Europe Wellness Supplements Market Size (2024-2030)

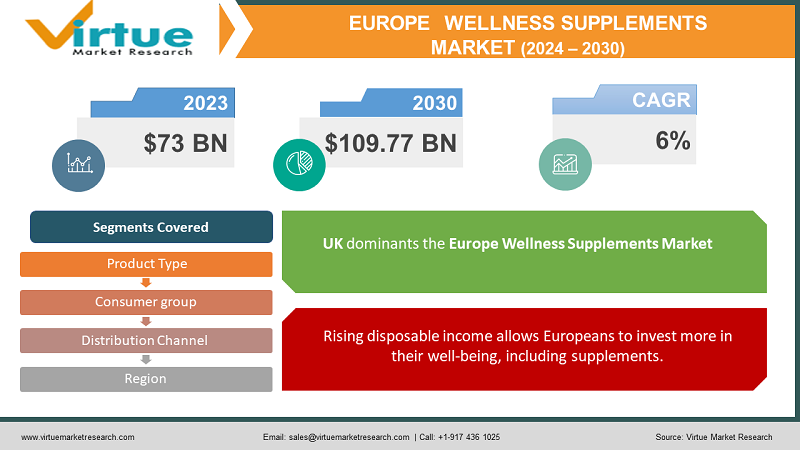

The Europe Wellness Supplements Market was valued at USD 73 billion in 2023 and is projected to reach a market size of USD 109.77 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 6%.

The European wellness supplements market is on a healthy trajectory, driven by a growing emphasis on preventative healthcare and overall well-being. Europeans are becoming more informed about their health and willing to invest in supplements to achieve their wellness goals. An aging population with specific health needs also contributes to the market's rise. As disposable incomes increase, Europeans have more resources for non-essential items like supplements. This focus on prevention translates to a rise in supplement use, seen to avoid chronic health issues. The market is led by established players, but a wave of smaller companies is entering the scene with specialized offerings catering to diverse consumer needs. Popular choices include vitamins, minerals, probiotics, and herbal remedies.

Key Market Insights:

The European wellness supplement market is booming, fueled by a cultural shift towards preventative healthcare. Europeans are prioritizing their overall well-being and actively seeking ways to optimize their health. This focus on prevention is driving a surge in supplement use, particularly those that address specific needs. Probiotics for gut health and natural immunity boosters are experiencing significant growth. An aging population with unique health concerns further contributes to market demand, creating opportunities for targeted supplement development.

Alongside established industry leaders, a wave of innovative startups is entering the European wellness supplement market. These smaller companies offer specialized products that cater to diverse consumer preferences. This focus on niche offerings allows them to carve out a space in the market and meet the evolving needs of health-conscious Europeans.

The European Union enforces strict regulations to ensure the safety and quality of all supplements. These regulations cover manufacturing, labeling, and marketing, fostering consumer trust in the market. With this focus on safety and a constant stream of innovative products, the European wellness supplement market is poised for continued growth in the coming years.

The Europe Wellness Supplements Market Drivers:

Europeans prioritize preventing illness, driving demand for preventative supplements.

Europeans are increasingly prioritizing preventing chronic diseases rather than simply treating them. This has led to a surge in demand for supplements perceived to boost immunity, improve gut health, and address potential deficiencies.

An aging population with unique needs creates a market for targeted supplements.

Europe has a growing senior demographic with specific health needs. This population segment is more likely to use supplements to maintain health and address age-related concerns. This creates a significant opportunity for tailored wellness supplements catering to their specific requirements.

Rising disposable income allows Europeans to invest more in their well-being, including supplements.

As economic prosperity increases across Europe, consumers have more money to spend on non-essential items like supplements. This allows them to invest in their well-being and explore a wider range of wellness products.

Increased health awareness fuels interest in supplements as a preventative approach.

Europeans are becoming more informed about health and wellness topics. This heightened awareness fuels interest in evidence-based approaches to preventative healthcare, including the potential benefits of specific supplements.

A preference for natural ingredients leads to demand for supplements with minimal processing.

There's a growing preference for natural and organic products in Europe. This trend translates to a demand for supplements formulated with natural ingredients and minimal processing, catering to consumers seeking a more holistic approach to wellness.

The Europe Wellness Supplements Market Restraints and Challenges:

The European wellness supplements market, while thriving, faces some challenges that hinder its unbridled growth. A significant hurdle is the high cost associated with these products. Compared to food options, supplements can be a pricier way to obtain nutrients, potentially limiting accessibility for some consumers. Additionally, there's a lack of clear distinction between certain supplements and traditional food categories. This ambiguity can lead to confusion for consumers unsure if a supplement is truly necessary or if they can meet their needs through dietary choices.

