Europe Stevia Market Size (2024-2030)

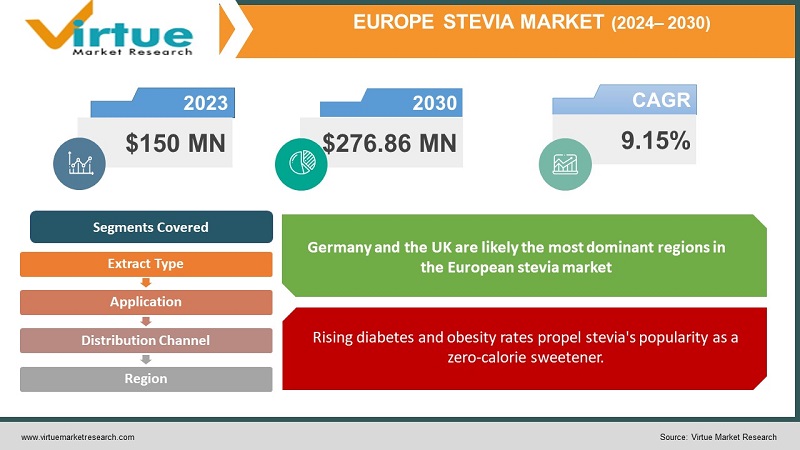

The Europe Stevia Market was valued at USD 150 million in 2023 and is projected to reach a market size of USD 276.86 million by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 9.15%.

The European stevia market is abuzz with activity, driven by a consumer base increasingly interested in health and natural ingredients. This translates to a growing demand for stevia, a natural sweetener derived from a plant. Several factors contribute to this growth. First, health-conscious consumers are actively seeking alternatives to sugar, and stevia fits the bill perfectly. Second, rising obesity and diabetes rates are prompting a search for sugar substitutes, and stevia emerges as a strong contender. Finally, the popularity of health and sports nutrition products, which often incorporate stevia, is on the rise.

Key Market Insights:

Europe's stevia market is experiencing a surge, fueled by a health-conscious population seeking natural alternatives to sugar. Consumers are actively making choices that prioritize well-being, and stevia, a plant-derived sweetener, fits the bill perfectly. This trend is further amplified by the growing prevalence of diabetes and obesity. As people search for sugar substitutes, stevia emerges as a strong contender due to its natural origin and lack of calories. The popularity of health and sports nutrition products, which often utilize stevia as a sweetener, further strengthens the market's position.

Stevia's sweetness extends beyond just a single application. Its versatility allows it to be incorporated into a wide range of food and beverage categories. From creamy dairy products and delectable bakery treats to refreshing beverages and convenient tabletop sweeteners, stevia is finding its way onto grocery store shelves and dinner tables across Europe.

While stevia faces some competition from established sugar substitutes like barley malts and maple syrup, its natural origin positions it well in a market increasingly focused on health and wellness. While these competitors offer unique flavor profiles, stevia's natural sweetness and zero-calorie content make it a compelling option for health-conscious consumers, suggesting a bright future for the European stevia market.

The Europe Stevia Market Drivers:

Europeans prioritize natural ingredients, driving demand for stevia, a plant-based sugar alternative.

Europeans are increasingly prioritizing health and natural ingredients in their diets. This translates to a surge in demand for sugar alternatives, and stevia, derived from a plant, perfectly aligns with this trend. Consumers perceive stevia as a healthier and more natural option compared to traditional sugar.

Rising diabetes and obesity rates propel stevia's popularity as a zero-calorie sweetener.

Unfortunately, Europe faces a growing burden of diabetes and obesity. This has prompted a significant portion of the population to seek sugar substitutes. Stevia emerges as a strong contender in this scenario due to its zero-calorie content and potential blood sugar management properties.

The integration of stevia in health-focused products strengthens the stevia market.

The popularity of health and sports nutrition products is skyrocketing. These products often incorporate stevia as a natural sweetener, further propelling the stevia market forward. This trend reflects a growing awareness of the importance of maintaining a healthy lifestyle.

Stevia's wide application across food and beverages caters to various consumer preferences.

Stevia's appeal extends beyond just a single application. Its versatility allows it to be incorporated into a wide range of food and beverage categories, catering to diverse consumer preferences. From creamy dairy products and delectable bakery treats to refreshing beverages and convenient tabletop sweeteners, stevia is finding its way onto grocery store shelves and dinner tables across Europe.

