Europe Seeds Market Size (2023-2030)

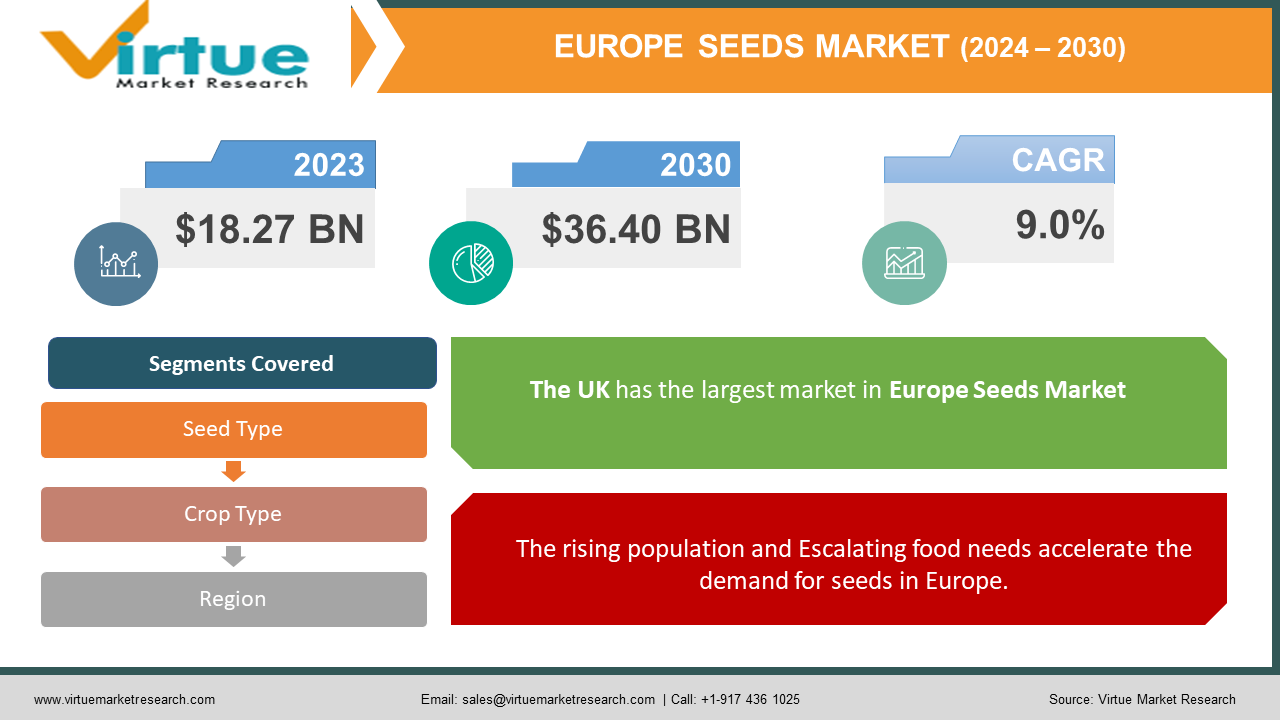

Europe Seeds Market was estimated to be worth USD 18.27 Billion in 2022 and is projected to reach a value of USD 36.40 Billion by 2030, growing at a CAGR of 9.0% during the forecast period 2023-2030.

The European seed market plays a significant role in ensuring the food security of the region, driving agricultural growth, and promoting sustainable farming practices. Seeds are the fundamental units of agriculture, serving as the initiation point for crop production. The market has a wide range of seed varieties, from traditional to genetically modified, catering to the diverse agricultural landscapes and climate conditions of European countries. The seed market forms the foundation of modern agriculture, providing farmers with the genetic material that is needed to grow crops that meet various demands like yield, quality, disease resistance, and environmental adaptability. As Europe faces challenges such as changing climate patterns, increasing population, and environmental concerns, the seed market becomes a focus point for addressing these issues sustainably.

Europe Seeds Market Drivers:

The rising population and Escalating food needs accelerate the demand for seeds in Europe.

