Europe Waste Management Market Size (2024-2030)

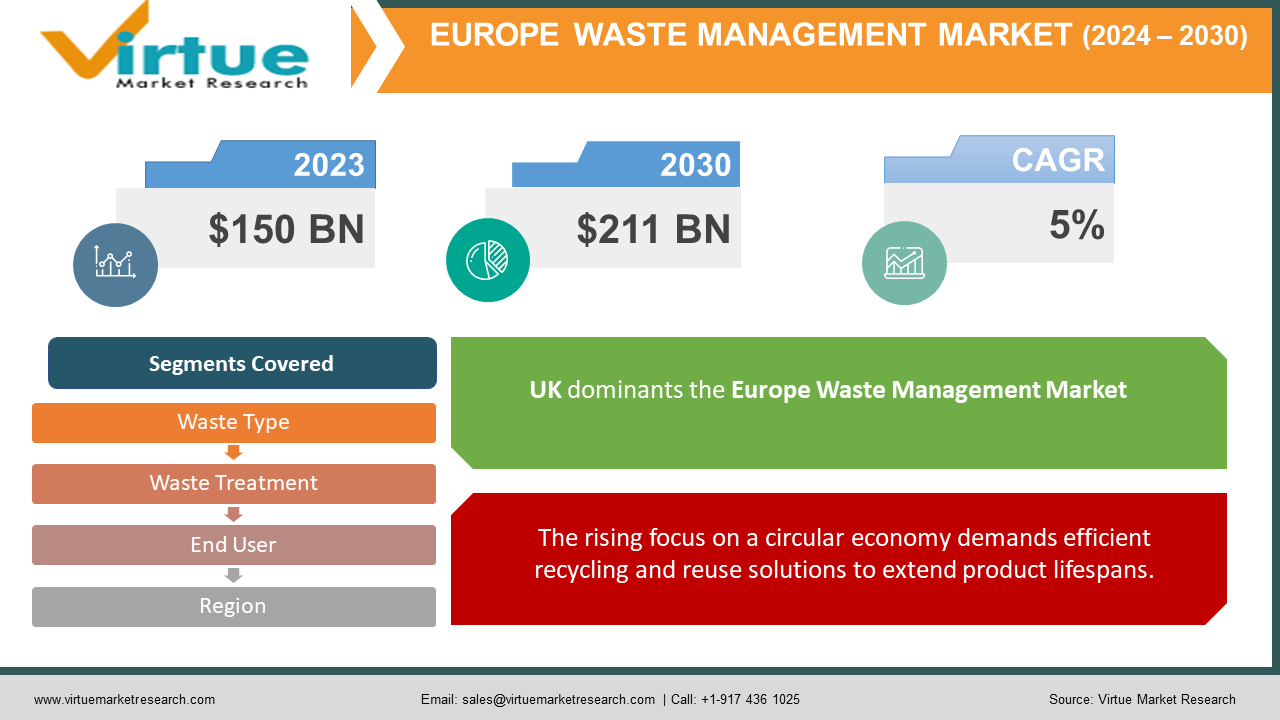

The Europe Waste Management Market was valued at USD 150 billion in 2023 and is projected to reach a market size of USD 211 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 5%.

The European waste management market is a complex and crucial sector, driven by rising waste generation, stricter environmental regulations, and growing public concern for sustainability. As populations grow and consumption patterns evolve, the amount of waste generated in Europe continues to climb. To address this challenge, the European Union has implemented stricter regulations, pushing for reduced waste production and increased recycling rates. Additionally, public awareness of environmental issues is rising, leading to a growing demand for sustainable waste management practices.

Key Market Insights:

- The European waste management market is driven by several key forces. Stringent EU regulations push for reduced waste generation and increased recycling, fostering a shift towards sustainable practices and innovative technologies. The growing focus on a circular economy emphasizes maximizing the lifespan of materials, leading to a demand for efficient recycling and reuse solutions. Technological advancements like automated sorting and advanced recycling methods are constantly improving efficiency and resource recovery. Public environmental awareness is rising, putting pressure on stakeholders to adopt responsible waste management strategies.

