Europe Taxi Market Size (2024-2030)

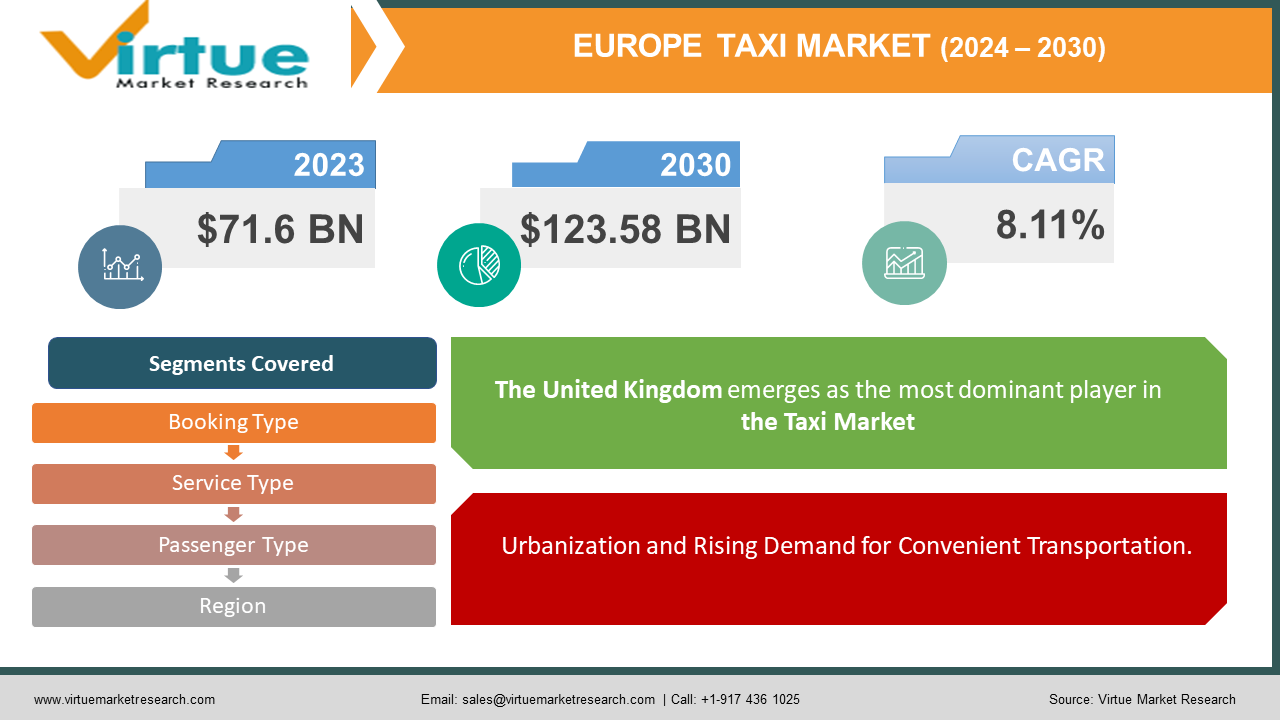

The Europe Taxi Market was valued at USD 71.6 Billion in 2023 and is projected to reach a market size of USD 123.58 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.11%.

The European taxi market, a network of iconic yellow cabs and modern ride-hailing services, plays a crucial role in transporting passengers across diverse landscapes. As European cities expand, the demand for convenient and reliable transportation solutions like taxis rises. Europe remains a top tourist destination, with millions of visitors relying on taxis to navigate unfamiliar cities. Eastern Europe presents an exciting growth market. Traditional taxis remain dominant, but ride-hailing apps are experiencing significant adoption, especially among younger demographics. Regulations in this region can be less stringent compared to Western Europe, allowing for faster innovation and market entry for ride-hailing companies. Southern European countries have a well-established taxi culture, often characterized by family-owned taxi businesses. Ride-hailing apps are making inroads, but their growth might be slower due to existing regulations and entrenched local taxi networks.

Key Market Insights:

The European taxi market is expected to see an increase in cashless payments, with over 80% of transactions projected to be cashless by 2028.

The UK and Germany are expected to account for over 40% of the total European taxi market revenue by 2028, driven by the increasing demand for on-demand mobility services and the presence of major players.

The Europe taxi market is witnessing a surge in investments from major players, with over $3.5 billion invested in the last three years (2021-2023) towards technological advancements and expansion strategies.

