Europe Power Electronics Market Size (2024-2030)

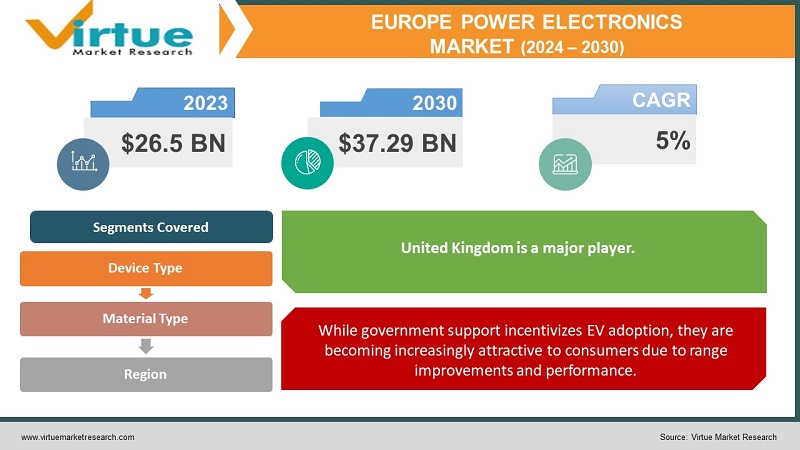

The Europe Power Electronics Market was valued at USD 26.5 Billion in 2023 and is projected to reach a market size of USD 37.29 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5%.

Power electronics is the technology of controlling and converting electrical power efficiently using semiconductor devices. The European market holds a significant position in this field, driven by a diverse range of industries and applications. Europe is recognized for its strengths in R&D and advanced power electronics design. The rise of electrification in vehicles is a significant market driver. Advanced power electronics enable the seamless integration of fluctuating solar and wind power into the grid, ensuring reliability. Power converters are crucial for battery storage systems for grid balancing and off-grid applications. SiC and GaN offer superior performance in high voltage, high temperature, and high switching frequency applications. Power electronics are the heart of modern industrial automation, enabling precise and efficient control of machinery. Integration of sensors and smart power management systems for optimized production processes. Industrial environments require robust power electronics components to ensure minimal downtime. Stricter energy efficiency standards across various sectors push for the adoption of high-performance power electronics. Focus on designing repairable, longer-lifespan power electronics, and exploring material recycling potential.

Key Market Insights:

Western European countries, including Germany, France, the United Kingdom, and Italy, collectively account for over 60% of the European power electronics market share.

The power semiconductor segment (power transistors, diodes, modules, etc.) accounts for a significant share of 40 % reflecting their fundamental role in power electronic systems.

Europe's focus on renewable energy generation significantly boosts the market. Increasing automation and the use of sophisticated industrial equipment and robotics necessitate advanced power electronics solutions, contributing to market expansion.

The automotive sector is a major adopter of power electronics, driven by the proliferation of electric vehicles (EVs) and hybrid vehicles. This segment exhibits particularly high growth potential.

The electrification of transportation, industrial processes, and growing consumer electronics adoption necessitates sophisticated power conversion and management technologies. The development of smart grids, microgrids, and the integration of distributed energy resources rely heavily on power electronics, creating new market opportunities.

Europe Power Electronics Market Drivers:

The world, and Europe specifically, is transitioning towards greater reliance on electricity as a primary energy carrier. This underpins the power electronics market's growth.

The European Union's ambitious decarbonization goals, coupled with the global energy transition, necessitate a shift away from direct fossil fuel combustion towards using electricity as a versatile and cleaner energy carrier. Power electronics components, encompassing a wide array of devices and systems, form the technological backbone of this transition. Regulatory tailwind, including stringent emissions standards and ICE vehicle phase-outs, accelerates the adoption of electric vehicles (EVs) in Europe. EVs are no longer merely a compliance tool. Range, charging speed, and performance improvements attract a growing consumer base. Components like inverters, DC-DC converters, onboard chargers, and battery management systems are essential for EV operation. Similar electrification trends are occurring in buses, trucks, two-wheelers, and even emerging sectors like electric aviation, propelling demand for various power electronics. Advanced inverters, power converters, and energy management systems ensure reliable and efficient integration of this variable energy into the grid. Power electronics play a vital role in the evolution of smart grids, enabling two-way energy flows, flexibility, and stability as renewable energy penetration increases. A major segment of industrial power electronics focuses on variable frequency drives (VFDs) and advanced motor control systems. Industries are exploring replacing combustion-based heating processes with cleaner electric alternatives powered by smart power electronics for control and optimization.