The region's increasing population is driving a surge in agricultural productivity, resulting in heightened demand for superior seeds to meet the escalating need for food. A direct consequence of this population growth is the increased demand for food, which places immense strain on current agricultural systems. This driver is compelling agricultural systems to enhance productivity to ensure food security.

Increasing focus on sustainable agriculture and changing climate conditions are accelerating the growth of the seeds market in Europe.

Europe has been witnessing a shift in agricultural activities and is moving towards sustainability, because of rising environmental concerns, resource scarcity, and long-term food security. These factors have increased the demand for seeds that are environmentally friendly and efficient. Climate change has also driven the demand for seeds that can adapt to these changing conditions.

Europe Seeds Market Challenges:

Regulatory hurdles pose a significant challenge to the European seeds market.

The stringent regulatory environment surrounding genetically modified organisms (GMOs) poses a significant challenge to the seed market. European countries have varying degrees of acceptance and restrictions regarding GMOs. This complex and sometimes inconsistent regulatory landscape can hinder the development, commercialization, and adoption of genetically modified seed varieties that could offer valuable traits such as improved pest resistance or nutritional content.

Climate change adoption could slow down the growth of the European seeds market.

Changing climate conditions increases the demand for seeds that are adapted to adverse conditions but, developing and breeding climate-resilient seed varieties is challenging, and this could pose a threat to the agriculture industry in the future. Developing seeds with traits like drought resistance, heat tolerance, and short maturation periods requires extensive research, technology, and resources. Overcoming these challenges is essential to ensure that farmers have access to seeds that can give yield in a rapidly changing climate.

COVID-19 Impact on the Europe Seeds Market:

The COVID-19 pandemic had a notable impact on the agriculture industry, including the European seed market. International and domestic movement restrictions disrupted the trade and distribution of seeds. This affected the on-time availability of seeds during crucial planting seasons, leading to delayed crop cycles. The pandemic caused shifts in consumer preferences and behavior. Increased focus on self-sufficiency and home gardening led to higher demand for seeds among households. Lockdowns and social distancing measures accelerated the adoption of digital platforms for seed procurement. E-commerce channels became important for farmers and consumers to access seeds, expanding online seed sales. Labor shortages posed great challenges during planting and harvesting seasons. Travel restrictions and lockdowns disrupted agricultural research activities, affecting the development of new seed varieties and innovations.

Economic uncertainties caused by the pandemic led to financial constraints for both farmers and seed companies. Farmers had limited resources for purchasing seeds, while seed companies faced challenges in research investments and production. Changes in consumer demand due to the closure of restaurants and disruptions in supply chains led to shifts in crop demand. Seed companies needed to adjust their offerings to cater to changing preferences.

EUROPE SEEDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.0% |

|

Segments Covered |

By Crop Type, Seed Type, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

U.K., Germany, France, Italy, Spain, Rest Of Europe |

|

Key Companies Profiled |

Syngenta AG, BASF SE, Bayer CropScience AG, DowDuPont Inc. (Corteva Agriscience), Monsanto Company (now part of Bayer), KWS SAAT SE, Limagrain, Rijk Zwaan, Enza Zaden, Vilmorin & Cie |

Europe Seeds Market Segmentation:

Europe Seeds Market Segmentation: By Seed Type

- Conventional Seeds

- Genetically Modified Seeds

- Hybrid Seeds

- Others

Conventional seeds are traditional, non-genetically modified varieties that have been developed through selective breeding over generations. They often exhibit natural traits suited to local climates and are widely used for a range of crops, because conventional seeds comprise the largest segment of the seeds market of Europe. Conventional seeds are valued for their stability and genetic diversity. GMO seeds are engineered in laboratories to express specific traits, such as resistance to pests, diseases, or herbicides. They offer advantages like increased yield and reduced chemical usage and are the fastest-growing segment because of the benefits they provide. However, their adoption faces regulatory challenges and concerns about potential environmental and health impacts. Other seed types include open-pollinated seeds and heirloom seeds.

