Europe Tinned Fruits Market Size (2024-2030)

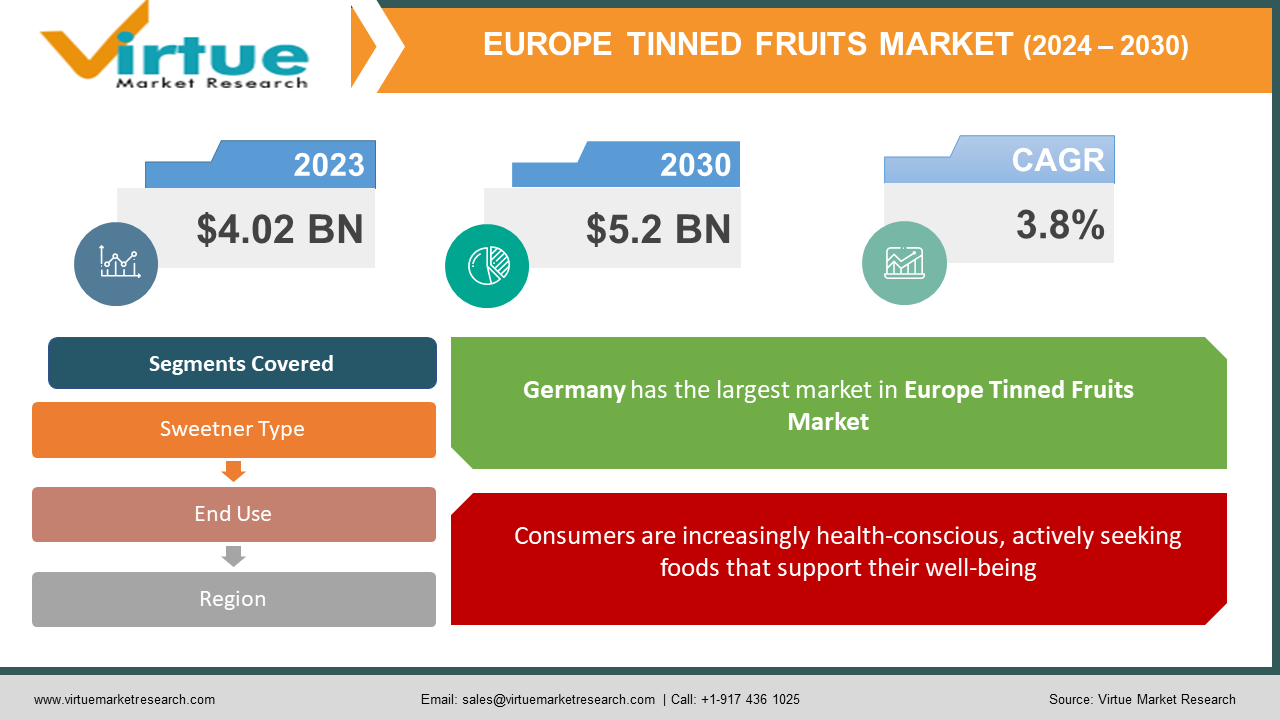

The Europe Tinned Fruits Market was valued at USD 4.02 Billion in 2023 and is projected to reach a market size of USD 5.2 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.8%.

The European tinned fruits market encompasses a diverse range of fruit products preserved in airtight metal cans. Classic tinned fruits like peaches, pears, pineapple, apricots, and fruit cocktail mixes enjoy widespread popularity. Demand for tinned fruits like mangoes, lychees, and guava is growing as consumers seek exciting and convenient options. Tinned berries, such as blueberries and cranberries, find their niche in baking and specific uses. Tinned fruits offer an easy, ready-to-eat solution with extended shelf life compared to fresh fruits. This aligns with the needs of busy modern consumers. Tinning provides access to seasonal fruits throughout the year, overcoming limitations posed by the perishability and seasonality of fresh produce. Tinned fruits play a significant role in baking, desserts, and the preparation of certain dishes where the consistency and texture provided by tinned fruits are desirable. Tinned fruits tend to be a cost-effective option, often more budget-friendly compared to fresh counterparts, especially out of season. They are widely accessible across various retail channels. While fresh is generally preferred, tinned fruits can still contribute valuable vitamins and fiber to the diet, especially when fresh options are unavailable or significantly more expensive. Consumers are more attentive to ingredient labels and nutritional content. There's a push for lower sugar content in tinned fruits, the use of natural sweeteners, and cleaner labels with fewer additives. The market is seeing the introduction of new flavor combinations, infusing tinned fruits with spices or botanicals, to create unique taste experiences and expand their culinary potential.

