Europe Sports Drink Market Size (2024-2030)

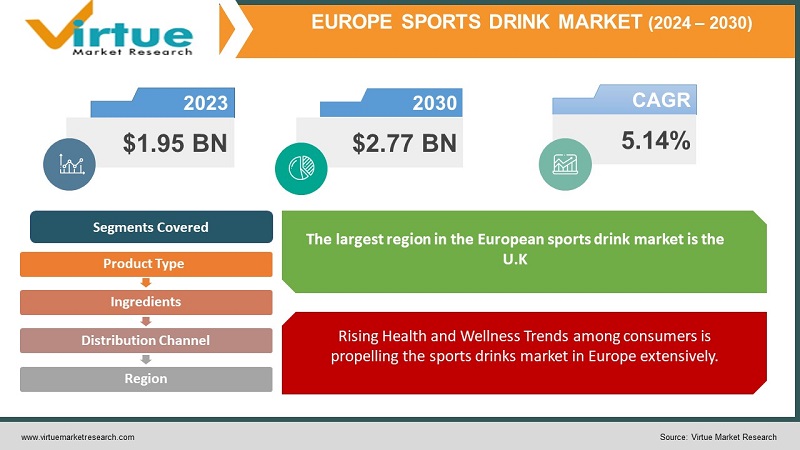

The Europe Sports Drink Market was valued at USD 1.95 Billion in 2023 and is projected to reach a market size of USD 2.77 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.14%.

The European sports drink market demonstrates a robust and evolving landscape, driven by increasing health consciousness and active lifestyles among consumers. With a growing emphasis on fitness and wellness, the market has witnessed a surge in demand for sports drinks formulated to replenish electrolytes and boost energy levels. Established brands continue to dominate, leveraging innovative marketing strategies and introducing new flavors and functional ingredients to cater to diverse consumer preferences. There's a notable trend towards cleaner labels and healthier formulations, incorporating natural ingredients and reduced sugar content, reflecting a shift towards more health-conscious choices among European consumers.

Key Market Insights:

In 2023, the European Energy & Sports Drinks market sees an average per capita revenue of US$34.43, a figure set to drive growth as market volume is projected to hit 4.5 billion liters by 2027.

Manufacturers in this sector are leveraging the burgeoning interest of active consumers seeking hydration solutions pre, during, and post-exercise. They're strategically employing measures such as collaborations, innovative product development, market expansions, and other initiatives to secure substantial market shares.

According to a Ministry of Education, Culture, and Sport survey conducted in 2022, over a quarter of male respondents reported daily engagement in sports, while approximately 21% of females echoed the same sentiment. Additionally, the survey highlighted that in Spain, gym memberships consisted of 19.8% of men and 21.3% of women while sports club memberships saw 16.9% of men, with lower rates among women across various age groups in 2022.

Europe Sports Drink Market Drivers:

Rising Health and Wellness Trends among consumers is propelling the sports drinks market in Europe extensively.

The increasing focus on health and wellness among European consumers is a significant driver. As people become more health-conscious and adopt active lifestyles, there's a growing demand for products that aid hydration and provide necessary nutrients during exercise or physical activity. Sports drinks, often marketed as performance enhancers, cater to this need by offering electrolyte replenishment and hydration, aligning with the health goals of consumers.

Innovation and Product Diversification in sport drinks industry is attracting more consumers, further increasing its growth.

Continuous innovation and product diversification within the sports drink market are driving its growth. Companies are introducing new formulations, flavors, and packaging sizes to appeal to a wider audience. Additionally, the introduction of drinks with natural ingredients, reduced sugar content, and functional additives such as vitamins or antioxidants aims to attract health-conscious consumers seeking healthier alternatives. This ongoing innovation fuels consumer interest and maintains the market's dynamism, capturing various consumer segments.

Europe Sports Drink Market Restraints and Challenges:

Health Concerns and Sugar Content in sports drink is concerning for consumers, which might hinder the growth of this market.

While sports drinks are perceived as beverages to support hydration and energy replenishment, there's a growing concern among consumers regarding their high sugar content and artificial additives. Increased awareness about the negative health effects of excessive sugar consumption has led many consumers to seek healthier alternatives. This poses a significant challenge for sports drink manufacturers who are under pressure to reformulate their products, reduce sugar content, and eliminate artificial ingredients while maintaining taste and functionality.

Market Saturation and Competition is a significant challenge for businesses in Europe sport drink market.

The European sports drink market is highly competitive with numerous established brands and new entrants vying for market share. This market saturation poses a challenge for both existing and new players to differentiate their products and stand out amidst fierce competition. With a plethora of options available to consumers, building brand loyalty and gaining a competitive edge becomes increasingly difficult. Moreover, the presence of alternative beverages marketed as healthier options, such as natural energy drinks, coconut water, and functional waters, further intensifies the competition within the sports drink segment.