Furthermore, the regulatory landscape in Europe can be complex and ever-changing. Strict regulations regarding health benefit claims and labelling can pose challenges for manufacturers seeking to bring new products to market. The process of navigating these regulations can be time-consuming and expensive, potentially hindering innovation and the introduction of potentially beneficial supplements.

Despite these challenges, the European wellness supplements market presents a promising future. With a growing focus on preventative healthcare and a rising health-conscious population, the demand for these products is likely to remain strong. Manufacturers who can address affordability concerns, differentiate their products effectively, and navigate the regulatory environment strategically will be well-positioned to capitalize on the ongoing growth in this dynamic market.

The Europe Wellness Supplements Market Opportunities:

The European wellness supplements market is a fertile ground for innovation and growth, brimming with opportunities for businesses that can cater to the ever-evolving needs of health-conscious consumers. Personalization is a key trend, with a growing demand for supplements designed for specific demographics or health goals. This opens doors for companies to develop targeted formulas for women's health, sports nutrition, or even address individual concerns like gut health or sleep issues. However, simply offering a unique product isn't enough. Consumers are increasingly seeking science-backed solutions, so investing in research and development to create innovative, evidence-based products with strong clinical trials is crucial for gaining a competitive edge.

EUROPE WELLNESS SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

6% |

||

|

Segments Covered |

By Product Type, Consumer group, Distribution Channel and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

GlaxoSmithKline, Bayer AG, Sanofi, Procter & Gamble, Perrigo Co Plc, Nestle SA, NBTY |

The Europe Wellness Supplements Market Segmentation:

Europe Wellness Supplements Market Segmentation: By Product Type:

- Dietary Supplements

- Functional Foods & Beverages

- Food Intolerance Products

- Dermo-Cosmetic Essentials

The European wellness supplements market is divided into various product types. The most dominant segment is Dietary Supplements, which encompasses vitamins, minerals, and herbal remedies. Consumers use these to address potential nutrient deficiencies or target specific health concerns. However, the fastest-growing segment is Functional Foods & Beverages. This segment includes everyday food items fortified with additional health benefits, like probiotics in yogurt or omega-3 fatty acids in enriched eggs. The growing focus on convenience and incorporating wellness into daily food choices is driving the surge in this segment.

Europe Wellness Supplements Market Segmentation: By Consumer Group:

- Age

- Gender

- Health Conditions

The "Adult" consumer group is the dominant segment within the European wellness supplement market by consumer group. This reflects the general focus on maintaining health throughout adulthood and addressing concerns like nutrient deficiencies or age-related health decline. However, the "Geriatric" consumer group is projected to be the fastest-growing segment. As the European population ages, there's a rising demand for supplements that address specific senior needs, like bone health or cognitive support.

Europe Wellness Supplements Market Segmentation: By Distribution Channel:

- Pharmacies & Drug Stores

- Supermarkets & Hypermarkets

- Online Channels

- Other Channels

Brick-and-mortar stores like pharmacies and supermarkets currently hold the dominant position in the European wellness supplement market, offering a trusted environment and easy access for consumers. However, the fastest-growing segment is online channels. E-commerce provides convenience, competitive pricing, and a wider selection, perfectly aligned with the increasing comfort Europeans have with online shopping. This trend is likely to continue as digital platforms play an ever-increasing role in the European wellness supplement market.

Europe Wellness Supplements Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The UK boasts a mature market with a high health consciousness among consumers. There's a strong demand for weight management, sports nutrition, and immune support supplements. Online retail is flourishing, and regulations are relatively relaxed compared to other European nations.

Germany is another prominent market with a focus on preventive healthcare and high-quality products. Consumers prioritize natural ingredients and evidence-based supplements. Pharmacies remain the dominant distribution channel, with stricter regulations compared to the UK.

The French market emphasizes natural remedies and traditional herbal medicines. There's a growing interest in beauty-from-within supplements and weight management products. Pharmacies play a crucial role here as well, but online channels are gaining traction.

The Spanish market is experiencing significant growth, driven by rising disposable income and a growing health-conscious population. Consumers favor natural ingredients and sports nutrition supplements. Pharmacies are the leading channel, followed by supermarkets.

Eastern European countries like Poland and Russia are witnessing a surge in the wellness supplement market due to increasing health awareness and economic development. However, regulations and market maturity can vary significantly across these regions.

