Europe Potato Chips and Crisps Market Size (2024-2030)

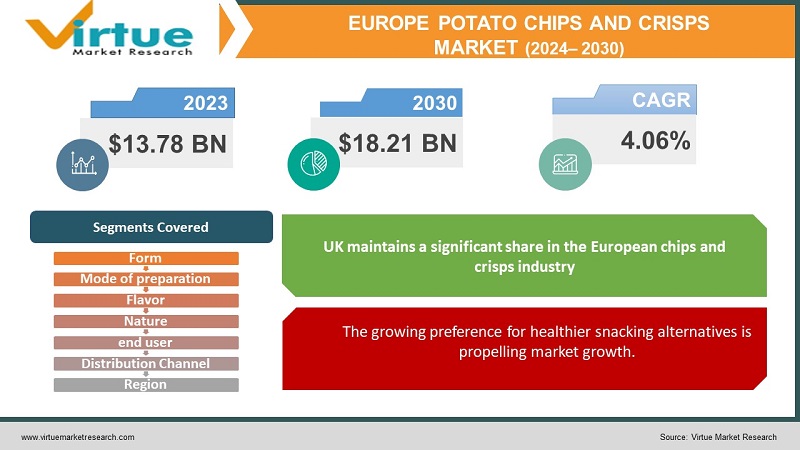

The Europe Potato Chips and Crisps Market was valued at USD 13.78 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD18.21 billion by 2030, growing at a CAGR of 4.06%.

Potato chips represent a highly convenient food choice for individuals navigating their busy schedules. They significantly reduce meal preparation time and can easily be enjoyed as a quick snack or incorporated into a meal. Consequently, the convenience offered by potato chips is a key factor propelling the market forward. With an increasing global focus on health, some manufacturers are now offering enhanced products that provide healthier alternatives to traditional potato chips. Typically, potato chips consist of very thin slices of potatoes that are fried until they achieve a hard, dry, and crisp texture, making them a popular cold snack. Additionally, the various nutritional benefits of potato chips, including their provision of essential vitamins and nutrients, are anticipated to further stimulate market growth.

Key Market Insights:

The growing demand for potato snacks is fueling the expansion of the European chips and crisps industry. A key factor behind this trend is that over 90% of the potatoes utilized for processing in Europe are cultivated in its northern regions, which serve as major hubs for potato processing, including the production of fries, chips, crisps, and various other potato products. Enhanced cross-border transportation among EU countries is a vital aspect of this primary potato-producing area, facilitating efficient supply to processing facilities.

Europe Potato Chips and Crisps Market Drivers:

The growing preference for healthier snacking alternatives is propelling market growth.

The European chips and crisps market has experienced a significant shift towards healthier eating options. As consumers increasingly prioritize wellness, there is a rising demand for snacks with improved nutritional profiles. In response, manufacturers are addressing these health-conscious preferences by introducing products that contain lower levels of fat, salt, and artificial ingredients. Innovative cooking methods such as baking and air-frying are gaining popularity as healthier alternatives to traditional fried snacks. Additionally, the use of natural ingredients and whole grains further enhances the health appeal of these products. Brands are also emphasizing nutritional information on packaging and transparent labeling to empower consumers to make informed, healthier choices. This trend towards healthier snacking is driving industry evolution, compelling producers to diversify and adapt their product offerings to meet the growing demand for satisfying and nutritious chip and crisp options.

Europe Potato Chips and Crisps Market Restraints and Challenges: The volatility of potato prices is hindering market growth.

Fluctuations in potato prices present a significant challenge to the profitability of potato chip and crisp manufacturers. When prices rise due to factors such as adverse weather conditions or disease outbreaks, it can negatively affect their financial performance. Given that potatoes represent a major portion of ingredient costs, fully absorbing these price increases may not be viable. Consequently, manufacturers face difficult choices. They might consider raising chip prices, which could alienate price-sensitive consumers, or they may opt to reduce portion sizes or use less favorable potato varieties, potentially compromising product quality and consumer satisfaction. Striking the right balance between maintaining profit margins and delivering an attractive product is essential for effectively managing these price fluctuations.

