Europe Textured Vegetable Protein Market Size (2024-2030)

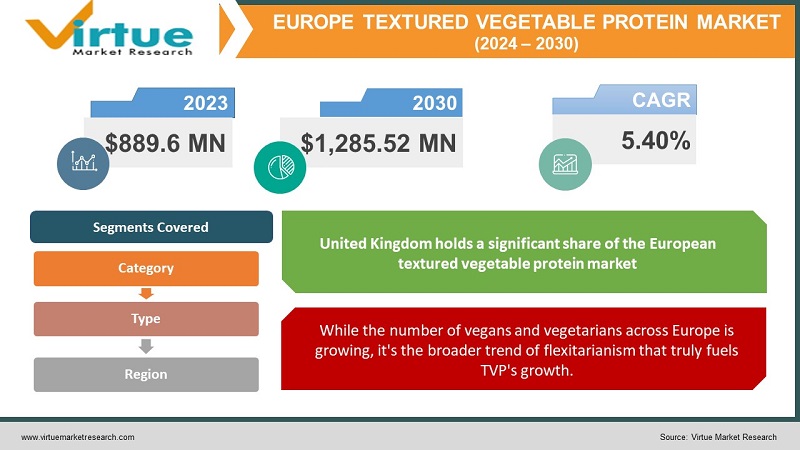

The Europe Textured Vegetable Protein Market was valued at USD 889.6 Million in 2023 and is projected to reach a market size of USD 1,285.52 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.40%.

The rise of flexitarianism, where people reduce meat consumption without eliminating it, and the growth of veganism and vegetarianism are transforming dietary patterns across Europe. TVP's affordability and versatility align well with these trends. Concerns about the health impacts of excessive red meat consumption and the search for protein sources with a lower environmental footprint propel consumers towards plant-based options like TVP. The vast majority of TVP in the European market is made from defatted soy flour. However, alternatives made from peas, wheat, and other plant-based proteins are gaining attention. TVP is available in various forms, including dry flakes, chunks, granules, and strips, catering to diverse culinary applications. It can mimic ground meat, sausage crumbles, or larger meaty pieces. The European TVP market is experiencing robust growth but with regional variations. Northern and Western Europe generally show more mature markets compared to some parts of Eastern Europe.

Key Market Insights:

It's no longer just about strict vegans or vegetarians. A significant portion of TVP's growth is driven by flexitarians consciously reducing meat consumption for health or environmental reasons without eliminating it. Consumers are increasingly accepting the idea that protein can come from diverse sources. TVP benefits as it offers a protein-dense plant-based option. Environmentally conscious consumers recognize that plant-based proteins, including TVP, generally have a smaller environmental footprint compared to animal-derived proteins. This is a growing factor in purchase decisions. Early TVP was often disappointed with its blandness. Today advances in extrusion technology and flavor science significantly enhance the taste and mouthfeel of TVP products. TVP isn't just targeting the vegan burger market. It's increasingly used as a cost-effective extender or protein booster in conventional processed meat products like meatballs, sausages, and ground meat mixtures. Strict EU regulations on allergen labeling are critical due to soy being the primary TVP source. Clear labeling is essential for consumer safety. Definitions and labeling requirements for plant-based products mimicking meat are still debated, potentially impacting how TVP products are marketed. Despite improvements, a segment of consumers still perceive plant-based substitutes as inferior to meat in taste. Continued innovation is crucial to overcome this. While TVP is generally more affordable than meat, some premium plant-based products incorporating TVP can be as expensive, if not more so, than their meat-based counterparts.

Europe Textured Vegetable Protein Market Drivers:

While the number of vegans and vegetarians across Europe is growing, it's the broader trend of flexitarianism that truly fuels TVP's growth.