COVID-19 Impact Analysis on the Europe Wellness Supplements Market:

The COVID-19 pandemic significantly impacted the European wellness supplements market, presenting a unique mix of challenges and opportunities. On the positive side, the heightened focus on health awareness during the pandemic led many Europeans to prioritize preventive healthcare. This sparked a surge in demand for immune-boosting supplements like Vitamin C, zinc, and elderberry, alongside general health supplements like probiotics and multivitamins. Additionally, social distancing measures and lockdowns fueled a significant rise in online shopping for supplements, benefiting e-commerce platforms. However, the pandemic also presented hurdles. Global supply chain disruptions caused temporary shortages of key ingredients and raw materials, leading to price fluctuations and potential stockouts. The economic downturn further impacted the market, as reduced disposable incomes forced some consumers to cut back on non-essential purchases like supplements. Despite these challenges, the overall impact of COVID-19 on the European wellness supplements market appears positive. The long-term focus on health and immunity has driven sustained growth for the industry. As the pandemic situation stabilizes, the market is expected to continue its upward trajectory, with e-commerce playing a central role in distribution. It's important to note that the pandemic's impact varied across different European regions. Countries with a strong emphasis on preventive healthcare likely experienced a more pronounced rise in supplement sales. Additionally, the pandemic accelerated the trend towards personalized and science-backed supplements, as consumers became more selective about the products they choose for their well-being.

Latest Trends/ Developments:

The European wellness supplements market is a hotbed of innovation, constantly adapting to meet evolving consumer preferences. A key trend is the rise of personalized nutrition, with companies offering customized supplement kits, DNA testing for targeted recommendations, and subscription services with tailored formulas. Gut health remains a major focus, driving a surge in demand for prebiotics, probiotics, and postbiotics for digestive and immune support, potentially even impacting mental well-being. Transparency and sustainability are also paramount, with consumers seeking supplements made with clean, ethically sourced ingredients, often organic and non-GMO. Sustainable packaging and eco-friendly practices are gaining traction as well. Mental wellness is another area of growth, with supplements containing adaptogens, nootropics, and L-theanine emerging to address stress, anxiety, and sleep issues. Technology is further shaping the market, with mobile apps tracking supplement intake, monitoring health metrics, and offering personalized recommendations. Wearable devices integrating with these apps are on the rise, promoting a holistic approach to health management. Finally, subscription services offering convenient and regular delivery of personalized supplement packs are experiencing a boom, catering to consumers who seek a hassle-free way to maintain their wellness routine. By capitalizing on these latest trends, European wellness supplement businesses can create innovative products and marketing strategies that resonate with today's health-conscious consumers.

Key Players:

- GlaxoSmithKline

- Bayer AG

- Sanofi

- Procter & Gamble

- Perrigo Co Plc

- Nestle SA

- NBTY

Chapter 1. Europe Wellness Supplements Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Wellness Supplements – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Wellness Supplements Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Wellness Supplements - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Wellness Supplements Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Wellness Supplements Market– By Product Type

6.1. Introduction/Key Findings

6.2. Dietary Supplements

6.3. Functional Foods & Beverages

6.4. Food Intolerance Products

6.5. Dermo-Cosmetic Essentials

6.6. Y-O-Y Growth trend Analysis By Extract Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Europe Wellness Supplements Market– By Consumer Group

7.1. Introduction/Key Findings

7.2 Age

7.3. Gender

7.4. Health Conditions

7.5. Y-O-Y Growth trend Analysis By Consumer Group

7.6. Absolute $ Opportunity Analysis By Consumer Group , 2024-2030

Chapter 8. Europe Wellness Supplements Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets & Hypermarkets

8.3. Pharmacies & Drug Stores

8.4. Online Channels

8.5. Other Channels

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Wellness Supplements Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Type

9.1.3. By Consumer Group

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Wellness Supplements Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 GlaxoSmithKline

10.2. Bayer AG

10.3. Sanofi

10.4. Procter & Gamble

10.5. Perrigo Co Plc

10.6. Nestle SA

10.7. NBTY

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Wellness Supplements Market was valued at USD 73 billion in 2023 and is projected to reach a market size of USD 109.77 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 6%.

Shifting focus towards preventative healthcare, aging population, rising disposable incomes, growing health awareness, focus on natural ingredients

Pharmacies & Drug Stores, Supermarkets & Hypermarkets, Online Channels, Other Channels.

UK and Germany are generally considered the most dominant regions in the European Wellness Supplements Market due to their high health awareness and established markets

GlaxoSmithKline, Bayer AG, Sanofi, Procter & Gamble, Perrigo Co Plc, Nestle SA, NBTY.