Europe Rum Market Size (2024-2030)

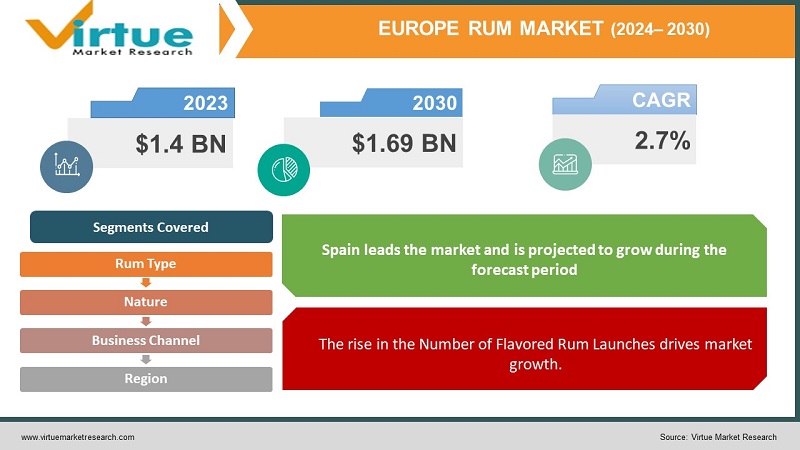

The Europe Rum Market was valued at USD 1.4 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.69 billion by 2030, growing at a CAGR of 2.7%.

Rum is a distilled beverage produced from fermented sugarcane, molasses, and other related byproducts. The fermentation process may also involve yeast. The mixture of fermented sugar juice or molasses with water is distilled to produce the liquor, which is then heated to evaporate the alcohol and re-condensed to form rum. On the market, rum is available in various types including light rum, gold rum, spiced rum, flavored rum, dark rum, and overproof rum. Light rum, often referred to as silver or white rum, is especially popular for its application in cocktails. Rum is a key ingredient in numerous cocktails such as mojitos and daiquiris, owing to its sweet flavor, which makes it a versatile mixer essential for any well-equipped bar. It is integral to a wide range of beverages from vibrant tropical tiki drinks to warming winter concoctions. The rum industry has seen substantial growth and is projected to continue expanding in the coming years, largely driven by increased consumption among millennials.

Key Market Insights:

Rum ranks as the second most popular spirit, with increasing interest in exploring a variety of flavors beyond just dark and golden rums. Flavored rums are extensively utilized in creating cocktails, shakers, and mixers. Historically, rum played a medicinal role for soldiers; during World War I, 'Totorum' was used to maintain the health of troops.

Recent studies suggest that rum may contribute to stronger bones, with moderate consumption potentially helping to prevent osteoporosis and alleviate arthritis pain. Additionally, rum may support heart health by raising HDL cholesterol levels and preventing arterial blockages. As one of the oldest alcoholic beverages, traditional rum enthusiasts often seek high-quality options with distinctive flavors.

Europe Rum Market Drivers:

The rise in the Number of Flavored Rum Launches drives market growth.

In recent years, several rum producers across Europe have launched an array of flavored rums. For instance, Bacardi has launched options such as Bacardi Coconut, Bacardi Pineapple, and Bacardi Raspberry. Malibu is known for its renowned coconut-flavored rum, alongside Malibu Mango and Malibu Passion Fruit. Captain Morgan has expanded its flavored rum selection with Captain Morgan Pineapple, Captain Morgan Orange Vanilla Twist, and Captain Morgan Tiki. Dead Man's Fingers has achieved notable popularity across Europe due to its unique flavor offerings, such as Dead Man's Fingers Coconut, Dead Man's Fingers Raspberry, and Dead Man's Fingers Spiced. The demand for flavored rums is on the rise, with new entrants like Bumbu Rum Co. and Bayou Rum offering a range of flavors in the European market. Additionally, there has been a notable increase in craft and artisanal rum brands in Europe, which produce small batches of flavored rum with a homemade touch.

Europe Rum Market Restraints and Challenges:

Growing Health Concerns hinder market growth.

Low-alcohol rum is gaining popularity as individuals become more health-conscious and seek healthier lifestyle choices. However, the rum market is not expanding as rapidly as anticipated due to a growing preference for healthier beverages overall. Consequently, there is a trend toward reduced alcohol consumption among consumers.

Europe Rum Market Opportunities:

Demand for Premium and High-Quality Rum creates opportunities.

