Europe Sodium Reduction Ingredients Market Size (2024-2030)

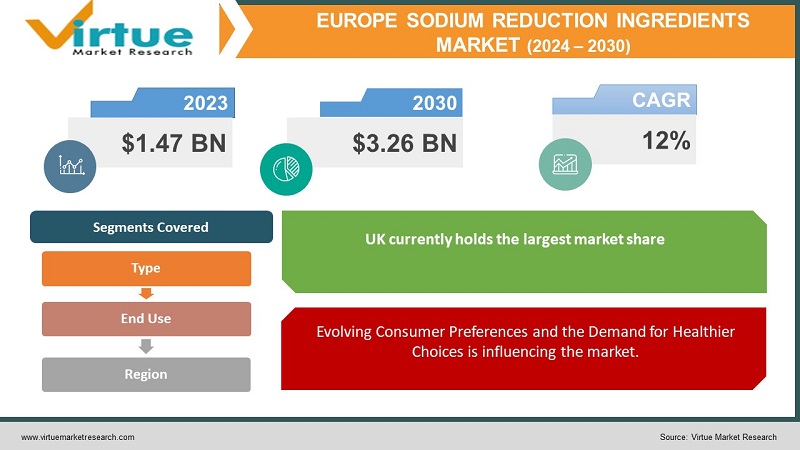

The Europe Sodium Reduction Ingredients Market was valued at USD 1.47 Billion in 2023 and is projected to reach a market size of USD 3.26 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12%.

Excessive sodium intake is a major public health concern linked to hypertension, cardiovascular disease, and other chronic ailments. In Europe, governments have established targets for sodium reduction in processed foods, putting the spotlight on reformulation efforts. Consumers are increasingly seeking out foods labeled as "lower sodium" or "reduced salt," driving demand for effective sodium reduction solutions. Potassium chloride is widely used but can have a slightly bitter or metallic off-taste if used in high proportions. Stricter regulations and sodium reduction targets across Europe act as a strong driver of innovation and adoption of sodium reduction ingredients. The focus on healthier food choices aligns with the demand for lower-sodium products, creating new market segments. Major food manufacturers, retailers, and food service companies are proactively reformulating products to achieve sodium reduction goals. The desire for recognizable ingredients drives the growth of natural solutions for sodium reduction.

Key Market Insights:

Consumers are becoming more mindful of sodium levels, seeking out healthier options, and scrutinizing product labels. This translates to a demand for food products with lower sodium content. Ingredients like yeast extracts, herbs, spices, and natural flavorings can help enhance the taste perception of low-sodium foods, masking the reduced salt content. Alternatives using magnesium or calcium salts are emerging, but finding the right balance of taste and functionality is key. Certain amino acids can provide a savory, umami flavor profile that can contribute to masking the reduction of sodium. Alongside sodium reduction, consumers are seeking recognizable, natural ingredients, adding a layer of complexity for manufacturers. Emerging technologies focus on modifying the physical structure of salt crystals or using coatings to enhance their taste impact, potentially allowing for lower overall usage. Achieving the right flavor profile and mouthfeel in sodium-reduced sauces and soups requires careful formulation and the artful use of alternative ingredients. Often the most effective approach is to subtly reduce sodium over time, allowing consumers' palates to adjust. This can be combined with the use of flavor enhancers. In certain products, partially replacing sodium with potassium can be viable, but close attention must be paid to potential off-flavors and labeling requirements. Combining lower sodium with bolder spice blends, textural components for mouthfeel, and smart marketing can help offset the reduced salt content. While the push for sodium reduction is widespread, specific targets, regulations, and labeling requirements vary across European countries.

Europe Sodium Reduction Ingredients Market Drivers:

European governments recognize the link between excess sodium intake and chronic health conditions. Many countries have established targets for the reduction of sodium content in specific food categories.

