Europe Soft Drink Concentrates Market Size (2024-2030)

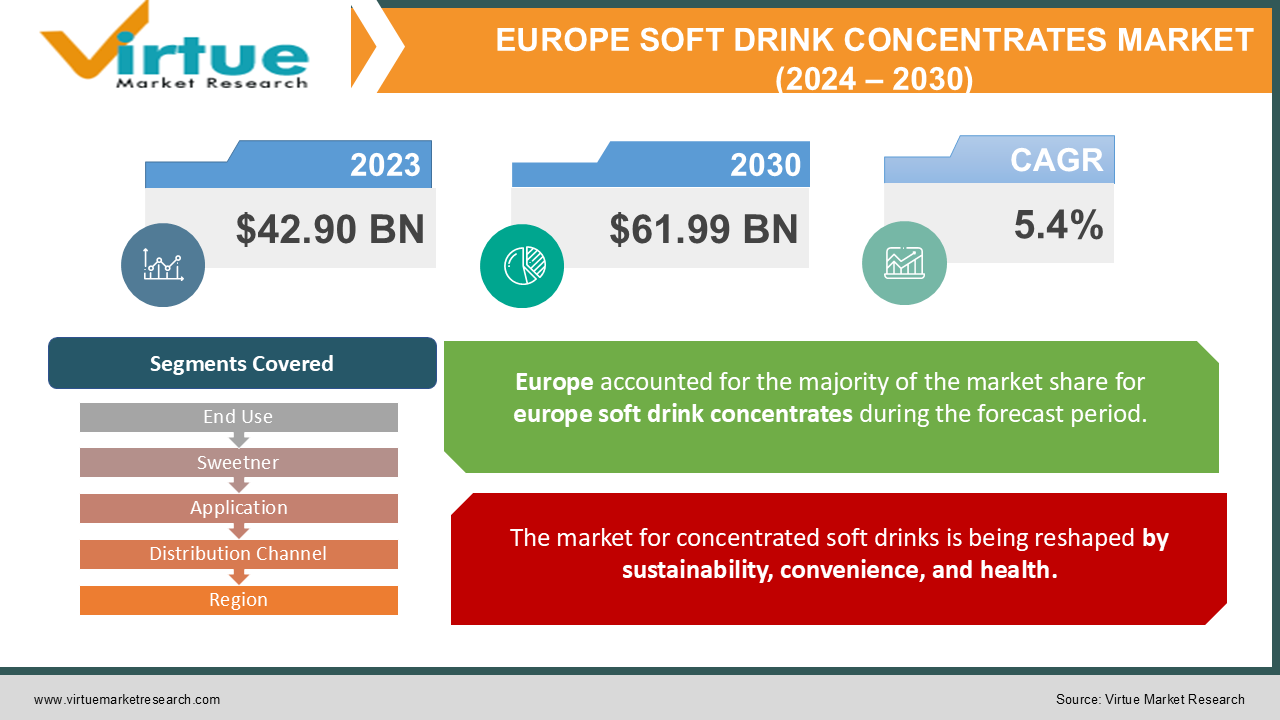

The Europe Soft Drink Concentrates Market was valued at USD 42.90 billion in 2023 and is projected to reach a market size of USD 61.99 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.4%.

In terms of the global soft drink concentrate market, Europe is the clear leader. This dominance is the result of several interrelated variables. First off, rising disposable income, urbanization, and fast-paced lifestyles are all contributing to the soft drink consumption boom among Europeans. Second, there is an extraordinarily wide range of soft drink concentrates available on the European market. There is a concentration to please every palate, ranging from well-known favorites like cola and lemonade to more unusual choices like elderflower and rhubarb. Lastly, convenience is a key factor. Soft drink concentrates provide customers the ability to manage the quantity of sugar and other components in their drinks while also providing an affordable method to enjoy soft drinks at home.

Key Market Insights:

Even though traditional flavors are still well-liked, the market for soft drink concentrate is seeing an increase in demand for healthier choices. This is demonstrated by the fact that no- and low-calorie products are important growth drivers for well-known brands in Western Europe, such as Coca-Cola. Customers are looking for concentrates with more natural flavorings and sweeteners and fewer artificial additives.