Key Market Insights:

Europe has a long history of canning fruits for preservation and convenience, making it a relatively mature market compared to some emerging economies. The market offers a wide range of tinned fruits – peaches, pineapples, pears, fruit cocktails, and more, catering to varied tastes and culinary uses. Tinned fruits enjoy popularity for their extended shelf-life, ease of storage, and often pre-portioned nature, making them a pantry staple in a busy world. While consumers recognize the inherent nutritional value of fruits, concerns exist about sugar content, particularly in syrups, and the potential for additives in some products. The market features established global brands alongside regional and private-label offerings, creating a diverse spectrum of price points and varying quality perceptions. Responding to growing health consciousness, manufacturers focus on reducing added sugar levels, utilizing natural sweeteners, or offering versions packed in juice or water. Consumers increasingly seek out tinned fruits free from artificial preservatives, colors, and flavorings, driving a shift towards simpler, more recognizable ingredient lists. Products highlighting high fiber content, specific vitamins, or the use of antioxidants are gaining traction with health-oriented consumers. Beyond everyday staples, a niche, yet growing, segment features premium tinned fruits with unique varietals, artisanal origins, or innovative flavor combinations, catering to discerning palates. Smaller-sized, single-serving cans of high-quality tinned fruits align with consumers who seek indulgent treats while emphasizing portion control.

Europe Tinned Fruits Market Drivers:

In today's fast-paced lifestyles, consumers across Europe prioritize convenience without sacrificing quality and taste. Tinned fruits effortlessly fit into this equation, offering several advantages that resonate strongly.

Tinning extends the shelf life of seasonal fruits, making them accessible year-round regardless of harvest periods. This allows consumers to enjoy their favorite fruits even outside their natural season. Unlike fresh fruits, tinned varieties often require no washing, peeling, or cutting, greatly reducing preparation time. This appeals to busy individuals, encouraging them to incorporate more fruits into their diet. The long shelf life and sturdy packaging of tinned fruits make them ideal for on-the-go snacking, lunchboxes, or for having as a backup in pantries for moments when fresh produce is not available. Tinned fruits help minimize food waste, especially for individuals or smaller households who might struggle to finish fresh fruit before it spoils. The portioned nature of tinned fruits allows for better consumption management. Tinned fruits align with the healthy snacking trend, displacing less healthy options. They become essential accomplices for yogurts, cereals, or in DIY snack mixes. The convenience of tinned fruits makes them popular ingredients in fast home-cooked meals, desserts, and baking recipes where time constraints might usually deter the use of fresh fruit.

Consumers are increasingly health-conscious, actively seeking foods that support their well-being. While tinned fruits might have an image of being overly sugary in the past, this perception is shifting, fueling market growth.

Modern canning methods ensure the preservation of many of the fruit's vitamins, minerals, and fibers. In some cases, the heating process can even increase the bioavailability of certain nutrients. The market has responded to health-conscious consumers by offering a wider range of tinned fruits canned in their natural juices or with significantly reduced sugar syrups. Clearer labeling practices and a focus on simple, recognizable ingredients enhance tinned fruits' position within the 'clean eating' trend. Tinned fruits offer an easy way for people with dietary restrictions (vegan, gluten-free) to incorporate a variety of fruits into their meals and snacks. With a greater focus on balanced diets, tinned fruits are no longer seen purely as a dessert indulgence. They are reframed as healthy components of meals, expanding their appeal. Highlighting nutritional content, the lack of additives, and recipe ideas that focus on the healthfulness of tinned fruits become prevalent in marketing campaigns. Tinned fruits expand beyond traditional demographics, with greater interest from fitness enthusiasts, families with young children, and health-conscious older consumers.

