Europe Cooking Oil Market Size (2024-2030)

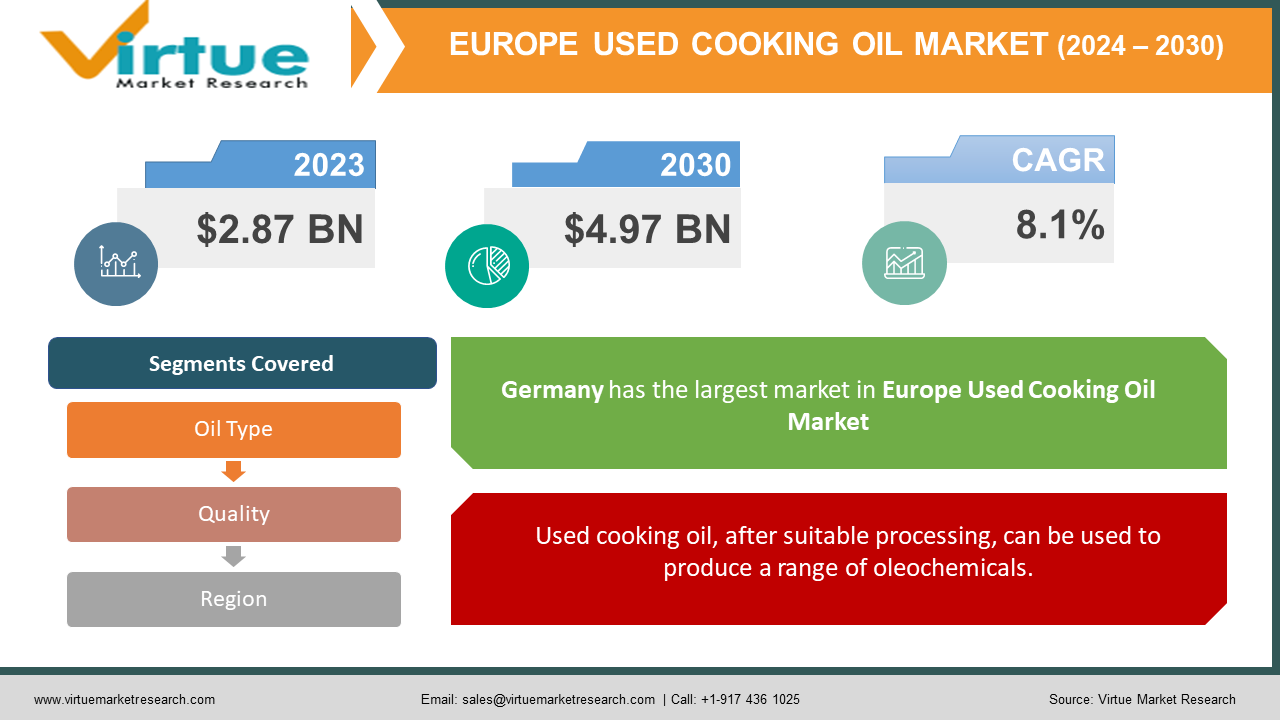

The Europe Cooking Oil Market was valued at USD 2.87 Billion in 2023 and is projected to reach a market size of USD 4.97 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.1%.

The European used cooking oil market encompasses the intricate network involved in collecting, processing, and repurposing the vast amount of used cooking oil generated by various entities in the food chain. UCO originates from restaurants, food processing industries, catering businesses, commercial kitchens, and even households. The type and quality can vary depending on the oil originally used and its applications (frying, baking, etc.). A mix of private collectors, municipalities, and waste management companies are involved in establishing efficient pipelines for UCO collection, often relying on designated collection points and specialized containers. Collected UCO undergoes a series of pre-treatment steps (filtering, dewatering) followed by refinement to remove impurities, free fatty acids, and other undesirable components. This creates a usable raw material for various applications. The most significant end-use for processed UCO is in the production of biodiesel, contributing to the renewable energy sector. It also finds applications in animal feed, technical-grade products, and potentially even future advancements in bioplastics. The most significant end-use for processed UCO is in the production of biodiesel, contributing to the renewable energy sector. It also finds applications in animal feed, technical-grade products, and potentially even future advancements in bioplastics.

