Europe Rice Flour Market Size (2024-2030)

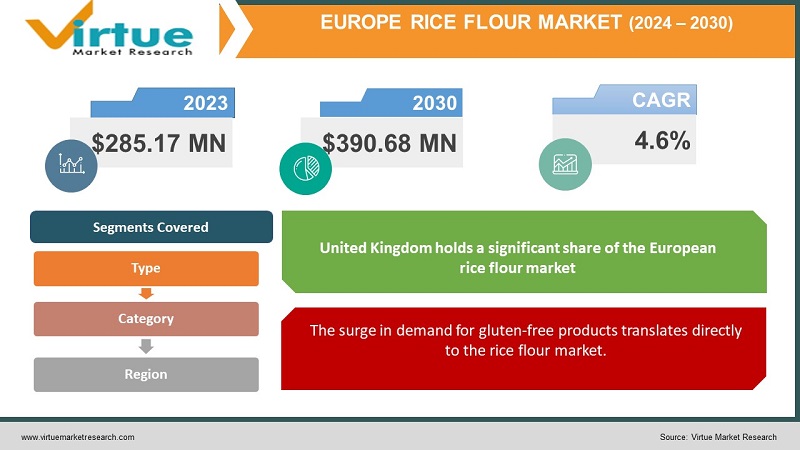

The Europe Rice Flour Market was valued at USD 285.17 Million in 2023 and is projected to reach a market size of USD 390.68 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.6%.

The rise of diagnosed celiac disease, gluten sensitivity, and a general perception of gluten-free diets as healthier creates a substantial demand for rice flour products. Rice flour provides a reliable staple for gluten-free baking and cooking. Rice flour's unique properties make it invaluable in a wide range of food applications. Its neutral taste, binding abilities and textural impact render it a favorite of industries ranging from bakery and confectionery to processed foods and snack manufacturers. Consumers in Europe are increasingly mindful of food labels. The 'clean label' trend favors minimally processed, natural ingredients like rice flour, driving its popularity among health-conscious consumers. Rice flour producers focus on developing distinct varieties derived from heirloom rice grains, offering sprouted options for enhanced nutrition, or utilizing specialized blends for specific baking and cooking needs. Consumers and manufacturers prioritize sustainability in production and sourcing. Manufacturers highlight traceability, organic practices, and reduced environmental impact of their rice flour products.

Key Market Insights:

Health and environmental concerns propel consumers toward organic food products, including organic rice flour. This trend aligns with the broader clean-label movement. Shoppers actively seek rice flour derived from rice grown without synthetic pesticides and fertilizers, leading to the rapid expansion of the organic segment within the market. Additionally, several governments across Europe offer incentives and support to organic agricultural practices, further promoting the availability of organic rice flour. Manufacturers are constantly exploring new rice varieties, blends, and processing methods to create innovative rice flour products. The goal is to enhance functionality, achieve desired textures, and boost the overall nutritional profile. Specialty blends of rice flour with other gluten-free flours are becoming increasingly common, aimed at offering optimal performance for specific baking and food processing applications. The intrinsic properties of rice flour make it an incredibly adaptable ingredient in the food and beverage industry. Its neutral flavor, absence of gluten, and fine texture allow manufacturers to incorporate it seamlessly into a diverse range of products. From gluten-free bread, cookies, and pastries to noodles, crackers, and extruded snacks, rice flour consistently delivers results that cater to evolving consumer preferences.

Europe Rice Flour Market Drivers:

The surge in demand for gluten-free products translates directly to the rice flour market.

Individuals who don't have medical conditions necessitating gluten avoidance are still incorporating gluten-free options into their diet. This trend, often termed "flexitarian," is driven by a perception that gluten-free products are healthier, easier to digest, or offer weight management benefits. It's no longer just about medical needs, but a broadening lifestyle choice. The surge in demand for gluten-free products translates directly to the rice flour market. Manufacturers no longer offer just a single rice flour option—there's a wide array of flours made from different rice varieties (white, brown, jasmine, etc.) and blends with other gluten-free flours. This caters to bakers and home cooks who may prioritize taste, texture, or specific baking requirements for different recipes. The early days of gluten-free products were sometimes marked by lackluster taste or crumbly textures. However, advancements in formulation technologies and the incorporation of rice flour in well-tested recipes have vastly improved the quality and taste of gluten-free breads, cakes, pastas, and other products. This increased consumer satisfaction further amplifies demand.