Europe Tinned Fruits Market Restraints and Challenges:

Health-conscious European consumers increasingly favor fresh fruits for their nutritional value, perceived freshness, and a wider range of seasonal choices. This trend can limit growth within the tinned fruit segment.

Health-conscious European consumers increasingly favor fresh fruits for their nutritional value, perceived freshness, and a wider range of seasonal choices. This trend can limit growth within the tinned fruit segment. Current dietary trends emphasize natural, minimally processed foods, creating an image challenge for tinned fruits, even though some retain excellent nutritional value. Supermarkets often devote more prominent shelf space and promotional activities to fresh produce sections, reinforcing the priority of fresh fruits in consumers' minds. The expansion of frozen fruit options offers consumers seeking convenience and longer shelf life a compelling alternative. Frozen fruits are often perceived as closer to their 'fresh' state. The rising popularity of dried fruits and innovative snack products based on them presents another competitive force, appealing to health-conscious consumers with convenient formats. Aseptic packaging and other preservation techniques for fruit-based juices and purées can also capture a segment of the market that tinned fruit might previously have occupied.

Europe Tinned Fruits Market Opportunities:

When compared to their fresh equivalents, canned fruits may have historically been associated with unfavorable health or freshness judgments. However, as more people become aware of their benefits, this perception is shifting. Particularly in the off-season, canned fruits are often more available and less expensive than fresh produce. They also have a longer shelf life and are convenient to store. For consumers searching for convenient yet nutrient-dense food sources, modern canning processes preserve a substantial amount of the nutritional value of fruits. Fruits in cans can be repositioned as a high-end, fashionable product by redesigning the packaging and using targeted marketing. Showcasing the fruit's origin and quality results in a more elegant positioning. Stress how canned fruits can be used in fancy recipes, intriguing flavor combos, or as an easy element for inventive home cooks. A growing trend for natural and organic ingredients is a great chance to market fruits in cans without additives or preservatives, which will appeal to consumers who are health conscious. Convenient eating options are dictated by busy lifestyles in Europe. This market responds well to marketing canned fruits as an easy-to-use, adaptable, and simple ingredient. To capitalize on the growing trend of snackification, create smaller tins or single-serve packaging that emphasizes portion control and on-the-go eating.

EUROPE TINNED FRUITS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.8% |

|

Segments Covered |

By Sweetner Type, end use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Del Monte Foods, Princes Group, Dole Food Company, Conserve Italia, Andros, Krinos Foods, Thomy |

Europe Tinned Fruits Market Segmentation:

Europe Tinned Fruits Market Segmentation: By Sweetener Type -

- Heavy Syrup

- Light Syrup

- Natural Juice

- Sugar-Free (Water Packed & Artificial Sweeteners)

Heavy Syrup: Preferred by some for classic desserts or where intense sweetness is desired for specific recipes. Strongly linked to certain fruits (peaches, pears) due to historical popularity. Faces declining demand as consumers seek healthier alternatives. Light Syrup: Appeals to a broader audience seeking sweetness but less than heavy syrup offers. Suitable for a wider variety of uses, both direct consumption and as an ingredient. Natural Juice: Resonates with consumers prioritizing "clean" products and natural ingredients. Can offer a unique flavor profile compared to syrup-based tinned fruits. May command a slightly higher price point due to the perception of premium quality. Sugar-Free (Water Packed & Artificial Sweeteners): Caters to those managing sugar intake (diabetics) or following strict low-carb diets. Water-packed fruits might lack appeal for some consumers accustomed to sweetness. Artificial sweeteners, while sweet, carry the flavor profiles that not everyone prefers. Historically, heavy syrup was likely the most dominant sweetener in the tinned fruit market. However, due to changing consumer preferences, light syrup and natural juice options are increasingly gaining prominence. Natural juice and sugar-free tinned fruit segments are expected to exhibit the most significant growth within the European market.

