Europe Polyolefins Market Size (2024-2030)

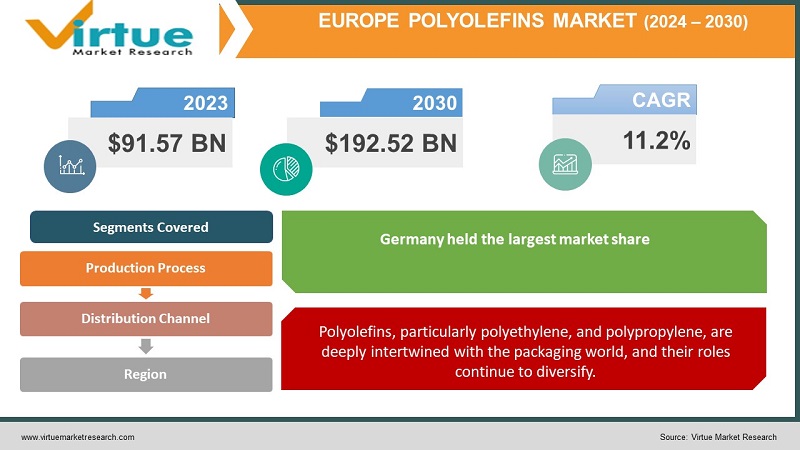

The Europe Polyolefins Market was valued at USD 91.57 Billion in 2023 and is projected to reach a market size of USD 192.52 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.2%.

Polyolefins constitute a broad family of versatile polymers derived from simple olefins (alkenes) like ethylene and propylene. It is Excellent for creating products with high strength-to-weight ratios. It is resistant to most solvents and acids, making them suitable for various applications. It can be easily molded into diverse shapes and readily formulated into end products. The largest demand for polyolefins stems from the vast European packaging sector. Flexible films, rigid containers, bottles – they're the backbone of modern packaging. Lightweight, strong polyolefin components (bumpers, interior parts) are crucial for reducing vehicle weight while increasing fuel efficiency. Polyolefins' durability and weather resistance make them ideal for pipes, roofing membranes, cable insulation, and various building materials. Polyolefins' biocompatibility and versatility make them indispensable in medical devices, packaging for pharmaceuticals, and other healthcare products. While posing environmental challenges, a growing focus on circular economy models and advancements in recycling technologies are shaping the market's evolution.

Key Market Insights:

The packaging industry is the single largest end-user of polyolefins in Europe. The demand for flexible and sustainable packaging solutions that protect and extend product shelf life is a strong market driver. The use of polyolefins in pipes, cable insulation, flooring, and roofing materials is a significant market segment. Increasing infrastructure development and a focus on durable, lightweight materials bode well for this sector. The drive for lighter-weight, fuel-efficient vehicles makes polyolefins attractive for car parts manufacturing, especially polypropylene. The electric vehicle (EV) shift could further open new applications for these plastics. Polyolefins, especially polypropylene, find use in medical devices, syringes, and packaging due to their biocompatibility, ease of sterilization, and chemical resistance. Europe's strong healthcare sector supports this market segment. Improvements in recycling technology and infrastructure are needed to reduce the plastic waste generated from polyolefin-heavy packaging. Initiatives involving recycled content, design for recyclability, and finding value in polyolefin waste offer the potential for a more sustainable future. Changing lifestyles with an emphasis on convenience and online shopping fuel demand for flexible, lightweight, and often single-use polyolefin-based packaging, putting pressure on the sustainability aspect. Advances in polyolefin properties like enhanced strength-to-weight ratio, barrier properties (for food preservation), and processability are crucial for expanding market share.

Europe Polyolefins Market Drivers:

Polyolefins, particularly polyethylene, and polypropylene, are deeply intertwined with the packaging world, and their roles continue to diversify.

