Europe Sugar Substitutes Market Size (2024-2030)

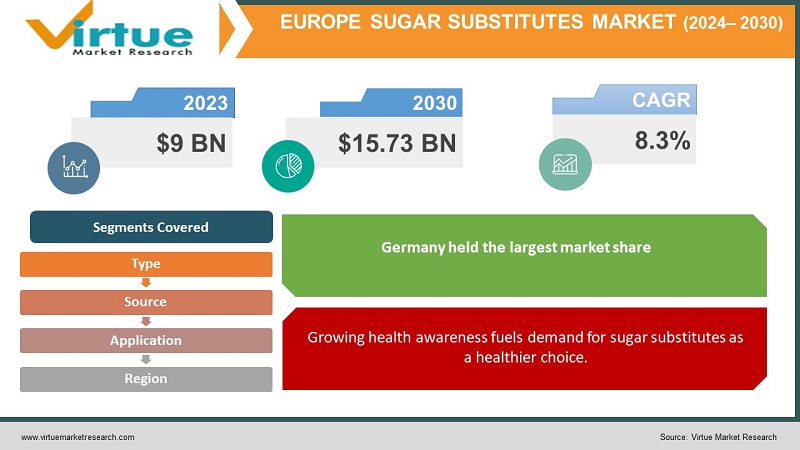

The European sugar substitute market was valued at USD 9 billion in 2023 and is projected to reach a market size of USD 15.73 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.3%.

The European sugar substitute market is driven by a growing awareness of the health benefits of reduced sugar intake, particularly for weight management and blood sugar control. This awareness, coupled with the rising prevalence of chronic diseases like obesity and diabetes, is fueling the demand for sugar substitutes. Consumers are increasingly seeking low-calorie and sugar-free food and beverage options, further propelling market growth. Rising disposable incomes allow for more spending on premium and functional products, while a trend toward natural ingredients is driving the popularity of stevia and erythritol over artificial sweeteners.

Key Market Insights:

The European sugar substitute market is on a steady rise, fueled by a growing health consciousness among consumers. As individuals become more aware of the benefits of reduced sugar intake, particularly for weight management and blood sugar control, the demand for sugar substitutes naturally increases. This trend is further amplified by the rising prevalence of chronic diseases like obesity and diabetes in Europe. This health focus is coupled with a shift in consumer preferences towards low-calorie and sugar-free options. As disposable incomes increase, consumers are willing to spend more on premium and functional products. This has led to a growing preference for natural sweeteners like stevia and erythritol, perceived as healthier alternatives to artificial sweeteners. The market extends beyond just food and beverages, finding applications in diverse sectors like pharmaceuticals, healthcare, personal care, and even cosmetics. Looking ahead, continued innovation in the development of new and improved sugar substitutes with better taste profiles and functionalities is expected to further drive market growth. This focus on innovation ensures that the industry remains competitive and caters to the evolving preferences of health-conscious consumers.

Europe Sugar Substitutes Market Drivers:

Growing health awareness fuels demand for sugar substitutes as a healthier choice.

A key driver of the European sugar substitute market is the increasing emphasis on health and wellness among consumers. People are becoming more informed about the negative impacts of excessive sugar consumption, including weight gain, difficulties with blood sugar control, and potential links to other chronic diseases. This awareness fuels demand for sugar substitutes, which are perceived as a healthier alternative to managing sugar intake.

Rising chronic diseases in Europe create a need for sugar substitutes as a management tool.

Another significant driver is the growing burden of chronic diseases in Europe, particularly obesity and diabetes. These conditions are often linked to excessive sugar intake, making sugar substitutes a potential tool for managing them. As the prevalence of these diseases continues to rise, the demand for sugar substitutes is expected to climb alongside it.

Shifting consumer preferences towards low-calorie and sugar-free options drives market growth.

Consumer preferences are also playing a major role in driving the market. There's a clear trend towards low-calorie and sugar-free food and beverage options. This shift reflects a desire for healthier lifestyles and a growing focus on preventive health measures. Sugar substitutes cater to this demand by offering a way to enjoy sweet-tasting products without the associated drawbacks of excessive sugar consumption.