Europe Potato Chips and Crisps Market Opportunities:

The potato chip and crisp market presents numerous opportunities for innovative brands. The demand from health-conscious consumers is driving interest in baked alternatives, veggie chips made from ingredients like sweet potatoes or kale, and options featuring whole grains and reduced sodium. Furthermore, exploring ethnic flavors can create exciting new offerings, while addressing dietary restrictions such as gluten-free or vegan options can attract diverse customer segments.

Interactive packaging, including resealable options and built-in portion control, aligns well with the on-the-go lifestyle of many consumers. The growth of e-commerce facilitates direct-to-consumer sales and subscription boxes featuring unique flavor combinations, while strategic partnerships with delivery services can capitalize on the increasing demand for convenient snacking solutions.

EUROPE POTATO CHIPS AND CRISPS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

CAGR |

4.06% |

|

Segments Covered |

By Form , Distribution Channel,Mode of preparation , Flavor , nature, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of the Europe |

|

Key Companies Profiled |

PepsiCo, The Hershey Company, Calbee Inc., Utz Brands, Inc., Mondelez International and Lorenz Bahlsen Snack-World Group. |

Europe Potato Chips and Crisps Market Segmentation:

Europe Potato Chips and Crisps Market Segmentation By Form:

- Sliced

- Compound

The sliced segment has captured a significant market share and is expected to achieve the highest compound annual growth rate (CAGR) during the forecast period. These chips are typically sliced before being fried in oil within a controlled temperature environment provided by a furnace. The crispiness of the chips is influenced by factors such as the moisture content, the quality of the potatoes, and the temperature and duration of frying. Additionally, the presence of major players in the region offering a diverse range of sliced chips, along with ongoing innovations, is anticipated to drive market growth.

Europe Potato Chips and Crisps Market Segmentation By Mode of preparation:

- Fried

- Baked

- Dehydrated

The fried segment has secured a notable market share and is expected to achieve a higher compound annual growth rate (CAGR) during the forecast period. Fried chips are typically produced using potatoes as the primary raw material, which are sliced and then fried to create potato chips. This frying process is essential for the production of potato crisps. The potato pieces are deep-fried for a specified duration at a high temperature, often utilizing either corn oil, cottonseed oil, or a blend of vegetable oils. Additionally, the oil undergoes purification during frying to ensure its quality. Furthermore, recent acquisitions of key players in the market are likely to enhance overall growth.

Europe Potato Chips and Crisps Market Segmentation By Flavor:

- Classic salty

- Barbeque

- Cheese

- salt and pepper

- cheese and onion

- Jalapeno

- others

The classic salty segment has captured a significant market share and is projected to register a higher compound annual growth rate (CAGR) during the forecast period. The growing preference for traditional salty chip flavors among Europeans presents substantial opportunities for market expansion. For instance, according to MRFR analysis, despite the availability of numerous innovative chip flavors, consumers in the UK predominantly favor plain, ready-salted chips. A recent study indicates that ready-salted products constitute the most popular category in the country, accounting for 25% of both volume and expenditure sales. Crisps are recognized as the leading savory snack in Britain, with seven out of ten respondents admitting to their addictive quality and associating them with feelings of nostalgia. While consumers report purchasing more chocolate and fruit, chips rank third overall in snack preferences. In the crisp category, potatoes dominate, with 87% of consumers having consumed them in the past three months, followed by biscuit varieties at 49%.