Key Market Insights:

Europe's commitment to reducing waste and increasing resource efficiency is a primary driver fueling the UCO market. Used cooking oil, when effectively harnessed, becomes a valuable feedstock for various applications rather than an environmental pollutant. EU directives and member-state policies on renewable energy and biofuels promote the collection and utilization of UCO. Incentives and mandates for biodiesel production are influential market forces. While UCO traditionally focused on oils like sunflower or rapeseed oil, the market is broadening to include alternative feedstocks. Animal fats and innovative sources like algae-derived oils are gaining consideration. The core application for UCO in Europe is biodiesel production. However, a wider array of applications is emerging, including animal feed, industrial uses, oleochemicals, and even conversion back into edible oil in limited, highly controlled scenarios. The UCO market involves multiple players – generators (restaurants, households), collectors, pre-processors, biofuel manufacturers, and end-users in various industries. Efficient coordination among these stakeholders is essential. The European Union's Renewable Energy Directive sets ambitious targets for renewable energy use across member states. UCO-derived biodiesel plays a part in fulfilling these mandates, further fueling the market. Improper disposal of UCO can lead to environmental problems like clogged drains and contaminated water sources. The European focus on the circular economy incentivizes the collection and repurposing of UCO as a sustainable waste management strategy.

Europe Used Cooking Oil Market Drivers:

The European Union, through initiatives like the Renewable Energy Directive (RED), sets ambitious targets for replacing fossil fuels with renewable sources in transportation.

The European Union, through initiatives like the Renewable Energy Directive (RED), sets ambitious targets for replacing fossil fuels with renewable sources in transportation. Biodiesel produced from UCO is a significant contributor towards achieving these targets. To encourage biodiesel adoption, many European countries offer subsidies, and tax breaks, or require blending a certain percentage of biodiesel into conventional diesel fuel. This creates a guaranteed and increasing demand for UCO as a primary feedstock. Biodiesel production from UCO aligns with the EU's circular economy goals. It positions a former waste product as a resource, preventing improper disposal while reducing the need for virgin vegetable oils specifically cultivated for fuel. As biodiesel becomes mainstream, UCO faces competition from other feedstocks like animal fats and purpose-grown oil crops. This puts upward pressure on UCO prices but also promotes innovation in biodiesel processing technology to utilize diverse and cheaper inputs. While biodiesel is considered renewable, concerns may arise regarding the overall sustainability of sourcing UCO at scale. The industry must prioritize traceability and combat potential instances of using questionably sourced UCO to maintain its environmentally positive image.

Used cooking oil, after suitable processing, can be used to produce a range of oleochemicals.

Used cooking oil, after suitable processing, can be used to produce a range of oleochemicals. These building blocks find their way into soaps, detergents, lubricants, cosmetics, and other industrial applications. The oleochemicals market provides an alternative outlet for UCO, reducing overreliance on the biodiesel sector. This creates a more balanced and resilient demand landscape. Advancements in purification and refining technologies unlock the potential for UCO to be used in higher-value products within the oleochemical industry. This boosts the value proposition for UCO collectors and processors. UCO suppliers are no longer solely dependent on biodiesel producers. Oleochemical manufacturers become key buyers, expanding the customer base and potentially improving price negotiation options. The oleochemical sector, with its focus on diverse end uses, might attract businesses specializing in refining and chemical processing that see an opportunity in UCO as a renewable and increasingly consistent feedstock. A well-functioning UCO market benefits the entire chain. Strong demand from oleochemicals can indirectly support prices for biodiesel production, improving the overall economics of UCO collection.

Europe Used Cooking Oil Market Restraints and Challenges:

Inconsistent and Uncertain Feedstock Supply is big a Market Restraint.

The primary source of UCO is household and commercial kitchens (restaurants, food processors). Collection infrastructure can be inconsistent. Some regions have robust networks, while others lack organized systems. Collected UCO can suffer from contamination due to improper disposal practices. Mixing with other waste or exposure to chemicals can significantly reduce quality. Higher levels of impurities (particularly free fatty acids and water) create processing challenges. Depending on regional regulations, low-quality UCO might be diverted to animal feed or other non-biofuel applications. This can create competition for feedstock and price fluctuations, particularly in a tight supply environment. While the EU has overarching goals regarding renewable fuels, individual member states have varying levels of policy support (incentives, mandates, taxation) for UCO-based biofuels. This can create complexity for companies operating across borders. The definition of "sustainable" UCO can be subject to debate and evolving regulations. Issues like double-counting (claiming UCO's environmental benefit in multiple sectors) and potential unintended consequences on land use remain concerns for some policymakers. While generally supportive of UCO-based biodiesel, environmental groups monitor its overall impact. If concerns arise about feedstock sourcing or competition with food production, there's potential for stricter controls in the future.