The Expanding Scope of Workplace Safety Culture is influencing the Europe Protective Footwear Market.

Rice flour is indispensable in the creation of gluten-free baked goods. From dense loaves of bread to light, airy cakes, and even chewy cookies, its properties allow for textural and taste successes. Europe's love affair with bread and pastries is a huge demand driver as more gluten-free versions hit the market. Rice flour's natural thickening and binding properties make it valuable in sauces, soups, gravies, and even puddings. It offers a clean flavor and good stability in both hot and cold preparations. The processed foods sector embraces rice flour for its unique qualities in creating extruded snacks with particular textures and shapes. It's also a staple in many gluten-free noodle varieties, both fresh and dried, opening up options for those needing culinary diversity. Rice flour finds popularity as a crispy alternative to wheat-based breadcrumbs on everything from chicken to fish. Specialty food producers cater to gluten-sensitive consumers with these innovative uses. Forward-thinking food companies are incorporating rice flour into non-traditional applications. From gluten-free infant/toddler foods to nutritional supplements and even pet foods catering to sensitive stomachs, rice flour is popping up in surprising places.

Europe Rice Flour Market Restraints and Challenges:

Major rice-producing regions can disrupt global supply chains due to geopolitical instability, trade disputes, or economic downturns.

Rice cultivation is highly susceptible to climatic anomalies. Droughts, floods, unseasonal rains, and pest outbreaks can severely impact rice harvests, leading to shortages and a subsequent surge in raw rice prices. This volatility directly impacts the cost of rice flour. Global rice supply chains can be disrupted by geopolitical instability, trade disputes, or economic downturns in major rice-producing regions. These disruptions create delays and inflated prices for imported rice, impacting the stability of the rice flour market for European producers. Europe relies significantly on rice imports from Asia and other regions. This dependence introduces potential challenges, where supply chain issues or import regulations can create supply limitations and price fluctuations. The diverse array of rice varieties, each with its specific starch composition and properties, leads to variations in the functionality and quality of rice flour. Maintaining consistency from batch to batch, especially when sourcing from different regions or using varied rice cultivars, presents a challenge. Variations in milling standards across rice flour manufacturers can lead to inconsistencies in particle size, texture, and overall flour quality. This can impact its performance in specific food applications. Rice flour, especially brown rice flour, can be susceptible to rancidity and oxidation due to its higher oil content. Proper storage, packaging, and adherence to shelf-life guidelines are crucial for maintaining product quality, but they add complexity for suppliers and end-users. The gluten-free market offers consumers a wide range of flour alternatives derived from sources like almonds, buckwheat, tapioca, and coconut. These flours compete with rice flour based on taste, functionality, and nutrient profile.

Europe Rice Flour Market Opportunities:

While the gluten-free market has matured in Europe, there's still room to cater to the evolving needs and sophisticated palates of consumers with celiac disease or gluten sensitivities. Rice flour will remain a cornerstone of this segment. Manufacturers can create unique blends of rice flour with other gluten-free flours (almond, oat, buckwheat) to achieve specific textures and flavor profiles. These blends offer improved functional properties for diverse baking and cooking applications. A shift towards premium, high-quality gluten-free products is evident. This creates an opportunity for rice flour sourced from specialty rice varieties with distinct qualities or flavor profiles that can command a higher price. While the focus has been on bread, pastries, and pasta, the gluten-free category encompasses sauces, ready-made meals, and snacks. Rice flour can serve as a crucial ingredient in these areas, diversifying its applications. Consumers increasingly lean towards plant-based and flexitarian diets. Rice flour, a naturally plant-based and vegan ingredient, strongly aligns with this trend. The demand for transparent ingredient lists and 'clean' products favors rice flour. It's associated with simple, natural ingredients, offering a competitive edge in a health-conscious environment.