While government support incentivizes EV adoption, they are becoming increasingly attractive to consumers due to range improvements and performance.

Improvements in battery technology, falling costs, and supportive policies drive a dramatic shift in both consumer perception and EV market viability. EVs now compete on performance, range, and desirability, leading to genuine consumer-driven growth in the sector. From passenger cars to expanding segments like electric buses, delivery trucks, and niche vehicles, electrification penetrates multiple transportation needs. As EVs proliferate, the need for home charging solutions, public charging networks, and fast DC charging stations along highways booms. All these rely on power electronics. Increased power demand from EVs requires a smarter grid, utilizing power electronics-based solutions to manage energy flows, integrate renewables, and ensure stability. The EV boom drives demand for semiconductors, capacitors, magnetic components, and the raw materials required to create them.

Europe Power Electronics Market Restraints and Challenges:

The cost of inverters, high-power converters, and other complex power electronics modules remains a consideration, particularly for price-sensitive applications.

While offering superior performance, devices based on silicon carbide (SiC), or gallium nitride (GaN) are currently more expensive than traditional silicon-based counterparts. The need to balance performance and cost can put pressure on margins, impacting technology adoption and innovation speed. Securing raw materials and component supplies at scale and consistent pricing impacts the final cost of power electronics solutions. Power electronics, particularly at the intersection of automotive, renewable energy, and grid-scale applications requires specific engineering skillsets. The rapid pace of innovation in this field demands an adaptable workforce and continuous upskilling to remain at the forefront. Power electronics may compete with other high-tech sectors to attract and retain the best engineers and researchers. Universities and technical training programs need to align their curricula with the rapidly evolving industry needs. While SiC and GaN hold promise, their widespread adoption depends on scaling up manufacturing capacity and solving cost hurdles. Integrating power electronics into increasingly complex systems (EV drive trains, smart grids) requires overcoming design complexity and ensuring robust performance. As power densities increase, effective cooling solutions become even more critical, necessitating R&D in sophisticated thermal management methods. The harsh operating environments in automotive or industrial applications demand power electronics components with extensive validation and long lifespans. Varied standards, particularly in EV charging infrastructure, can slow deployment and consumer adoption, hindering market growth. Changes in safety regulations, electromagnetic interference (EMI) standards, or efficiency requirements can necessitate redesign or delays in product rollouts.

Europe Power Electronics Market Opportunities:

Power electronics components made from materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) offer significant advantages over traditional silicon-based devices. WBG semiconductors boast higher switching frequencies, lower power losses, greater thermal resilience, and improved power density. European manufacturers and research institutions have the potential to become leaders in the design, production, and application of WBG devices. While semiconductor materials are crucial, how power electronics components are packaged strongly influences performance, reliability, and thermal management. European firms with expertise in packaging, materials science, and thermal design can partner with component makers to develop cutting-edge solutions. The shift to decentralized, renewable-heavy power grids requires intelligent power flow management and advanced power conversion technologies. European green energy initiatives create a favorable environment for companies specializing in grid-focused power electronics solutions. While the spotlight is on EVs, electrification is expanding to various mobility segments, opening new markets.