TVP, especially soy-based, is affordable, versatile, and readily adapts to familiar meat-based recipes. This offers a low-risk way for flexitarians to experiment. Unlike strict vegan diets, flexitarianism doesn't require an overhaul of entire eating patterns. The option to swap TVP for some meat-based meals makes adoption easier. TVP can be a stepping-stone. Over time, flexitarian consumers might find they need less actual meat, and reliance on plant-based replacements increases naturally. While ground beef and sausage analogs drive entry, TVP can be used in global cuisines like curries, stir-fries, and pasta sauces, making it a pantry staple rather than a niche imitation. The image of plant-based foods as being solely for strict vegetarians is shifting. Flexitarians come from all demographics. Food marketers recognize a large, untapped market segment among those who still enjoy meat but are open to reducing its prominence in their diets. Flexitarian parents look for ways to add plant-based nutrition for the whole family. TVP's affordability and kid-friendly uses are attractive. Pre-seasoned TVP crumbles, ready-to-eat vegan meatballs, and mix-in sauces cater to busy lifestyles. The focus moves away from 'meat-free' towards highlighting flavor, culinary versatility, and the positive reasons for plant-based choices.

Historically, some TVP products suffered from bland flavor and an overly chewy texture. Technological innovation is rapidly overcoming these drawbacks.

Extrusion involves forcing a protein source (soy flour, pea protein isolate, etc.) through specialized equipment under heat and pressure, creating unique textures. Sophisticated extrusion techniques can replicate the fibrous bite of meat. This is key to overcoming the 'chewy' or 'mushy' texture problems associated with earlier TVP products. By fine-tuning parameters like temperature, moisture content, and die shapes, manufacturers can produce TVP with textures tailored to mimic ground beef, chicken shreds, pulled pork-like pieces, and more. Blending TVP with plant-based fats, binders, and flavorings opens the door to unique new formats like plant-based sausage links or seafood-alternative products. Consumers are increasingly wary of lengthy ingredient lists full of unfamiliar chemical terms. Techniques like mechanical texturization, which rely more on physical processes than chemical additives, are gaining attention. While soy-based TVP dominates, alternatives like TVP from peas, lentils, and sunflower seeds cater to specific dietary needs.

Europe Textured Vegetable Protein Market Restraints and Challenges:

Plant-based meat alternatives, including TVP, faced criticism for bland flavors, unappealing textures, and being overly 'processed.'

Some consumers associate plant-based meat alternatives, including TVP, with being overly processed or artificial. Emphasis on clean-label ingredients and transparent processes is needed to counter this perception. While TVP has vastly improved, some consumers still carry memories of bland or unappealingly textured products from the past. This creates skepticism that needs to be overcome. Consumers unfamiliar with working with TVP may be unsure of its culinary uses or how to achieve the best results – requiring education and recipe support. TVP competes with other plant-based options like tempeh, tofu, seitan, and newer entrants derived from mycoprotein (fungi), all vying for consumer attention. Established meat producers and brands may not react passively to the rise of plant-based alternatives – lobbying efforts and marketing strategies could counter TVP's growth. While TVP is generally more affordable than meat, some premium and innovative products carry a higher price tag, potentially limiting their reach within the broader market. As the plant-based sector grows, consumers are wary of companies making exaggerated sustainability claims. Transparency and verifiable data about TVP's environmental footprint are essential

Europe Rice Flour Market Opportunities:

TVP can mimic the flaky texture of fish or the bite of shrimp, expanding options in the rapidly growing 'alternative seafood' space. TVP's versatility makes it adaptable to diverse recipes from curries to stir-fries, expanding its appeal to adventurous eaters. TVP-based jerky, savory crumbles for wraps, and fillings for dumplings offer convenience and plant-based protein on the go. Pea-based TVP benefits from a neutral flavor profile and an 'allergen-friendly' image. Significant investment is going into this area. Europeans are increasingly conscious of food production's environmental impact. TVP, with its lower footprint compared to meat, has a natural advantage. Finding ways to further reduce water use, optimize energy efficiency, and utilize production byproducts makes TVP an even more sustainable choice. Exploring biodegradable or fully recyclable packaging strengthens the environmental appeal of TVP products. Adding vitamins (B12 is common), iron or fiber can elevate TVP products to nutrition powerhouses.