- The market caters to diverse segments, including various waste types (municipal, industrial, hazardous), treatment methods (landfill, incineration, recycling, composting), and end users (residential, commercial, industrial). Understanding these segments is crucial for tailored solutions and targeted strategies. Digitalization is emerging as a powerful tool for waste collection tracking, route optimization, and overall management improvement.

- While opportunities abound, challenges remain. Implementing new technologies and infrastructure is costly, complying with stricter regulations is demanding, and public resistance to certain facilities persists. Overcoming these hurdles is essential for realizing a sustainable waste management future across Europe.

The Europe Waste Management Market Drivers:

Stricter EU regulations push for less waste and more recycling, driving sustainable practices and technologies.

The European Union (EU) plays a pivotal role in shaping the market through stricter environmental regulations. These regulations aim to reduce waste generation and increase recycling rates, pushing businesses and governments to adopt sustainable practices and innovative technologies.

The rising focus on a circular economy demands efficient recycling and reuse solutions to extend product lifespans.

The concept of a circular economy is gaining significant traction, emphasizing keeping products and materials in use for extended periods. This translates to a growing demand for technologies that facilitate efficient recycling and reuse of waste materials, minimizing environmental impact.

Continuous technological advancements like automated sorting and advanced recycling methods improve efficiency and resource recovery.

Continuous development of new technologies is transforming the waste management landscape. These advancements include automated sorting systems, advanced recycling techniques, and waste-to-energy solutions. These innovations aim to improve efficiency, resource recovery, and overall sustainability in the sector.

Growing public environmental awareness pressures businesses and governments to adopt responsible waste management strategies.

Public awareness of environmental issues like pollution and climate change is steadily increasing. This translates to a growing demand for sustainable waste management practices. This puts pressure on businesses and governments to adopt responsible waste management strategies, further driving market growth.

The diverse market, segmented by waste type, treatment, and user, necessitates tailored solutions and targeted strategies.

The European waste management market is highly diverse, encompassing various waste types (municipal, industrial, hazardous), treatment methods (landfill, incineration, recycling, composting), and end users (residential, commercial, industrial). Understanding these diverse segments is crucial for stakeholders to develop tailored solutions and targeted strategies that cater to specific needs.

The Europe Waste Management Market Restraints and Challenges:

While the European waste management market boasts promising growth, it also faces several significant restraints and challenges. One major hurdle is the high cost associated with implementing new technologies and infrastructure. Advanced sorting systems, waste-to-energy plants, and other innovative solutions require substantial upfront investments, which can be a barrier for smaller companies or municipalities with limited budgets.

Another challenge lies in meeting increasingly stringent environmental regulations. The EU's ever-tightening regulations regarding waste disposal and recycling rates put pressure on stakeholders to constantly adapt and upgrade their practices. This ongoing effort requires not only financial resources but also expertise and efficient management strategies.

Furthermore, public resistance to certain waste treatment facilities remains a persistent challenge. The construction of new landfills or waste-to-energy plants often faces opposition from local communities due to concerns about potential environmental and health risks. Addressing these concerns through transparent communication, community engagement, and ensuring adherence to the highest safety standards is crucial for overcoming this obstacle.

Despite these challenges, the European waste management market demonstrates a strong commitment to progress. By fostering collaboration between governments, businesses, and communities, investing in innovative solutions, and prioritizing responsible waste management practices, the market can navigate these hurdles and pave the way for a more sustainable future.

The Europe Waste Management Market Opportunities:

The European waste management market, despite its challenges, presents a multitude of promising opportunities. The market's projected growth fueled by regulations, environmental awareness, and technological advancements translates to a rising demand for innovative solutions and services, creating opportunities for both established players and newcomers. Emerging technologies like automation, artificial intelligence, and biotechnologies hold immense potential to revolutionize waste management by improving sorting, recycling, and even waste-to-energy conversion, leading to more efficient and sustainable practices. The growing focus on circularity creates exciting opportunities for businesses developing solutions that extend product lifecycles, from designing products for reuse to exploring material recovery methods. Decentralized waste management, with smaller treatment facilities closer to waste generation points, offers advantages like reduced transportation costs, lower environmental impact, and potential for local renewable energy generation. Finally, public-private partnerships can unlock significant potential through joint investments in infrastructure, technology development, and public awareness campaigns, accelerating progress towards a sustainable waste management future in Europe.

