Europe Organic Soy Protein Market Size (2024-2030)

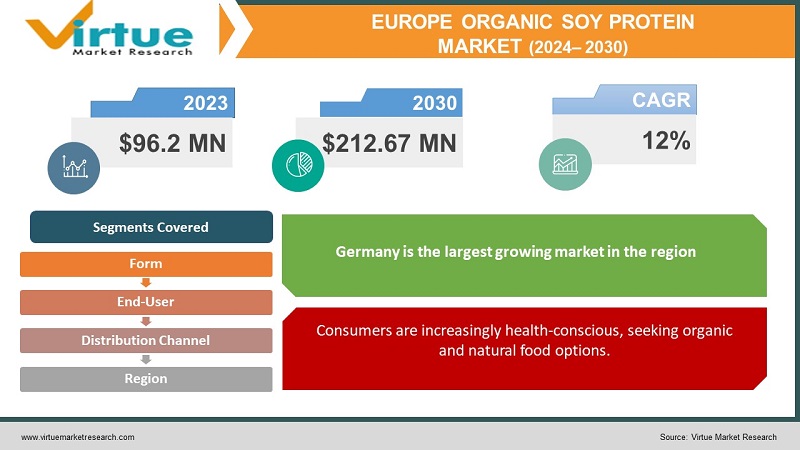

The European organic soy protein market was valued at USD 96.2 million in 2023 and is projected to reach a market size of USD 212.67 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 12%.

The European organic soy protein market is experiencing steady growth, fueled by a rising interest in health and sustainability. Consumers are increasingly aware of the benefits of organic food and the advantages of plant-based proteins like soy, which offers complete protein, essential amino acids, and fiber. This aligns with the growing popularity of vegan, vegetarian, and flexitarian diets, placing soy protein in high demand. Additionally, the use of soy protein in functional foods like protein bars and fortified dairy alternatives further expands its market reach.

Key Market Insights:

The European organic soy protein market is fueled by a growing interest in health and sustainability. Consumers are increasingly health-conscious and prioritize organic food choices. Soy protein, with its complete protein profile and essential nutrients, aligns perfectly with this trend. Its popularity further soars due to the rise of vegan, vegetarian, and flexitarian diets. Additionally, soy protein finds diverse applications in functional foods like protein bars and fortified dairy alternatives, expanding its market reach. However, the market faces some challenges. Organic soybeans are more expensive than their conventional counterparts, which can limit their accessibility. Additionally, the availability of organic soy protein ingredients can be limited, posing a hurdle for manufacturers. Despite these challenges, the future of the European organic soy protein market appears promising. The growing demand for plant-based protein and the expanding functional food sector suggest continued growth in the coming years. This trend is expected to further drive innovation and overcome existing limitations, leading to a thriving market for organic soy protein in Europe.

European Organic Soy Protein Market Drivers:

Consumers are increasingly health-conscious, seeking organic and natural food options.

Consumers in Europe are increasingly prioritizing their health and well-being, leading to a heightened awareness of the benefits associated with organic food. It's a wonderful choice for people who are aiming to maintain a healthy weight because it's low in fat and carbs. This shift in consumer behavior translates into a growing demand for organic soy protein, which is perceived as a healthy and natural source of complete protein, essential amino acids, and fiber.

The popularity of plant-based diets is surging, making soy protein a valuable source of protein for vegetarians, vegans, and flexitarians.

Concerns regarding animal welfare, environmental sustainability, and personal health are driving the popularity of plant-based diets across Europe. Soy protein emerges as a popular choice for vegetarians, vegans, and flexitarians due to its excellent nutritional profile and versatility.

Soy protein's functionality and versatility allow its use in various food applications beyond traditional protein supplements.

Soy protein's unique properties, like good solubility and functionality, make it a valuable ingredient in the food industry. Emulsification and texturizing are done by employing soy proteins, such as adhesives, asphalts, resins, cleaning supplies, cosmetics, and inks. It finds applications in various food products beyond traditional protein supplements.

A growing focus on sustainable food choices positions organic soy protein favorably compared to conventional protein sources.

Consumers are becoming increasingly conscious of the environmental impact of their food choices. Organic soy protein production is perceived as more sustainable compared to conventional protein sources like meat, further fueling its popularity in Europe.

Continuous innovation in the market, with new product development and improved formulations, caters to evolving consumer preferences.

The European market witnesses continuous innovation in the organic soy protein sector, with manufacturers developing new and improved products to cater to evolving consumer preferences. This includes exploring different forms of soy protein (isolates, concentrates), flavors, and functionalities, expanding its appeal to a wider audience.