Europe Sports Drink Market Opportunities:

The European sports drink market presents promising opportunities amidst the growing emphasis on health and wellness trends. The increasing adoption of active lifestyles, coupled with rising awareness about the benefits of hydration and functional beverages, creates a favorable environment for market expansion. There's a burgeoning demand for innovative formulations that cater to specific consumer needs, such as natural ingredients, low-calorie options, and functional benefits beyond traditional hydration, providing ample room for brands to innovate and capture diverse consumer segments. Strategic marketing campaigns focusing on the association of sports drinks with overall well-being and performance enhancement can further propel market growth and consumer adoption.

EUROPE SPORTS DRINK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.14% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

U.K, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Red Bull, PepsiCo, The Coca-Cola Company, Lucozade, Monster Beverage Corporation, Abbott Laboratories, BioSteel, Vitacoco, Multipower, SIS |

Europe Sports Drink Market Segmentation:

Europe Sports Drink Market Segmentation: By Product Type:

- Isotonic

- Hypotonic

- Hypertonic

The largest segment in the European sports drink market by product type is typically the isotonic drinks holding market share of 67% in 2023. Isotonic drinks hold this position due to their widespread popularity among athletes and fitness enthusiasts for their ability to rapidly replenish fluids, electrolytes, and carbohydrates lost during intense physical activity. These beverages mimic the body's natural fluids, aiding in quick hydration and providing a source of energy, which makes them highly favored among those engaging in strenuous workouts, sports, and endurance activities. Their balanced composition effectively addresses the immediate needs of individuals involved in physical exertion, contributing to the dominance of isotonic drinks within the market segment. The fastest-growing segment in the European sports drink market by product type is the category of functional ingredient drinks. This growth can be attributed to evolving consumer preferences and demands for beverages offering more than just hydration and energy replenishment. Functional ingredient drinks, incorporating additives such as vitamins, antioxidants, adaptogens, and herbal extracts, cater to consumers seeking targeted health benefits and enhanced performance beyond basic hydration.

Europe Sports Drink Market Segmentation: By Ingredients:

- Electrolyte- Based

- Energy-enhancing Drinks

- Functional Ingredients

In 2023, the largest segment in the European sports drink market by ingredient type is the electrolyte-based drinks having revenue share of 45%. These drinks, formulated to replenish essential minerals like sodium and potassium lost during physical activities, hold the largest share due to their fundamental role in aiding hydration and maintaining optimal performance during exercise. Electrolytes play a pivotal role in regulating bodily functions, particularly during periods of increased exertion and sweating. As consumers increasingly prioritize hydration and seek beverages that support active lifestyles, the emphasis on electrolyte-based drinks aligns with this demand, driving their prominence within the market. The association of electrolytes with rehydration and quick recovery further solidifies their position as the leading ingredient type in the sports drink market. The fastest-growing segment in the European sports drink market by ingredient type is the Functional Ingredient Drinks category expected to increase at a rate of 8.2%. Functional ingredient drinks incorporate additives such as vitamins, antioxidants, adaptogens, and herbal extracts that offer targeted health benefits, addressing consumers' demands for holistic wellness solutions. The increasing focus on overall well-being and the desire for beverages that support specific health aspects, such as immune function, cognitive enhancement, or stress reduction, has driven the rapid growth of this segment. As consumers become more health-conscious and seek products with added functional benefits, the demand for sports drinks with supplementary ingredients that promote health and performance beyond basic hydration continues to surge, propelling the growth of this specialized category.

Europe Sports Drink Market Segmentation: By Distribution Channel:

- Retail Stores

- Online Retail

- Direct Sales

The retail store segment stands as the largest distribution channel in the European sports drink market having significant market share of 68% in the year 2023. This dominance is primarily attributed to the widespread accessibility and convenience offered by supermarkets, convenience stores, and specialty sports nutrition outlets across various European regions. Retail stores have established robust networks, allowing sports drink brands to reach a broad consumer base, including athletes, fitness enthusiasts, and the general population, through strategic placement and visibility on shelves. These outlets often host diverse product ranges, enabling consumers to compare options and make informed choices, further solidifying the retail store segment's prominence in distributing sports drinks across Europe. The online retailing segment has emerged as the fastest-growing distribution channel in the European sports drink market. This growth can be attributed to the increasing prevalence of e-commerce platforms, shifting consumer behaviors favoring online shopping for convenience, and the wider availability of sports drink varieties offered by both established brands and niche players in digital marketplaces.

