alike.

Hybrid Events is driving the market growth

The event industry is witnessing a boom in niche markets, a shift away from broad appeal towards hyper-focused gatherings. This caters directly to the evolving needs of attendees and exhibitors. Imagine a craft beer festival unlike any other, designed exclusively for home brewers, featuring workshops on specific brewing techniques and competitions judged by renowned cicerones (beer experts). This targeted approach creates a community atmosphere where everyone shares a deep passion. Exhibitors at such events can tailor their offerings and presentations to a highly relevant audience, maximizing their impact. Gone are the days of generic booths at mega-events. Niche events allow for deeper industry discussions, fostering stronger connections and leading to more qualified leads and sales. This focus on specialization benefits everyone involved, creating a win-win situation for attendees seeking a unique and in-depth experience, and exhibitors who can connect with a highly engaged audience.

Growth of Niche Markets is driving the market growth

Hybrid events are the hottest trend, seamlessly blending the best of both physical and virtual worlds. This innovative approach offers unmatched flexibility and reach. Imagine a keynote address delivered by a renowned expert beamed live to a global audience, while those who crave in-person interaction can gather at a local venue to experience the energy and engage in discussions. Hybrid events cater to a wider audience, removing geographical barriers and allowing anyone with an internet connection to participate. Busy professionals who can't travel can still gain valuable insights, while those seeking face-to-face connection have that option. This dual-pronged approach fosters a more inclusive environment, attracting a diverse attendee pool. The virtual component also allows for cost-effective participation for both attendees and organizers. Recordings of sessions can be accessed on-demand, extending the event's reach and educational value. Hybrid events are the future, offering unparalleled flexibility, wider engagement, and a dynamic experience that caters to the evolving needs of today's audience.

Global Event and Exhibition Market challenges and restraints:

Competition from Digital Marketing is restricting the market growth

The rise of digital marketing presents a significant challenge for event organizers. Online channels offer a cost-effective way to reach a broad audience, generate leads, and promote products or services. This can make it difficult to convince potential attendees, especially businesses, to invest in the cost of travel, accommodation, and event fees. To counter this, event organizers need to clearly articulate the unique value proposition of physical events. This includes the irreplaceable benefits of face-to-face networking, building stronger relationships, and creating a more immersive and engaging brand experience. Events foster a sense of community, spark creativity through live interactions, and provide valuable opportunities for product demonstrations and in-person feedback. By highlighting these advantages and tailoring events to address specific industry needs, organizers can demonstrate that physical events offer a distinct advantage over solely digital interactions.

Logistical Challenges are restricting the market growth

The dream of a truly global event can be hampered by logistical hurdles. Travel restrictions, ever-changing due to political climates or public health concerns, can limit attendance from specific regions. The complexities of visa applications, with lengthy processing times and required documentation, can further discourage international participation. Beyond these, the sheer logistics of organizing an international event can be daunting. Coordinating travel arrangements, time zone differences, and ensuring compliance with varying regulations across borders adds a significant layer of complexity. This can be especially challenging for smaller organizations or those without experience hosting international events. These logistical roadblocks can significantly limit the diversity of perspectives and ideas at an event, hindering the potential for cross-cultural collaboration and innovation.

Market Opportunities:

The events and exhibition market presents exciting opportunities for growth. The rise of experiential marketing and increasing corporate spending on branding create a fertile ground for events that offer immersive brand experiences and networking opportunities. Technological advancements like virtual reality and augmented reality can enhance physical events, creating hybrid formats that cater to both in-person and remote audiences. This expands reach and overcomes geographical barriers, attracting a wider demographic. Globalization fosters a demand for international events, facilitating knowledge sharing and collaboration across borders. This trend, coupled with a growing focus on sustainability, presents an opportunity for events that promote eco-friendly practices and responsible business conduct. Furthermore, the increasing demand for personalized experiences opens doors for customized events that cater to specific industry needs and audience interests. By leveraging data analytics to understand attendee preferences and tailor content accordingly, organizers can create highly relevant and engaging events. This focus on personalization, combined with the irreplaceable benefits of face-to-face interactions, allows event organizers to solidify their position in a competitive digital landscape.

EVENT AND EXHIBITION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.9% |

|

Segments Covered |

By Event Type, Revenue Stream, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Informa PLC, Reed Exhibitions (now RX), Messe Frankfurt, Hyve Group, ComExposium Group, Clarion Events, Emerald Expositions, Tarsus Group, Deutsche Messe AG, Fiera Milano SpA |

Event and Exhibition Market Segmentation - By Event Type

-

B2B (Business-to-Business)

-

B2C (Business-to-Consumer)

-

Mixed/Hybrid

The B2B event and exhibition segment holds the dominant market share. This dominance can be attributed to the undeniable effectiveness of B2B events in fostering industry connections, facilitating product demonstrations, and driving sales leads. Trade shows, conferences, and product launches provide valuable platforms for businesses to network, build relationships, and stay updated on industry trends. While B2C and hybrid events are experiencing growth, the established role of B2B events in driving business development continues to solidify its position as the leading market force.