Many countries have established targets for the reduction of sodium content in specific food categories. These might be voluntary agreements with the food industry or have the potential to become legally binding maximum limits. Examples include the UK's salt reduction targets across numerous food groups. Governments often work with food manufacturers, retailers, and food service establishments to facilitate product reformulation and encourage the development of lower-sodium options. This can take the form of joint task forces or research funding. Wide-reaching campaigns through various media platforms aim to educate consumers about the risks of high-sodium diets, empower them to read food labels, and make informed dietary choices. These campaigns often emphasize practical tips like choosing fresh produce or comparing sodium content in similar products. Implementing simplified, standardized front-of-pack labeling systems that highlight sodium content is another strategy. Traffic light color-coding or similar visual cues aid consumers in making quick comparisons, increasing the appeal of lower-sodium products.

Evolving Consumer Preferences and the Demand for Healthier Choices is influencing the market.

Consumers are becoming more proactive about reading food labels and scrutinizing sodium content. This trend goes beyond those with specific medical conditions, reflecting a broader shift towards healthier eating habits. The desire for foods with simpler ingredient lists and recognizable ingredients aligns perfectly with many sodium reduction solutions. Natural flavor enhancers and potassium-based alternatives often tick the 'clean label' box. Consumers are realizing that 'low sodium' doesn't have to equal 'bland'. The growing interest in global cuisines, bolder spice blends, and fermented foods demonstrate an openness to flavor exploration beyond relying solely on salt. As consumers become more aware of the negative effects of high sodium, they are increasingly open to trying reformulated products and potentially adjusting their taste expectations. While health is a driver, uncompromising palatability is key to long-term success. Ingredients that not only reduce sodium but actively enhance flavor profiles have an advantage. Highlighting the use of natural sodium alternatives and emphasizing flavor, not just sodium reduction, plays a significant role in consumer acceptance and product success. Government mandates push the industry while changing consumer preferences provide a receptive market for well-executed sodium-reduced options.

Europe Sodium Reduction Ingredients Market Restraints and Challenges:

Balancing sodium reduction with trends like the reduction of artificial preservatives adds layers of complexity for manufacturers to address.

Sodium is a powerful taste enhancer. While consumers might desire healthier options, ingrained preferences for salty flavors are hard to completely ignore. Finding the right balance between sodium reduction and palatability is key. Unfortunately, some consumers still associate "low sodium" with bland or flavor-compromised products. Overcoming this perception is essential for market success. Successful sodium reduction often involves the artful use of alternative flavor enhancers, herbs, and spices, and the development of bolder flavor profiles. This requires skill, experimentation, and a shift away from relying solely on salt. Alternative ingredients for sodium reduction can often be more expensive than traditional salt. This can elevate the cost of reformulated products, creating a potential barrier for price-conscious consumers. In certain products, sodium plays a role beyond just taste. In baked goods or processed meats, alternatives need to mimic sodium's contributions to texture, protein interaction, and dough formation to ensure product quality isn't compromised. While desiring lower sodium, many consumers also want recognizable ingredients and 'clean labels.' Some effective sodium reduction ingredients like potassium chloride might raise concerns due to potential off-taste or might not fit the 'natural' image. Natural flavor enhancers, like yeast extracts, can play a role, but might not be potent enough for drastic sodium reductions in certain product categories. There's room for further innovation in naturally derived ingredients. While the focus on sodium reduction is pan-European, specific regulations, labeling requirements, and the pace of implementation vary across the region. This can create a fragmented compliance landscape for manufacturers.

Europe Sodium Reduction Ingredients Market Opportunities:

One of the biggest hurdles in sodium reduction is maintaining palatability. Ingredients that naturally enhance savory, umami flavors or mask potential off-tastes become highly sought after. Rich in flavor-enhancing compounds, yeast extracts are multifaceted ingredients finding increasing application in sodium-reduced products. Suppliers developing innovative flavor-boosting ingredients or offering customized solutions that successfully address specific product challenges hold tremendous value in this market. Advances in processing, blending potassium with other mineral salts, or using taste-masking technologies aim to improve its flavor profile and increase its usage potential. Developing potassium-based ingredients that better mimic sodium's technical roles in food preservation, texture, and product stability expand their applicability and market potential. Partnerships between ingredient suppliers, food scientists, and manufacturers are crucial to advancing the usage and acceptance of potassium-based alternatives in a wider range of products. The demand for healthier, low-sodium foods coincides perfectly with consumers seeking simple, recognizable ingredients. Clever use of flavor enhancers, potassium-based salts in moderation, along with potentially a small degree of sodium chloride creates a broader solution space for manufacturers.