EUROPE WASTE MANAGEMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Waste Type, waste treatment, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Veolia Environnement S.A., SUEZ SA, Remondis SE & Co. Kg., FCC Servicios Medioambientales, S.A., Urbaser Servicios Medioambientales, S.A., Biffa plc, Clean Harbors Inc., Covanta Holding Company, Daiseki Co., Ltd. |

The Europe Waste Management Market Segmentation:

Europe Waste Management Market Segmentation: By Waste Type:

- Municipal Solid Waste (MSW)

- Industrial Waste

- Hazardous Waste

- Other Waste Types

The European waste management market by waste type is dominated by Municipal Solid Waste (MSW), encompassing household waste from residential areas. This segment makes up a significant portion due to Europe's large and continuously growing population. On the other hand, the fastest-growing segment is Hazardous Waste. Stricter regulations, increasing industrial activity, and growing awareness of the potential environmental and health risks associated with improper hazardous waste management are driving this segment's significant projected growth.

Europe Waste Management Market Segmentation: By Waste Treatment:

- Landfill Disposal

- Incineration

- Recycling

- Composting

- Other Treatment Methods

While facing decline due to stricter regulations and environmental concerns, landfill disposal remains the dominant segment in the European waste treatment sector, primarily due to established infrastructure and lower upfront costs. However, recycling is experiencing the fastest growth, driven by increasing regulations, environmental awareness, and advancements in recycling technologies. This shift towards more sustainable practices is expected to continue shaping the future of the European waste management landscape.

Europe Waste Management Market Segmentation: By End User:

- Residential

- Commercial

- Industrial

The European waste management market is segmented by end user, with the residential sector currently being the most dominant contributor, generating the largest volume of waste. However, the industrial sector is expected to witness the most significant growth in the coming years, driven by factors like increasing industrial activity and stricter regulations mandating waste management practices. This trend is expected to continue as industries strive towards sustainable operations and comply with evolving regulations.

Europe Waste Management Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

UK: The UK is a mature market with a focus on landfill diversion and increased recycling rates. They are actively exploring advanced technologies like anaerobic digestion and exploring waste-to-energy solutions.

Germany: Renowned for its robust waste management infrastructure, Germany boasts high recycling and composting rates. They are leaders in circular economy initiatives and actively promote resource recovery.

France: Like Germany, France prioritizes recycling and waste reduction. They are implementing extended producer responsibility schemes to incentivize sustainable product design and waste management practices.

Italy: While facing challenges with illegal dumping and inadequate infrastructure, Italy is making strides towards modernizing its waste management system. They are investing in new treatment facilities and promoting public awareness campaigns.

Spain: Spain has experienced significant growth in its recycling rates in recent years. They are focusing on improving infrastructure and implementing stricter regulations to further enhance waste management practices.

Rest of Europe: This diverse region encompasses various countries at different stages of development in their waste management practices. Some Eastern European nations are catching up to their western counterparts, investing in infrastructure upgrades and adopting EU regulations.

COVID-19 Impact Analysis on the Europe Waste Management Market:

The COVID-19 pandemic significantly impacted the European waste management landscape. Lockdowns and movement restrictions led to a surge in household waste due to increased consumption of packaged and disposable items at home. This disrupted the usual flow of waste, with commercial waste declining while household waste rose, challenging collection and sorting processes. Waste management personnel faced higher exposure risks due to handling potentially contaminated materials, necessitating additional safety measures and potentially impacting efficiency. Additionally, the pandemic generated a significant amount of medical waste requiring dedicated treatment to minimize health risks. While some investment may have shifted away from long-term infrastructure upgrades during the pandemic, there were also potential opportunities. Heightened awareness of hygiene and sanitation could lead to a long-term increase in public concern for proper waste management, and the challenges faced could stimulate innovation in areas like contactless collection, improved sorting technologies, and more efficient treatment methods. Overall, the pandemic's impact was multifaceted, highlighting the importance of robust waste management systems while also potentially paving the way for future advancements in the sector.