Several factors contribute to the rising demand for premium and high-quality rums, including increased interest in product quality and authenticity, a shift towards more sophisticated drinking experiences, and a heightened focus on health and well-being. To meet this demand, rum producers are offering premium aged rums crafted using traditional methods and aged in oak barrels. For example, Venezuelan Rum Diplomático's Reserva Exclusiva, which can be aged for up to 12 years, has received numerous accolades for its exceptional quality and flavor. Similarly, Guatemalan Rum Ron Zacapa's Centenario Solera 23, aged for up to 23 years, is celebrated for its complex and refined flavor profile. Additionally, rum companies are catering to affluent and discerning consumers by providing unique and distinctive flavor profiles that stand out in the market.

EUROPE RUM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.7% |

|

Segments Covered |

By Rum Type,nature , Business Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of the Europe |

|

Key Companies Profiled |

Bacardi Global Brands Ltd., Asahi Group Holdings Ltd., Davide Campari-Milano Spa, Nova Scotia Spirit Co., Demerara Distillers Ltd., Diageo Plc., William Grant & Sons Ltd., Suntory Holdings Ltd., Halewood International Holdings PLC and Pernod Ricard SA. |

Europe Rum Market Segmentation:

Europe Rum Market Segmentation- By Rum Type:

- White Rum

- Light or Gold Rum

- Dark Rum

- Spiced Rum

- Other Rums

The light/gold rum category holds the leading position in the market. This type of rum is usually aged in oak barrels, which contributes to its smoother taste and appealing amber hue. This aging process not only enhances its premium status but also encourages consumers to pay a higher price for its quality. The prevalence of light/gold rum can be attributed to its versatility and widespread appeal, making it a popular choice for cocktails like Mojitos and Piña Coladas and an essential ingredient in mixology.

Spiced rum is the second most popular segment, catering to those who prefer a richer and more aromatic profile in their drinks. The inclusion of spices and caramelized sugar gives spiced rum a unique flavor, making it ideal for creating specialty cocktails such as Spiced Rum Punch and Captain Morgan & Cola.

Europe Rum Market Segmentation- By Nature:

- Plain Rum

- Flavored Rum

- Organic Rum

- Conventional Rum

- Other Categories

The plain rum segment dominated the market. Traditional plain rum, with its rich history and enduring appeal, remains a trusted choice for consumers. Its versatility as a base for cocktails and mixology contributes to its broad consumer base.

Conversely, the flavored rum segment has experienced significant growth, fueled by consumer interest in innovative and exciting flavors. The addition of fruit, spice, and other aromatic infusions has broadened the appeal of rum, attracting a younger and more diverse audience. Flavored rum, is favored for its ability to enhance cocktails and mixers with a wide range of flavors and aromas. Prominent brands driving the flavored rum market include Bacardi, Malibu, Kraken, Captain Morgan, and Sailor Jerry, each of which dominates in this category.

Europe Rum Market Segmentation- By Business Channel:

- Business to Business

- Hypermarkets or Supermarkets

- Specialty Stores

- Online Retails

- Other Sales Channel

The Hypermarkets and Supermarkets segment leads the market. These off-trade channels, including liquor stores and hypermarkets or supermarkets, provide consumers with convenience and a wide variety of rum options, encouraging exploration and purchase for home consumption. The COVID-19 pandemic significantly accelerated this trend, as lockdowns and social distancing measures reduced opportunities for on-trade consumption.

Additionally, consumers are increasingly favoring the enjoyment of rum in their home settings, where they can taste and explore different options, thus bolstering off-trade market shares.

Market leaders are also expanding their distribution channels to include online platforms. This shift allows them to reach a larger consumer base and offers direct selling, which can reduce rum prices for end consumers. However, in some regions, government regulations and policies have imposed restrictions on rum sales.

Europe Rum Market Segmentation- by region

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

Spain leads the market and is projected to grow during the forecast period. Europe, known for its high alcohol consumption, saw Belarus as the top consumer. The premiumization trend in alcoholic beverages, including rum, is driving increased alcohol consumption across the region. The demand for premium rums is growing as consumers seek more refined drinking experiences, prompting regional rum producers to shift from bulk production to premium offerings. This trend is notable in countries such as the UK, Belgium, the Czech Republic, Denmark, Germany, Switzerland, and France.

The rise in premium rum launches in Europe reflects consumers' enthusiasm for new products and flavors, contributing to market growth. However, alcohol is the third-leading risk factor for disease and death in Europe, according to the WHO. Consequently, some regional countries, like Russia, are implementing policies to reduce alcohol consumption.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has disrupted global economies, impacting various industries differently. While sectors such as essential food, cleaning and hygiene products, and healthcare have experienced significant growth, the rum industry has faced challenges. The pandemic has led consumers to prioritize traditional, staple, and healthy foods, resulting in a decline in rum demand. Additionally, lockdowns have disrupted supply chains and led to shortages of workers and raw materials, hindering rum production.