EUROPE RICE FLOUR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Type, Category, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Ebro Foods , Associated British Foods, ADM, Beneo, AGRANA, Riso Gallo |

Europe Rice Flour Market Segmentation:

Europe Rice Flour Market Segmentation: By Type

- White rice flour

- Brown Rice Flour

White rice flour remains the most dominant type in the European market. Its versatility, neutral flavor, and wide availability make it a staple for gluten-free food manufacturers. Made from milled, polished white rice grains, with the bran and germ removed. This creates a very fine, white flour with a neutral flavor and smooth texture. Highly versatile due to its neutral taste. Used extensively in gluten-free baking (breads, pastries, cakes), noodles, pasta, batters, and as a thickener for sauces. Favored in applications where a light color and texture are desired. Brown Rice Flour is made from whole-grain brown rice, retaining the bran and germ layers. Possesses a slightly nutty flavor, a coarser texture than white rice flour, and a light brown color. Suitable for gluten-free baking, especially in denser items like bread and muffins. Used in crackers, breading for fried foods, and in combination with other flours to enhance texture. Also finding uses in snacks and extruded products. Brown rice flour occupies a smaller but rapidly growing share of the market. Consumer interest in whole-grain products and increased health consciousness are driving its popularity. Brown rice flour is the fastest-growing segment. Its whole-grain appeal aligns with the trend toward healthier food choices, and manufacturers are increasingly finding ways to incorporate it for its functional benefits and appealing flavor profile.

Europe Rice Flour Market Segmentation: By Category -

- Organic Rice Flour

- Conventional Rice Flour

Organic Rice Flour-Manufactured from rice cultivated without synthetic pesticides, herbicides, or fertilizers. Organic rice farming emphasizes sustainable practices, soil health, and biodiversity. Associated with health benefits, environmental consciousness, and higher quality standards. Often commands a premium price. Rising consumer awareness about food safety, traceability, and sustainability fuels the demand for organic rice flour. Government initiatives supporting organic agriculture also play a role in its growth. Conventional Rice Flour- Produced from rice grown using conventional agricultural methods, which may involve the use of synthetic fertilizers and pesticides. While facing competition from the growing organic segment, conventional rice flour still holds a sizeable share of the market. It could represent around 65-75% of the total European rice flour market. Cost-conscious consumers, established food industry use for certain applications, and readily available supply are drivers for the conventional rice flour segment. At present, conventional rice flour remains the dominant category within the European market. This is largely due to its wider availability, lower price point, and established use in various processed food products. The organic rice flour segment is experiencing the most rapid growth within the European market. This surge aligns with the broader 'clean label' movement' and health-conscious choices. Consumers increasingly prioritize natural, minimally processed foods.

Europe Rice Flour Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The United Kingdom holds a significant share of the European rice flour market, accounting for approximately 14% of the overall market. British consumers have embraced rice flour as a gluten-free alternative, fueled by the growing demand for healthy and allergen-friendly food products. Major players in the UK market include Doves Farm, Tilda, and Sharpham Park. Germany is a big player in the European rice flour market, contributing around 16% of the total market share. German consumers value the nutritional benefits and versatility of rice flour, incorporating it into various baked goods, snacks, and traditional dishes. France accounts for approximately 12% of the European rice flour market share. French consumers have a strong appreciation for high-quality, artisanal food products, contributing to the demand for premium rice flour offerings. Major players in the French market include Celnat, Bjorg, and Jardin Bio. Italy contributes around 10% to the overall European rice flour market share. Italian consumers have a long-standing tradition of incorporating rice into their cuisine, making rice flour a natural fit for various culinary applications. Major players in the Italian market include Ecor, Le Veneziane, and Riso Gallo. Spain accounts for approximately 8% of the European rice flour market share. Spanish consumers value the convenience and versatility of rice flour, using it in various dishes and baked goods. Major players in the Spanish market include Harinera Vilafranquina, La Finestra Sul Cielo, and Huercasa. The remaining European countries, collectively referred to as the "Rest of Europe," account for approximately 40% of the overall rice flour market share. This segment includes countries such as the Netherlands, Belgium, Sweden, Poland, and Switzerland, among others. Each of these countries has its unique market dynamics, consumer preferences, and regulatory frameworks governing the rice flour industry. The fastest-growing region in the European rice flour market is the Rest of Europe segment. This segment encompasses various countries that are witnessing a surge in consumer interest and demand for rice flour driven by factors such as changing dietary preferences, increasing awareness of gluten intolerance and celiac disease, and the popularity of alternative and healthier flour options.