Europe Tinned Fruits Market Segmentation: By End Use -

- Household Consumption

- Food Service Sector

- Industrial Use

Household Consumption: Tinned fruits offer easy preparation, long shelf-life, and affordability, making them appealing for home use. Eaten as a snack, dessert, or incorporated into yogurt, smoothies, baked goods, and numerous recipes. Emphasis on smaller cans or portions for on-the-go convenience and health focus. Consumer trends toward health, adventurous eating, and culinary experimentation can shape the products and flavors favored in this segment. Food Service Sector: Tinned fruits provide a reliable source of quality ingredients at a predictable cost, crucial for businesses needing to control expenses. Utilized in desserts, as toppings on ice creams and waffles, within fruit salads, and occasionally as savory recipe components. Expanding the restaurant industry and the trend of eating out more frequently can drive demand for tinned fruits within the food service sector. Fresh and frozen fruits are competitors. Tinned fruits must emphasize their advantages to remain a preferred choice for food services. Industrial Use: Tinned fruits are predominantly used as one component within more complex processed foods. Jams, jellies, baked goods, confectionaries, fruit sauces, yogurt mixes, and other similar products. Price plays a significant role alongside consistent quality and year-round availability. Within the European tinned fruits market, household consumption holds the largest share. This is primarily due to the convenience, affordability, and wide range of uses tinned fruits offer individual consumers across various income groups. The food service sector exhibits strong potential for increased tinned fruit consumption.

Europe Tinned Fruits Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany: German consumers favor high-quality tinned fruits, often seeking out less common varieties and those preserved in natural juices. Major supermarket chains play a significant role in distribution and product promotion. Germany processes a portion of its fruit production into tinned formats, contributing to the market. France: Tinned fruits have a place in both home cooking and within the food service industry, used in desserts and as components in classic dishes. Growing preference for organic and sustainably sourced tinned fruits aligns with trends across the French food industry. Italy: A long history of canning fruits, driven both by the abundance of fresh produce and a focus on preserving harvests. Tinned fruits, like peaches and pears, are often utilized in traditional Italian desserts and baked goods. Italy is a major producer of tinned fruits, both for domestic consumption and significant export markets. UK: Tinned fruits enjoy widespread use, with well-established brands and consumer preferences. The UK market seeks new flavors, exotic additions, and formats like pouches for on-the-go usage. Growing focus on sugar reduction can impact product choices within the UK tinned fruit sector. Spain: Spain is a significant fruit producer, some of which is processed into tinned products. Tinned fruits play a role in both classic Spanish recipes and as convenient staples for modern households. Rest of Europe: Nations in Eastern Europe are developing a stronger taste for tinned fruits driven by accessibility and convenience. Diverse culinary traditions within this region influence the types of tinned fruits favored in specific markets. Western Europe collectively holds the largest share of the tinned fruits market. The "Rest of Europe" segment shows strong potential to be the fastest-growing region within the European tinned fruits market. Improving economic conditions in nations like Poland, Hungary, and others in Eastern Europe are boosting consumer purchasing power.