The Europe Stevia Market Restraints and Challenges:

The European stevia market, though experiencing a boom, faces challenges that hinder its unbridled growth. Regulatory hurdles can be a stumbling block. Complex and evolving European regulations regarding stevia use create uncertainty for businesses, making them hesitant to incorporate stevia into their products.

Consumer acceptance is another hurdle. While stevia boasts natural origins and zero calories, some consumers might find its taste unpleasant compared to sugar. This perception necessitates continued product development to improve stevia's palatability and consumer education highlighting its benefits. Additionally, the current selection of stevia-containing products might be limited compared to traditional sweetener options. Expanding product variety across different food and beverage categories is crucial to attracting a wider consumer base. Finally, price fluctuations pose a challenge for manufacturers. The cost of stevia leaves can fluctuate due to factors like seasonal variations and crop yields. This volatility makes it difficult for manufacturers to maintain stable product pricing. Overcoming these challenges will be essential for the European stevia market to fully blossom.

The Europe Stevia Market Opportunities:

The future of the European stevia market is ripe with opportunity. Innovation in stevia blends, for example, can address taste concerns by combining stevia with other natural sweeteners. This paves the way for exciting new product creations that cater to diverse palates. Furthermore, stevia's potential blood sugar management properties align perfectly with the booming functional food and beverage market. This opens doors for stevia to be incorporated into health-focused products targeting consumers seeking additional benefits beyond just sweetness. Stevia's versatility extends beyond traditional applications. By venturing into new food categories like condiments, sauces, and even pharmaceuticals, the market can broaden its reach and cater to specific consumer needs. Moreover, with a growing focus on sustainability, highlighting eco-friendly stevia farming practices can be a strong selling point, attracting environmentally conscious consumers. Finally, strategic partnerships between stevia growers, manufacturers, and distributors can streamline the supply chain, improve overall efficiency, and potentially lower costs. This would make stevia-containing products more accessible to a wider range of European consumers, solidifying stevia's position as a leading sweetener in the health-conscious market.

EUROPE STEVIA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

9.15% |

||

|

Segments Covered |

By Extract Type, Application , Distribution Channel and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Cargill, Ingredion, Archer Daniels Midland Company (ADM), PureCircle, Tate & Lyle, Oviatis |

The Europe Stevia Market Segmentation:

Europe Stevia Market Segmentation: By Extract Type:

- Whole Leaf Stevia

- Powdered Stevia

- Liquid Stevia

The dominant segment in the European stevia extract market is powdered stevia, widely used by food and beverage manufacturers for its ease of incorporation. However, whole-leaf stevia is gaining traction among health-conscious consumers seeking a natural and unrefined stevia experience, making it the fastest-growing segment.

Europe Stevia Market Segmentation: By Application:

- Beverages

- Bakery & Confectionery

- Dairy Products

- Tabletop Sweeteners

- Other Applications

The dominant application segment in the European stevia market is likely beverages, owing to its widespread use in various drinks. However, the functional food & beverage segment is expected to be the fastest-growing segment due to stevia's potential blood sugar management properties, catering to health-conscious consumers seeking additional benefits.

Europe Stevia Market Segmentation: By Distribution Channel:

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Retailers

Supermarkets and hypermarkets likely hold the dominant position in the European stevia market by distribution channel. These major retailers offer a wide variety of stevia-containing products, making them a one-stop shop for most consumers. However, online retailers are expected to be the fastest-growing segment. E-commerce platforms provide convenient access to a wider selection of stevia products, including niche and international options, catering to the growing online shopping trend and interest in specialty stevia varieties.

Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

UK: The UK is a frontrunner in the European stevia market, driven by a high prevalence of health concerns like diabetes and a growing sugar tax. Consumers are actively seeking sugar alternatives, making stevia a popular choice.

Germany: Germany boasts a strong health and wellness culture, propelling the demand for stevia-infused products. Additionally, a significant immigrant population with a taste for natural sweeteners further fuels market growth.

France: French consumers are known for their discerning palates. Here, innovation in stevia blends to address taste preferences is crucial. However, the market holds promise due to a growing focus on health and natural ingredients.

Italy: While Italians have a strong tradition of sugar use, a growing health-conscious segment is driving interest in stevia. The market offers potential for incorporating stevia into sweet treats while maintaining a focus on taste.