European Organic Soy Protein Market Restraints and Challenges:

The European organic soy protein market, despite its positive trajectory, faces certain limitations and challenges. One primary concern is the higher cost of organic soybeans compared to their conventional counterparts. This price difference can hinder the affordability and accessibility of organic soy protein products for consumers, potentially limiting market growth. Additionally, the availability of organic soy protein ingredients can be limited, particularly for smaller manufacturers. This scarcity can pose challenges for production consistency and expansion plans. Furthermore, negative perceptions surrounding soy protein, such as concerns about potential hormonal effects or allergenicity, can deter some consumers from choosing this option. Addressing these concerns through proper education and transparent labeling is crucial. Finally, the market faces competition from established players in the conventional protein market, as well as from other emerging plant-based protein sources like pea protein and hemp protein. This competitive landscape necessitates continuous innovation and product differentiation to maintain market share and attract consumers. Despite these challenges, the European organic soy protein market remains promising due to the strong underlying drivers, such as the growing demand for plant-based protein and the increasing focus on health and sustainability. By addressing these limitations through cost-reduction strategies, improved supply chain management, addressing consumer concerns, and fostering innovation, the European organic soy protein market can continue to thrive in the years to come.

European Organic Soy Protein Market Opportunities:

Beyond its current applications, the European organic soy protein market holds promising growth opportunities. Firstly, its versatility allows for the exploration of various food products beyond traditional uses, such as bakery goods, confectionery, and even plant-based seafood alternatives, catering to diverse consumer preferences. Secondly, manufacturers can target specific consumer segments, like athletes and individuals with dietary restrictions, by developing specialized products that cater to their unique needs. Additionally, emphasizing the environmental sustainability of organic soy protein production compared to conventional options can resonate with environmentally conscious consumers, further driving market growth. Furthermore, exploring new delivery formats like convenient protein beverages and snacks or incorporating soy protein into existing snack mixes can attract new and different consumer segments. Finally, leveraging the rise of online grocery shopping by establishing a strong e-commerce presence can expand reach and facilitate access to organic soy protein products for consumers across various regions. By capitalizing on these opportunities and addressing existing limitations, the European organic soy protein market can solidify its position within the evolving food landscape and unlock its full growth potential.

EUROPE ORGANIC SOY PROTEIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By Form , End user, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Archer Daniels Midland Company, DuPont, Sojaprotein GmbH, Ingredion Incorporated, Cargill, Incorporated, ADM Protexin, SunOpta Inc., Wilmar International Limited |

Europe Organic Soy Protein Market Segmentation:

Europe Organic Soy Protein Market Segmentation: By Form:

- Concentrates

- Isolates

- Textured/Hydrolysed

In the European organic soy protein market, concentrates are the most dominant segment by form, accounting for the largest market share due to their lower cost. Soy protein concentrates have a weight percentage of 70–80% protein, making them high in protein. They are, therefore, an excellent source of plant-based protein for a range of uses. However, the isolates segment is experiencing the most rapid growth, driven by the increasing popularity of plant-based diets and functional foods. This segment is further divided into applications like protein supplements, fortified dairy alternatives, and meat alternatives, catering to diverse consumer needs.

Europe Organic Soy Protein Market Segmentation: By End-User:

- Animal Feed

- Human Consumption

The European organic soy protein market is segmented by end-use, with animal feed being the dominant segment due to its established presence in the region's agricultural sector. However, human consumption is the fastest-growing segment, fuelled by the rising popularity of plant-based diets, functional foods, and diverse applications like protein supplements, meat alternatives, and fortified dairy products. This segment caters to a growing, health-conscious population seeking sustainable and ethical protein sources.

Europe Organic Soy Protein Market Segmentation: By Distribution Channel:

- Supermarkets and hypermarkets

- Specialty stores

- Online retailers

Within the European organic soy protein market, supermarkets and hypermarkets reign supreme as the most dominant distribution channels, offering a diverse selection of brands and varieties to cater to a wide range of consumers. However, online retailers are experiencing the fastest growth, fueled by the increasing convenience and accessibility they offer for purchasing organic soy protein products directly from the comfort of one's home. This trend suggests a potential shift in consumer behavior towards online grocery shopping, presenting exciting opportunities for market expansion in the coming years.