Europe Seeds Market Segmentation: By Crop Type

- Cereals

- Fruits & Vegetables

- Oilseeds

- Leguminous Crops

- Forage and Pasture

Cereal crops include staple foods that provide a significant portion of the European diet and comprise the largest segment in this market because cereals are crucial for food security. Seed varieties that offer high yields, disease resistance, and adaptability to diverse climates are sought after by cereal farmers. Seeds for fruits and vegetables are in high demand due to the popularity of fresh produce and growing interest in healthy diets. Farmers often look for seeds that yield flavourful, nutritious, and visually appealing produce. Oilseed crops like sunflower and soybean are grown for their oil-rich seeds. Seeds that produce oilseeds with high oil content and resistance to pests are valuable to oilseed farmers. Leguminous crops, such as beans, and lentils, can fix nitrogen from the atmosphere into the soil. Seeds that facilitate nitrogen fixation and yield nutritious legumes are significant in sustainable agriculture. Forage and pasture seeds are essential for livestock farming, providing feed for animals. Farmers seek seeds that offer high nutritional value, drought resistance, and compatibility with rotational grazing practices.

Europe Seeds Market Segmentation: By Region

- U.K.

- Germany

- France

- Italy

- Spain

- Rest Of Europe

The United Kingdom is known for its diverse agricultural practices, ranging from arable farming to livestock production. The U.K. emphasizes sustainable agriculture and quality produce, driving the demand for seeds that align with these priorities. Germany has varied climate zones impacting seed preferences, with crops like cereals, potatoes, and sugar beets being significant. France boasts a rich agricultural landscape and is the largest segment in this market and includes vineyards, orchards, and expansive cereal fields. This diversity impacts seed preferences, with a high demand for seeds suitable for grapes, apples, wheat, and other crops. Italy's agricultural practices range from traditional olive and grape cultivation to modern vegetable production. The country places a strong emphasis on organic and high-quality produce. Spain's diverse climate zones, ranging from Mediterranean to arid, influence the types of crops grown. The country is known for producing fruits, vegetables, and olive oil. The "Rest of Europe" category includes countries like Scandinavia, Poland, Hungary, Greece, and others.

Europe Seeds Market Key Players:

- Syngenta AG

- BASF SE

- Bayer CropScience AG

- DowDuPont Inc. (Corteva Agriscience)

- Monsanto Company (now part of Bayer)

- KWS SAAT SE

- Limagrain

- Rijk Zwaan

- Enza Zaden

- Vilmorin & Cie

Chapter 1. Europe Seed Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Seed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Seed Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Seed Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Seed Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Seed Market– By Crop Type

6.1. Introduction/Key Findings

6.2. Cereals

6.3. Oilseed

6.4. Fruit and Vegetable

6.5. Forage and Pasture

6.6. Leguminous Crops

6.7. Y-O-Y Growth trend Analysis By Crop Type

6.8. Absolute $ Opportunity Analysis By Crop Type, 2023-2030

Chapter 7. Europe Seed Market– By Seed Type

7.1. Introduction/Key Findings

7.2. Conventional Seeds

7.3. Genetically Modified Seeds

7.4. Hybrid Seeds

7.5. Y-O-Y Growth trend Analysis By Seed Type

7.6. Absolute $ Opportunity Analysis By Seed Type, 2023-2030

Chapter 8. Europe Seed Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Seed Type

8.1.3. By Crop Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 8. Europe Seed Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Syngenta AG

8.2. BASF SE

8.3. Bayer CropScience AG

8.4. DowDuPont Inc. (Corteva Agriscience)

8.5. Monsanto Company (now part of Bayer)

8.6. KWS SAAT SE

8.7. Limagrain

8.8. Rijk Zwaan

8.9. Enza Zaden

8.10. Vilmorin & Cie

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Europe Seeds Market was estimated to be worth USD 18.27 Billion in 2022 and is projected to reach a value of USD 36.40 Billion by 2030, growing at a CAGR of 9.0% during the forecast period 2023-2030.

The European seeds Market Drivers are the Rising population, Escalating food needs, increasing focus on sustainable agriculture and changing climate conditions.

. Based on the Product type, the European seeds Market is segmented into Cereals, Fruits and vegetables, Oilseeds, Leguminous Crops, Forage, and Pasture

France is the most dominating in the Europe Seeds Market

Syngenta AG, BASF SE, and Bayer Crop Science AG are a few of the leading players in the Europe Seeds Market.