Europe Sorghum Market Size (2025-2030)

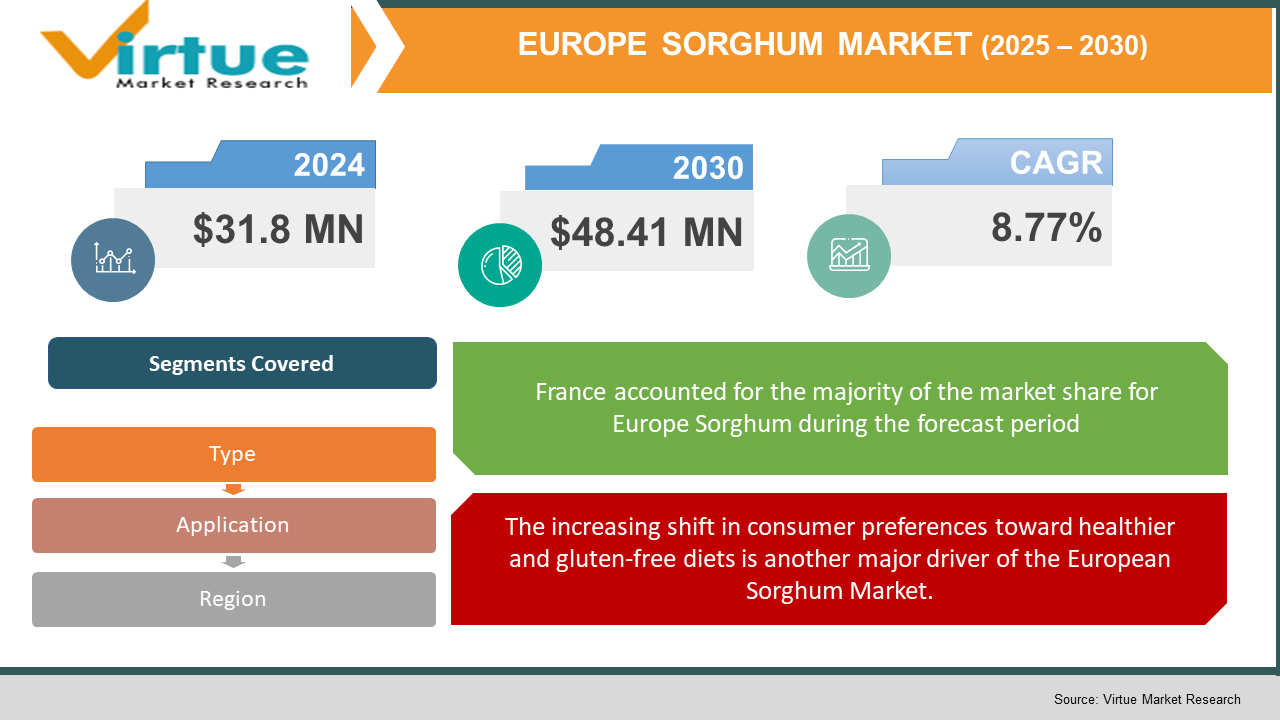

The European Sorghum Market was valued at USD 31.8 million in 2024 and is projected to reach a market size of USD 48.41 million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.77%.

The market for Sorghum in Europe is now rapidly generating momentum since more and more countries in the region are focusing on sustainable agriculture. This region is gaining adaptation to climate and nutrition diversification. Farmers and food manufacturers are getting interested in this cereal grain because it is tolerant of droughts and requires less input to grow. The upsurge is reflecting on the cultivation of sorghum in European countries because of the abundance of its suitability for food, feed, and bioenergy applications, while conserving the favourable government interventions plus research-supported benefits. The market emerges from interest in gluten-free grains, compatible farming practices with changing climates, and the innovative application of sorghum in developing health food products.

Key Market Insights:

The food-grade sorghum demand has grown by 42% in the past three years due to its popularity in gluten-free and health-focused products.

Over 60% of new sorghum-based products in Europe fall under the snacks and breakfast cereals category, showing a rapid rise in consumer adoption.

Sorghum’s water efficiency is gaining attention, requiring 30–50% less water than maize, making it a preferred crop in Southern and Eastern Europe.

Europe Sorghum Market Drivers:

One of the primary drivers of the European Sorghum Market is the increasing demand for climate-resilient and sustainable crops in response to erratic weather patterns and water scarcity.

The Sorghum Market in Europe is driven primarily by the increasing demand for climate-resilient and sustainable crops due to erratic weather patterns and water stress. Sorghum is itself drought-tolerant and requires much lower water levels than traditional grains such as wheat and maize. Given increasing occurrences of heat waves and irregularity of rainfall over the larger European continent, farmers are actively making a transition toward crops that can survive such conditions. In addition to its adaptability to poor soils, which require minimal pesticide use, sorghum is highly regarded from an environmental perspective. EU policies and subsidies under the Green Deal and Common Agricultural Policy (CAP) promote further sustainable farming practices. Thus, the area under sorghum cultivation is being increased, especially in Southern France, Italy, and parts of Eastern Europe. Such transitions cater to Europe’s goal of reducing the agricultural carbon footprint while ensuring food security.

