Europe Whole Grain Foods Market Size (2024-2030)

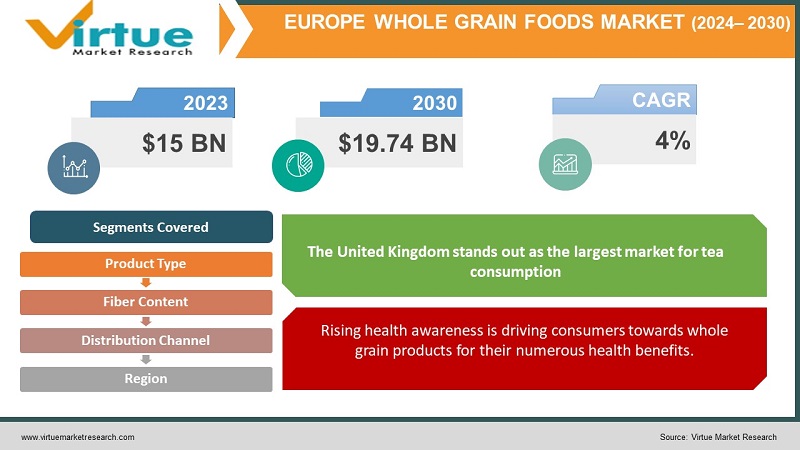

The Europe Whole Grain Foods Market was valued at USD 15 billion in 2023 and is projected to reach a market size of USD 19.74 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 4%.

The European whole grain foods market is poised for continued growth, fueled by increasing health consciousness and demand for convenient, nutritious options. Consumers are recognizing the benefits of whole grains, like lowering the risk of chronic diseases, while leading busy lives that necessitate readily available healthy choices. Rising disposable incomes and urbanization further contribute to the market's expansion. However, competition from other healthy alternatives, higher price points compared to conventional products, and limited awareness about whole grain varieties pose challenges. Manufacturers are innovating with organic, gluten-free, and flavorful whole-grain products to cater to evolving consumer preferences, ensuring the market's dynamism and potential for future success.

Key Market Insights:

The European whole grain market is thriving, fueled by a growing population of health-conscious consumers seeking convenient and nutritious options. Consumers are increasingly aware of the benefits of whole grains, including their ability to reduce the risk of chronic diseases. This, coupled with busy lifestyles that demand readily available healthy choices, is driving significant market growth. Additionally, rising disposable incomes and urbanization further contribute to the expansion of the market as consumers have more resources and shift towards processed and packaged foods.

However, the market faces challenges that require strategic navigation. Competition from other healthy alternatives like fruits, vegetables, and nuts necessitates effective differentiation strategies for whole grain products. Additionally, the higher price point compared to conventional options can deter budget-conscious consumers. Furthermore, limited awareness about the various types of whole grains and their specific health benefits necessitates targeted education efforts to bridge the knowledge gap.

Despite these challenges, the market presents a promising outlook with significant growth potential. Manufacturers are addressing these concerns through innovative product development, focusing on organic, gluten-free, and flavorful options that cater to evolving consumer preferences.

The Europe Whole Grain Foods Market Drivers:

Rising health awareness is driving consumers towards whole grain products for their numerous health benefits.

Consumers are increasingly recognizing the substantial health benefits of whole grains, including their ability to reduce the risk of chronic diseases like heart disease, stroke, and type 2 diabetes, while also promoting digestive health and providing essential nutrients. This growing awareness is driving a significant shift towards healthier food choices, leading to an increased demand for whole grain products across Europe.

The convenience and ease of incorporating whole grains into meals make them a popular choice for busy individuals.

The fast-paced nature of modern life often leaves consumers with limited time for elaborate meal preparation. Whole grain products cater to this need by being readily available in various forms like bread, pasta, cereals, and snacks, making them easy to incorporate into meals such as quick breakfasts, lunches, or healthy snacks. This convenience factor, coupled with the health benefits they provide, makes whole grain products a popular choice for health-conscious individuals with busy lifestyles.

Increasing disposable incomes allow consumers to invest in perceived high-quality and healthier options like whole grains.

Rising disposable incomes in European countries empower consumers to prioritize their well-being through higher spending on perceived high-quality and healthier options like whole grain foods. This increased purchasing power also allows them to explore new varieties of whole grains, trying new brands or different types, further contributing to market growth.

Urbanization creates a demand for convenient and shelf-stable food options, which the whole grain food industry can effectively meet.

The growing trend of urbanization in Europe leads to a shift in consumer preferences towards processed and packaged foods due to busier lifestyles and limited access to fresh produce. This creates a demand for convenient and shelf-stable food options, which the whole grain food industry can effectively meet by offering convenient and readily available whole grain products, making them a relevant and attractive choice for urban consumers.