EUROPE POWER ELECTRONICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Device Type, Material type, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Infineon Technologies, STMicroelectronics, NXP Semiconductors, ABB, Schneider Electri, Vincotech, Danfoss, AkzoNobel |

Europe Power Electronics Market Segmentation:

Europe Power Electronics Market Segmentation: By Device Type -

- Discrete power semiconductors

- Power modules

- Power Integrated Circuits (ICs)

Discrete power semiconductors, such as individual diodes, transistors (MOSFETs, IGBTs, etc.), and thyristors, are essential parts. They are widely utilized in many different applications and provide flexibility in circuit design. Discrete components have a sizable market share, mostly because of their widespread usage in established, cost-sensitive applications. However, integration tendencies are undermining their hegemony. Power modules combine several power semiconductors into a single package, frequently with passive parts like capacitors and even gate drivers. As an alternative to creating circuits with only discrete parts, they enhance thermal performance, simplify design, and take up less board space. Power modules are becoming more and more popular in applications where dependability, efficiency, and power density are critical factors. Power Integrated Circuits (ICs) are specialty chips that combine driver circuitry, control, protection, and power switching features; they are frequently designed for particular uses. They provide small-sized power management solutions for LED lights, smart appliances, consumer electronics, and related industries. Power integrated circuits (ICs) are a rapidly increasing section of the market while making up a smaller fraction of all devices due to the growing requirement for sophisticated power control. Discrete power semiconductors have always had the most market share because of their vast use and reasonably developed technology. But their hegemony is slowly being questioned. Right now, the fastest-growing segment is power modules. Their usage is accelerating due to the need for compact, high-performing, and efficient power conversion solutions across several industries.

Europe Power Electronics Market Segmentation: By Material Type -

- Silicon

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- Insulated-Gate Bipolar Transistors (IGBTs)

Silicon has been the foundation of the semiconductor industry for decades, and it still holds a prominent position in the power electronics market. Silicon-based devices, such as MOSFETs, IGBTs, and power diodes, account for approximately 45% of the overall European power electronics market share. The silicon segment is characterized by its maturity, cost-effectiveness, and well-established manufacturing processes. However, as the demand for higher efficiency and performance increases, the industry is exploring alternative materials to overcome the limitations of silicon. Silicon Carbide (SiC) is a wide-bandgap semiconductor material that has gained significant traction in the power electronics market due to its superior properties, such as high breakdown voltage, high thermal conductivity, and low on-resistance. SiC-based devices, including SiC MOSFETs, SiC diodes, and SiC modules, contribute approximately 18% to the overall European power electronics market share. Gallium Nitride (GaN) is another wide-bandgap semiconductor material that has gained significant traction in the power electronics market. GaN-based devices, such as GaN transistors and GaN power integrated circuits (ICs), account for approximately 12% of the overall European power electronics market share. Insulated-Gate Bipolar Transistors (IGBTs) are a type of power semiconductor device widely used in various power electronics applications, such as motor drives, power inverters, and renewable energy systems. IGBTs based on silicon technology contribute approximately 10% to the overall European power electronics market share.

Europe Power Electronics Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Presently accounting for about 14% of the European power electronics market, the United Kingdom is a major player. The demand for innovative power electronics solutions has been fueled by the UK's strong position in the automotive, aerospace, and renewable energy sectors. With over 20% of the market, Germany holds a significant position in the European power electronics industry. Germany has a high demand for power electronics solutions in industries including industrial motors, renewable energy systems, and electric vehicles because it is a manufacturing powerhouse and a leader in the automotive and industrial sectors. About sixteen percent of the European power electronics market is accounted for by France. The nation's emphasis on aircraft, transportation, and renewable energy has increased demand for sophisticated power electronics solutions. About 12% of the power electronics market in Europe is held by Italy. The need for power electronics solutions is fueled by the Italian manufacturing industry, which includes the consumer electronics, automotive, and industrial machinery sectors. Among the leading companies in the Italian market are Finergy, Eltek, and STMicroelectronics. About 10% of the European power electronics market is accounted for by Spain. The need for power electronics solutions has been pushed by Spain's automotive, industrial, and renewable energy sectors. Among the leading companies in the Spanish market are Circutor, Gamesa, and Ingeteam. The remaining European countries, collectively referred to as the "Rest of Europe," account for approximately 28% of the overall power electronics market share. This segment includes countries such as the Netherlands, Belgium, Sweden, Switzerland, and Poland, among others. Each of these countries has its unique market dynamics, industrial strengths, and specific applications for power electronics solutions.

