Europe Whey Protein Ingredients Market Size (2024-2030)

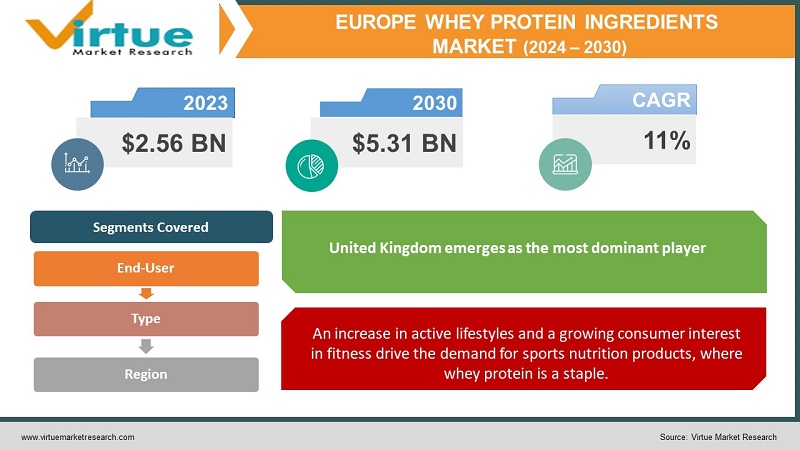

The European whey Protein Ingredients Market is valued at USD 2.56 Billion and is projected to reach a market size of USD 5.31 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11%.

Whey proteins are widely integrated to boost protein content and add functionality to products like protein bars, beverages, baked goods, dairy products, and more. Specialized whey protein formulations are crucial components in infant formulas due to their nutritional profile and similarity to breast milk. Whey protein plays a role in nutritional supplements for the elderly or individuals with medical conditions requiring additional protein intake. A growing focus on fitness, sports, and active lifestyles fuels the demand for protein supplements and functional foods that support an active lifestyle. Whey protein aligns with consumer demand for natural, whole-food adjacent ingredients.

Key Market Insights:

The growing demand from the infant formula and nutraceutical industries is expected to propel the whey protein isolate (WPI) category, which is predicted to increase at the highest CAGR of 7.5% over the forecast period.

In 2023, the sports nutrition application category commanded the largest share of 35% in the Europe whey protein components market, with a market value of $1.12 billion.

Germany is predicted to hold the greatest market share in Europe for whey protein components, accounting for 18% of the market and bringing in $576 million by 2023.

The baby formula application category is estimated to grow at the highest CAGR of 8.1% throughout the forecast period, driven by the growing requirement for high-quality protein sources in newborn nutrition.

The growing demand for dietary supplements containing whey protein is predicted to propel the nutraceutical application segment's growth at a compound annual growth rate (CAGR) of 7.8% over the forecast period.

Whey protein fortification is becoming more and more popular, and in 2023 the food and beverage sector held a 28% market share, valued at $896 million.

In 2023, the price of whey protein isolate 90 (WPI90) was approximately $7.20 per kilogram in Europe, while the price of whey protein concentrate 80 (WPC80) was roughly $3.80 per kilogram.

The growing demand for baked goods that are functional and protein-enriched is predicted to propel the market for bakeries and confectionery to develop at a compound annual growth rate of 7.2% throughout the forecast period.

Due to consumers' increased interest in natural and clean-label products, the market for organic whey protein components is projected to rise at a compound annual growth rate of 9.2% over the anticipated period.

Europe Whey Protein Ingredients Market Drivers:

An increase in active lifestyles and a growing consumer interest in fitness drive the demand for sports nutrition products, where whey protein is a staple.

Whey protein aligns with the focus on preventive health measures, preserving muscle mass, and addressing age-related changes. The availability of whey isolates and hydrolysates cater to individuals with sensitivities or those requiring rapid post-exercise recovery. European consumers are keen on understanding the source, processing methods, and quality certifications for whey ingredients. Whey protein's benefits in muscle maintenance and sarcopenia prevention make it appealing to senior populations concerned about healthy aging. Whey protein has shed its niche image and is embraced by mainstream consumers who seek convenient and functional nutrition. European consumers are discerning about ingredient quality and origin, with grass-fed, organic, or hormone-free whey often commanding a premium.

