Europe Water Testing And Analysis Market Size (2024-2030)

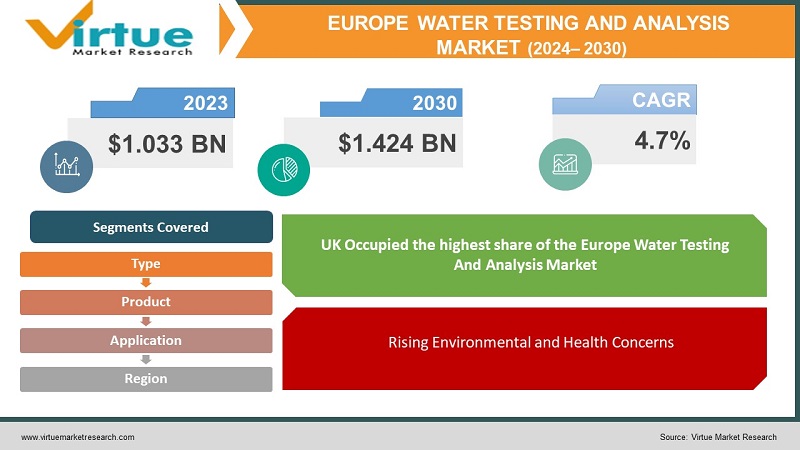

The Europe Water Testing And Analysis Market was valued at USD 1.033 billion in 2023 and is projected to reach a market size of USD 1.424 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4.7% between 2024 and 2030.

The Europe Water Testing and Analysis Market is poised for significant growth, driven by increasing awareness of water quality and safety across various sectors. Stringent regulations imposed by the European Union, along with rising concerns over environmental pollution, are propelling the demand for advanced water testing technologies. Industries such as pharmaceuticals, food and beverages, and agriculture are increasingly adopting water testing and analysis to ensure compliance with safety standards and to mitigate risks associated with contaminated water. The market is also being bolstered by advancements in testing technologies, including the development of portable and real-time water analysis devices that offer rapid and accurate results. Additionally, the growing emphasis on sustainability and the need for efficient water management practices are further fueling the demand for comprehensive water testing solutions across the region. As a result, the Europe Water Testing and Analysis Market is expected to witness robust growth in the coming years, with key players focusing on innovation and expansion to cater to the evolving needs of various industries.

Key Market Insights:

Industrial sectors contribute 35% to the market. Agricultural applications make up 15% of the market.

Environmental monitoring accounts for 25%.

Drinking water testing represents 20% of the market.

Portable and on-site testing solutions cover 30% of the market.

Europe Water Testing and Analysis Market Drivers:

Stringent EU Regulations.

One of the most significant drivers of the Europe Water Testing and Analysis Market is the stringent regulatory framework established by the European Union (EU). The EU has implemented comprehensive directives such as the Water Framework Directive, the Drinking Water Directive, and the Bathing Water Directive, which mandate strict water quality standards for all member states. These regulations require consistent monitoring, assessment, and reporting of water quality in various sectors, including industrial, agricultural, and municipal applications. Non-compliance with these regulations can result in severe penalties, creating a strong incentive for industries and local governments to invest in advanced water testing and analysis technologies. The need to ensure that water used in industrial processes, agricultural irrigation, and public drinking supplies meets these high standards has significantly increased the demand for water testing solutions. Moreover, the growing complexity of pollutants, driven by industrial activities and environmental changes, necessitates more sophisticated testing methods, further driving the market. As the EU continues to enhance its environmental and public health policies, the demand for state-of-the-art water testing technologies is expected to grow, making regulatory compliance a key driver of market expansion in Europe.

Rising Environmental and Health Concerns

The growing concern over environmental pollution and its impact on public health is another critical driver of the Europe Water Testing and Analysis Market. As awareness of the adverse effects of water contamination on ecosystems and human health increases, there is a heightened demand for comprehensive water testing and analysis. Contaminants such as heavy metals, pesticides, pharmaceuticals, and microbial pathogens are increasingly being detected in water sources, raising alarm among both the public and regulatory bodies. These pollutants can have severe consequences, including the spread of waterborne diseases, disruption of aquatic ecosystems, and long-term health risks such as cancer and neurological disorders. In response, industries, municipalities, and environmental agencies are investing heavily in water testing technologies to detect and mitigate these threats. The adoption of real-time, accurate testing solutions is becoming crucial to identify contaminants early and take corrective actions to prevent harm. This growing emphasis on safeguarding public health and the environment is driving the market for water testing and analysis in Europe, as stakeholders prioritize the protection of water quality to ensure the well-being of communities and the preservation of natural resources.