The Europe Whole Grain Foods Market Restraints and Challenges:

One key challenge lies in competition from other healthy alternatives like fruits, vegetables, and nuts. This necessitates effective differentiation strategies for whole grain products, highlighting their unique health benefits and taste profiles to stand out in the crowded market.

Another hurdle is the relatively higher price point compared to conventional options. This can deter budget-conscious consumers, especially in times of economic strain. Manufacturers need to explore cost-effective production methods and consider offering diverse price points to cater to different consumer segments.

Furthermore, limited awareness about the various types of whole grains and their specific health benefits remains a challenge. Targeted education efforts are crucial to bridge this knowledge gap and educate consumers about the diverse options available and their unique nutritional value. This can involve collaborating with nutritionists, influencers, and retailers to raise awareness and promote informed choices.

Despite these challenges, the market presents a promising outlook with significant growth potential. By addressing these concerns through innovative product development, effective marketing strategies, and consumer education initiatives, the European whole grain market can overcome these hurdles and solidify its position as a leading force in the healthy food sector.

The Europe Whole Grain Foods Market Opportunities:

The European whole grain market, while experiencing promising growth, also faces challenges that demand strategic solutions. Competition from other healthy alternatives necessitates effective differentiation, highlighting unique health benefits and taste profiles. The higher price point compared to conventional options requires exploring cost-effective production and diverse pricing strategies. Limited awareness about different whole grain types and their benefits necessitates targeted education through collaboration with nutritionists, influencers, and retailers.

Despite these challenges, the market presents exciting opportunities. Expanding organic and gluten-free options caters to specific consumer segments with growing preferences for natural and sustainable products, while addressing the needs of individuals with celiac disease or gluten sensitivity. Innovation in product development can involve creating convenient snack options, incorporating whole grains into popular bakery items, or developing ready-to-eat meal solutions. Focusing on functionality and flavor involves fortifying products with essential nutrients and creating appealing taste profiles to attract consumers who might perceive whole grains as bland. Targeting specific consumer segments like athletes, families, or health-conscious professionals requires understanding their unique needs and developing targeted offerings.

EUROPE WHOLE GRAIN FOODS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Product Type, Fiber content, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Cargill, General Mills, Nestlé, PepsiCo, Kellogg's, Mondelez International, Flower Foods, Bob's Red Mill, Food for Life, Grupo Bimbo |

The Europe Whole Grain Foods Market Segmentation:

Europe Whole Grain Foods Market Segmentation: By Product Type:

- Baked Goods

- Cereals

- Flours

- Seeds and Nuts

- Other

The dominant segment in the European whole grain foods market by product type is Baked Goods, encompassing bread, pasta, cookies, and pastries. This segment holds the largest market share due to its widespread consumption and diverse product offerings. However, the fastest-growing segment is Snacks, driven by increasing demand for convenient and healthy on-the-go options. Consumers are seeking nutritious alternatives to traditional sugary snacks, and whole-grain options are gaining traction in this space.

Europe Whole Grain Foods Market Segmentation: By Fiber Content:

- High Fibre

- Soluble Fibre

- Insoluble Fibre

Based on market research and industry reports, the high-fiber segment is currently the most dominant within the European whole grain foods market by fiber content. This segment caters to consumers seeking digestive health benefits and is often associated with a higher perceived value. However, the Soluble Fibre segment is expected to be the fastest-growing due to increasing awareness of its potential cholesterol-lowering effects and growing demand for functional foods. Manufacturers are actively innovating in this segment to cater to this rising consumer interest.

Europe Whole Grain Foods Market Segmentation: By Distribution Channel:

- Supermarkets/Hypermarkets

- Online/E-Commerce

- Independent Retail Outlets

- Other

The European whole grain market is dominated by Supermarkets/Hypermarkets, accounting for the majority of sales due to their wide reach and diverse product offerings. However, the Online/E-Commerce segment is experiencing the fastest growth, driven by increasing consumer preference for convenience, home delivery options, and access to niche or specialty whole grain products not readily available in traditional stores. This trend is expected to continue as online grocery shopping becomes increasingly popular.

Europe Whole Grain Foods Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The UK market thrives on rising health awareness and disposable incomes, driving demand for convenient options like ready-to-eat cereals and whole grain bakery items. The presence of major international and regional players further fuels market growth.

Similar trends prevail in Germany, with growing health consciousness and government initiatives promoting healthy lifestyles. Traditional whole wheat bread dominates the market, but there's room for expansion in other whole grain categories.

The remaining countries present diverse market potential based on economic development, cultural preferences, and government policies. Some might exhibit similar trends to established markets, while others require targeted strategies to address specific challenges and opportunities.