EUROPE TEXTURED VEGETABLE PROTEIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.40% |

|

Segments Covered |

By Type, Category , and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

ADM, Cargill, Dupont, Roquette, MGP Ingredients, Beyond Meat , Böden, Cosucra |

Europe Textured Vegetable Protein Market Segmentation:

Europe Textured Vegetable Protein Market Segmentation: By Type-

- Soy

- Pea

- Wheat (Gluten)

- Alternative Sources

Soy: Defatted soy flour, a byproduct of soybean oil production, is the most common source for TVP globally and within Europe. Soy-based TVP holds the largest market share, roughly estimated in the 60-70% range. However, its dominance is gradually decreasing. Pea: Derived from yellow field peas, pea protein isolates are used to create TVP. Pea-based TVP is the fastest-growing segment, with an estimated share of around 20-25%, though this is in constant flux. Wheat (Gluten): Wheat gluten (also called seitan) is a protein complex extracted from wheat flour. Wheat-based TVP holds a smaller, more specialized niche, perhaps around the 5-10% share, limited by its unsuitability for gluten-sensitive individuals. Alternative Sources: TVP is being developed from various sources including Lentils, Chickpeas, Fava Beans, and Sunflower seeds. Soy-based TVP still holds the largest market share currently due to its cost-effectiveness and established processes. Pea-based TVP is experiencing the most rapid growth, driven by consumer demand for allergen-friendly, sustainable, and clean-label plant-based protein options.

Europe Textured Vegetable Protein Market Segmentation: By Category -

- Dry TVP

- Hydrated TVP

- Flavored and Marinated TVP

Dry TVP is a TVP in its dehydrated form. Versatile and requires rehydration with broth or water before incorporating into recipes. Comes in various forms - Flakes: Small, coarse pieces resembling breadcrumbs. Chunks: Larger, irregularly shaped pieces (often used in stews or chili). Granules/Mince: Finely ground, mimics the consistency of ground meat. Strips or Shreds: Textured to replicate shredded or pulled meat textures. Dry TVP holds the dominant share, roughly estimated at 60-70% of the market. Hydrated TVP is a TVP sold pre-hydrated and often refrigerated, offering convenience. Forms: Typically mimics ground meat or larger crumbles. May be plain or pre-flavored. Growing in popularity. Holds a smaller share, estimated at 20-30% of the market. Flavored and Marinated TVP includes both dry and hydrated TVP with pre-added seasonings, marinades, or sauces. Forms are diverse from pre-formed burger patties to seasoned crumbles for tacos. Smaller but rapidly expanding segment, roughly has a 5-10% share. Dry TVP, particularly the granules/mince form, remains the most widely available and widely used product type due to its versatility and affordability. Flavored and marinated TVP is seeing the most significant growth. Driven by consumers seeking easy-to-use products with minimal cooking time.

Europe Textured Vegetable Protein Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The United Kingdom holds a significant share of the European textured vegetable protein market, accounting for approximately 16% of the overall market. British consumers have embraced plant-based and sustainable food options, driving the demand for TVP as a meat alternative and protein source. Germany boasts one of the most developed TVP markets in Europe, contributing around 18% of the total market share. Germany consistently ranks among European nations with higher percentages of plant-based eaters. Strong consumer focus on healthy eating drives interest in plant-based alternatives for protein. France accounts for approximately 14% of the European textured vegetable protein market share. French consumers have a growing interest in plant-based and sustainable food products, contributing to the demand for TVP-based meat alternatives and protein-rich options. Italy contributes around 12% to the overall European textured vegetable protein market share. Italian consumers have a long-standing tradition of incorporating plant-based proteins into their cuisine, making TVP a natural fit for various culinary applications. Spain accounts for approximately 10% of the European textured vegetable protein market share. Spanish consumers value the versatility and nutritional benefits of TVP, using it in various plant-based dishes and meat alternatives. The remaining European countries, collectively referred to as the "Rest of Europe," account for approximately 30% of the overall textured vegetable protein market share. This segment includes countries such as the Netherlands, Belgium, Sweden, Poland, and Switzerland, among others. Each of these countries has its unique market dynamics, consumer preferences, and regulatory frameworks governing the textured vegetable protein industry.