Europe Potato Chips and Crisps Market Segmentation By Nature:

- Organic

- Conventional

The conventional segment has captured a notable market share and is expected to register the highest compound annual growth rate (CAGR) during the forecast period. Conventional chips and crisps are made from potatoes, vegetables, and other raw materials using traditional farming practices. They remain popular among younger consumers due to their wide availability and affordability. Unlike organic products, conventional farming methods are employed for the production of these snacks, as they tend to be more efficient and cost-effective. The lower price point of conventional chips and crisps enables manufacturers to sustain production levels. Additionally, the ease of access to conventional fries and crisps allows consumers to readily find and purchase these products in the market. To meet consumer demand, conventional chips and crisps can also be produced in large quantities.

Europe Potato Chips and Crisps Market Segmentation By end user:

- Residential

- Commercial

The residential segment has captured the largest market share and is projected to register a compound annual growth rate (CAGR) during the forecast period. Increasing government investment in the residential sector has prompted European chips and crisps manufacturers to develop a diverse array of products to meet consumer demands, which is anticipated to further enhance market growth. For example, in February 2022, all major political parties in England committed to increasing housing supply as outlined in their 2019 election manifestos.

Europe Potato Chips and Crisps Market Segmentation By Distribution Channel:

- Supermarkets & Hypermarkets

- Specialty stores

- Online

- Others

The supermarkets and hypermarkets segment has secured the largest market share and is expected to achieve the highest compound annual growth rate (CAGR) during the forecast period. Supermarkets typically feature large retail spaces where products are organized for consumer selection. Shoppers can easily fill their trolleys with desired items and pay at the checkout. The numerous advantages of supermarkets and hypermarkets—such as self-service operations, a wide variety of products, discounts on various items, and the freedom of choice for customers—are anticipated to drive market growth significantly.

Europe Potato Chips and Crisps Market Segmentation- by region

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

The UK maintains a significant share in the European chips and crisps industry, largely due to the presence of major players in the region. For instance, Intersnack, which was founded in Germany over 60 years ago, produced its first batch of potato chips and has since contributed to the market's growth.

Germany was initially a minor player in the chips market, offering only a few basic flavors. However, over the past two decades, the country has experienced a significant expansion in the potato chips sector, now featuring a diverse array of flavors. Lay's has even established a factory in Germany, and many crisps available in the UK are marketed under similar branding in Germany. Among the leading brands is Intersnack's Funny Frisch, which has gained popularity, particularly for its paprika flavor.

COVID-19 Pandemic: Impact Analysis

The impact of COVID-19 on the potato chip and crisp market can be described as a tale of two halves. Initially, lockdowns prompted panic buying, resulting in a surge in demand as consumers stocked up on convenient snacks. This shift benefited major manufacturers, leading to a temporary sales boom in 2020. However, supply chain disruptions caused by lockdowns and travel restrictions hindered production and distribution in certain areas. Additionally, the closure of restaurants and entertainment venues significantly reduced out-of-home consumption, a key sales channel.

As restrictions eased and consumers began to venture out, the market observed a shift toward healthier snacking options. This trend, along with a return to pre-pandemic routines, led to a moderation in at-home chip consumption. Overall, the long-term effects of COVID-19 on the market are still evolving. While the initial surge has diminished, steady growth is anticipated as the enduring appeal of this salty comfort food continues.

Latest Trends/ Developments:

In February 2023, Europe Snacks announced its acquisition of 100% of Burts Snacks, a UK-based producer known for hand-cooked chips. This acquisition, set to be finalized in March, marks Europe Snacks’ latest expansion into the UK market.

In May 2022, Walkers, the premium potato crisp brand in the United Kingdom, introduced a range of special flavors to celebrate the Queen's Jubilee. The new offerings included unique flavors such as spit-roast pork and apple sauce, as well as baked cheese and sweet honey.

Key Players:

These are top 10 players in the Europe Potato Chips and Crisps Market :-

- PepsiCo

- The Hershey Company

- Calbee Inc.

- Utz Brands, Inc.