Europe Used Cooking Oil Market Opportunities:

UCO is a primary feedstock for biodiesel production. With the European Union's strong push for renewable energy and reduction of transport sector emissions, UCO has become a prized commodity. UCO fits neatly into circular economy models, promoting resource efficiency and reducing reliance on virgin vegetable oils. Its potential beyond biodiesel extends to the chemical and animal feed industries. Directives like the Renewable Energy Directive (RED II) and national policies across Europe incentivize the collection and processing of UCO for sustainable uses, driving the market. UCO needs to be pre-processed to remove impurities and free fatty acids (FFAs) before conversion into biodiesel or other applications. Upgrading pre-processing facilities is crucial for meeting quality standards. Pre-processing innovations to produce higher-quality UCO cater to a broader range of potential applications in the oleochemical industry and advanced biofuels (like Hydrotreated Vegetable Oil - HVO), unlocking further market value. Biodiesel remains the primary use case for UCO in Europe. Expanding biodiesel conversion capacity remains critical to keep up with demand. Integrating biodiesel production from UCO with other value-added products within a biorefinery concept maximizes resource utilization and profitability. Processed UCO can serve as a raw material for soaps, detergents, lubricants, and other industrial chemicals. Developing new niches within this sector reduces reliance solely on biodiesel demand. Advancements in technologies like Hydrotreated Vegetable Oil (HVO) open up a path for using UCO to produce a high-quality, drop-in replacement for traditional diesel, particularly appealing for aviation.

EUROPE USED COOKING OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.1% |

|

Segments Covered |

By Oil Type, quality, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Renewi, SARIA, Olleco, Tradebe, Lesieur Cristal, Neste, UPM Biofuels |

Europe Used Cooking Oil Market Segmentation:

Europe Used Cooking Oil Market Segmentation: By Oil Type -

- Sunflower Oil

- Rapeseed Oil

- Soybean Oil

- Olive Oil

- Palm Oil

- Animal Fats

Sunflower Oil has good oxidative stability, a favorable fatty acid profile for biodiesel, and widespread availability. It can have a higher cloud point (solidification temperature) compared to some oils, requiring adjustments for use in colder climates. Rapeseed Oil excels in low-temperature performance as biodiesel, a good source of oleic acid for chemical industry uses. Historically higher processing costs due to FFA content, but innovation is addressing this issue. Soybean Oil is a plentiful source, particularly from UCO collected from processed food manufacturers. The polyunsaturated fatty acid profile can impact biodiesel stability, often blended with other UCO types. Olive Oil is concentrated in certain regions, it possesses high value in oleochemical applications beyond biodiesel. Palm Oil usage can be controversial due to sustainability concerns surrounding its production, impacting its UCO market acceptance in some areas. Animal Fats can be a source for niche biodiesel or specific industrial uses. It is highly regulated due to potential contaminants. Requires specialized processing, generally lower value than vegetable UCO sources.

Europe Used Cooking Oil Market Segmentation: By Quality -

- Grade A

- Grade B

- Grade C

Grade A Emphasis on source separation and efficient collection to maintain low FFA levels and minimize impurities. Beyond premium biodiesel, Grade A is sought after for oleochemical applications where purity is paramount. This broadened market creates greater demand. High-quality UCO could command a higher price due to its value in producing both sustainable biofuels and premium chemicals. Grade B requires more extensive pre-processing but is still the most cost-effective feedstock for the majority of biodiesel production. Improving pre-processing technologies to handle higher FFA content widens the acceptable pool of Grade B UCO. Grade B faces potential competition from alternative feedstocks for biodiesel if those become economically attractive. Processing Grade C UCO for higher-value applications is often cost-prohibitive or technically complex. Strict regulations often limit the use of Grade C UCO for animal feed, particularly for ruminant animals. Potential for Grade C in specific industrial lubricants, combustion applications, and conversion processes with higher tolerance for impurities.

Europe Used Cooking Oil Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany: One of the leaders in UCO collection in Europe, fueled by efficient systems and an established biodiesel industry. German companies are often at the forefront of technological developments in UCO pre-processing and conversion processes. France: Government initiatives and regulations strongly support UCO collection and valorization for sustainability goals. Significant and growing interest in using UCO within the oleochemical industry for producing soaps, detergents, and other products. Italy: Expanding UCO collection networks, especially in urban areas, driven by a greater focus on renewable energy sources. Biodiesel is a significant driver, but exploration of high-value niche applications in the oleochemical sector is also gaining traction. UK: UCO collection systems are evolving, and government policies aim to increase the utilization of UCO for biofuels and other sustainable purposes. Growing awareness and public pressure for environmentally conscious practices create opportunities within the UCO market. Spain: Increasing biodiesel production capacity generates demand for UCO feedstocks. Focus on improving UCO collection infrastructure and engaging households and smaller businesses in proper disposal. Rest of Europe: Expanding economies driving increased UCO generation and collection, particularly in Poland and surrounding nations. A mix of countries with established UCO industries alongside those in earlier stages of market development. Western Europe collectively holds the largest share of the UCO market within the continent. Countries like Germany and France boast well-established biodiesel production capacity creating consistent demand for UCO feedstock. The "Rest of Europe" segment encompasses a diverse mix of countries and exhibits strong potential to be the fastest-growing region within the European UCO market.