Europe Water Testing And Analysis Market Restraints and Challenges:

The Europe Water Testing and Analysis Market faces several restraints and challenges that could hinder its growth. One of the primary challenges is the high cost associated with advanced water testing technologies. Implementing sophisticated testing methods and maintaining high-quality laboratory infrastructure requires significant financial investment, which can be prohibitive for smaller organizations and municipalities. Additionally, the complexity of testing processes, which often require specialized knowledge and skilled personnel, further escalates operational costs. Another challenge is the lack of uniformity in water quality regulations across different countries in Europe. While the European Union has established overarching directives, the interpretation and enforcement of these regulations can vary significantly among member states, leading to inconsistencies in market demand. This fragmentation can create barriers for companies trying to offer standardized testing services across the region. Moreover, the slow adoption of new technologies in certain sectors due to traditional practices or budget constraints can also impede market growth. These factors, combined with the challenges of accurately detecting emerging contaminants in increasingly complex water matrices, present significant obstacles to the expansion of the Europe Water Testing and Analysis Market, requiring innovative solutions and policy harmonization to overcome them.

Europe Water Testing And Analysis Market Opportunities:

The Europe Water Testing and Analysis Market presents several promising opportunities for growth, driven by technological advancements and increasing environmental awareness. One of the key opportunities lies in the development and adoption of portable, real-time water testing devices. These innovative technologies enable faster and more efficient water quality assessments, making it easier for industries, municipalities, and environmental agencies to monitor water sources on-site and respond swiftly to contamination issues. Additionally, the growing emphasis on sustainability and green practices across Europe is creating a demand for more eco-friendly testing solutions. Companies that can offer low-cost, energy-efficient testing methods with minimal environmental impact are likely to gain a competitive edge. Furthermore, the rise of smart water management systems, which integrate advanced sensors and data analytics, opens up opportunities for companies to provide comprehensive water testing services that align with the broader goals of digitalization and smart city initiatives. As water scarcity and pollution continue to be pressing concerns, there is also potential for growth in markets related to wastewater treatment and recycling, where accurate and continuous water quality monitoring is essential. These opportunities underscore the potential for innovation and expansion in the Europe Water Testing and Analysis Market.

EUROPE WATER TESTING AND ANALYSIS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By Product, Type, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of the Europe |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Danaher Corporation, Horiba, Ltd., PerkinElmer, Inc., Xylem Inc., Shimadzu Corporation, Eurofins Scientific, Merck KGaA, Hach (A Danaher Company), ABB Ltd., General Electric Company |

Europe Water Testing And Analysis Market Segmentation:

Europe Water Testing And Analysis Market segementation By Type:

- Portable

- Handheld

- Benchtop

In 2023, based on market segmentation by Type, Portable Occupies the highest share of the Europe Water Testing And Analysis Market. Portable water testing devices have become a dominant force in the Europe Water Testing and Analysis Market due to their combination of portability, affordability, and ease of use. These devices offer significant flexibility, enabling on-site testing in diverse locations such as industrial facilities, remote water sources, and environmental sites. This convenience is particularly valuable for rapid assessments and emergency response situations, where quick and accurate water quality analysis is crucial. Moreover, the affordability of portable devices makes them accessible to a wider range of users, including small businesses, municipalities, and even individual consumers, broadening the market reach. The user-friendly design of these devices also ensures that operators with limited technical expertise can conduct reliable tests, further driving their adoption. Additionally, the increasing regulatory requirements across Europe, which mandate more frequent and comprehensive water quality testing, have fueled the demand for portable solutions that can easily meet these standards. Technological advancements have further enhanced the accuracy, sensitivity, and reliability of portable water testing devices, making them a preferred choice for many applications. These factors collectively contribute to the strong market presence and growing demand for portable water testing equipment in Europe, positioning them as a key driver in the region's water testing and analysis industry.