Europe Sports Drink Market Segmentation: Regional Analysis:

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

The largest region in the European sports drink market is the U.K. having market share of 34% in 2023. The U.K. holds this position due to several factors, including a strong culture of fitness and sports participation among its population. The U.K. market benefits from a robust infrastructure for sports and fitness activities, including a well-developed network of gyms, sporting events, and outdoor recreational spaces, driving consistent demand for sports drinks. A higher consumer awareness regarding health and wellness, coupled with a trend toward healthier beverage choices, has contributed to the U.K.'s prominent position in the consumption of sports drinks within the European region. The fastest-growing region in the European sports drink market is Germany. With an increasing number of consumers actively engaging in fitness activities and sports, there's a heightened demand for sports drinks tailored to hydration and performance enhancement. The country's inclination towards natural and healthier beverage options has led manufacturers to innovate by introducing products with reduced sugar content and natural ingredients, aligning with the preferences of health-conscious German consumers. Strategic marketing campaigns and expanding distribution networks have further boosted the adoption of sports drinks in Germany, contributing to its rapid growth within the European market.

COVID-19 Impact Analysis on the Europe Sports Drink Market:

The COVID-19 pandemic significantly impacted the European sports drink market, initially witnessing a decline in sales due to the closure of gyms, sporting events, and restrictions on outdoor activities, which limited consumer access to fitness-related venues. However, as restrictions eased, there was a gradual resurgence in demand as consumers prioritized health and wellness, seeking hydration solutions for home workouts and outdoor activities. The pandemic accelerated the trend towards healthier options, prompting manufacturers to focus on product innovation, emphasizing immunity-boosting ingredients and functional benefits to meet evolving consumer preferences for wellness-focused beverages.

Latest Trends/ Developments:

One prevailing trend in the European sports drink market is the increasing emphasis on sustainability and eco-friendly packaging. Consumers are becoming more conscious of the environmental impact of their purchases, leading sports drink manufacturers to explore and adopt sustainable packaging solutions. This trend includes a shift towards using recyclable materials, reducing plastic usage, and introducing biodegradable packaging options. Brands are aligning their strategies with environmental values to attract eco-conscious consumers and differentiate themselves in the market.

A notable development in the European sports drink market is the expansion and diversification of functional ingredients beyond electrolytes and carbohydrates. Manufacturers are incorporating a wider array of functional additives such as adaptogens, vitamins, natural antioxidants, and botanical extracts to enhance the performance and health benefits of sports drinks. This development aims to cater to specific consumer demands for beverages that offer not only hydration and energy replenishment but also targeted functionalities like improved recovery, mental focus, or stress reduction, aligning with the growing trend of holistic wellness in the market.

Key Players:

- Red Bull

- PepsiCo

- The Coca-Cola Company

- Lucozade

- Monster Beverage Corporation

- Abbott Laboratories

- BioSteel

- Vitacoco

- Multipower

- SIS

In March 2022, Gatorade, a sports drink brand under PepsiCo, introduced Gatorade Fit to the market. This new offering boasts electrolytes without any inclusion of added sugar, artificial flavors, sweeteners, or colors. Enriched with antioxidants, as well as vitamins A and C, this drink has made its debut on various third-party retail platforms, including Amazon United Kingdom.

Chapter 1. Europe Sports Drink Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Sports Drink Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Sports Drink Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Sports Drink Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Sports Drink Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Sports Drink Market– By Product Type

6.1. Introduction/Key Findings

6.2. Isotonic

6.3. Hypotonic

6.4. Hypertonic

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Europe Sports Drink Market– By Ingredients

7.1. Introduction/Key Findings

7.2 Electrolyte- Based

7.3. Energy-enhancing Drinks

7.4. Functional Ingredients

7.5. Y-O-Y Growth trend Analysis By Ingredients

7.6. Absolute $ Opportunity Analysis By Ingredients , 2024-2030

Chapter 8. Europe Sports Drink Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Retail Stores

8.3. Online Retail

8.4. Direct Sales

8.5. Y-O-Y Growth trend Analysis Distribution Channel

8.6. Absolute $ Opportunity Analysis Distribution Channel, 2024-2030

Chapter 9. Europe Sports Drink Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Product Type

9.1.3. By Ingredients

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Sports Drink Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Red Bull

10.2. PepsiCo

10.3. The Coca-Cola Company

10.4. Lucozade

10.5. Monster Beverage Corporation

10.6. Abbott Laboratories

10.7. BioSteel

10.8. Vitacoco

10.9. Multipower

10.10. SIS

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Sports Drink Market was valued at USD 1.95 Billion in 2023 and is projected to reach a market size of USD 2.77 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.14%.

Rising Health and Wellness Trends among consumers along with Innovation and Product Diversification in sport drinks industry are drivers of Europe Sports Drink market

Based on product type, the Europe Sports Drink Market is segmented into Isotonic, Hypotonic and Hypertonic

UK is the most dominant region for the Europe Sports Drink Market

BioSteel, Vitacoco, Multipower, SIS are few of the key players operating in the Europe Sports Drink Market.