Spain: Spain presents an exciting opportunity with a rising demand for healthy and functional food products. Stevia's potential blood sugar management properties resonate with Spanish consumers, making it a promising market.

COVID-19 Impact Analysis on the Europe Stevia Market:

The COVID-19 pandemic's effect on the European stevia market was a mixed bag. Initial lockdowns and supply chain disruptions caused difficulties for stevia production and product availability. Additionally, a decline in sales from restaurants and food service establishments, major users of stevia-containing products, dampened demand. However, the pandemic also presented unexpected opportunities. Heightened health concerns during this time shifted consumer focus towards immunity and overall well-being. This led many Europeans to seek out healthier options, potentially boosting the demand for stevia as a natural sweetener. Increased home baking and cooking trends during lockdowns also created a potential opportunity for stevia in table-top sweeteners and baking ingredients. While the initial disruptions have subsided, some uncertainties remain. The long-term impact of COVID-19 on consumer behavior and economic stability is still being evaluated. Continued economic concerns could potentially affect spending on stevia-containing products. Overall, despite the initial challenges, the COVID-19 pandemic's net impact on the European stevia market appears to be positive. The surge in health consciousness might lead to a long-term increase in stevia demand, but ongoing monitoring of economic factors and consumer behavior is essential to understand the market's full trajectory.

Latest Trends/ Developments:

The European stevia market is abuzz with innovation. To address taste concerns and broaden appeal, manufacturers are developing new stevia blends incorporating natural sweeteners like monk fruit. Additionally, stevia's potential for blood sugar management is being explored, leading to a possible rise in functional stevia products catering to health-conscious consumers. Stevia's reach is also expanding beyond traditional uses. Condiments, sauces, and even pharmaceuticals are potential new frontiers for stevia as manufacturers explore its versatility. Sustainability is another hot topic, with eco-friendly stevia farming practices becoming a selling point for environmentally conscious consumers. Technological advancements in extraction and processing could further enhance stevia's appeal by creating purer extracts with better taste and functionalities. Finally, the e-commerce boom allows for convenient access to a wider range of stevia products, including niche and international options. This caters to the growing online shopping trend and empowers consumers to explore the full potential of stevia beyond what's available in traditional supermarkets. These trends highlight a dynamic European stevia market constantly evolving to meet consumer preferences and expand its reach.

Key Players:

- Cargill

- Ingredion

- Archer Daniels Midland Company (ADM)

- PureCircle

- Tate & Lyle

- Oviatis

Chapter 1. Europe Stevia Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Stevia – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Europe Stevia Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Stevia - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Europe Stevia Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Stevia Market– By Extract Type

6.1. Introduction/Key Findings

6.2. Whole Leaf Stevia

6.3. Powdered Stevia

6.4. Liquid Stevia

6.5. Y-O-Y Growth trend Analysis By Extract Type

6.6. Absolute $ Opportunity Analysis By Extract Type , 2024-2030

Chapter 7. Europe Stevia Market– By Application

7.1. Introduction/Key Findings

7.2 Beverages

7.3. Bakery & Confectionery

7.4. Dairy Products

7.5. Tabletop Sweeteners

7.6. Other Applications

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Stevia Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets & Hypermarkets

8.3. Specialty Stores

8.4. Online Retailers

8.5. Y-O-Y Growth trend Analysis Distribution Channel

8.6. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Stevia Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.1. By Type

9.1.3. By Application

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Stevia Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill

10.2. Ingredion

10.3. Archer Daniels Midland Company (ADM)

10.4. PureCircle

10.5. Tate & Lyle

10.6. Oviatis

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Europe Stevia Market was valued at USD 150 million in 2023 and is projected to reach a market size of USD 276.86 million by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 9.15%.

Health & Natural Sweetener Preference, Rising Diabetes & Obesity Rates, Integration with Health & Sports Nutrition Products, Versatility Across Food & Beverage Categories

Beverages, Bakery & Confectionery, Dairy Products, Tabletop Sweeteners, Other Applications.

Germany and the UK are likely the most dominant regions in the European stevia market due to a strong focus on health and wellness, and a growing sugar tax (UK).

Cargill, Ingredion, Archer Daniels Midland Company (ADM), PureCircle, Tate & Lyle, Oviatis