The Europe taxi market is expected to create job opportunities for over 1.2 million drivers by 2028, with the ride-hailing segment being the major contributor.

The Europe taxi market is expected to witness significant growth in electric and hybrid vehicles, with their adoption projected to increase from 12% in 2023 to 28% by 2028.

The Europe taxi market is highly fragmented, with the top 10 players accounting for only 25% of the total market share in 2023.

Germany's taxi market was valued at $3.71 billion in 2024, with a significant portion of the revenue generated from traditional taxi services in major cities like Berlin and Munich.

Europe Taxi Market Drivers:

Urbanization and Rising Demand for Convenient Transportation.

The European continent is witnessing a continuous rise in urbanization. As populations migrate towards cities in search of job opportunities and a vibrant lifestyle, the demand for convenient and reliable transportation solutions escalates. Traditional public transport systems like buses and subways, while valuable, often struggle to cater to the growing need for door-to-door service, particularly for late-night journeys or trips with luggage. This is where taxis, both traditional and ride-hailing, offer a compelling solution. Taxis provide passengers with the flexibility to hail a ride on demand, eliminating the need for fixed schedules or pre-booking. This convenience factor is particularly attractive for busy urban professionals or travelers unfamiliar with city layouts. Additionally, taxis offer a sense of security and privacy, especially for solo travelers or those navigating unfamiliar areas at night. As European cities continue to expand and densify, the demand for this type of efficient and personalized transportation is expected to keep the taxi market thriving.

The Allure of Tourism and Exploring Unfamiliar Cities.

Europe remains a top global tourist destination, attracting millions of visitors each year. Tourists often rely on taxis as a convenient and reliable way to navigate unfamiliar cities. Compared to public transportation systems, which can be complex or require local language proficiency, taxis offer a straightforward solution for reaching specific destinations with minimal hassle. Furthermore, taxis provide visitors with a level of flexibility and spontaneity. Tourists can use taxis to explore hidden gems or off-the-beaten-path locations that might not be easily accessible by public transport. The ability to hail a ride on-demand allows tourists to maximize their time and itinerary without being constrained by bus or train schedules. This convenience and adaptability make taxis an indispensable tool for many tourists navigating the diverse landscapes of Europe.

Europe Taxi Market Restraints and Challenges:

Traditional taxi operators often face stricter regulations regarding licensing, vehicle standards, and driver qualifications. Ride-hailing companies, on the other hand, may benefit from less stringent regulations, creating an uneven playing field that traditional taxi operators perceive as unfair. Regulatory frameworks in some European countries haven't fully adapted to the ride-hailing model. This can lead to delays in granting licenses to ride-hailing companies and hinder the overall growth of the market. The competitive pricing offered by ride-hailing companies can put pressure on traditional taxi operators' profit margins. This can lead to price wars that ultimately affect both passengers and drivers. The gig economy model employed by some ride-hailing companies can lead to driver dissatisfaction regarding wages, working conditions, and access to social security benefits. This can create a high driver turnover rate and potentially impact service quality. Traffic congestion and carbon emissions from taxis contribute to environmental concerns. The adoption of electric vehicles and sustainable practices are essential for a greener taxi landscape.

Europe Taxi Market Opportunities:

While still in the nascent stages, AV technology holds immense promise for the future of taxi services. Integrating self-driving cars into taxi fleets can revolutionize urban mobility by offering 24/7 availability, improved efficiency, and potentially reduced costs. However, addressing safety concerns, developing robust regulations, and ensuring responsible implementation will be crucial. Leveraging data analytics can be a powerful tool for taxi companies. Analyzing passenger travel patterns can allow for dynamic pricing strategies, optimizing fleet deployment during peak hours, and identifying underserved areas. Additionally, data can be used to personalize passenger experiences and tailor offerings based on customer preferences. Families with young children often require additional space and amenities. Providing car seats, spacious vehicles, and child-friendly entertainment options can attract this specific passenger segment. Collaboration between traditional taxi operators and ride-hailing companies can leverage the strengths of both models. Taxis can benefit from the wider reach and booking convenience of ride-hailing apps, while app-based companies can gain access to established taxi networks and experienced drivers. Integrating taxi services with public transport networks can offer seamless multimodal travel options for passengers, encouraging them to combine taxis with buses or trains for last-mile connectivity.

