Europe Palm Oil Market Size (2024-2030)

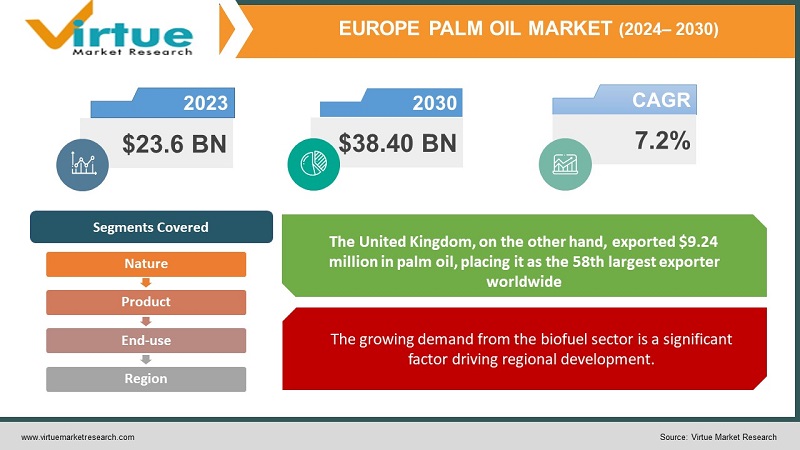

The Europe Palm Oil Market was valued at USD 23.6 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 38.40 billion by 2030, growing at a CAGR of 7.2%.

Palm oil, a type of edible vegetable oil, is derived from the mesocarp of oil palm fruit. It represents the most productive vegetable oil crop globally, yielding 5 to 10 times more per hectare than other major vegetable oil crops. This oil is low in fat, easily digestible, and rich in carotenoids and vitamin A, which offer numerous nutritional advantages.

Palm oil is primarily utilized in food production, including cooking and frying oils, shortenings, margarine, and confectionery fats. The high consumer demand for these products contributes to the robust growth of the palm oil market.

In addition to the oil itself, by-products such as palm shells, mesocarp fibers, empty fruit bunches, oil palm fronds, and trunks are being repurposed in the production of medium-density fiberboard, particleboard, pulp and paper, plastic composites, and bioenergy. Oil palm biomass serves as an excellent alternative to wood in a variety of applications.

Key Market Insights:

- The rising consumer awareness regarding environmental and social concerns associated with palm oil has led to increased demands for sustainably and responsibly sourced palm oil.

- Numerous palm oil companies have committed to sourcing certified sustainable palm oil or have started utilizing alternative ingredients to align with consumer preferences. This trend is anticipated to enhance the growth of the palm oil market.

Europe Palm Oil Market Drivers:

The growing demand from the biofuel sector is a significant factor driving regional development.

Palm oil is distributed through exports from various countries. Farmers cultivating palm oil receive support from the government, contributing significantly to the revenue of many small- and medium-sized enterprises in the region. The industry's contributions have played a crucial role in the growth and development of local cultivators.

Similarly, there has been an increasing demand for products from the biofuel sector. Palm oil is utilized in biofuel production, serving as an eco-friendly alternative to crude oil in various applications, including motor oil. Although the biofuel industry is still emerging, its current applications remain somewhat restricted.

Europe Palm Oil Market Restraints and Challenges:

An insufficient workforce poses a challenge to market growth.

The pandemic has resulted in labor shortages affecting palm oil production. With fewer workers available, production efficiency declined, leading to increased production costs and tighter profit margins.

Simultaneously, a surge in demand, driven by government policies promoting the blending of palm oil into diesel, has exacerbated supply chain issues. Consequently, the industry is facing constraints that hinder the anticipated rapid growth.

Europe Palm Oil Market Opportunities:

A highly competitive market, coupled with the presence of numerous players, creates significant opportunities for growth and innovation.

The market is characterized by intense competition and a diverse array of players, ranging from small to large-scale enterprises. These participants are continually seeking to gain a competitive advantage by enhancing production capabilities, refining distribution networks, improving product quality, and implementing various competitive strategies.

The involvement of numerous stakeholders in research and development activities is expected to drive industry advancement. As the demand for palm oil continues to rise, the market is anticipated to experience increased growth potential, further strengthening its position in the sector.