Europe Water Testing And Analysis Market segementation By Product:

- Dissolved Oxygen Meter

- TOC Analyzer

- Conductivity Meter.

- PH meter

- Turbidity Meter

In 2023, based on market segmentation by Product, Dissolved Oxygen Meter Occupies the highest share of the Europe Water Testing And Analysis Market. Dissolved oxygen meters play a critical role in the Europe Water Testing and Analysis Market, largely due to their essential function in ensuring the health of aquatic life and maintaining water quality. Dissolved oxygen is a key indicator of water health, as it is vital for the survival of aquatic organisms. Monitoring these levels is particularly important in water bodies used for drinking water, aquaculture, and environmental conservation. As a result, dissolved oxygen meters are indispensable tools for various industries, including wastewater treatment, environmental monitoring, pharmaceuticals, and food and beverage processing. Their versatility and importance in these sectors contribute to their strong market demand. Furthermore, regulatory compliance is a major driver, as many regulatory bodies mandate regular monitoring of dissolved oxygen levels in water sources, pushing the need for reliable and accurate meters. Technological advancements have also played a significant role in enhancing the appeal of dissolved oxygen meters, with continuous improvements leading to the development of more accurate, portable, and user-friendly models. While other water testing instruments like pH meters and conductivity meters are also important, the critical role of dissolved oxygen in aquatic health and regulatory compliance likely positions dissolved oxygen meters as a dominant product segment in the European market.

Europe Water Testing And Analysis Market segementation By Application:

- Industrial

- Government

- Laboratory

- Environmental

In 2023, based on market segmentation by Application, Industrial Occupies the highest share of the Europe Water Testing And Analysis Market. The industrial sector's demand for water testing and analysis is a dominant force in the European market, driven by the need to meet stringent quality standards, optimize processes, and ensure environmental compliance. High-quality water is essential for many industrial processes, as it directly impacts product quality and operational efficiency. This creates a strong demand for rigorous water testing to ensure that water used in production meets industry standards and regulations. Moreover, water testing is crucial for process optimization, as it helps identify and mitigate issues like scaling, corrosion, and contamination, which can compromise equipment performance and increase operational costs. Environmental compliance is another significant factor, with industries required to adhere to strict regulations concerning wastewater discharge and water consumption. Water testing allows industries to monitor these parameters closely, ensuring they meet legal requirements and avoid penalties. Additionally, by identifying and addressing water-related problems early, industries can reduce costs associated with equipment damage, process inefficiencies, and non-compliance. While environmental monitoring and government regulation are important, the industrial sector's reliance on water testing for quality control, process optimization, and regulatory adherence makes it a dominant application in the European water testing and analysis market.

Europe Water Testing And Analysis Market segementation By Region:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

In 2023, based on market segmentation by Region, the UK Occupied the highest share of the Europe Water Testing And Analysis Market. The United Kingdom stands out as a leading market for water testing and analysis in Europe, driven by a combination of stringent regulatory frameworks, developed infrastructure, and a strong focus on research and development. The UK's robust regulatory environment enforces strict water quality standards, compelling industries and municipalities to invest heavily in water testing to ensure compliance. This regulatory pressure is a significant driver of market demand. Additionally, the UK's well-developed infrastructure for water treatment and distribution requires regular and rigorous monitoring to maintain operational efficiency and safety, further boosting the demand for water testing services. The country's position as a hub for research and development in water technology also attracts substantial investment and fosters innovation in water testing and analysis, keeping the market at the cutting edge of technological advancements. Moreover, the UK's large population and densely populated urban areas create a significant need for reliable water quality monitoring to ensure public health and safety. While other European countries like Germany and France also have strong water markets, the UK's unique combination of regulatory stringency, advanced infrastructure, research capabilities, and population density likely positions it as a key player in the European water testing and analysis market.

COVID-19 Impact Analysis on the Europe Water Testing And Analysis Market.