Breakthroughs in taste and texture allow seamless integration of whey protein into everyday foods, boosting their nutritional profile.

From yogurts and snack bars to baked goods, whey enhances protein content while addressing consumer demand for healthier options. Ready-to-drink (RTD) protein shakes offer convenience for the on-the-go fitness enthusiast. Specialized whey formulations address medical needs (malnutrition, wound healing) in hospital and care settings. Addressing taste and solubility challenges expands whey's usability. Whey fractions like glycomacropeptide (GMP) isolate niche applications. Whey protein, with its natural origins, aligns with the demand for clean labels and minimally processed ingredients. Whey-based RTD protein beverages provide a portable and convenient option, blurring the lines between sports nutrition and everyday beverages. Research into whey-derived peptides and specialized fractions unlocks potential health applications beyond core sports nutrition. Addressing the environmental impacts of dairy production and whey processing becomes a differentiating factor.

Europe Whey Protein Ingredients Market Restraints and Challenges:

Whey protein faces increasing competition from both plant-based and animal-based protein sources in the broader protein ingredients market. Pea, soy, rice, and other plant-derived protein isolates and concentrates are attracting attention due to sustainability, allergy concerns, and a desire for variety by some consumers. Insect-based proteins, while still nascent, are being explored as a novel and potentially more sustainable alternative within a certain consumer segment. Whey protein needs to emphasize its advantages like a complete amino acid profile, digestibility, and proven results to remain competitive in a diversified market. While whey protein isolates tend to be very low in lactose, a significant portion of the European population has some degree of lactose sensitivity. This can limit whey's appeal within certain demographics. Some consumers are wary of highly processed ingredients, seeking more 'natural' and minimally processed alternatives. Whey protein might need to be marketed in conjunction with whole foods to address this perception. Consumer preferences are constantly shifting. The focus on plant-based options or a desire for new and exciting flavor experiences could potentially pose a challenge to whey protein's dominance. The European Union has stringent food safety regulations. Any incidents of contamination or adulteration of whey protein could negatively impact consumer confidence and lead to increased scrutiny. Possible future regulations regarding labeling, allowable additives, or sustainability claims in the protein ingredient sector could create additional compliance hurdles.

Europe Whey Protein Ingredients Market Opportunities:

Europe's aging population presents a unique opportunity for the whey protein ingredients market. Whey protein can help address concerns associated with aging, such as sarcopenia (muscle loss) and reduced bone density. Whey protein powder remains a mainstay in the sports nutrition segment, offering a convenient and customizable way to increase protein intake. Ready-to-drink protein beverages cater to busy consumers seeking on-the-go protein solutions. Whey protein is finding its way into bakery items like protein bread and cookies, as well as protein-enriched snacks like bars and bites. These products cater to consumers seeking satiating snacks that support healthy weight management and muscle building. Whey protein plays a crucial role in infant formulas, providing essential amino acids for optimal growth and development. Advances in whey protein processing techniques are leading to the development of hypoallergenic formulas suitable for babies with sensitive digestive systems. Whey protein's functionality extends beyond traditional food and beverage categories. Its potential applications are being explored in the development of weight management supplements, clinical nutrition products, and even cosmetics due to its perceived benefits for skin health. Advancements in processing techniques, such as microfiltration and ultrafiltration, are leading to the development of new whey protein derivatives with improved functionality, solubility, and taste profiles. Manufacturers are constantly innovating with flavors and formulations to enhance the taste and appeal of whey protein products, catering to diverse consumer preferences.

EUROPE WHEY PROTEIN INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Agrial,Arla Foods amba, Glanbia PLC, Groupe Lactalis, Hilmar Cheese Company, Davisco Food International, Maple Island Inc., Meggle AG |

Europe Whey Protein Ingredients Market Segmentation

Europe Whey Protein Ingredients Market Segmentation: By Type

- Whey Protein Concentrate (WPC)

- Whey Protein Isolate (WPI)

- Hydrolyzed Whey Protein (HWP)

- Demineralized Whey Protein

WPC reigns supreme in the European market, accounting for a dominant share of 60-65%. This popularity stems from its cost-effectiveness and versatility. WPC typically contains 35-80% protein content, with some residual lactose and fat. Its production process involves separating whey from cheese curds and concentrating the protein content through processes like filtration. WPC's functionality makes it a popular choice across various food and beverage categories. It finds application in yogurts, kefir, bakery items (bread, cookies), protein-fortified snacks (bars, bites), and even breakfast cereals. In sports nutrition, WPC is a key ingredient in some protein powders and RTD beverages.