The adoption of new technologies and increased awareness present significant opportunities for growth.

Market participants are poised to benefit from lucrative opportunities arising from the adoption of advanced technologies, such as satellite-based systems that facilitate deforestation monitoring. Additionally, significant initiatives from governments in countries like Denmark and other Western European nations will play a crucial role. Growing consumer awareness of the health benefits associated with palm oil is also expected to drive future market expansion.

Europe Palm Oil Market Segmentation:

Europe Palm Oil Market Segmentation By Nature:

- Organic

- Conventional

Conventional oil palm farms serve as a vital source of income for small and medium-sized producers, as synthetic chemicals can enhance productivity. This conventional sector is particularly prevalent in countries with low per capita incomes and large populations.

In contrast, the organic segment, which is contemporary to conventional farming, holds a relatively small market share due to production challenges that limit product availability. Stringent regulations and high costs associated with inputs, such as specialized soil maintenance products, make large-scale production financially unfeasible and difficult for manufacturers. While awareness of the benefits of organic products is expected to grow rapidly, this increase is not anticipated to be as significant as that of the conventional sector.

Europe Palm Oil Market Segmentation By Product:

- CPO

- RBD Palm Oil

- Palm Kernel Oil

- Fractionated Palm Oil

The fractionated palm oil category has emerged as the market leader, primarily due to its availability and cost-effectiveness. Its abundant supply and affordability make it particularly favored in low-income countries, where it can be produced in large quantities with ease.

The Crude Palm Oil (CPO) segment has also made a significant contribution to revenue, largely due to its essential role in the food and beverage industry. The inclusion of vitamin A in this product enhances its appeal, making it a preferred choice for edible applications.

The widespread use of CPO in the food sector is expected to drive market demand further. Additionally, there is notable demand for CPO from the cosmetics and pharmaceutical industries, where it serves as a key ingredient in the formulation of various products.

Europe Palm Oil Market Segmentation By End-use:

-

Food Industry

- Personal Care

- Biofuel Industry

- Pharmaceutical Industry

- Cosmetics Industry

- Animal Feed Industry

- Other End-Uses

The food and beverage sector holds a significant share of the market, driven by the increasing demand for palm oil as a raw material and the expanding range of palm oil-containing products. The growth of the population has further influenced this trend, boosting product demand on an international scale.

Following the food and beverage segment, the personal care and cosmetics, as well as biofuel and energy sectors, exhibit only slight variations in revenue share. These markets are expected to experience rapid growth in the coming years, fueled by technological advancements.

Despite a slower growth rate, the personal care and cosmetics segment is projected to make a notable contribution to revenue by the end of the forecast period. The diversification of product portfolios and the rising demand for organic and sustainable plant-based products are anticipated to drive this market segment's growth.

The demand for palm oil in biofuels is increasing as many countries shift towards sustainable alternatives to reduce carbon footprints. The adoption of biodiesel in various regions is significantly raising palm oil demand. Additionally, palm oil is utilized in fertilizers across multiple applications, highlighting the versatility of palm trees.

Sustainable farming practices are being established to combat deforestation and mitigate the industry's adverse impacts, providing a more viable pathway for the growth of the palm oil sector. In contrast to the established personal care and cosmetics industry, the biofuel sector is still emerging but is projected to reach its full potential as technology evolves. As non-renewable resource reserves deplete, biofuel—an environmentally friendly alternative to traditional fuels—could become a vital solution for the energy sector.

Europe Palm Oil Market Segmentation- by region

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

France exported $10.5 million worth of palm oil, ranking it as the 56th largest palm oil exporter globally. During the same year, palm oil was the 982nd most exported product from France.

The United Kingdom, on the other hand, exported $9.24 million in palm oil, placing it as the 58th largest exporter worldwide. Palm oil was the 862nd most exported product in the UK that year. The primary destinations for palm oil exports from the UK included Ireland ($4.8 million), the Netherlands ($1.07 million), France ($653,000), Spain ($496,000), and South Korea ($388,000). As of June 2024, the UK’s palm oil exports totaled £3.33 million, while imports reached £34.5 million, resulting in a negative trade balance of £31.1 million.

