Europe Socks Market Size (204-2030)

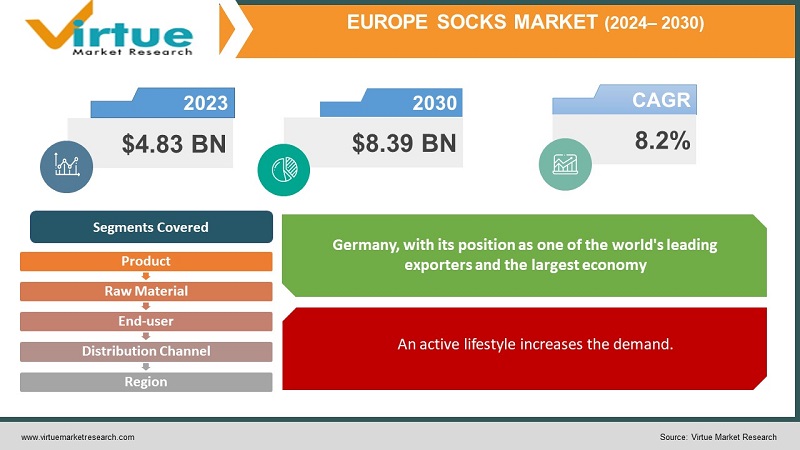

The Europe Socks Market was valued at USD 4.83 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 8.39 billion by 2030, growing at a CAGR of 8.2%.

A sock is a garment designed to cover the foot or lower leg, typically crafted from soft materials. Commonly knitted from cotton, wool, or nylon, socks are worn beneath footwear. They come in a wide range of colors, sizes, and fabrics to meet diverse customer preferences.

Key Market Insights:

Europe leads the way in the fashion industry's shift towards sustainability and ethical practices, a trend reflected in its socks market. An increasing number of European sock companies are prioritizing fair labor standards, ethical manufacturing processes, and eco-friendly materials in response to consumer demands for social responsibility and environmental stewardship. The European socks market features a variety of sustainable options, from organic cotton to recycled polyester blends, allowing consumers to make more socially conscious purchases. Additionally, factors such as climate, lifestyle, and fashion preferences significantly influence the European socks market.

Europe Socks Market Drivers:

Fashion and trend-setting culture drives market growth

Europe’s influential fashion culture and discerning consumers significantly shape the socks market. Beyond their practical function, socks are regarded by European buyers as stylish accessories that enhance their outfits. This focus on style and aesthetics drives demand for a diverse array of sock designs, ranging from classic patterns to bold, avant-garde styles. To meet the evolving preferences of fashion-forward consumers, European manufacturers and retailers must stay abreast of the latest fashion trends and offer a broad selection of sock options.

An active lifestyle increases the demand.

Europe's active lifestyles and outdoor leisure culture create a strong demand for performance-oriented socks designed for sports, hiking, and other outdoor activities. Europeans value socks that offer comfort, support, and durability for their various outdoor pursuits, whether trekking through the Alps, cycling in picturesque landscapes, or engaging in water sports along the coast. Sock companies that specialize in performance socks with features such as moisture-wicking fabrics, cushioned soles, and improved arch support can effectively cater to outdoor enthusiasts across Europe.

Europe Socks Market Restraints and Challenges:

Seasonal fluctuation hinders market growth.

Seasonal variations in demand present a significant challenge for the socks industry in Europe. The differing seasons across European countries impact consumer preferences for sock types and materials. For example, there is an increased demand for thermal socks during the winter, which shifts to lighter, more breathable options in the summer. To address these fluctuating seasonal needs and avoid issues such as stock shortages or excess inventory, manufacturers must engage in strategic planning and maintain flexibility in production. Effective management of inventory levels and production schedules is crucial.

Europe Socks Market Opportunities:

European consumers have become increasingly conscious of health and fitness, with activities such as running, gym workouts, cycling, and hiking gaining popularity. This heightened awareness has led to a growing demand for socks specifically designed for athletic performance and comfort. The athletic sock market has experienced significant advancements in materials and technology, with companies now providing socks featuring moisture-wicking fabrics, cushioned soles, arch support, seamless designs, and anti-blister properties. These features cater to the specific needs of athletes and fitness enthusiasts, transforming athletic socks into essential gear rather than mere accessories.