COVID-19 Impact Analysis on the Europe Rice Flour Market:

Strict lockdown measures across Europe disrupted supply chains for rice flour. Border closures and limitations on transportation hampered the movement of raw materials and finished products. Restrictions on movement and potential illness among workers hampered rice flour production in some areas. This, coupled with a potential rise in demand for essential goods, could have led to temporary shortages. Disruptions in the global rice trade, along with stockpiling behaviors and panic buying, could have caused temporary fluctuations in rice prices, impacting the cost of rice flour. With lockdowns forcing people to stay home, home baking witnessed a significant surge. Rice flour, a gluten-free alternative, potentially benefitted as consumers with celiac disease or gluten sensitivities continued to bake at home. The pandemic heightened health consciousness, potentially leading some consumers to explore gluten-free options like rice flour for perceived health benefits, even without a diagnosed gluten intolerance. With physical stores facing limitations, the e-commerce sector boomed. This potentially benefitted online retailers specializing in gluten-free flour, including rice flour. As restrictions eased and food supply chains stabilized, the initial surge in demand for rice flour might have normalized somewhat. However, the focus on health and home cooking may have had a lasting positive impact.

Latest Trends/ Developments:

While standard white and brown rice flours still hold a major share, there's a growing interest in exploring rice flours made from ancient and heirloom rice varieties. Ancient varieties like black rice, red rice, and others offer distinct colors, flavors, and potentially higher levels of antioxidants and micronutrients. Heirloom rice varieties, often tied to specific European regions, appeal to consumers seeking unique, artisanal ingredients with a sense of history and origin. Sprouted rice flour utilizes grains that have just begun the germination process. This unlocks enzymes, potentially improving the bioavailability of certain nutrients and boosting digestibility. This type of flour aligns with the demand for functional foods offering added nutritional benefits beyond basic calories. European consumers are increasingly discerning about ingredients. Rice flour, with its naturally simple, single-ingredient nature, fits well within the demand for clean-label products. Demand for rice flour produced from organic and non-GMO rice crops is on the rise, driven by concerns around sustainability and health.

Key Players:

- Ebro Foods

- Associated British Foods

- ADM

- Beneo

- AGRANA

- Riso Gallo

Chapter 1. Europe Rice Flour Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Rice Flour Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Rice Flour Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Rice Flour Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Rice Flour Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Rice Flour Market– By Type

6.1. Introduction/Key Findings

6.2. White rice flour

6.3. Brown Rice Flour

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Rice Flour Market– By Category

7.1. Introduction/Key Findings

7.2 Organic Rice Flour

7.3. Conventional Rice Flour

7.4. Y-O-Y Growth trend Analysis By Category

7.5. Absolute $ Opportunity Analysis By Category , 2024-2030

Chapter 8. Europe Rice Flour Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Category

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Rice Flour Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Ebro Foods

9.2. Associated British Foods

9.3. ADM

9.4. Beneo

9.5. AGRANA

9.6. Riso Gallo

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The prevalence of celiac disease, a severe autoimmune reaction to gluten, is a primary driver. Rice flour offers a safe, versatile alternative for those managing this condition.

Rice cultivation is susceptible to weather fluctuations like droughts, floods, and pest infestations. Such events can impact yields, leading to fluctuations in raw rice prices that in turn affect rice flour costs

Ebro Foods, Associated British Foods, ADM, Beneo, AGRANA

Riso Gallo.

Germany currently holds the largest market share, estimated at around 16%.

Several nations in Eastern Europe, like Poland, Hungary, Romania, etc., are experiencing economic expansion. This generally translates to increasing disposable incomes and evolving consumption patterns