While the WPI segment holds a smaller market share compared to WPCs, it is considered the fastest-growing type in the European whey protein ingredients market. WPI is the refined form of whey protein, boasting a higher protein content (typically 80-90%) with significantly lower levels of lactose and fat. This purification process makes WPI a more premium offering, reflected in its estimated market share of 20-25%. The growing demand for premium, high-protein sports nutrition products is propelling the WPI segment. Consumers seeking fast-acting protein sources for muscle building and recovery are driving the market for WPI-based products. Additionally, the rising focus on lactose intolerance is creating a niche for WPI as a suitable alternative for those with lactose sensitivities.

Europe Whey Protein Ingredients Market Segmentation: By End-User

- Food and Beverage Manufacturers

- Sports Nutrition Brands

- Pharmaceutical and Nutraceutical Companies

- Infant Formula Manufacturers

Food and beverage manufacturers hold the largest share of the European whey protein ingredients market. Whey Protein's functionality allows its incorporation into a broad range of food and beverage products, expanding its reach to various consumer segments. Consumers are increasingly seeking food and beverages that offer additional health benefits beyond basic nutrition. Whey protein's association with muscle building, satiety, and overall well-being aligns perfectly with this trend. Food and beverage companies are constantly innovating with new product formats, flavors, and functionalities utilizing whey protein. This continuous development keeps consumer interest piqued and fuels market growth. Whey protein-fortified food and beverages offer convenient ways to increase protein intake throughout the day. This caters to busy lifestyles and makes protein readily accessible to a wider audience.

The sports nutrition segment represents the fastest-growing end-use in the European whey protein ingredients market. Increased participation in sports, fitness activities, and weight training drives the demand for protein supplements to support muscle building and recovery. Athletes and fitness enthusiasts are becoming more educated about the benefits of whey protein, leading to a rise in targeted product consumption. Whey protein powders, RTD beverages, and bars offer convenient and readily available protein sources for athletes on the go. Sports nutrition brands are constantly innovating with new formulations, flavors, and delivery methods to cater to diverse athlete preferences and dietary needs.

Europe Whey Protein Ingredients Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Among the European regions, the United Kingdom emerges as the most dominant player, accounting for approximately 22% of the overall European whey Protein Ingredients Market. The UK's well-established dairy industry, coupled with its expertise in whey protein production and innovation, has solidified its position as a leading regional player. One of the notable trends in the UK's whey protein market is the growing popularity of plant-based and vegan alternatives, as consumers seek out more sustainable and ethical protein sources. This has prompted manufacturers to diversify their product portfolios and develop plant-based protein options to meet evolving consumer preferences.

The fastest-growing region in the European whey Protein Ingredients Market is Spain, which has witnessed a surge in demand for whey protein ingredients driven by the country's thriving food and beverage industry and the growing health consciousness among consumers. Spain's whey protein market is expected to continue its rapid expansion, driven by the increasing popularity of sports nutrition, functional food products, and the rising demand for plant-based and sustainable protein sources. Spanish manufacturers have leveraged their expertise in dairy processing to develop a diverse range of whey protein products, catering to the needs of various end-use sectors, such as sports nutrition, clinical nutrition, and food and beverage formulations. These companies have also been actively investing in research and development to innovate and enhance the quality and functionality of their whey protein offerings.