Premiumization and natural ingredient trends boost the popularity of stevia and erythritol.

Rising disposable incomes are allowing European consumers to spend more on premium and functional food and beverage products. This trend, coupled with a preference for natural ingredients, is boosting the popularity of natural sweeteners like stevia and erythritol. These substitutes are perceived as healthier alternatives to traditional artificial sweeteners, further driving market growth within the natural segment.

Diverse applications and constant innovation propel market expansion and cater to evolving preferences.

The European sugar substitute market extends beyond just food and beverages. Sugar substitutes find applications in various sectors, including pharmaceuticals, healthcare, personal care, and even cosmetics. This broadens the market reach and opens doors for further growth. Additionally, continuous innovation in developing new and improved sugar substitutes with better taste profiles and functionalities is expected to further drive market expansion. This focus on innovation ensures the industry remains competitive and adapts to evolving consumer preferences for healthier and more functional products.

European Sugar Substitutes Market Restraints and Challenges:

Despite the promising growth drivers, the European sugar substitute market faces some hurdles. Stringent regulations regarding safety, labeling, and approval processes, particularly for artificial sweeteners, can hinder market expansion. These regulations, coupled with varying standards across European countries, can complicate product development and market entry for manufacturers. Additionally, some consumers remain hesitant due to a negative perception of artificial sweeteners, often fueled by ongoing scientific debates and inconclusive studies regarding their potential health risks. Market affordability can also be impacted by fluctuating raw material costs, potentially limiting consumer choices. Furthermore, the continued presence of readily available and affordable natural sugar, alongside efforts to promote its sustainable production, poses a competitive challenge to sugar substitutes. Finally, the market grapples with the ongoing challenge of developing substitutes that perfectly replicate the taste and functionality of sugar, which can limit their adoption in specific applications and hinder wider consumer acceptance. Overcoming these restraints and challenges will be crucial for the European sugar substitute market to reach its full potential.

European Sugar Substitutes Market Opportunities:

The European sugar substitute market holds exciting opportunities for future growth and innovation. The rising demand for natural ingredients creates fertile ground for the expansion of the natural sweetener segment, with stevia, erythritol, and other plant-based options gaining traction as healthier alternatives. Furthermore, continuous research and development can lead to improved taste profiles that closely mimic sugar, overcoming a key challenge and potentially broadening their appeal. Additionally, exploring and highlighting the potential functional benefits of certain sugar substitutes, such as prebiotic effects or blood sugar control support, can unlock new market opportunities. Targeted marketing and educational initiatives are crucial to addressing consumer concerns and misconceptions surrounding sugar substitutes and promoting their potential health benefits and safety. Moreover, exploring new applications beyond traditional food and beverage sectors, such as nutraceuticals, dietary supplements, and even pet food, can offer significant growth potential. Finally, aligning with sustainability principles through ethical sourcing and eco-friendly packaging can attract environmentally conscious consumers and enhance brand image, further propelling the market forward. By capitalizing on these opportunities, stakeholders can ensure the European sugar substitute market thrives in the coming years.

EUROP SUGAR SUBSTITUTES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.3% |

|

Segments Covered |

By Product Type, Source, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Cargill, Ingredion, Archer Daniels Midland, Tate & Lyle, Süsswarenfabrik J.D. Sprengel, Ajinomoto, Roquette Frères, PureCircle, JK Sucralose, MacAndrews & Forbes |

Europe Sugar Substitutes Market Segmentation:

Europe Sugar Substitutes Market Segmentation: By Type:

- High-Intensity Sweeteners

- Low-Intensity Sweeteners

The largest and fastest-growing segment in the European sugar substitute market by type is high-intensity sweeteners, driven by the increasing consumer preference for natural ingredients. Fewer sweeteners are needed to provide the same sweetness as high-intensity sweeteners since they are substantially sweeter than table sugar (sucrose). The increasing worldwide trend towards health and well-being is anticipated to expand the range of applications for high-intensity sweetness.