COVID-19 Impact Analysis on Europe Used Cooking Oil Market:

Lockdowns and social distancing measures forced the closure or significant reduction in operations of restaurants, cafes, and hospitality businesses across Europe. This led to a drastic decline in the generation of used cooking oil, the primary source material for the UCO market. Restrictions on movement and social distancing protocols hampered collection activities, causing logistical challenges and a temporary halt to the smooth flow of UCO from source to processors. Demand for biodiesel, the primary end-use for UCO in Europe, plummeted due to a significant decrease in transportation fuel needs with fewer cars and commercial vehicles on the road. This further dampened the demand for UCO feedstock. While the food service industry suffered, a surge in home cooking activities led to a potential increase in household-generated UCO. However, efficient collection systems were often not yet in place to capture this new source effectively. The pandemic spurred innovation within the UCO sector. Companies explored new technologies for pre-processing and conversion to expand UCO's applications beyond biodiesel. This included research on using UCO for sustainable aviation fuel (SAF) and other high-value products.

Latest Trends/ Developments:

The UCO collection process is getting a technological upgrade, moving away from simple bins at restaurants to more sophisticated systems. Smart containers utilizing IoT (Internet of Things) sensors monitor UCO fill levels in real time, optimizing collection routes and preventing overflow. Data collected from smart systems helps UCO collectors streamline logistics, reduce unnecessary trips, and increase efficiency, ultimately lowering collection costs. Development of smaller-scale smart collection solutions tailored for domestic kitchens, making it easier for households to contribute to the UCO circular economy. Upgrading pre-processing technology is key to increasing the viability of lower-quality UCO (higher in free fatty acids and impurities). Explorations into novel pre-processing methods like enzymatic treatments, advanced filtration systems, and chemical processes that cost-effectively improve UCO quality. The oleochemical industry uses oils and fats to create soaps, detergents, lubricants, cosmetics, and other valuable products. High-quality UCO is a promising sustainable alternative feedstock.

Key Players:

- Renewi

- SARIA

- Olleco

- Tradebe

- Lesieur Cristal

- Neste

- UPM Biofuels

Chapter 1. Europe Used Cooking Oil Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Oil Type

1.5. Secondary Product Oil Type

Chapter 2. Europe Used Cooking Oil Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Used Cooking Oil Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Used Cooking Oil Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Used Cooking Oil Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Used Cooking Oil Market– By Oil Type

6.1. Introduction/Key Findings

6.2. Sunflower Oil

6.3. Rapeseed Oil

6.4. Soybean Oil

6.5. Olive Oil

6.6. Palm Oil

6.7. Animal Fats

6.8. Y-O-Y Growth trend Analysis By Oil Type

6.9. Absolute $ Opportunity Analysis By Oil Type , 2024-2030

Chapter 7. Europe Used Cooking Oil Market– By Quality

7.1. Introduction/Key Findings

7.2 Grade A

7.3. Grade B

7.4. Grade C

7.5. Y-O-Y Growth trend Analysis By Quality

7.6. Absolute $ Opportunity Analysis By Quality , 2024-2030

Chapter 8. Europe Used Cooking Oil Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By oil Type

8.1.3. By Quality

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Used Cooking Oil Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Renewi

9.2. SARIA

9.3. Olleco

9.4. Tradebe

9.5. Lesieur Cristal

9.6. Neste

9.7. UPM Biofuels

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The EU's Renewable Energy Directives (RED I and II), along with individual member states' targets, mandate an increase in renewable fuels within the transportation sector. UCO is a prime feedstock for biodiesel.

The quality of UCO varies depending on its source (restaurants vs. food processing), the type of oil used, and how it was handled. Inconsistent quality complicates processing and can limit end-use applications.

Renewi, SARIA, Olleco, Tradebe, Lesieur Cristal, Neste, UPM, Biofuels.

Germany currently holds the largest market share, estimated at around 25%.

Countries within Eastern Europe, such as Poland, Hungary, the Czech Republic, and others, are seeing significant economic growth and rising disposable incomes.