The COVID-19 pandemic had a mixed impact on the Europe Water Testing and Analysis Market. On one hand, the pandemic underscored the importance of hygiene and public health, leading to an increased focus on water quality, particularly in public and healthcare facilities. This heightened awareness drove demand for water testing services to ensure that water sources were free from contaminants that could exacerbate health risks. However, the pandemic also caused significant disruptions, particularly in industrial sectors where water testing is a critical component. Lockdowns and restrictions led to the temporary shutdown of many industrial operations, reducing the demand for routine water testing and analysis. Additionally, supply chain disruptions affected the availability of testing equipment and reagents, causing delays and increasing costs. The economic uncertainty during the pandemic also led to budget constraints, causing some organizations to defer or scale back their investments in water testing infrastructure. Despite these challenges, the post-pandemic recovery phase has seen a resurgence in demand, driven by the need for more stringent water quality monitoring as industries and municipalities resume full operations. Overall, COVID-19 acted as both a catalyst and a constraint for the market, highlighting the critical role of water testing in safeguarding public health while also exposing vulnerabilities in supply chains and operational continuity.

Latest trends / Developments:

The Europe Water Testing and Analysis Market is experiencing several notable trends and developments that are shaping its future. One of the most significant trends is the increasing adoption of digital and smart water testing technologies. Advanced sensors, IoT devices, and data analytics are being integrated into water testing systems, enabling real-time monitoring and more accurate analysis of water quality. This digital transformation is not only improving efficiency but also allowing for predictive maintenance and quicker response to potential contamination issues. Another key development is the growing emphasis on sustainability and green technologies. Companies are increasingly focusing on eco-friendly testing solutions that minimize environmental impact, such as reducing chemical usage and waste in testing processes. There is also a rising demand for portable and handheld water testing devices, which offer convenience and flexibility, particularly for on-site and remote testing applications. Additionally, the market is seeing an expansion in the scope of testing parameters, with a greater focus on detecting emerging contaminants like microplastics, pharmaceuticals, and endocrine-disrupting chemicals. These advancements are being driven by stricter regulations, heightened environmental awareness, and the need for comprehensive water quality management, positioning the market for continued innovation and growth in the coming years.

Key Players:

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Danaher Corporation

- Horiba, Ltd.

- PerkinElmer, Inc.

- Xylem Inc.

- Shimadzu Corporation

- Eurofins Scientific

- Merck KGaA

- Hach (A Danaher Company)

- ABB Ltd.

- General Electric Company

Chapter 1. Europe Water Testing And Analysis Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Water Testing And Analysis Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Water Testing And Analysis Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Water Testing And Analysis Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Water Testing And Analysis Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Water Testing And Analysis Market– By Type

6.1. Introduction/Key Findings

6.2. Portable

6.3. Handheld

6.4. Benchtop

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Water Testing And Analysis Market– By Product

7.1. Introduction/Key Findings

7.2 Dissolved Oxygen Meter

7.3. TOC Analyzer

7.4. Conductivity Meter.

7.5. PH meter

7.6. Turbidity Meter

7.7. Y-O-Y Growth trend Analysis By Product

7.8. Absolute $ Opportunity Analysis By Product , 2024-2030

Chapter 8. Europe Water Testing And Analysis Market– By Application

8.1. Introduction/Key Findings

8.2. Industrial

8.3. Government

8.4. Laboratory

8.5. Environmental

8.7. Y-O-Y Growth trend Analysis Application

8.8. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 9. Europe Water Testing And Analysis Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Application

9.1.3. By Product

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Water Testing And Analysis Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Thermo Fisher Scientific Inc.

10.2. Agilent Technologies, Inc.

10.3. Danaher Corporation

10.4. Horiba, Ltd.

10.5. PerkinElmer, Inc.

10.6. Xylem Inc.

10.7. Shimadzu Corporation

10.8. Eurofins Scientific

10.9. Merck KGaA

10.10. Hach (A Danaher Company)

10.11. ABB Ltd.

10.12. General Electric Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

By 2023, the Europe Water Testing And Analysis market is expected to be valued at US$ 1.033 billion

Through 2030, the Europe Water Testing And Analysis market is expected to grow at a CAGR of 4.7%.

By 2030, Europe Water Testing And Analysis Market is expected to grow to a value of US$ 1.424 billion

North America is predicted to lead the European Water Testing And Analysis market

The European water Testing And Analysis Market is segmented by product, type, Application, and Region