Europe Organic Soy Protein Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany boasts the most developed market for organic soy protein in Europe. Driven by high disposable income, growing health consciousness, and a significant expatriate population already familiar with plant-based options, demand for soy protein is notable. This area serves as a distribution hub, facilitating imports and access to wider markets. The United Kingdom is the fastest-growing region. This is because there is an increasing interest in healthy and sustainable food options, including organic soy protein. Government initiatives promoting healthier lifestyles also boost market growth potential. High disposable income fuels this trend, fostering market growth within the region.

COVID-19 Impact Analysis on the European Organic Soy Protein Market:

The COVID-19 pandemic brought both challenges and opportunities to the European organic soy protein market. While lockdowns, border closures, and labor shortages initially disrupted the supply chain of organic soybeans and soy protein products, the pandemic also triggered positive shifts in consumer behavior. The heightened focus on health during the pandemic led some consumers to seek out healthier food options, including organic and plant-based products, which benefited the organic soy protein market. Additionally, the rise in awareness surrounding food sustainability and health risks during this period contributed to an increased interest in plant-based diets, further boosting demand for organic soy protein. Moreover, the pandemic-driven surge in online grocery shopping expanded the reach and accessibility of organic soy protein products, offering a convenient alternative to traditional purchasing methods. Overall, the COVID-19 pandemic's influence on the European organic soy protein market has been multifaceted. While disruptions and economic uncertainty posed challenges, the focus on health, the shift towards plant-based diets, and the growth of e-commerce created new opportunities. The long-term impact remains to be seen, but the pandemic's influence has likely accelerated the adoption of healthier and more sustainable food choices, potentially leading to continued positive developments for the organic soy protein market in the coming years.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are

spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

The European organic soy protein market is buzzing with new developments, reflecting evolving consumer preferences and a commitment to sustainability. Manufacturers are pushing beyond traditional protein supplements by incorporating organic soy protein into diverse functional food products like fortified dairy alternatives, protein-enriched snacks, and even functional beverages. This caters to the growing demand for convenient and healthy protein sources. Additionally, the environmental impact is being addressed using sustainable packaging solutions, with a focus on obtaining third-party certifications to verify responsible practices throughout the supply chain. Furthermore, improved flavor and texture are becoming priorities, making the products more enjoyable and versatile for diverse culinary applications. Finally, direct-to-consumer sales through online platforms are gaining traction, offering manufacturers a wider reach and potentially more competitive pricing. These trends showcase the dynamism and promising future of the European organic soy protein market, highlighting its potential for continued innovation and growth in the years ahead.

Key Players:

- Archer Daniels Midland Company

- DuPont

- Sojaprotein GmbH

- Ingredion Incorporated

- Cargill, Incorporated

- ADM Protexin

- SunOpta Inc.

- Wilmar International Limited

Chapter 1. Europe Organic Soy Protein Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Organic Soy Protein Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Organic Soy Protein Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Organic Soy Protein Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Organic Soy Protein Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Organic Soy Protein Market– By Form

6.1. Introduction/Key Findings

6.2 Concentrates

6.3. Isolates

6.4. Textured/Hydrolysed

6.5. Y-O-Y Growth trend Analysis By Form

6.6. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 7. Europe Organic Soy Protein Market– By End-User

7.1. Introduction/Key Findings

7.2 Animal Feed

7.3. Human Consumption

7.4. Y-O-Y Growth trend Analysis By End-User

7.5. Absolute $ Opportunity Analysis By End-User , 2024-2030

Chapter 8. Europe Organic Soy Protein Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets and hypermarkets

8.3. Specialty stores

8.4. Online retailers

8.5. Y-O-Y Growth trend Analysis Distribution Channel

8.6. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Organic Soy Protein Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Form

9.1.3. By End-User

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Organic Soy Protein Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Archer Daniels Midland Company

10.2. DuPont

10.3. Sojaprotein GmbH

10.4. Ingredion Incorporated

10.5. Cargill, Incorporated

10.6. ADM Protexin

10.7. SunOpta Inc.

10.8. Wilmar International Limited

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The European organic soy protein market was valued at USD 96.2 million in 2023 and is projected to reach a market size of USD 212.67 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 12%.

. The rising health consciousness, booming plant-based protein trend, functionality, and versatility, growing interest in sustainable food choices, innovation, and product development are the main market drivers

Based on distribution channels, the market is divided into supermarkets and hypermarkets, specialty stores, and online retailers

Germany is often identified as a leading market due to its developed food & beverage industry and growing consumer interest in organic and plant-based products

Archer Daniels Midland Company, DuPont, Sojaprotein GmbH, Ingredion Incorporated, Cargill Incorporated, ADM Protexin, SunOpta Inc., and Wilmar International Limited are the major players