- Mondelez International

- Lorenz Bahlsen Snack-World Group

- Intersnack Group GmbH & Co. KG

- Diamond Foods

- Synder's-Lance

- Kettle Foods

Chapter 1. Europe Potato Chips and Crisps Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Potato Chips and Crisps Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Potato Chips and Crisps Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Potato Chips and Crisps Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Potato Chips and Crisps Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Potato Chips and Crisps Market – By Form

6.1. Introduction/Key Findings

6.2. Sliced

6.3. Compound

6.4. Y-O-Y Growth trend Analysis By Form

6.5. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 7. Europe Potato Chips and Crisps Market – By Mode of preparation

7.1. Introduction/Key Findings

7.2 Fried

7.3. Baked

7.4. Dehydrated

7.5. Y-O-Y Growth trend Analysis By Mode of preparation

7.6. Absolute $ Opportunity Analysis By Mode of preparation , 2024-2030

Chapter 8. Europe Potato Chips and Crisps Market – By Flavor

8.1. Introduction/Key Findings

8.2 Classic salty

8.3. Barbeque

8.4. Cheese

8.5. salt and pepper

8.6. cheese and onion

8.7. Jalapeno

8.8. others

8.9. Y-O-Y Growth trend Analysis Flavor

8.10. Absolute $ Opportunity Analysis Flavor , 2024-2030

Chapter 9. Europe Potato Chips and Crisps Market – By Nature

9.1. Introduction/Key Findings

9.2 Organic

9.3. Conventional

9.4. Y-O-Y Growth trend Analysis Nature

9.5. Absolute $ Opportunity Analysis Nature , 2024-2030

Chapter 10. Europe Potato Chips and Crisps Market – By Distribution Channel

10.1. Introduction/Key Findings

10.2 Supermarkets & Hypermarkets

10.3. Specialty stores

10.4. Online

10.5. Others

10.6. Y-O-Y Growth trend Analysis Distribution Channel

10.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 11 . Europe Potato Chips and Crisps Market – By End-User

11 .1. Introduction/Key Findings

11 .2 Residential

11.3. Commercial

11.4. Y-O-Y Growth trend Analysis End-User

11.5. Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 12 . Europe Potato Chips and Crisps Market , By Geography – Market Size, Forecast, Trends & Insights

12 .1. Europe

12 .1.1. By Country

12 .1.1.1. U.K.

12 .1.1.2. Germany

12 .1.1.3. France

12 .1.1.4. Italy

12 .1.1.5. Spain

12 .1.1.6. Rest of Europe

12 .1.2. By Mode of preparation

12 .1.3. By Flavor

12 .1.4. By Form

12 .1.5. Nature

12 .1.6. Distribution Channel

12.1.7. End user

12.1.8 Countries & Segments - Market Attractiveness Analysis

Chapter 13. Europe Potato Chips and Crisps Market – Company Profiles – (Overview, Form Portfolio, Financials, Strategies & Developments)

13.1 The 13.2 . Hershey Company

13.3. Calbee Inc.

13.4. Utz Brands, Inc.

13.5. Mondelez International

13.6. Lorenz Bahlsen Snack-World Group

13.7. Intersnack Group GmbH & Co. KG

13.8. Diamond Foods

13.9. Synder's-Lance 13.10. Kettle Foods

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

A key factor behind this trend is that over 90% of the potatoes utilized for processing in Europe are cultivated in its northern regions, which serve as major hubs for potato processing, including the production of fries, chips, crisps, and various other potato products.

The top players operating in the Europe Potato Chips and Crisps Market are - PepsiCo, The Hershey Company, Calbee Inc., Utz Brands, Inc., Mondelez International and Lorenz Bahlsen Snack-World Group.

The impact of COVID-19 on the potato chip and crisp market can be described as a tale of two halves. Initially, lockdowns prompted panic buying, resulting in a surge in demand as consumers stocked up on convenient snacks

Exploring ethnic flavors can create exciting new offerings, while addressing dietary restrictions such as gluten-free or vegan options can attract diverse customer segments.

Germany is the fastest-growing region in the Europe Potato Chips and Crisps Market.