As lockdowns lift, there may be a resurgence in consumer traffic for the rum market. Furthermore, e-commerce is likely to see growth in the post-pandemic environment, potentially boosting rum sales through online platforms. To adapt to the evolving business landscape, companies need to adjust their supply chain and production strategies to align with the new market conditions.

Latest Trends/ Developments:

In August 2022, Hilton Head Distillery revealed plans to introduce its Panela and Solera Rum products at its distillery and retail locations throughout South Carolina. The announcement highlighted that only limited batches of each distinctive rum, crafted using copper pot distillation, would be released.

In July 2022, The Bush Rum Co., a UK-based company, launched its sustainable rum in India via a local partnership with Mumbai-based Monika Alcobev Limited. In addition to its brand, the company has introduced other notable brands to the Indian market, including Jose Cuervo, Templeton Rye whiskey, and Rutini wines.

Key Players:

These are the top 10 players in the Europe Rum Market: -

- Bacardi Global Brands Ltd.

- Asahi Group Holdings Ltd.

- Davide Campari-Milano Spa

- Nova Scotia Spirit Co.

- Demerara Distillers Ltd.

- Diageo Plc.

- William Grant & Sons Ltd.

- Suntory Holdings Ltd.

- Halewood International Holdings PLC

- Pernod Ricard SA

Chapter 1. Europe Rum Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Rum Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Rum Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Rum Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Rum Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Rum Market– By Rum Type

6.1. Introduction/Key Findings

6.2. White Rum

6.3. Light or Gold Rum

6.4. Dark Rum

6.5. Spiced Rum

6.6. Other Rums

6.7. Y-O-Y Growth trend Analysis By Rum Type

6.8. Absolute $ Opportunity Analysis By Rum Type , 2024-2030

Chapter 7. Europe Rum Market– By Nature

7.1. Introduction/Key Findings

7.2 Plain Rum

7.3. Flavored Rum

7.4. Organic Rum

7.5. Conventional Rum

7.6. Other Categories

7.7. Y-O-Y Growth trend Analysis By Nature

7.8. Absolute $ Opportunity Analysis By Nature , 2024-2030

Chapter 8. Europe Rum Market– By Business Channel

8.1. Introduction/Key Findings

8.2. Business to Business

8.3. Hypermarkets or Supermarkets

8.4. Specialty Stores

8.5. Online Retails

8.6. Other Sales Channel

8.7. Y-O-Y Growth trend Analysis Business Channel

8.8. Absolute $ Opportunity Analysis Business Channel , 2024-2030

Chapter 9. Europe Rum Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Business Channel

9.1.3. By Nature

9.1.4. By Rum Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Rum Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Bacardi Global Brands Ltd.

10.2. Asahi Group Holdings Ltd.

10.3. Davide Campari-Milano Spa

10.4. Nova Scotia Spirit Co.

10.5. Demerara Distillers Ltd.

10.6. Diageo Plc.

10.7. William Grant & Sons Ltd.

10.8. Suntory Holdings Ltd.

10.9. Halewood International Holdings PLC

10.10. Pernod Ricard SA

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Rum ranks as the second most popular spirit, with increasing interest in exploring a variety of flavors beyond just dark and golden rums. Flavored rums are extensively utilized in creating cocktails, shakers, and mixers. Historically, rum played a medicinal role for soldiers; during World War I, 'Totorum' was used to maintain the health of troops

The top players operating in the Europe Rum Market are - Bacardi Global Brands Ltd., Asahi Group Holdings Ltd., Davide Campari-Milano Spa, Nova Scotia Spirit Co., Demerara Distillers Ltd., Diageo Plc., William Grant & Sons Ltd., Suntory Holdings Ltd., Halewood International Holdings PLC and Pernod Ricard SA.

The COVID-19 pandemic has disrupted global economies, impacting various industries differently. While sectors such as essential food, cleaning and hygiene products, and healthcare have experienced significant growth, the rum industry has faced challenges.

In August 2022, Hilton Head Distillery revealed plans to introduce its Panela and Solera Rum products at its distillery and retail locations throughout South Carolina. The announcement highlighted that only limited batches of each distinctive rum, crafted using copper pot distillation, would be released.

Spain leads the market and is projected to grow during the forecast period.