COVID-19 Impact Analysis on the Europe Whey Protein Ingredients Market:

Manufacturers faced production slowdowns due to workforce limitations and social distancing measures. Additionally, managing existing inventories and adjusting production plans to adapt to the uncertain demand landscape proved challenging. With job insecurity and economic anxieties rising, consumers initially focused on stocking up on essential goods. Discretionary spending on health and wellness products, including whey protein, took a backseat. With limited access to physical stores, consumers turned to online platforms for their whey protein needs. This shift benefited established e-commerce retailers and manufacturers with strong online presence. As the focus shifted from purely muscle-building to overall health and well-being, whey protein's potential benefits for immune function gained traction. Manufacturers reformulated products or launched new lines highlighting the immune-supporting properties of whey protein. The rise of home fitness routines and DIY workout programs created a demand for convenient protein sources. Whey protein RTD beverages and smaller-sized protein powder formats catered to this trend. Manufacturers explored innovative delivery formats beyond traditional powders and beverages. Protein-fortified snack bars, baking mixes, and even protein shots emerged as convenient on-the-go options for health-conscious consumers. Consumers are likely to remain more conscious of their health and prioritize products supporting immune function. Whey protein manufacturers can capitalize on this trend by emphasizing the role of whey protein in supporting overall wellness.

Latest Trends/ Developments:

The rise of plant-based diets has fueled the popularity of plant-based protein alternatives. While pea protein, soy protein, and brown rice protein are gaining traction, whey protein remains a dominant player. However, an interesting trend is the emergence of hybrid protein products that combine whey protein with plant-based protein sources. This caters to consumers seeking a balanced amino acid profile and potentially appealing to those with lactose intolerance or those who may also be following a partially plant-based diet. Consumers are increasingly seeking personalized nutrition solutions tailored to their specific needs and preferences. The whey protein market is responding to this trend with the introduction of customizable protein blends. These blends allow consumers to choose from a variety of protein sources (whey, plant-based), add functional ingredients (vitamins, minerals, probiotics), and adjust flavors to create a personalized protein powder or beverage. Whey protein's satiating properties and potential for boosting metabolism are being harnessed to create weight management products like protein shakes and meal replacements. Emerging research suggests that whey protein peptides may positively impact cognitive function. This paves the way for the development of whey protein-fortified food and beverage products targeting brain health.

Key Players:

- Agrial

- Arla Foods amba

- Glanbia PLC

- Groupe Lactalis

- Hilmar Cheese Company

- Davisco Food International

- Maple Island Inc.

- Meggle AG

Chapter 1. Europe Whey Protein Ingredients Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Whey Protein Ingredients Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Whey Protein Ingredients Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Whey Protein Ingredients Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Whey Protein Ingredients Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Whey Protein Ingredients Market– By Type

6.1. Introduction/Key Findings

6.2. Whey Protein Concentrate (WPC)

6.3. Whey Protein Isolate (WPI)

6.4. Hydrolyzed Whey Protein (HWP)

6.5. Demineralized Whey Protein

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Whey Protein Ingredients Market– By End User

7.1. Introduction/Key Findings

7.2 Food and Beverage Manufacturers

7.3. Sports Nutrition Brands

7.4. Pharmaceutical and Nutraceutical Companies

7.5. Infant Formula Manufacturers

7.6. Y-O-Y Growth trend Analysis By End User

7.7. Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 8. Europe Whey Protein Ingredients Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Animal Type

8.1.3. By Ingredient

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Whey Protein Ingredients Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Agrial

9.2. Arla Foods amba

9.3. Glanbia PLC

9.4. Groupe Lactalis

9.5. Hilmar Cheese Company

9.6. Davisco Food International

9.7. Maple Island Inc.

9.8. Meggle AG

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Consumers are becoming increasingly aware of the importance of protein for building and maintaining muscle mass, supporting overall well-being, and potentially aiding in weight management. Whey protein, with its complete amino acid profile and high digestibility, emerges as a popular choice.What are the main concerns about the European whey Protein Ingredients Market?

Whey protein is a by-product of cheese production. Fluctuations in milk prices directly impact the cost of whey protein concentrate (WPC), the primary raw material. This volatility can create uncertainty for both manufacturers and consumers

Agrial, Arla Foods amba, Glanbia PLC, Groupe Lactalis, Hilmar Cheese

The company, Davisco Food International, Maple Island Inc., Meggle AG

The UK currently holds the largest market share, estimated at around 22%.

The fastest-growing region in the European whey Protein Ingredients Market is Spain, which has witnessed a surge in demand for whey protein ingredients driven by the country's thriving food and beverage industry and the growing health consciousness among consumers.