Despite the shared European market, national preferences for concentrates differ significantly. For instance, Belgium has the greatest average yearly consumption of carbonated soft drinks per capita in all of Europe nearly 109 liters. Whereas cola and lemonade are more popular in Western Europe, fruit-flavored concentrates may be more preferred in Eastern European nations.

Europe Soft Drink Concentrates Market Drivers:

The market for concentrated soft drinks is being reshaped by sustainability, convenience, and health.

In Europe, people no longer just grab sugar-filled beverages on the go. Their increasing inclination towards soft drink concentrates reflects their high regard for their health. Sugar-free and low-calorie choices are becoming more and more popular, especially as large brands start meeting this need. A growing trend is a preference for natural flavorings and sweeteners over artificial ones. The growing desire for ease and the emphasis on health go hand in hand. Concentrates for soft drinks are sweetened with the convenience of preparation for home use. Concentrates provide you control over dilution, so you may customize the sweetness to your preferred degree. Another benefit is the portion control feature, which allows you to make larger batches or single servings according to your needs.

Customers Purchasing Soft Drink Concentrates Have More Options Thanks to Convenience Stores and Online Retail

Supermarkets and hypermarkets have long been the preferred locations to restock soft drink concentrates, but the distribution channels in the European market are becoming more diverse. Convenience stores are becoming formidable competitors, appealing to time-pressed customers looking for quick refreshments. Smaller concentrate forms are available in these retailers, which are ideal for making a quick single serving or a few sips at home in a tiny bottle. Conversely, the availability of soft drink concentrates is being revolutionized by internet retail. Compared to traditional businesses, e-commerce platforms provide a greater range, especially for specialty or foreign brands that may not be easily found at your neighborhood grocery. This accommodates a wider variety of palates and lets customers experience a wider array of flavors. With only a few clicks, internet stores may provide you with a solution, regardless of your preference for a familiar favourite or a novel flavor experience.

Europe Soft Drink Concentrates Market Restraints and Challenges:

Despite its dominance, the European soft drink concentrate business is not without its difficulties. Doubt about sugary drinks is growing due to health concerns and sugar prices. Concentrates are losing market share as consumers choose for healthier options including fruit juices, tea, and bottled water. Stricter rules on ingredients may also stifle creativity and the development of novel flavor combinations. Variations in the price of raw materials, such as fruits and sugar, can also affect how profitable a manufacturing is. Additionally, because there is such a wide range of concentrates available, customers are more inclined to experiment with multiple brands, making brand loyalty erratic. And last, another challenge facing the sector is customers' rising awareness of the environmental effects of plastic packaging.

Europe Soft Drink Concentrates Market Opportunities:

The European market for soft drink concentrates is full of potential as well as obstacles to overcome. Sugar-free, stevia-sweetened, or natural sweetener choices might be just right for health-conscious customers. By developing concentrates with additional vitamins, minerals, or additives that promote health, manufacturers may also capitalize on the popularity of functional beverages. Another strategy to differentiate yourself is to target niche markets with distinctive flavors, ethnic ingredients, or organic certifications. Sustainability is a big deal; therefore, businesses may stand out from the competition by investing in environmentally friendly packaging made of recycled or biodegradable materials. In addition to providing new audiences with access to internet platforms and social media marketing, the digital era also presents exciting potential for increasing sales through e-commerce channels. Lastly, forging strategic alliances with ingredient suppliers, health food retailers, or flavor houses can lead to innovative new product development and distribution channels.

EUROPE SOFT DRINK CONCENTRATES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By end use, sweetner, application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Dohler GmbH, Keurig Dr Pepper Inc., PepsiCo Inc., The Coca-Cola Company |

Europe Soft Drink Concentrates Market Segmentation:

Europe Soft Drink Concentrates Market Segmentation: By Application:

- Carbonated Concentrates

- Non-Carbonated Concentrates

Non-carbonated concentrates are driving the trend of healthier choices in the European soft drink concentrate industry. The growing emphasis on health and well-being is driving this increase, as customers look for beverages with natural ingredients and lower sugar content. Compared to pre-made beverages, non-carbonated choices such as fruit juices, flavored waters, and sports drinks are more convenient to prepare at home and simpler to regulate portion sizes. As a result, in the European soft drink concentrate market, the non-carbonated category is not only the largest but also expanding at the quickest rate.