The increasing shift in consumer preferences toward healthier and gluten-free diets is another major driver of the European Sorghum Market.

The latest market trend is moving towards healthy and gluten-free foods, which goes hand in hand with the newer trend in the European Sorghum market. Naturally gluten-free, sorghum happens to be quite rich in antioxidants, dietary fibres, and scores a low glycemic index, which perfectly fits the modern dietary trends. European buyers are showing enough interest in functional foods, whole grains, and plant-based products to incorporate sorghum perfectly into the market. This is reflected in the food industry, where there has been a tremendous increase in sorghum-based cereal launches, baked goods, snacks, and beverages. From 2021 to 2024, sorghum has seen a 40% rise in sorghum flour use for food in Europe. Besides that, based on how it can reproduce the textures and flavours to mimic wheat-based products, it is ideally suited for gluten-sensitive consumers. As the concept exudes, food labelling goes on being more transparent; before long, sorghum might enjoy even greater popularity in European supermarkets and health food shops.

Europe Sorghum Market Restraints and Challenges:

Despite its nutritional and environmental benefits, one of the major restraints in the European Sorghum Market is the limited consumer awareness and lack of established processing infrastructure.

The limited consumer awareness of the nutritional characteristics of sorghum, along with the lack of established processing infrastructure, hinders the growth of the Sorghum Market in Europe. Most European consumers are generally unfamiliar with sorghum as a food grain, especially when compared to more common substitutes like quinoa, oats, or rice. This limited knowledge dampens the possibilities of its promotion choice in the grocery stores and also delays product innovation. Often, food manufacturers also lack the specialised technological capabilities or processing knowledge to handle sorghum; it has different milling and cooking properties from standard grains. This gap in technical and operational know-how discourages food processors from large-scale adoption and cripples the growth of the value chain for this crop. Besides growing interest in sustainability and health, sorghum may stay underutilised in Europe without proper marketing, culinary integration, and supply chain development.

Europe Sorghum Market Opportunities:

The European sorghum market has ample opportunities due to the demand for sustainable agriculture, functional foods, and alternative energy sources. Sorghum thus stands well to become a credible alternative vis-à-vis water-guzzling grains, especially with increasing emphasis on low-input climate-resilient crops. Opportunities for sorghum also arise in the innovative food segment, such as gluten-free baked products, plant-based snacks, and probiotic beverages, where its nutritional properties will significantly benefit such products. Also, the bioenergy sector provides a valid growth opportunity, with Europe exploring sorghum for bioethanol and biomass fuel applications in line with renewable energy objectives. Investments in research improving varieties, together with developing value-added processing technologies, could give sorghum an even greater market penetration. Sorghum also appears to be set for a phenomenal appeal across the continent from agri-tech innovators and health-conscious consumers alike, as more government policies and sustainability certifications promote environmentally friendly farming.

EUROPE SORGHUM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.77% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Europe |

|

Key Companies Profiled |

. KWS SAAT SE & Co. KGaA, Groupe Limagrain, Advanta Seeds, Corteva Agriscience, Bayer CropScience, UPL Limited, RAGT Semences, and Caussade Semences |

Europe Sorghum Market Segmentation:

Europe Sorghum Market Segmentation: By Type

- Grain Sorghum

- Forage Sorghum

- Biomass Sorghum

- Sweet Sorghum

The Europe Sorghum Market types include grain sorghum, forage sorghum, biomass sorghum, and sweet sorghum. This segmentation reflects the various end uses of sorghum under agriculture, food, energy, and industry. Each type of sorghum offers specific advantages, with grain sorghum being mainly used in food and feed, forage sorghum for animal nutrition, biomass sorghum in renewable energy, and sweet sorghum in biofuel production. There is a growing need for climate-resilient crops and sustainable farming systems, which is driving adoption across all types. Moreover, governments and research institutions promote region-specific sorghum varieties according to industry requirements, thus creating growth opportunities under this segmentation.

Europe Sorghum Market Segmentation: By Application

- Food & Beverages

- Animal Feed

- Bioenergy

- Industrial Applications

Depending on how they are used, the European Sorghum Market is categorised into food & beverages, animal feed, bioenergy, and industrial applications. The food & beverages market is rapidly expanding with the growing health awareness about gluten-free grains. Animal feed, however, remains stable and mature since sorghum is a nutritious and cheap alternative to traditional cereals. The bioenergy side has been developing due to the EU's interest in renewable fuel supply, while industrial uses have been coming up slowly due to the growing use of biodegradable and plant-based materials. This segmentation showcases the versatility of sorghum and its increasing relevance in traditional and novel industries.