EUROPE SODIUM REDUCTION INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By Type, End Use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Germany, UK, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Cargill, Kerry Group, ADM, Jungbunzlauer, Angel Yeast, K+S Group, Solvay |

Europe Sodium Reduction Ingredients Market Segmentation:

Europe Sodium Reduction Ingredients Market Segmentation: By Type-

- Potassium-Based Salts

- Yeast Extracts

- Flavor Enhancers (Herbs, Spices, Natural Extracts)

- Mineral Salts (Magnesium, Calcium)

Potassium-Based Salts: Potassium chloride is the most widely used sodium alternative due to its availability and cost-effectiveness. Potential bitterness or a metallic aftertaste, particularly when used in high amounts, limits its sole use for significant sodium reduction. Yeast Extracts: Rich in naturally occurring glutamates, which impart a savory, umami flavor that helps compensate for lower sodium content. Often perceived as a 'natural' ingredient, aligning well with consumer preferences. Flavor Enhancers (Herbs, Spices, Natural Extracts): This diverse category focuses on enhancing overall taste perception and complexity to make reduced-sodium products more appealing. Includes everything from traditional herbs and spices to fermented ingredients, concentrated vegetable extracts, and naturally derived flavoring compounds. Mineral Salts (Magnesium, Calcium): Salts of calcium and magnesium offer alternatives or can be blended with potassium to improve the overall flavor profile. Some potential advantages in specific applications where they may mimic sodium's functional properties in texture or food preservation.

Europe Sodium Reduction Ingredients Market Segmentation: By End Use

- Health-Conscious Consumers

- Consumers with Medical Conditions

- General Population

Health-Conscious Consumers (50%): The largest segment, seeking lower sodium for overall well-being. Focus on clean labels and natural ingredients. Proactive health choices, desire to reduce risk of chronic diseases. May be influenced by nutrition trends and wellness movements. Clean label ingredients, recognizable "whole food" solutions, and bold flavors to compensate for reduced salt. Consumers with Medical Conditions (20%): Actively managing sodium intake due to specific health needs (hypertension, heart disease, etc.). Strict adherence to dietary guidelines due to hypertension, kidney issues, or other conditions where sodium restriction is medically advised. Solutions tailored to their needs, potential potassium limitations, clear labeling, and ingredient transparency. General Population (30%): Responding to broader public health campaigns, increasingly choosing lower-sodium alternatives as they become available and palatable. The gradual shift towards healthier choices is influenced by public awareness campaigns and the increasing availability of low-sodium options. Mainstream products with unnoticeable reductions in sodium, affordability, and familiar flavors. Subtle emphasis on sodium reduction as an added benefit within familiar food brands, easy-to-understand front-of-pack labeling.

Europe Sodium Reduction Ingredients Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

UK (20%): A mature market with strong government initiatives driving sodium reduction efforts. The UK has some of the most ambitious sodium reduction targets in Europe, with well-established voluntary agreements and public awareness campaigns. Major supermarkets and food manufacturers are actively reformulating products, creating a strong demand for sodium-reduction ingredients. Germany (18%): Health-conscious consumers and an established food processing sector fuel demand. German consumers are known for being health-conscious, driving interest in products contributing to overall well-being. A large food processing industry necessitates ingredient solutions for sodium reduction across diverse categories. France (15%): Growth potential, influenced by health trends and evolving consumer preferences. A balance between health awareness and a strong culinary heritage influences the market. Clever sodium reduction that preserves the characteristic flavors of French cuisine is crucial. Italy (12%): Balancing tradition with innovation, opportunities exist in reformulating classic products. A deep-rooted culinary culture poses a challenge to reformulating traditional foods. Sodium reduction solutions must respect the iconic flavor profiles of Italian dishes. Potential lies in 'invisible' sodium reduction – technologies modifying the salt structure or ingredients enhancing its distribution for lower overall usage. Spain (10%): Expanding market with an increasing focus on packaged foods and product reformulation. Growth in packaged and processed foods drives the need for sodium reduction solutions. Rest of Europe (25%): Holds significant potential, with varying degrees of market maturity and diverse consumer preferences. Encompasses countries with varying levels of sodium awareness, regulations, and economic development. Nations like Poland and Hungary show potential as incomes rise, and consumption of packaged food increases.