COVID-19 Impact Analysis on the Europe Textured Vegetable Protein Market:

Lockdowns and border restrictions initially disrupted the flow of raw materials and finished TVP products across Europe. Shortages and price fluctuations created uncertainty for manufacturers and retailers. A surge in demand for shelf-stable food items, including some dry TVP products, was observed as consumers stocked up during lockdowns. This could have temporarily inflated sales figures but may not reflect long-term trends. With restaurant closures and limitations on dining out, consumers turned to home cooking. This could have benefited the market for versatile ingredients like TVP, particularly convenient options like pre-seasoned or hydrated varieties. Disruptions in supermarket operations, including limitations on in-store browsing and potential product shortages, may have impacted impulse purchases of TVP products. While the initial surge in panic buying may not be sustained, the pandemic potentially accelerated the pre-existing trend toward plant-based eating. This could benefit the TVP market in the long run.

Latest Trends/ Developments:

While ground meat analogs triggered initial growth, the focus now extends to replicating whole muscle-like textures. Innovative use of high-moisture extrusion and sophisticated die shapes enables the creation of 'fibrous' TVP resembling whole chicken breast, fish filets, or even steak-like cuts. This opens new avenues for chefs, allowing for plant-based versions of roasted, pan-fried, or even seared 'meats' made from TVP. Improved understanding of natural flavor development and the use of culinary techniques takes TVP beyond basic salt and spice. Consumers scrutinize labels, seeking plant-based, recognizable ingredients with minimal processing. Alongside being vegan, products emphasize being also soy-free, gluten-free, and made without artificial additives. Incorporating vegetables, ancient grains, or legumes alongside TVP for added nutrition and textural interest.

Key Players:

- ADM

- Cargill

- Dupont

- Roquette

- MGP Ingredients

- Beyond Meat

- Böden

- Cosucra

Chapter 1. Europe Textured Vegetable Protein Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Textured Vegetable Protein Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Textured Vegetable Protein Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Textured Vegetable Protein Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Textured Vegetable Protein Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Textured Vegetable Protein Market– By Type

6.1. Introduction/Key Findings

6.2. Soy

6.3. Pea

6.4. Wheat (Gluten)

6.5. Alternative Sources

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Textured Vegetable Protein Market– By Category

7.1. Introduction/Key Findings

7.2 Dry TVP

7.3. Hydrated TVP

7.4. Flavored and Marinated TVP

7.5. Y-O-Y Growth trend Analysis By Category

7.6. Absolute $ Opportunity Analysis By Category , 2024-2030

Chapter 8. Europe Textured Vegetable Protein Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K.

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Category

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Textured Vegetable Protein Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. ADM

9.2. Cargill

9.3. Dupont

9.4. Roquette

9.5. MGP Ingredients

9.6. Beyond Meat

9.7. Böden

9.8. Cosucra

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

While vegetarians and vegans are core TVP consumers, the major force is the rise of flexitarians – people actively reducing meat intake without eliminating it.

TVP production relies on agricultural raw materials like soy, peas, etc. Weather events, pests, and global agricultural market shifts can impact prices

ADM, Cargill, Dupont, Roquette, MGP Ingredients, Beyond Meat, Böden

Cosucra.

Germany currently holds the largest market share, estimated at around 18%.

Several nations in Eastern Europe, like Poland, Hungary, Romania, etc., are experiencing economic expansion. This generally translates to increasing disposable incomes and evolving consumption patterns.