EUROPE SOCKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.2% |

|

Segments Covered |

By Product, raw material, end user, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of the Europe |

|

Key Companies Profiled |

The Sock Factory, Golden Lady Company SpA, Nester Hosiery, Hanesbrands Inc., Under Armour®, Inc., Strumpfwerk Lindner GmbH, Exceptio Ltd, Nike Inc, PUMA SE, and HJ Hall Socks. |

Europe Socks Market Segmentation

Europe Socks Market Segmentation By Product:

- Casual

- Formal

- Athletic

The casual segment represents the largest portion of the market. Casual socks, known for their comfort and versatility, are suitable for everyday wear. Typically crafted from a blend of cotton,

wool, or synthetic fibers, these socks come in various colors and patterns. Popular styles include crew socks, ankle socks, and no-show socks, which can be paired with outfits such as jeans, shorts, and sneakers.

Conversely, the athletic segment is projected to experience the highest growth rate. Athletic socks have evolved significantly from their basic white predecessors. The athletic community, including events like the Tour de France, has embraced innovations such as no-show socks. Brands like Nike offer no-show socks for both men and women, generally available in packs of three pairs. Similarly, Zukeasox provides men’s no-show socks in packs of six pairs, featuring non-slip cotton, a low cut, an invisible casual ankle liner, and a silicone grip to enhance comfort and performance.

Europe Socks Market Segmentation- By Raw Material:

- Cotton

- Nylon

- Wool

- Others

Cotton socks hold a dominant position in the market due to their widespread appeal, which is attributed to their breathability, comfort, and moisture-wicking properties. The natural cotton fibers facilitate superior air circulation, minimizing foot perspiration and discomfort. In October 2023, the London Sock Company, a UK-based brand, launched its line of back-to-work socks. These socks are hand-finished from a finely knitted, trademark stretch-cotton blend, designed to enhance durability.

Wool socks are favored for their exceptional insulation, keeping feet warm in colder conditions while efficiently managing moisture to maintain dryness. The inherent elasticity of wool fibers ensures a snug fit, providing both comfort and support. In October 2023, DeFeet, renowned for its commitment to sustainable, high-performance socks, introduced the first Merino wool versions of its Woolie Boolie and Wooleator Pro socks in the country. These products feature the Responsible Wool Standard (RWS) certification on the packaging, underscoring their commitment to responsible wool sourcing.

Europe Socks Market Segmentation- By End-user:

- Men

- Women

- Children

Men’s socks lead the market, with a notable preference for formal styles compared to women. Men’s choices often reflect their style and the activities they regularly participate in.

However, the demand for women’s socks is expected to rise in the future. According to the World Federation of the Sporting Goods Industry (WFSGI), increased female participation in sports is anticipated to benefit the sportswear sector. Since 2019, the number of female runners has surpassed that of males. A 2020 BBC report indicated that approximately 30% of women in India were involved in sports. The growing engagement of women in various sports highlights their increasing recognition of sports as a vital component of health and well-being.

Europe Socks Market Segmentation- By Distribution Channel:

- Hypermarkets and Supermarket

- Convenience Store

- Online

- Others

In 2023, the hypermarkets and supermarkets segment led the market, holding a 56.4% share. Consumers typically prioritize product life cycle and price/value factors when making purchases, finding retail stores to be the most convenient locations for trying and evaluating products before buying. Additionally, the presence of knowledgeable staff who can provide detailed information about product specialties and segments attracts first-time buyers to this retail channel.

The online distribution channel is projected to experience growth during the forecast period. Consumers increasingly favor online platforms and official websites for purchasing premium products due to the added benefits they offer, such as convenient return policies, cash on delivery, and centralized customer service. E-commerce sites are particularly popular for buying sportswear, as they provide access to the latest styles at competitive prices.

Europe Socks Market Segmentation- by Region

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

Germany, with its position as one of the world's leading exporters and the largest economy in Europe, plays a significant role in the socks market. Its robust economy is characterized by high

levels of industrialization, technological innovation, and strong consumer spending power. This favorable economic environment, supported by steady growth and a wealthy population, creates an advantageous climate for sock manufacturers and retailers. German consumers are known for their keen sense of style and preference for high-quality apparel and accessories. In Germany, socks are considered an essential garment, and customers place considerable emphasis on brand, material, and style when making their purchases.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a profound impact on the sock market. Lockdowns and travel restrictions caused significant disruptions in the supply chain, affecting both production and distribution. Factory closures, transportation challenges, and labor shortages further compounded these issues. There was a notable decline in demand for specific types of socks, particularly those related to formal or athletic wear, due to reduced opportunities for socializing and outdoor activities. Conversely, the surge in online shopping during lockdowns led to an increase in e-commerce sales of socks. Consumers increasingly turned to online platforms for their purchases, creating opportunities for brands with a robust online presence.