The demand for flexible, lightweight packaging options for food, beverages, and consumer goods continues to be a primary driver of the polyolefins market. Advancements in film technology allow thinner, stronger polyolefin films, reducing material use while maintaining performance. Polyolefins extend shelf-life, reducing food wastage, a major focus for retailers and consumers alike. The online retail explosion requires a massive amount of protective packaging (bubble wraps, air pillows, film), where polyolefins' versatility and cost-effectiveness shine. Developments in mono-material (all-polyethylene) packaging structures or those designed for easy sorting and recycling gain traction. The incorporation of post-consumer recycled (PCR) polyolefins into packaging helps build a circular economy, with growing consumer and regulatory demand. Partially bio-based polyolefins, while still nascent, could reduce traditional plastic packaging's environmental footprint.

From essential infrastructure to modern homes, the construction sector is a consistent consumer of polyolefins, particularly polypropylene and HDPE, offering long-term market growth.

Polyolefin pipes, valued for their durability, corrosion resistance, and ease of installation, are a major growth area. Applications range from indoor plumbing to large-scale water and sewage transport. Polyolefins find use in insulation for buildings and electrical wiring. Their lightweight nature and thermal properties contribute to energy efficiency. Polyolefin fabrics stabilize soil and control erosion in road-building and landscaping projects. Durable polyolefin-based membranes protect roofs and extend their lifespan. Polyolefin-backed carpets and floor coverings provide wear resistance and ease of maintenance. Off-site manufacturing of building components, where polyolefins could be used for lightweight structures, potentially opening new markets. Polyolefin's lightweight and strong properties can contribute to building designs that use materials efficiently. Advances in polyolefin recyclability could make them even more attractive to a construction industry focused on reducing its environmental footprint. Flexible packaging for processed food often requires transportation, thus linking it indirectly to the construction industry building warehouses, and infrastructure. A healthy economy with investment in construction directly benefits the polyolefins market. The demand for sustainable materials and construction methods might influence the specific types of polyolefins used within the sector.

Europe Polyolefins Market Restraints and Challenges:

While polyolefins possess many desirable properties, their environmental impact remains a key concern and a potential restraint on market growth.

The sheer volume of plastic waste generated, especially from single-use polyolefin-based packaging, pollutes landscapes and oceans. European consumers and policymakers are increasingly aware of this issue. Plastics, including polyolefins, often carry a negative stigma associated with pollution and environmental harm, regardless of recyclability. The EU is implementing stricter regulations on single-use plastics, waste reduction, and recycled content mandates. This could force costly changes in packaging design and supply chains. Environmentally conscious consumers are turning towards products with 'lower plastic' footprints or reusable packaging, putting pressure on brands to rethink polyolefin reliance. Claims about the recyclability or sustainability of polyolefins need robust evidence, as consumers grow skeptical of vague environmental promises. Global crude oil and natural gas prices significantly impact the cost of feedstocks (ethylene and propylene) for polyolefin production. Geopolitical events or supply shocks directly influence manufacturers' margins. Higher raw material costs get passed down the supply chain, contributing to inflation in prices for finished goods that use polyolefins, hurting consumer demand. The long-term trajectory of fossil fuel prices and efforts towards energy transition raises questions about raw material cost stability for polyolefin production in the future.

Europe Polyolefins Market Opportunities:

Currently, complex multi-material packaging structures are difficult to recycle. Redesigning packaging using predominantly (or solely) polyolefins simplifies the recycling process significantly. The current market for recycled polyolefins is limited. Incentives, investments, and technological advancements supporting the use of recycled polyolefins in packaging and other applications are crucial. Even with recyclable packaging, efficient systems for collecting and sorting polyolefin waste are essential. Technology like digital watermarking can improve sorting accuracy for recycling streams. Overcoming the negative consumer perception of plastic packaging is vital. Transparent communication about efforts in polyolefin sustainability and positive examples of recycled plastic use are key. Harmonized regulations on design for recyclability and recycled content mandates across Europe would create a level playing field and drive innovation. Lighter, stronger, and easily molded polyolefins can replace denser materials in cars. Developments in polyolefin composites could open up even more applications beyond the existing significant uses. Lighter, stronger, and easily molded polyolefins can replace denser materials in cars. Developments in polyolefin composites could open up even more applications beyond the existing significant uses. While still nascent, developing polyolefin materials specifically optimized for the growing 3D printing market offers possibilities for customized or complex shaped parts across industries. Success here relies on close collaboration between polyolefin producers, researchers, and end-users in specialized industries to develop tailor-made polymers.