Latest Trends/ Developments:

The European waste management market is undergoing a transformation, driven by several key trends. The concept of a circular economy is gaining significant traction, pushing for extended product lifespans through design for disassembly, efficient repair programs, and exploring new avenues for material recovery and recycling. Bio-based and compostable materials are emerging as sustainable alternatives to traditional plastics, potentially reducing reliance on landfills and promoting composting. Additionally, Artificial Intelligence and Machine Learning are finding applications in optimizing collection routes, improving sorting accuracy, and predicting waste generation patterns. Decentralized waste management, with smaller treatment facilities closer to waste sources, is gaining interest due to its potential for reduced transportation costs, lower environmental impact, and local energy generation through technologies like biogas. Finally, public-private partnerships are becoming increasingly common, facilitating joint investments in infrastructure, technology development, and public awareness campaigns, all aimed at achieving a more sustainable future for waste management in Europe.

Key Players:

- Veolia Environnement S.A.

- SUEZ SA

- Remondis SE & Co. Kg.

- FCC Servicios Medioambientales, S.A.

- Urbaser Servicios Medioambientales, S.A.

- Biffa plc

- Clean Harbors Inc.

- Covanta Holding Company

- Daiseki Co., Ltd.

Chapter 1. Europe Waste Management Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Waste Management – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Waste Management Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Waste Management - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Waste Management Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Waste Management Market– By Waste Type

6.1. Introduction/Key Findings

6.2. Municipal Solid Waste (MSW)

6.3. Industrial Waste

6.4. Hazardous Waste

6.5. Other Waste Types

6.6. Y-O-Y Growth trend Analysis By Waste Type

6.7. Absolute $ Opportunity Analysis By Waste Type , 2024-2030

Chapter 7. Europe Waste Management Market– By Waste Treatment

7.1. Introduction/Key Findings

7.2 Landfill Disposal

7.3. Incineration

7.4. Recycling

7.5. Composting

7.6. Other Treatment Methods

7.7. Y-O-Y Growth trend Analysis By Waste Treatment

7.8. Absolute $ Opportunity Analysis By Waste Treatment , 2024-2030

Chapter 8. Europe Waste Management Market– By End User

8.1. Introduction/Key Findings

8.2. Residential

8.3. Commercial

8.4. Industrial

8.5. Y-O-Y Growth trend Analysis End User

8.6. Absolute $ Opportunity Analysis End User , 2024-2030

Chapter 9. Europe Waste Management Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Waste Type

9.1.3. By Waste Treatment

9.1.4. By End User

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Waste Management Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Veolia Environnement S.A.

10.2. SUEZ SA

10.3. Remondis SE & Co. Kg.

10.4. FCC Servicios Medioambientales, S.A.

10.5. Urbaser Servicios Medioambientales, S.A.

10.6. Biffa plc

10.7. Clean Harbors Inc.

10.8. Covanta Holding Company

10.9. Daiseki Co., Ltd.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Europe Waste Management Market was valued at USD 150 billion in 2023 and is projected to reach a market size of USD 211 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 5%.

Regulatory Landscape, Focus on Circular Economy, Technological Advancements, Growing Public Environmental Awareness, Diverse Market Segmentation

Landfill Disposal, Incineration, Recycling, Composting, Other Treatment Methods

Germany is considered the most dominant region in the European Waste Management Market due to its well-established infrastructure, high recycling rates, and focus on waste prevention and resource recovery

Medioambientales, S.A., Biffa plc, Clean Harbors Inc., Covanta Holding Company, Daiseki Co., Veolia Environnement S.A., SUEZ SA, Remondis SE & Co. Kg., FCC Servicios Medioambientales, S.A., Urbaser Servicios Ltd..