Latest Trends/ Developments:

In January 2024, Puma S.E. announced the launch of its newest store at the City Walk location in Dubai, UAE. This marks the company’s fourth store opening in the UAE for the year and will showcase some of its most popular products.

In December 2023, Under Armour, Inc. inaugurated its first outlet store at the O2 multipurpose indoor arena in London, UK. Part of the brand's new Factory House retail concept, the 3,949-square-foot store features a curated selection of sportswear, footwear, and accessories.

Also in December 2023, Nike Inc. collaborated with STÜSSY, a renowned apparel brand, to unveil the Stüssy x Nike Air Flight 89 collection. This collection includes a variety of hoodies, jackets, tops, sweatpants, and socks, featuring classic DRIFIT socks with simple contrast branding on the ribbing.

Key Players:

These are the top 10 players in the Europe Socks Market:-

- The Sock Factory

- Golden Lady Company SpA

- Nester Hosiery

- Hanesbrands Inc.

- Under Armour®, Inc.

- Strumpfwerk Lindner GmbH Exceptio Ltd

Chapter 1. Europe Socks Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Socks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Socks Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Socks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Socks Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Socks Market – By Product

6.1. Introduction/Key Findings

6.2. Casual

6.3. Formal

6.4. Athletic

6.5. Y-O-Y Growth trend Analysis By Product

6.6. Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Europe Socks Market – By Raw Material

7.1. Introduction/Key Findings

7.2 Cotton

7.3. Nylon

7.4. Wool

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Raw Material

7.7. Absolute $ Opportunity Analysis By Raw Material , 2024-2030

Chapter 8. Europe Socks Market – By End-user

8.1. Introduction/Key Findings

8.2 Men

8.3. Women

8.4. Children

8.5. Y-O-Y Growth trend Analysis End-user

8.6. Absolute $ Opportunity Analysis End-user , 2024-2030

Chapter 9. Europe Socks Market – By Distribution Channel

9.1. Introduction/Key Findings

9.2 Hypermarkets and Supermarket

9.3. Convenience Store

9.4. Online

9.5. Others

9.6. Y-O-Y Growth trend Analysis Distribution Channel

9.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 10. Europe Socks Market , By Geography – Market Size, Forecast, Trends & Insights

10.1. Europe

10.1.1. By Country

10.1.1.1. U.K.

10.1.1.2. Germany

10.1.1.3. France

10.1.1.4. Italy

10.1.1.5. Spain

10.1.1.6. Rest of Europe

10.1.2. By Product

10.1.3. By Distribution Channel

10.1.4. By Raw Material

10.1.5. End-user

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Europe Socks Market – Company Profiles – (Overview, Flavor Product Type Portfolio, Financials, Strategies & Developments)

11.1 The Sock Factory

11.2. Golden Lady Company SpA

11.3. Nester Hosiery

11.4. Hanesbrands Inc.

11.5. Under Armour®, Inc.

11.6. Strumpfwerk Lindner GmbH Exceptio Ltd

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Europe leads the way in the fashion industry's shift towards sustainability and ethical practices, a trend reflected in its socks market. An increasing number of European sock companies are prioritizing fair labor standards, ethical manufacturing processes, and eco-friendly materials in response to consumer demands for social responsibility and environmental stewardship.

The top players operating in the Europe Socks Market are - The Sock Factory, Golden Lady Company SpA, Nester Hosiery, Hanesbrands Inc., Under Armour®, Inc., Strumpfwerk Lindner GmbH, Exceptio Ltd, Nike Inc, PUMA SE, and HJ Hall Socks.

The COVID-19 pandemic had a profound impact on the sock market. Lockdowns and travel restrictions caused significant disruptions in the supply chain, affecting both production and distribution.

. In December 2023, Under Armour, Inc. inaugurated its first outlet store at the O2 multipurpose indoor arena in London, UK. Part of the brand's new Factory House retail concept, the 3,949-square-foot store features a curated selection of sportswear, footwear, and accessories.

Germany, with its position as one of the world's leading exporters and the largest economy in Europe, plays a significant role in the socks market. Its robust economy is characterized by high levels of industrialization, technological innovation, and strong consumer spending power