EUROPE TAXI MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Booking Type, service type, passenger type, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Radio Taxi, czarne taksówki, The London Taxi Company , Uber, Cabify, Kapten, Gett |

Europe Taxi Market Segmentation:

Europe Taxi Market Segmentation: By Booking Type:

- Offline Booking (Traditional Hailing & Phone Calls)

- Online Booking (Ride-hailing Apps)

The Offline Booking (Traditional Hailing & Phone Calls) segment, once the undisputed king, currently holds an estimated market share of around 60% in Europe. However, it's experiencing a gradual decline, particularly in major cities. Offline booking, the traditional method of hailing a taxi on the street or pre-booking via phone calls, remains dominant in several regions. This familiarity and comfort factor resonates with passengers who may be less tech-savvy or prefer personal interaction with a driver. Some traditional taxi companies are embracing technology by implementing dispatch systems that connect passengers with available taxis. Additionally, a few have launched their mobile apps for pre-booking, blurring the lines between online and offline booking.

The digital challenger, online booking through ride-hailing apps, is experiencing explosive growth. It's estimated to capture a growing share, currently around 40% of the market, and is projected to surpass offline booking shortly. Ride-hailing apps have revolutionized the way Europeans hail taxis. Their user-friendly interface, transparent pricing structures (fare estimates upfront), and convenient on-demand services are fuelling their rapid growth.

Europe Taxi Market Segmentation: By Service Type:

- Metered Taxis

- Ride-hailing Apps with Dynamic Pricing

- Fixed Fare Taxis

The Metered taxi segment still holds a significant share, estimated to be around 60% of the European taxi market. This dominance is particularly pronounced in Southern Europe and certain parts of Eastern Europe. Metered taxis, the iconic yellow cabs or licensed sedans, remain the dominant service type in the European taxi market. Metered taxis have been the go-to option for generations, offering a familiar and reliable service. Passengers know what to expect in terms of pricing structure and vehicle type. Stringent regulations and licensing requirements for metered taxis ensure a certain level of professionalism and driver qualifications, which can be a comfort factor for some passengers.

Ride-hailing apps, with their user-friendly interfaces and app-based booking systems, are the fastest-growing service type in the European taxi market. Ride-hailing apps offer a seamless booking experience, allowing passengers to see fare estimates upfront, track driver arrival times, and pay conveniently through digital wallets. Ride-hailing apps connect passengers with a wider pool of drivers, potentially reducing wait times, especially in major cities. Many ride-hailing apps offer a range of vehicle options beyond basic sedans, catering to diverse passenger needs and budgets.

Europe Taxi Market Segmentation: By Passenger Type:

- Business Travelers

- Tourists

- Local Residents

Residents form the backbone of the European taxi market, utilizing taxis for various purposes throughout their daily lives. Taxis serve as a reliable and convenient alternative to public transportation for short-distance commutes, late-night journeys, or when carrying bulky groceries or luggage. Factors like affordability, familiarity with local regulations, and accessibility during peak hours are crucial considerations for this segment. Residents utilize taxis for running errands, attending appointments, or navigating unfamiliar parts of their city. Reliability, prompt service, and potentially cashless payment options are key considerations for frequent users. Taxis are a go-to option for safe and reliable transportation during evenings and nights, especially when public transportation options are limited or unavailable. Security, clear pricing structures, and potential pre-booking options are important aspects of this segment.

Business travelers are a rapidly growing segment, demanding efficient and reliable taxi services for their work-related needs. Business travelers require taxis to arrive promptly and navigate efficiently through traffic to meet tight schedules. Seamless integration of cashless payment options like credit card or e-wallet integrations streamlines the payment process. Clean, well-maintained vehicles and professional drivers contribute to a positive first impression for business associates.

Europe Taxi Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The United Kingdom emerges as the most dominant player in the Taxi Market, accounting for approximately 24% of the overall regional market share. The UK's thriving urban centers, coupled with its well-established transportation infrastructure and the presence of iconic black cabs, have solidified the country's position as a leading regional player. The UK's taxi market is characterized by a diverse range of service offerings, including traditional black cabs, private hire vehicles, and app-based ride-hailing services. The London black cab, with its iconic design and reputation for exceptional customer service, has long been a symbol of the UK's taxi industry.

The fastest-growing country in the Europe Taxi Market is Spain, which has witnessed a surge in demand for taxi services driven by the country's urban development and the growing popularity of app-based ride-hailing platforms. Spain's taxi market is expected to continue its rapid expansion, driven by the increasing collaboration between traditional taxi operators and innovative mobility service providers, as well as the growing demand for eco-friendly transportation options. The Spanish taxi market is characterized by a well-established system of licensing and regulation, with the government playing a crucial role in ensuring the quality and safety of taxi services. The industry is dominated by traditional taxi operators, who have been adapting to the rise of app-based ride-hailing services.