COVID-19 Impact Analysis on the Europe Power Electronics Market:

Lockdowns and social distancing measures disrupted manufacturing operations across Europe. Power electronics companies faced temporary closures or reduced capacity, impacting production volumes and delivery schedules. Globalized supply chains became vulnerable, with border restrictions and logistical hurdles hindering the smooth flow of raw materials and components. Shortages of essential materials like silicon and electronic parts caused delays and price fluctuations. The pandemic's economic fallout led to a decline in demand from certain sectors. Notably, the automotive industry, a major consumer of power electronics for vehicles, experienced significant production slowdowns, impacting power electronics demand in that segment. In the face of economic uncertainty, companies prioritized cost-effectiveness. This potentially increased demand for efficient power electronics solutions that could lower energy consumption and operational costs. Social distancing measures and labor shortages fueled a renewed push toward automation in various industries. This could have benefited power electronics companies catering to industrial automation systems and motor drives.

Latest Trends/ Developments:

Materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) fundamentally transform power electronics performance. Higher voltages, faster switching speeds, lower power losses, and improved thermal management compared to traditional silicon devices. Innovations in how power electronics devices are physically packaged, interconnected, and integrated are becoming a key differentiator. Combining multiple power devices, passive components, and even sensors within a single module for space savings, reliability, and simplified design. New materials and advanced cooling techniques address the increasing power density enabled by SiC and GaN devices, ensuring long-term performance. Specialized packaging designed to meet the stringent shock, vibration, and temperature demands of automotive and aerospace applications. The proliferation of electric vehicles (cars, buses, trucks, and even emerging sectors like electric boats) profoundly impacts power electronics. Emphasis on highly efficient traction inverters, compact onboard chargers, and robust power management systems for batteries and auxiliary systems. The need for a vast charging network, including both home and fast DC charging stations, drives demand across a range of power conversion components.

Key Players:

- Infineon Technologies

- STMicroelectronics

- NXP Semiconductors

- ABB

- Schneider Electric

- Vincotech

- Danfoss

- AkzoNobel

Chapter 1. Europe Power Electronics Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Power Electronics Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Power Electronics Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Power Electronics Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Power Electronics Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Power Electronics Market– By Device Type

6.1. Introduction/Key Findings

6.2. Discrete power semiconductors

6.3. Power modules

6.4. Power Integrated Circuits (ICs)

6.5. Y-O-Y Growth trend Analysis By Device Type

6.6. Absolute $ Opportunity Analysis By Device Type , 2024-2030

Chapter 7. Europe Power Electronics Market– By Material Type

7.1. Introduction/Key Findings

7.2 Silicon

7.3. Silicon Carbide (SiC)

7.4. Gallium Nitride (GaN)

7.5. Insulated-Gate Bipolar Transistors (IGBTs)

7.6. Y-O-Y Growth trend Analysis By Material Type

7.7. Absolute $ Opportunity Analysis By Material Type , 2024-2030

Chapter 8. Europe Power Electronics Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Material Type

8.1.3. By Device Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Power Electronics Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Infineon Technologies

9.2. STMicroelectronics

9.3. NXP Semiconductors

9.4. ABB

9.5. Schneider Electric

9.6. Vincotech

9.7. Danfoss

9.8. AkzoNobel

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

. Europe's aggressive climate goals and policies aimed at phasing out fossil fuels necessitate a transition to electricity as a primary energy carrier across sectors

Cost pressures from global players, particularly in the mature silicon-based device market, challenge European manufacturers on pricing and margins.

Infineon Technologies, STMicroelectronics, NXP Semiconductors, ABB

Schneider Electric, Vincotech, Danfoss, AkzoNobel.

Germany currently holds the largest market share, estimated at around 20%.

. Several nations in Eastern Europe, like Poland, Hungary, Romania, etc., are experiencing economic expansion. This generally translates to increasing disposable incomes and evolving consumption patterns.