Event and Exhibition Market Segmentation - By Revenue Stream

-

Exhibitor Fees

-

Sponsorship Fees

-

Entrance Fees

-

Services

Exhibitor Fees are the dominant revenue stream in the event and exhibition market. This dominance stems from the core value proposition of events for businesses: a platform to showcase products and services directly to potential customers. Companies are willing to pay premium fees for prime booth locations and access to a targeted audience, making exhibitor fees the primary driver of revenue for event organizers. While Sponsorship Fees and Entrance Fees contribute to the overall financial picture, they play a secondary role compared to the direct investment companies make through booth rentals.

Event and Exhibition Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America reigns supreme. It boasts the largest market share, accounting for around 32% of the global industry. This dominance can be attributed to factors like frequent summits, conferences, and a high number of both domestic and international trade show attendees. The United States itself holds a record for hosting a massive number of B2B trade shows annually, further solidifying North America's position as the leading event and exhibition hub.

COVID-19 Impact Analysis on the Global Event and Exhibition Market

The COVID-19 pandemic delivered a devastating blow to the global event and exhibition market. Enforced lockdowns, travel restrictions, and social distancing measures necessitated widespread cancellations and postponements, leading to a dramatic decline in revenue. The industry grappled with financial losses, logistical nightmares, and attendee anxieties. However, this crisis also spurred innovation. The rise of virtual and hybrid events emerged as a lifeline, allowing for continued engagement despite physical limitations. While the initial shock was immense, the industry demonstrated remarkable resilience. Organizers embraced virtual platforms, experimented with live streaming and interactive formats, and honed their skills in creating engaging online experiences. This shift towards digitalization has opened doors to a wider audience, overcoming geographical constraints and offering cost-effective participation options. As the world recovers, the industry is witnessing a hybrid approach, blending the irreplaceable aspects of physical events with the accessibility and reach of virtual elements. This newfound adaptability positions the event and exhibition market for a potential rebound, albeit with a transformed landscape that prioritizes flexibility, safety, and the strategic use of technology.

Latest trends/Developments

The events and exhibition market is buzzing with innovation as it adapts to a post-pandemic world. Hybrid events continue to reign supreme, offering the best of both physical and virtual worlds. Organizers are using technology to enhance attendee experiences, with features like virtual reality booths, interactive live streams, and AI-powered networking tools fostering deeper engagement. Sustainability is becoming a top priority, with eco-conscious practices like green venues, locally sourced catering, and carbon offsetting initiatives gaining traction. Data analytics are playing a crucial role, allowing organizers to personalize event content and target specific audience segments for a more impactful experience. The rise of "geo-cloning" sees successful events replicated in different regions, maximizing reach and minimizing risk. Additionally, event marketing is undergoing a transformation, with events becoming integrated components of broader marketing campaigns, emphasizing their strategic value in driving brand awareness and customer relationships. Looking ahead, expect to see a focus on hyper-personalization, with events tailored to individual attendee interests and learning styles. Integration with the metaverse holds exciting possibilities for immersive experiences that transcend physical limitations. The future of events and exhibitions is undoubtedly hybrid, data-driven, and deeply intertwined with technology, all while keeping sustainability and a focus on attendee needs at the forefront.

Key Players:

-

Informa PLC

-

Reed Exhibitions (now RX)

-

Messe Frankfurt

-

Hyve Group

-

ComExposium Group

-

Clarion Events

-

Emerald Expositions

-

Tarsus Group

-

Deutsche Messe AG

-

Fiera Milano SpA

Chapter 1. Event and Exhibition Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Event and Exhibition Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Event and Exhibition Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Event and Exhibition Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Event and Exhibition Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Event and Exhibition Market – By Event Type

6.1 Introduction/Key Findings

6.2 B2B (Business-to-Business)

6.3 B2C (Business-to-Consumer)

6.4 Mixed/Hybrid

6.5 Y-O-Y Growth trend Analysis By Event Type

6.6 Absolute $ Opportunity Analysis By Event Type, 2024-2030

Chapter 7. Event and Exhibition Market – By Revenue Stream

7.1 Introduction/Key Findings

7.2 Exhibitor Fees

7.3 Sponsorship Fees

7.4 Entrance Fees

7.5 Services

7.6 Y-O-Y Growth trend Analysis By Revenue Stream

7.7 Absolute $ Opportunity Analysis By Revenue Stream, 2024-2030

Chapter 8. Event and Exhibition Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Event Type

8.1.3 By Revenue Stream

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Event Type

8.2.3 By Revenue Stream

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Event Type

8.3.3 By Revenue Stream

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Event Type

8.4.3 By Revenue Stream

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Event Type

8.5.3 By Revenue Stream

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Event and Exhibition Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Informa PLC

9.2 Reed Exhibitions (now RX)

9.3 Messe Frankfurt

9.4 Hyve Group

9.5 ComExposium Group

9.6 Clarion Events

9.7 Emerald Expositions

9.8 Tarsus Group

9.9 Deutsche Messe AG

9.10 Fiera Milano SpA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Event and Exhibition Market was valued at USD 40.02 billion in 2023 and will grow at a CAGR of 3.9% from 2024 to 2030. The market is expected to reach USD 52.57 billion by 2030.

Demand for Live Experiences and growth of Niche Markets are the reasons that are driving the market.

Based on event type it is divided into three segments – B2B (Business-to-Business), B2C (Business-to-Consumer) , and Mixed/Hybrid.

North America is the most dominant region for the Event and Exhibition Market.

Emerald Expositions, Tarsus Group, Deutsche Messe AG, Fiera Milano SpA