Europe Soft Drink Concentrates Market Segmentation: By End Use:

- Food Service

- Mass Merchandise

- Fountain Machine Concentrates

Although Fountain Machine Concentrates appear to be the most popular product, the Mass Merchandise sector is the real winner in the European Soft Drink Concentrates Market by End Use. This supremacy is the result of several reasons. The largest selection of concentrates can be found at supermarkets and hypermarkets, which makes them your one-stop shop for all your bubbly (or non-fizzy) requirements. Additionally, they are an affordable option for consumption at home because of their reasonable cost, availability in a range of sizes, and ease of getting a concentrate with your shopping. Therefore, mass goods stores are the true giants of the concentrate industry, even though fountain machines churn out beverages.

Europe Soft Drink Concentrates Market Segmentation: By Sweetener:

- Sugar-Based Concentrates

- Sugar-Free and Low-Calorie Concentrates

The market for soft drink concentrates in Europe is being drained of sugar! Low-calorie and sugar-free concentrates are the fastest-growing and soon-to-be largest market category. Sugar levies and a health-conscious culture are driving this increase in demand for these products. Technological developments in sweeteners are producing more delicious sugar-free options that appeal to diabetics, dieters, and anybody who just wants a less sugary beverage. So, if you believed that sugar was king or queen of the concentrated world, think again. Sugar-free reigns supreme.

Europe Soft Drink Concentrates Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

The newest and most exciting channel in the European soft drink concentrate business is online retail – forget about the physical aisles! Although supermarkets used to be the dominant player, internet retailers are drawing in business with an incredible assortment of concentrates, including specialty and foreign brands that may not be available in your area. Online retail is the clear leader in this market's growth because of its convenient delivery options that allow you to buy from the comfort of your sofa and have items at competitive costs delivered right to your door. The next time you have a taste for anything, skip the trip to the grocery store and visit the internet retail industry instead.

Europe Soft Drink Concentrates Market Segmentation: By Region:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

This market is usually divided into smaller areas, such as Eastern and Western Europe. The larger participant is usually found in Western Europe, where there are well-known brands and a fondness for traditional tastes like cola and lemonade. However, Eastern Europe appears to be becoming more and more of a fan of fruity drinks, and it may even have a larger market share for non-carbonated beverages. This sub-regional dissection offers a more sophisticated perspective on European consumer preferences.

COVID-19 Impact Analysis on the Europe Soft Drink Concentrates Market:

For the European market for soft drink concentrates, COVID-19 wasn't just flat cola. The first lockdowns sparked a panic purchase frenzy as individuals stocked up on concentrates for their homes, which exploded in sales. The closing of pubs and restaurants also encouraged people to prepare beverages at home, which could have helped sales of concentrates. As conventional businesses faced limits, online sellers emerged as heroes, providing a simple and safe method to purchase a broader assortment of concentrates. But the epidemic also left behind some unpleasant memories. Lockdowns caused supply chain disruptions around the world, making it challenging to acquire components and make concentrates. People's disposable income was reduced because of the pandemic's economic burden, which included soft beverages. Ultimately, customers may have shifted to healthier beverages because of health concerns, which would have placed downward pressure on sugary concentrates.