COVID-19 Impact Analysis on the Europe Sodium Reduction Ingredients Market:

Lockdowns and border restrictions disrupted the flow of raw materials and ingredients, impacting the production and availability of sodium reduction solutions. Panic buying and stockpiling initially focused on shelf-stable, processed foods, often higher in sodium, potentially impacting demand for sodium-reduced alternatives. The pandemic heightened public awareness of health issues, potentially increasing interest in preventative measures like sodium reduction. Lockdowns and restaurant closures led to more home cooking, potentially creating an opportunity for ingredient suppliers to target consumers seeking healthier choices for their meals. The surge in online grocery shopping could benefit ingredient suppliers with a strong digital presence and the ability to reach home cooks directly. Ingredient suppliers focused on developing solutions with enhanced functionality to address potential cost concerns in reformulation. Some explored ingredients with additional health benefits, like potassium for immune support, potentially appealing to COVID-conscious consumers.

Latest Trends/ Developments:

While early focus lay in directly replacing sodium, the trend is shifting towards enhancing the overall savory flavor profile of foods. Ingredients like yeast extracts, rich in umami-boosting compounds, are increasingly used in combination with reduced sodium levels. Innovations in areas like enzymatic modification of ingredients unlock their flavor potential, making them powerful tools for sodium reduction strategies. Advances in masking technology, blending potassium with other minerals, and improved processing techniques aim to reduce the off-tastes often associated with potassium chloride. Research focuses on developing potassium-based ingredients that better replicate sodium's functional roles – texture, preservation, and product stability. Exploring the synergistic use of potassium in combination with flavor enhancers or lower levels of sodium for greater success. Staying abreast of potential labeling requirements or restrictions on potassium use in specific food categories is crucial. The desire for 'recognizable' ingredients aligns perfectly with sodium reduction. Consumers scrutinize labels more closely, seeking solutions they perceive as natural.

Key Players:

- Cargill

- Kerry Group

- ADM

- Jungbunzlauer

- Angel Yeast

- K+S Group

- Solvay

Chapter 1. Europe Sodium Reduction Ingredients Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Sodium Reduction Ingredients Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Sodium Reduction Ingredients Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Sodium Reduction Ingredients Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Sodium Reduction Ingredients Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Sodium Reduction Ingredients Market– By Type

6.1. Introduction/Key Findings

6.2. Potassium-Based Salts

6.3. Yeast Extracts

6.4. Flavor Enhancers (Herbs, Spices, Natural Extracts)

6.5. Mineral Salts (Magnesium, Calcium)

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Sodium Reduction Ingredients Market– By End Use

7.1. Introduction/Key Findings

7.2 Health-Conscious Consumers

7.3. Consumers with Medical Conditions

7.4. General Population

7.5. Y-O-Y Growth trend Analysis By End Use

7.6. Absolute $ Opportunity Analysis By End Use , 2024-2030

Chapter 8. Europe Sodium Reduction Ingredients Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By End Use

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Sodium Reduction Ingredients Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Cargill

9.2. Kerry Group

9.3. ADM

9.4. Jungbunzlauer

9.5. Angel Yeast

9.6. K+S Group

9.7. Solvay

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Many European countries have voluntary or even mandatory targets for sodium reduction across various food categories. This creates direct pressure on the food industry to innovate and drives the demand for effective solutions

Replacing sodium with alternatives often impacts taste. Finding solutions that effectively mask off-flavors, provide a salty taste perception, or enhance overall flavor is an ongoing challenge.

Cargill, Kerry Group, ADM, Jungbunzlauer, Angel Yeast, K+S Group, Solvay K.

The UK currently holds the largest market share, estimated at around 20%.

Several nations in Eastern Europe, like Poland, Hungary, Romania, etc., are experiencing economic expansion. This generally translates to increasing disposable incomes and evolving consumption patterns, which often include a rise in packaged and processed food consumption