EUROPE POLYOLEFINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.2% |

|

Segments Covered |

By Production process, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Germany, UK, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

LyondellBasell, SABIC, Borealis, ExxonMobil, INEOS, Total Energies, Repsol |

Europe Polyolefins Market Segmentation:

Europe Polyolefins Market Segmentation: By Production Process -

- Slurry Polymerization

- Gas-Phase Polymerization

- Solution Polymerization

Slurry Polymerization: The most widespread process, involves polymerization in a liquid slurry medium using catalysts. This process is adaptable and cost-effective, making it suitable for a wide range of polyolefin grades. (Estimated Market Share: 45-55%). Gas-Phase Polymerization: In this process, polymerization occurs in a gaseous reactor. It's known for its energy efficiency and ability to produce consistent quality polymers. It has gained significant traction in recent years. (Estimated Market Share: 30-40%). Solution Polymerization: Polyolefins are dissolved in a solvent during polymerization. This process excels at creating polyolefins with specialized properties, like enhanced clarity or specific molecular weight distribution. (Estimated Market Share: 10-20%). Slurry polymerization remains the dominant process in Europe. Suitable for producing a broad spectrum of polyethylene and polypropylene grades catering to a wide range of applications. Existing slurry plants can be modified to accommodate new catalyst systems and product variations with relative ease.

Europe Polyolefins Market Segmentation: By Distribution Channel -

- Direct Sales

- Distributors and Traders

- Online Marketplaces

Direct Sales: Major end-users, especially those in the packaging, construction, and automotive industries, are frequently the direct targets of large polyolefins producers. Stable partnerships and volume sales are provided by this. Market share is estimated at 35–45%. Distributors and Traders: This market segment is essential to the polyolefins industry. Distributors have several benefits. carrying a range of polyolefin grades from different manufacturers. serving companies who don't need the full truckloads that direct sales usually require. Frequently offer value-added guidance and assistance on the choice or application of polyolefins. (An estimated 40–50% of the market). Internet marketplaces: a route that is expanding, especially for smaller volume transactions, recycled grades, and specialized polyolefins. Benefits include making smaller buyers and sellers connected, no matter where they are, and making it easier for purchasers to compare prices. Online resources provide a simple and rapid procurement procedure. (5–12% is the estimated market share). In the European polyolefins market, wholesalers and traders have historically held the biggest total market share. They ensure that polyolefin products have a wide market penetration by serving a wide range of industries and businesses of various sizes. Within the supply chain, their solid ties to end users and producers of polyolefins are valuable. For smaller and medium-sized businesses, distributors' technical assistance and knowledge are frequently essential. In the European polyolefins market, online marketplaces are probably the distribution channel that is expanding the fastest. Online business-to-business (B2B) platforms are becoming more and more popular due to their ease of use and increased accessibility for purchasers.

Europe Polyolefins Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

UK: While a significant market, it may not be the absolute largest within Europe, particularly in recent years due to a greater focus on sustainability, which can push focus towards alternatives in certain applications. (Estimated Market Share: 15-20%). Germany: Likely a dominant player in the European polyolefins landscape due to a large manufacturing base, a strong automotive industry, and a focus on high-quality products. (Estimated Market Share: 20-25%). France: A significant consumer of polyolefins, particularly considering its robust packaging and consumer goods industries. (Estimated Market Share: 12-18%). Italy: Well-developed packaging and construction sectors support polyolefin demand. (Estimated Market Share: 10-15%). Spain: A growing market with increasing applications in agriculture and packaging as the economy develops further. (Estimated Market Share: 5-8%). Rest of Europe: This includes a diverse mix of countries like the Netherlands, Poland, Scandinavian nations, and Eastern Europe. Some nations in this category are exhibiting strong growth potential. (Estimated Market Share: 20-25%). Germany likely holds a strong position as the largest market for polyolefins in Europe. Large manufacturing base across multiple sectors that utilize polyolefins in significant quantities. Several nations within this region are experiencing economic expansion, driving investment in infrastructure (boosting demand for polyolefins in construction) and an increase in consumer spending (packaging sector). Specific countries within Scandinavia and the Benelux region (Belgium, Netherlands) with an emphasis on sustainability and innovation could drive growth through the adoption of recycled content polyolefins and new 'greener' applications.