Europe Sugar Substitutes Market Segmentation: By Source:

- Plant-based

- Synthetic

The synthetic segment is the largest. Aspartame, saccharin, and sucralose are examples of artificial sugar replacements that have traditionally been widely utilized in the food and beverage business. These artificial sweeteners provide sweetness without the calorie count of sugar and are frequently used in a range of tabletop sweeteners, drinks, and processed foods. Because they are so widely used by both food makers and consumers, synthetic sugar replacements continue to have a considerable market share in Europe, despite concerns over potential health impacts and artificiality. The plant-based segment is the fastest-growing, driven by consumer preference for natural ingredients. Rising health consciousness has been extremely beneficial for this category. This segment encompasses natural sweeteners like stevia and erythritol.

Europe Sugar Substitutes Market Segmentation: By Application:

- Food and Beverages

- Pharmaceuticals and Healthcare

- Personal Care and Cosmetics

The European sugar substitute market is segmented by application, with food and beverages being the dominant segment due to their widespread use in various low-calorie and sugar-free products. However, the pharmaceuticals and healthcare segment is expected to see the fastest growth in the coming years due to the increasing demand for sugar-free medications and diabetic supplements.

Europe Sugar Substitutes Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany is the largest growing market, driven by a diverse food and beverage industry and a strong emphasis on product innovation. German consumers are increasingly health-conscious and receptive to sugar substitutes. However, price sensitivity remains a factor, and affordability plays a crucial role in consumer choices. The market sees a balanced presence of both natural and artificial sweeteners, with ongoing innovation focusing on improved taste profiles and functionality. The UK market for sugar substitutes is the fastest-growing, driven by a growing health-conscious population and increasing awareness of the benefits of reduced sugar intake. Consumers are actively seeking low-calorie and sugar-free options, particularly in beverages and baked goods. The market also sees a growing preference for natural sweeteners like stevia and erythritol. Regulatory factors play a significant role, with the UK aligning with broader European Union regulations regarding sweetener safety and labeling. The French market for sugar substitutes is characterized by a growing demand for natural sweeteners, particularly stevia, which aligns well with the French preference for natural and high-quality ingredients. Regulatory scrutiny in France is relatively moderate compared to other European countries, but safety and labeling requirements still play a crucial role. The market caters to a diverse range of applications, including food and beverages, pharmaceuticals, and personal care. The Italian sugar substitute market is experiencing moderate growth, influenced by both health-conscious consumers and a strong cultural preference for traditional desserts and beverages. While there is a growing awareness of the benefits of reduced sugar intake, the market still sees a significant presence of traditional sugar-based products. The adoption of natural sweeteners is gaining traction, but artificial sweeteners remain prevalent, particularly in specific product categories. The Spanish market for sugar substitutes is expected to see significant growth in the coming years, driven by rising disposable incomes and increasing health awareness among consumers. The market sees a growing preference for natural sweeteners, alongside a continued presence of artificial sweeteners. Affordability is a key factor influencing consumer choices, and price sensitivity plays a crucial role in market dynamics. Continued innovation and education regarding the benefits of sugar substitutes are expected to further drive market growth in Spain. The rest of the Europe segment encompasses various smaller European countries with diverse market dynamics. Eastern European countries, in particular, are expected to see significant growth in the sugar substitute market due to rising disposable incomes, increasing awareness of health benefits, and growing adoption of Western European dietary trends. However, regulatory environments and consumer preferences can vary significantly across these countries, requiring a nuanced approach from market players.

COVID-19 Impact Analysis on the European Sugar Substitutes Market:

The COVID-19 pandemic has had a dual impact on the European sugar substitute market. Initial disruptions included supply chain issues due to lockdowns, leading to temporary shortages and price fluctuations. Additionally, shifting consumer behavior during the early stages, with a focus on stockpiling essentials, might have caused a dip in demand. Production slowdowns due to safety measures also played a role in temporary availability issues. However, the long-term outlook appears positive. The pandemic has heightened awareness of health and well-being, potentially leading to a sustained rise in demand for healthier options like sugar substitutes. The growth of e-commerce platforms, which boomed during the pandemic, could further benefit sugar substitute sales as consumers shift to online grocery shopping. Additionally, the growing interest in immune-boosting products might create opportunities for sugar substitutes marketed with potential benefits like weight management, which can indirectly support immune health. Overall, while the initial stages of the pandemic caused some disruption, the long-term impact on the European sugar substitute market is expected to be positive. The growing focus on health and immunity, coupled with the rise of e-commerce and potential benefits linked to weight management, could contribute to market growth in the coming years. Despite these considerations, the market is expected to adapt and emerge stronger due to underlying growth drivers and a potential shift towards a more health-conscious consumer landscape in the post-pandemic era. Overall, while the initial COVID-19 impact might have been negative, the long-term outlook seems mixed. The food service sector's recovery might be slow, but opportunities exist in the rising home cooking trend, e-commerce adoption, and a potential shift towards healthier options. Manufacturers who adapt their products and strategies to cater to these evolving preferences are well-positioned to thrive in the post-pandemic European jams and preserves market.