COVID-19 Pandemic: Impact Analysis

Europe encounters distinct challenges related to specific oil palm products and their supply chains, impacting sectors beyond food, including oleochemicals and animal feed. Economic and industrial activities faced temporary disruptions, with nearly every manufacturing unit utilizing advanced ceramics—such as those in the electrical, electronics, transportation, industrial, and chemical sectors (excluding medical)—reducing their production capacities due to labor shortages. The lockdown measures imposed further interrupted supply chains, leading to significant repercussions for both the production and demand for advanced ceramics.

Latest Trends/ Developments:

In November 2022, ADM announced the establishment of a new microbiology laboratory in North America to enhance its research and quality capabilities.

In December 2022, Sime Darby Plantation outlined a comprehensive roadmap aimed at achieving net-zero status by 2050.

Additionally, in November 2022, Sime Darby Plantation, along with Intan Hebat Baru and Wild Asia, initiated efforts to elevate standards for small palm oil producers.

Key Players:

These are top 10 players in the Europe Palm Oil Market :-

- Sime Darby Plantation Berhad

- Golden Agri-Resources Ltd

- Musim Mas Group

- Archer Daniels Midland (ADM)

- United Plantations Berhad

- Bunge Loders Croklaan

- Kuala Lumpur Kepong Berhad

- Astra Agro Lestari

- Genting Plantations Berhad

- Hap Seng Plantations Holdings

Chapter 1. Europe Palm Oil Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Palm Oil Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Palm Oil Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Palm Oil Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Palm Oil Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Palm Oil Market– By Nature

6.1. Introduction/Key Findings

6.2 Organic

6.3. Conventional

6.4. Y-O-Y Growth trend Analysis By Nature

6.5. Absolute $ Opportunity Analysis By Nature , 2024-2030

Chapter 7. Europe Palm Oil Market– By Product

7.1. Introduction/Key Findings

7.2 CPO

7.3. RBD Palm Oil

7.4. Palm Kernel Oil

7.5. Fractionated Palm Oil

7.6. Y-O-Y Growth trend Analysis By Product

7.7. Absolute $ Opportunity Analysis By Product , 2024-2030

Chapter 8. Europe Palm Oil Market– By End-use

8.1. Introduction/Key Findings

8.2. Food Industry

8.3. Personal Care

8.4. Biofuel Industry

8.5. Pharmaceutical Industry

8.6. Cosmetics Industry

8.7. Animal Feed Industry

8.8. Other End-Uses

8.9. Y-O-Y Growth trend Analysis End-use

8.10. Absolute $ Opportunity Analysis End-use , 2024-2030

Chapter 9. Europe Palm Oil Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By End-use

9.1.3. By Product

9.1.4. By Nature

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Palm Oil Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Sime Darby Plantation Berhad

10.2. Golden Agri-Resources Ltd

10.3. Musim Mas Group

10.4. Archer Daniels Midland (ADM)

10.5. United Plantations Berhad

10.6. Bunge Loders Croklaan

10.7. Kuala Lumpur Kepong Berhad

10.8. Astra Agro Lestari

10.9. Genting Plantations Berhad

10.10. Hap Seng Plantations Holdings

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The rising consumer awareness regarding environmental and social concerns associated with palm oil has led to increased demands for sustainably and responsibly sourced palm oil.

The top players operating in the Europe Palm Oil Market are - Sime Darby Plantation Berhad, Golden Agri-Resources Ltd, Musim Mas Group, Archer Daniels Midland (ADM), United Plantations Berhad, Bunge Loders Croklaan, Kuala Lumpur Kepong Berhad, Astra Agro Lestari, Genting Plantations Berhad and Hap Seng Plantations Holdings.

Europe encounters distinct challenges related to specific oil palm products and their supply chains, impacting sectors beyond food, including oleochemicals and animal feed.

. In November 2022, ADM announced the establishment of a new microbiology laboratory in North America to enhance its research and quality capabilities.

The United Kingdom, on the other hand, exported $9.24 million in palm oil, placing it as the 58th largest exporter worldwide.