COVID-19 Impact Analysis on the Europe Whole Grain Foods Market:

The COVID-19 pandemic's impact on the European whole grain market was a mixed bag. Initial disruptions like panic buying and supply chain issues caused temporary setbacks. However, the long-term effects have been surprisingly positive, contributing to market growth.

The pandemic heightened awareness of health and immunity, leading consumers to prioritize healthy choices like whole grains, perceived as beneficial for overall well-being. This increased demand for various whole grain products.

Lockdowns and movement restrictions fuelled the growth of e-commerce, as consumers shifted towards online grocery shopping, benefiting online retailers of whole grain products. Additionally, the need for convenience and shelf-stable options during lockdowns drove demand for packaged whole-grain products like bread, cereals, and snacks.

Overall, while the pandemic initially presented challenges, the long-term impact on the European whole grain market has been positive. The pandemic not only heightened awareness of the health benefits of whole grains but also accelerated existing trends towards convenience and online shopping, paving the way for continued market growth in the coming years.

Latest Trends/ Developments:

The European whole grain market is experiencing a surge of exciting trends. Consumers are increasingly seeking plant-based and functional whole grains enriched with vitamins, minerals, or probiotics for added health benefits. Sustainability and ethical sourcing are gaining traction, with consumers favoring products boasting organic and fair-trade certifications.

Innovation is at the forefront, with manufacturers developing convenient snack options, incorporating whole grains into popular bakery items, and creating unique flavor profiles to attract consumers who might find traditional options bland. Personalized nutrition and targeted marketing strategies are emerging, utilizing data analytics to tailor product offerings and marketing campaigns to specific consumer segments based on their needs and preferences.

Transparency and education are crucial, with consumers demanding clear labeling and information about ingredients, sourcing, and processing methods. To cater to this need, manufacturers are providing detailed information and engaging in educational initiatives to address misconceptions and raise awareness about the diverse benefits of whole grains.

Finally, the rising popularity of ancient grains like quinoa and amaranth presents a new frontier for market expansion. These unique options, with their perceived health benefits, offer manufacturers an opportunity to broaden their product range and cater to consumers seeking diverse and innovative whole-grain choices.

Key Players:

- Cargill

- General Mills

- Nestlé

- PepsiCo

- Kellogg's

- Mondelez International

- Flower Foods

- Bob's Red Mill

- Food for Life

- Grupo Bimbo

Chapter 1. Europe Whole Grain Foods Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Whole Grain Foods Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Whole Grain Foods Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Whole Grain Foods Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Whole Grain Foods Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Whole Grain Foods Market– By Product Fiber Content

6.1. Introduction/Key Findings

6.2. Baked Goods

6.3. Cereals

6.4. Flours

6.5. Seeds and Nuts

6.6. Other

6.7. Y-O-Y Growth trend Analysis By Product Fiber Content

6.8. Absolute $ Opportunity Analysis By Product Fiber Content , 2024-2030

Chapter 7. Europe Whole Grain Foods Market– By Fiber Content

7.1. Introduction/Key Findings

7.2 High Fibre

7.3. Soluble Fibre

7.4. Insoluble Fibre

7.5. Y-O-Y Growth trend Analysis By Fiber Content

7.6. Absolute $ Opportunity Analysis By Fiber Content , 2024-2030

Chapter 8. Europe Whole Grain Foods Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets and hypermarkets

8.3. Independent Retail Outlets

8.4. Online retailers

8.5. Other

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Whole Grain Foods Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Product Fiber Content

9.1.3. By Fiber Content

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Whole Grain Foods Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill

10.2. General Mills

10.3. Nestlé

10.4. PepsiCo

10.5. Kellogg's

10.6. Mondelez International

10.7. Flower Foods

10.8. Bob's Red Mill

10.9. Food for Life

10.10. Grupo Bimbo

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Whole Grain Foods Market was valued at USD 15 billion in 2023 and is projected to reach a market size of USD 19.74 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 4%.

Rising health awareness is driving consumers towards whole grain products for their numerous health benefits, The convenience and ease of incorporating whole grains into meals make them a popular choice for busy individuals, and increasing disposable incomes allow consumers to invest in perceived high-quality and healthier options like whole grains, Urbanization creates a demand for convenient and shelf-stable food options, which the whole grain food industry can effectively meet

Supermarkets/Hypermarkets, Online/E-Commerce, Independent Retail Outlets, Other

While specific data might vary, UK is generally considered the most dominant region in the European whole grain foods market, driven by rising health awareness and a strong market for whole grain bread and bakery products

. Cargill, General Mills, Nestlé, PepsiCo, Kellogg's, Mondelez International, Flower Foods, Bob's Red Mill, Food for Life, Grupo Bimbo, Campbell Soup Company, Aunt Millie's, Aryzta