Europe Sorghum Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The European Sorghum Market is further divided into geographical regions, which include key countries like France, Italy, Germany, Spain, Romania, and the rest of Europe. While France remains the leader in cultivation and innovation, Italy and Germany are swiftly incorporating sorghum into food processing and energy initiatives. Eastern European countries like Romania and Hungary are expanding cultivation because of the climate's favorability and support from policy. The rest of Europe, including the Netherlands and the UK, shows potential for the niche application of sorghum for food and renewable energy applications. Regional segmentation gives insight into the varying rates of adoption due to climate suitability, infrastructure, and policy frameworks.

COVID-19 Impact Analysis on the European Sorghum Market:

The European Sorghum Market had an impact in a mixed manner because of the COVID-19 pandemic. Early in the crisis of this pandemic, supply chain disruption and logistical hurdles affected channels for cultivation and distribution. However, with the change to home cooking and health awareness due to lockdowns, the curiosity of consumers is dramatically boosted by factors such as gluten-free and nutritious ingredients like sorghum. Such curiosity among consumers has increased retail sales, having a significant impact on online grocery platforms, which recorded rapid growth in demand for sorghum-based products. As restrictions were relaxed, demand from foodservice and export markets rebounded, and the market was further stabilised. Thus, the pandemic catalysed the adoption of digital sales and consumer education, thus laying a foundation for long-term growth of the sorghum industry across Europe.

Latest Trends/ Developments:

The current scenario of rapid evolution in the sorghum landscape within Europe can easily be traced to the increasing diversity in gluten-free, clean-label, and sustainable food products that include sorghum flour, snacks, and beverages. Grain sorghum, which enjoys the best market performance available in sorghum, is expected to post a solid CAGR of around 6% by 2030, according to industry projections. Technological innovations also change the scenario of market biotech innovations, improved crop yields and diseases are enhanced by biotechnology, proving to be attractive features for many farmers and processors. In addition, the grain markets of sorghum are developing fast into the biofuel and bioenergy sectors in various countries of the EU; their latest policies are targeting carbon emissions reduction by definition. There are pilot projects for biomass and sweet sorghum types in pellet production and for bioethanol, thus far consistent with Europe's green energy targets. It is sorghum, which has suddenly gained the fast endorsement as mainstream acceptance of clean, climate-resilient grains, that promises to be a significant player in Europe's agricultural and industrial transformation.

Key Players:

- KWS SAAT SE & Co. KGaA

- Groupe Limagrain

- Advanta Seeds

- Corteva Agriscience

- Bayer CropScience

- UPL Limited

- RAGT Semences

- Caussade Semences

- Euralis Semences

- Agri Obtentions

- Cargill

- Archer Daniels Midland (ADM)

- Bunge

Chapter 1. Europe Sorghum Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. EUROPE SORGHUM MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. EUROPE SORGHUM MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. EUROPE SORGHUM MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. EUROPE SORGHUM MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. EUROPE SORGHUM MARKET – By Type

6.1 Introduction/Key Findings

6.2 Grain Sorghum

6.3 Forage Sorghum

6.4 Biomass Sorghum

6.5 Sweet Sorghum

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis ByType, 2025-2030

Chapter 7. EUROPE SORGHUM MARKET – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Animal Feed

7.4 Bioenergy

7.5 Industrial Applications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. EUROPE SORGHUM MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. EUROPE SORGHUM MARKET – Company Profiles – (Overview, Product, Portfolio, Financials, Strategies & Developments)

9.1 KWS SAAT SE & Co. KGaA

9.2 Groupe Limagrain

9.3 Advanta Seeds

9.4 Corteva Agriscience

9.5 Bayer CropScience

9.6 UPL Limited

9.7 RAGT Semences

9.8 Caussade Semences

9.9 Euralis Semences

9.10 Agri Obtentions

9.11 Cargill

9.12 Archer Daniels Midland (ADM)

9.13 Bunge

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The European Sorghum Market was valued at USD 31.8 million in 2024 and is projected to reach a market size of USD 48.41 million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.77%.

The European Sorghum Market is driven by the rising demand for gluten-free, nutrient-rich grains and the increasing adoption of drought-resistant crops for sustainable agriculture. Additionally, growing use in bioenergy production supports market expansion across the region.

Based on Service Provider, the European Sorghum Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, and End-to-End Solution Providers.

France is the most dominant region for the European Sorghum Market.

KWS SAAT SE & Co. KGaA, Groupe Limagrain, Advanta Seeds, Corteva Agriscience, Bayer CropScience, UPL Limited, RAGT Semences, and Caussade Semences are the key players in the European Sorghum Market.