COVID-19 Impact Analysis on the Europe Taxi Market:

The initial months of the pandemic witnessed a dramatic decline in ridership. Travel restrictions brought tourism to a standstill, business travel ceased, and residents opted for private transportation or stayed home altogether due to health concerns. Reports suggest a decline in taxi bookings by as much as 90% in some European cities compared to pre-pandemic levels. With a significant drop in revenue, taxi companies faced immense financial strain. Many drivers experienced reduced income or even unemployment, while companies struggled to cover operational costs and maintain their fleets. The fear of infection among passengers and drivers led to increased sanitization protocols, the use of protective equipment (masks, gloves), and the adoption of contactless payment options to minimize physical interaction. The European taxi market's recovery has been uneven across regions and segments. Tourist destinations heavily reliant on international travel lagged, while cities with strong local demand witnessed a faster rebound.

Latest Trends/ Developments:

Many cities are exploring ways to integrate taxi services with public transport networks. This allows passengers to combine taxis with buses, trains, or trams for first-mile or last-mile connectivity, creating a more efficient travel experience. Apps like City Mapper or Moovit are emerging that aggregate various transportation options, including taxis, ride-hailing services, bikes, and scooters, allowing users to compare prices, plan journeys, and book seamlessly within a single platform. This convenience and ease of use can attract a wider range of passengers to taxis. Many European governments are offering incentives like tax breaks or subsidies for the purchase and operation of electric taxis. This financial support is accelerating the adoption of electric vehicles (EVs) within the taxi industry. Electric taxis significantly reduce air and noise pollution compared to traditional gasoline-powered vehicles. This aligns with growing environmental concerns and can appeal to eco-conscious passengers and municipalities. Ride-hailing apps can continue to innovate by offering features like pre-booking schedules, carpooling options for budget-conscious passengers, or integrating loyalty programs to incentivize repeat business. Investing in comprehensive driver training programs that focus on defensive driving techniques, passenger interaction skills, and first-aid certification can create a safer and more professional taxi experience.

Key Players:

- Radio Taxi

- czarne taksówki

- The London Taxi Company

- Uber

- Cabify

- Kapten

- Gett

Chapter 1. Europe Taxi Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Taxi Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Taxi Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Taxi Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Taxi Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Taxi Market– By Booking Type

6.1. Introduction/Key Findings

6.2. Energy Shots

6.3. Natural/Organic Energy Drinks

6.4. Sugar-free or low-calorie energy Drinks

6.5. Traditional Energy Drinks

6.6. Y-O-Y Growth trend Analysis By Booking Type

6.7. Absolute $ Opportunity Analysis By Booking Type , 2024-2030

Chapter 7. Europe Taxi Market– By Service Type

7.1. Introduction/Key Findings

7.2 Glass Bottles

7.3. Metal Can

7.4. PET Bottles

7.5. Y-O-Y Growth trend Analysis By Service Type

7.6. Absolute $ Opportunity Analysis By Service Type , 2024-2030

Chapter 8. Europe Taxi Market– By Passenger Type

8.1. Introduction/Key Findings

8.2. Off-trade

8.3. On-trade

8.4. Y-O-Y Growth trend Analysis Passenger Type

8.5. Absolute $ Opportunity Analysis Passenger Type , 2024-2030

Chapter 9. Europe Taxi Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Passenger Type

9.1.3. By Service Type

9.1.4. By Booking Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Taxi Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Radio Taxi

10.2. czarne taksówki

10.3. The London Taxi Company

10.4. Uber

10.5. Cabify

10.6. Kapten

10.7. Gett

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Europe Taxi Market was valued at USD 71.6 Billion in 2023 and is projected to reach a market size of USD 123.58 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.11%.

The rise of ride-hailing apps like Uber and Bolt has disrupted the traditional taxi market. These companies often offer lower fares due to their more flexible operating models, putting pressure on traditional taxi companies to adapt and potentially reduce their prices

Radio Taxi, czarne taksówki, The London Taxi Company, Uber, Cabify,

Kapten, Gett

The UK currently holds the largest market share, estimated at around 24%.

The fastest-growing country in the Europe Taxi Market is Spain, which has witnessed a surge in demand for taxi services driven by the country's urban development and the growing popularity of app-based ride-hailing platforms