COVID-19 Impact Analysis on the Europe Polyolefins Market:

Lockdowns and economic slowdown led to a sharp decline in demand across sectors that heavily rely on polyolefins. Construction projects stalled, automotive production halted, and consumer spending on non-essential goods (often packaged in polyolefins) dipped significantly. Border restrictions, lockdowns, and social distancing measures disrupted global supply chains for polyolefins and their raw materials. Transportation delays and limited production capacity created uncertainties and shortages in certain regions. The overall decrease in demand, coupled with volatile oil prices, caused fluctuations in the cost of raw materials like naphtha, impacting polyolefin production costs. A surge in online shopping initially boosted demand for flexible polyolefin packaging for e-commerce deliveries. However, concerns about hygiene and potential virus transmission on packaging materials led some consumers to favor alternative materials. Polyolefin producers across Europe were forced to adjust production volumes to align with the reduced demand. Some plants temporarily shut down, and others operated at reduced capacity. The sudden shift in demand patterns created challenges in managing inventory levels for both polyolefin producers and converters (companies that transform polyolefins into usable products). With fluctuating demand and feedstock costs, polyolefin prices experienced periods of instability, making it difficult for businesses to plan and budget effectively. The pandemic heightened awareness of hygiene, leading to a potential rise in demand for polyolefins used in medical applications like syringes and sterilization packaging for medical equipment.

Latest Trends/ Developments:

Shifting to packaging structures, often mono-material (PE or PP), that are readily recyclable within existing systems. Brands and regulators increasing demand for polyolefins incorporating post-consumer recycled content. Gaining traction as a complementary method to handle mixed plastic waste and produce feedstocks for new polyolefin production. Companies seeking to lower their carbon footprint look to bio-based polyolefins, particularly in consumer-facing packaging. Improvements in feedstock production and polymerization processes are gradually improving the feasibility and cost-competitiveness of bio-based polyolefins. Greenwashing is a concern. Companies are expected to provide clear data and transparently communicate the sustainability improvements offered by their polyolefin-based products. Ultra-pure polyolefins tailored for medical device applications, drug delivery systems, and pharmaceutical packaging are a growth area driven by an aging population and medical advancements. Data analytics and AI tools are used to optimize production processes in real time, minimizing waste, saving energy, and increasing output from existing plants.

Key Players:

- LyondellBasell

- SABIC

- Borealis

- ExxonMobil

- INEOS

- Total Energies

- Repsol

Chapter 1. Europe Polyolefins Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Polyolefins Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Polyolefins Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Polyolefins Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Polyolefins Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Polyolefins Market– By Production Process

6.1. Introduction/Key Findings

6.2. Slurry Polymerization

6.3. Gas-Phase Polymerization

6.4. Solution Polymerization

6.5. Y-O-Y Growth trend Analysis By Production Process

6.6. Absolute $ Opportunity Analysis By Production Process , 2024-2030

Chapter 7. Europe Polyolefins Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Direct Sales

7.3. Distributors and Traders

7.4. Online Marketplaces

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Europe Polyolefins Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Production Process

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Polyolefins Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. LyondellBasell

9.2. SABIC

9.3. Borealis

9.4. ExxonMobil

9.5. INEOS

9.6. Total Energies

9.7. Repsol

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Polyolefins Market was valued at USD 91.57 Billion in 2023 and is projected to reach a market size of USD 192.52 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.2%.

Building vertical farms requires substantial upfront investments in infrastructure (lighting systems, climate control, growing structures) and technology (automation, sensors).

LyondellBasell, SABIC, Borealis, ExxonMobil, INEOS, Total Energies

Repsol.

Germany currently holds the largest market share, estimated at around 25%.

The Benelux region has significant room for growth in specific segments.