Recent Trends and Developments in the Europe Soft Drink Concentrates Market:

Natural ingredient concentrates without added sugar are becoming more popular as health becomes the focus. The newest sensation in sweeteners is stevia, and some concentrations are even receiving a nutritional boost from extra vitamins and minerals. However, the flavor is remembered. While classic flavors are still well-liked, there is an increasing desire for novel and interesting flavors. Consider recipes with an ethnic flair, notes of flowers and herbs like hibiscus and elderflower, and sugar-free versions that are just as delicious. Additionally, sustainability is rising to the top. To lessen their environmental impact and satisfy consumers who care about the environment, manufacturers are turning to recycled or biodegradable packaging. There are a tonne of opportunities in the internet world. Discovering the ideal flavor fix is now simpler than ever because of the staggering assortment of concentrates available on e-commerce platforms, particularly for specialty and foreign brands. Another novel approach is subscription services, which provide concentrate pods or syrups straight to your door—ideal for people with hectic schedules and daring palates. Manufacturers are also collaborating with ingredient suppliers, health food retailers, and flavor houses to remain ahead of the curve. These collaborations are creating innovative new solutions that satisfy dietary requirements and palate preferences. The European soft drink concentrate market is expected to remain dynamic for the foreseeable future, owing to its emphasis on health, innovative flavor profiles, and environmentally conscious operations.

Key Players:

- Dohler GmbH

- Keurig Dr Pepper Inc.

- PepsiCo Inc.

- The Coca-Cola Company

Chapter 1. Europe Soft Drink Concentrates Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Soft Drink Concentrates Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Soft Drink Concentrates Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Soft Drink Concentrates Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Soft Drink Concentrates Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Soft Drink Concentrates Market – By Application

6.1. Introduction/Key Findings

6.2. Carbonated Concentrates

6.3. Non-Carbonated Concentrates

6.4. Y-O-Y Growth trend Analysis By Application

6.5. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. Europe Soft Drink Concentrates Market – By End Use

7.1. Introduction/Key Findings

7.2 Food Service

7.3. Mass Merchandise

7.4. Fountain Machine Concentrates

7.5. Y-O-Y Growth trend Analysis By End Use

7.6. Absolute $ Opportunity Analysis By End Use , 2024-2030

Chapter 8. Europe Soft Drink Concentrates Market – By Sweetener

8.1. Introduction/Key Findings

8.2 Sugar-Based Concentrates

8.3. Sugar-Free and Low-Calorie Concentrates

8.4. Y-O-Y Growth trend Analysis Sweetener

8.5. Absolute $ Opportunity Analysis Sweetener , 2024-2030

Chapter 9. Europe Soft Drink Concentrates Market – By Distribution Channel

9.1. Introduction/Key Findings

9.2 Supermarkets/Hypermarkets

9.3. Convenience stores

9.4. Online Retail Stores

9.5. Y-O-Y Growth trend Analysis Distribution Channel

9.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 10. Europe Soft Drink Concentrates Market , By Geography – Market Size, Forecast, Trends & Insights

10.1. Europe

10.1.1. By Country

10.1.1.1. U.K.

10.1.1.2. Germany

10.1.1.3. France

10.1.1.4. Italy

10.1.1.5. Spain

10.1.1.6. Rest of Europe

10.1.2. By Application

10.1.3. By Distribution Channel

10.1.4. By End Use

10.1.5. Sweetener

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Europe Soft Drink Concentrates Market – Company Profiles – (Overview, Flavor Product Type Portfolio, Financials, Strategies & Developments)

11.1 Dohler GmbH

11.2. Keurig Dr Pepper Inc.

11.3. PepsiCo Inc.

11.4. The Coca-Cola Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Soft Drink Concentrates Market size is valued at USD 42.90 billion in 2023.

The worldwide Europe Soft Drink Concentrates Market growth is estimated to be 5.4% from 2024 to 2030.

Europe Soft Drink Concentrates Market segmentation covered in the report is By Application (Carbonated Concentrates, Non-Carbonated Concentrates); By End Use (Food Service, Mass Merchandise, Fountain Machine Concentrates); By Sweetener (Sugar-Based Concentrates, Sugar-Free and Low-Calorie Concentrates); By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail) and by region.

Functional and organic concentrates, e-commerce sales, and strategic collaborations for innovation are all predicted to expand in the European soft drink concentrate industry.

Due to hoarding and at-home consumption, the COVID-19 pandemic temporarily increased sales, but it also brought about long-term problems like supply chain interruptions, financial hardship, and a possible move towards healthier beverage options.