Latest Trends/ Developments:

The European sugar substitute market is buzzing with exciting developments. The demand for natural sweeteners like stevia and erythritol is on the rise, prompting manufacturers to create innovative blends that deliver the desired sweetness and functionality. Furthermore, research is focused on improving taste profiles to closely resemble sugar, addressing a key consumer concern. Additionally, sustainability is becoming paramount, with companies emphasizing ethically sourced materials, eco-friendly packaging, and reduced environmental impact. The market is also witnessing expansion beyond food and beverages, with sugar substitutes finding applications in nutraceuticals, dietary supplements, and even pet food. Targeted marketing and educational initiatives are crucial to address consumer concerns and promote the potential health benefits and safety of sugar substitutes, particularly for artificial options facing lingering negativity. Regulatory bodies are constantly updating safety and labeling requirements, requiring manufacturers to stay informed and compliant. Finally, an increase in mergers and acquisitions indicates a dynamic market where companies are seeking to expand their reach, strengthen positions, and acquire new technologies. By staying abreast of these trends, stakeholders can position themselves to capitalize on opportunities and contribute to the continued growth and evolution of the European sugar substitute market.

Key Players:

- Cargill

- Ingredion

- Archer Daniels Midland

- Tate & Lyle

- Süsswarenfabrik J.D. Sprengel

- Ajinomoto

- Roquette Frères

- PureCircle

- JK Sucralose

- MacAndrews & Forbes

Chapter 1. Europe Sugar substitute Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Sugar substitute – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Sugar substitute Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Sugar substitute - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Sugar substitute Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Sugar substitute Market– By Type

6.1. Introduction/Key Findings

6.2. High-Intensity Sweeteners

6.3. Low-Intensity Sweeteners

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Sugar substitute Market– By Source

7.1. Introduction/Key Findings

7.2 Plant-based

7.3. Synthetic

7.4. Y-O-Y Growth trend Analysis By Source

7.5. Absolute $ Opportunity Analysis By Source , 2024-2030

Chapter 8. Europe Sugar substitute Market– By Application

8.1. Introduction/Key Findings

8.2. Food and Beverages

8.3. Pharmaceuticals and Healthcare

8.4. Personal Care and Cosmetics

8.5. Y-O-Y Growth trend Analysis Application

8.6. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 9. Europe Sugar substitute Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Type

9.1.3. By Source

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Sugar substitute Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill

10.2. Ingredion

10.3. Archer Daniels Midland

10.4. Tate & Lyle

10.5. Süsswarenfabrik J.D. Sprengel

10.6. Ajinomoto

10.7. Roquette Frères

10.8. PureCircle

10.9. JK Sucralose

10.10. MacAndrews & Forbes

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The European sugar substitute market was valued at USD 9 billion in 2023 and is projected to reach a market size of USD 15.73 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.3%.

Growing focus on health and wellness, rising prevalence of chronic diseases, shifting consumer preferences, premiumization, demand for natural ingredients, diverse applications, and innovation focus are the main market drivers

Based on application, the market is divided into food and beverages, pharmaceuticals and healthcare, personal care and cosmetics

. The most dominant region in the European sugar substitute market is Germany, driven by its diverse food and beverage industry, strong emphasis on innovation, and growing health-conscious population

Cargill, Ingredion, Archer Daniels Midland, Tate & Lyle, Süsswarenfabrik J.D. Sprengel, Ajinomoto, Roquette Frères, PureCircle, JK Sucralose, and MacAndrews & Forbes are the major players.