COVID-19 Impact Analysis on the Europe Tinned Fruits Market:

The early stages of the pandemic witnessed a surge in demand for shelf-stable food items, including tinned fruits. This initial surge likely reflected stockpiling behavior as consumers prepared for potential food shortages or disruptions in fresh produce supply chains. Lockdowns and border restrictions temporarily disrupted supply chains, impacting the import and export of tinned fruits within Europe and from other regions. This could have led to short-term product availability issues in some areas. As the pandemic progressed, consumers became more conscious of their health and well-being. Tinned fruits, perceived as a source of vitamins and minerals, may have benefited from this trend, particularly if positioned as a convenient way to boost daily fruit intake. Restaurant closures and social distancing measures led to a significant increase in home cooking. This could have driven demand for tinned fruits as a versatile ingredient for homemade desserts, snacks, or baking. The economic fallout from the pandemic could lead to price sensitivity among consumers, potentially impacting sales of premium tinned fruit options or those with higher price points. Transparency and sustainability concerns could come to the forefront. Consumers might be more interested in tinned fruits with ethical sourcing practices and responsible environmental footprints. Dried fruits or shelf-stable pouches containing fruit purees could see increased competition with tinned fruits as convenient and healthy options.

Latest Trends/ Developments:

Consumers increasingly scrutinize the sugar content in foods. Tinned fruits in natural juices, lower-sugar syrups, or with alternative sweeteners (like stevia) are gaining popularity. A push towards products with fewer additives, preservatives, and artificial ingredients. This favors tinned fruits that highlight their natural origins and simpler formulations. Beyond just sweetness, tinned fruits can cleverly market their inherent nutritional value – vitamins, minerals, and fiber – catering to health-conscious shoppers. Tinned fruits expand beyond peaches and pears. Mangoes, lychees, guava, and other tropical or less-common fruits offer novel flavors and excitement. While traditional cans dominate, new packaging formats are emerging - pouches for portability, and resealable plastic containers for multiple uses. Collaborations with food bloggers, recipe websites, and even packaging-based suggestions spark creativity, expanding tinned fruits' usage occasions. Digital platforms are used creatively to promote tinned fruits, showcase recipes, highlight product benefits, and connect with younger demographics.

Key Players:

- Del Monte Foods

- Princes Group

- Dole Food Company

- Conserve Italia

- Andros

- Krinos Foods

- Thomy

Chapter 1. Europe Tinned Fruits Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Sweetener Type

1.5. Secondary Product Sweetener Type

Chapter 2. Europe Tinned Fruits Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Tinned Fruits Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Tinned Fruits Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Tinned Fruits Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Tinned Fruits Market– By Sweetener Type

6.1. Introduction/Key Findings

6.2. Heavy Syrup

6.3. Light Syrup

6.4. Natural Juice

6.5. Sugar-Free (Water Packed & Artificial Sweeteners)

6.6. Y-O-Y Growth trend Analysis By Sweetener Type

6.7. Absolute $ Opportunity Analysis By Sweetener Type , 2024-2030

Chapter 7. Europe Tinned Fruits Market– By End Use

7.1. Introduction/Key Findings

7.2 Household Consumption

7.3. Food Service Sector

7.4. Industrial Use

7.5. Y-O-Y Growth trend Analysis By End Use

7.6. Absolute $ Opportunity Analysis By End Use , 2024-2030

Chapter 8. Europe Tinned Fruits Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Sweetener Type

8.1.3. By End Use

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Tinned Fruits Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Del Monte Foods

9.2. Princes Group

9.3. Dole Food Company

9.4. Conserve Italia

9.5. Andros

9.6. Krinos Foods

9.7. Thomy

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The fast pace of modern life, especially in urban areas, favors convenient food choices. Tinned fruits offer pre-prepped, ready-to-eat options with a long shelf life.

While there's increasing availability of sugar-free or minimally sweetened tinned fruits, those in heavy syrup persist. This can create a negative health perception for the category overall. Evolving recommendations on sugar intake and consumer focus on wellness can impact consumption patterns of traditionally sweetened tinned fruits.

Del Monte Foods, Princes Group, Dole Food Company, Conserve Italia

Andros, Krinos Foods, Thomy.

Germany currently holds the largest market share, estimated at around 18%.

Within the Rest of Europe segment, the Netherlands stands out as a significant player in the tinned fruits market. The Netherlands is a major hub for food processing and distribution, with well-developed infrastructure and logistics networks.