Europe Olive Oil Market Size (2024-2030)

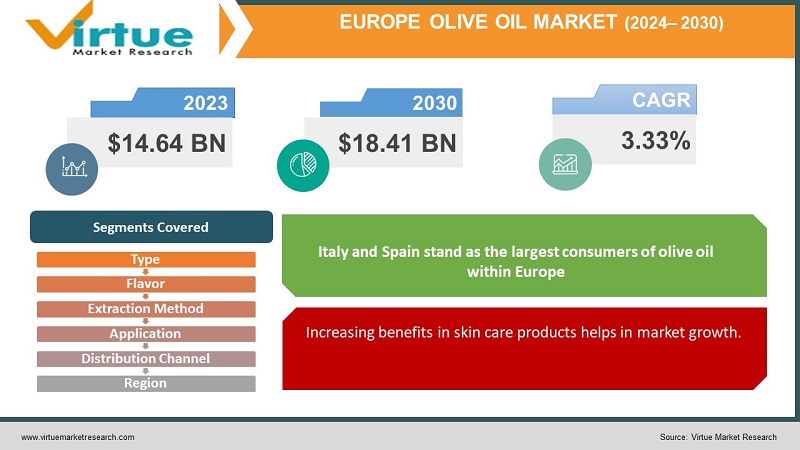

The Europe Olive Oil Market was valued at USD 14.64 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 18.41 billion by 2030, growing at a CAGR of 3.33%.

Olive oil serves multiple functions beyond its culinary application. Recognized as a cornerstone of the Mediterranean diet, it offers notable cardiovascular benefits, including mitigation of heart disease, stroke, and heart failure. Olive oil boasts a wealth of healthy mono-unsaturated fatty acids and antioxidants such as polyphenols. The characteristics and qualities of olive oils exhibit significant diversity across regions and countries of cultivation, reflecting variations in both geographical origins and fruit varieties.

Key Market Insights:

The market is witnessing expansion driven by a prevailing trend toward health and wellness, prompting a shift toward healthier oil alternatives. With the rise in lifestyle-related ailments, consumers are increasingly gravitating towards healthier vegetable oil options in their daily dietary routines. Lifestyle factors such as stress and busyness have contributed to a surge in obesity and cardiovascular conditions like heart attacks and heart failure, affecting not only adults and the elderly but also the younger demographic.

The heightened awareness of the correlation between dietary fats/oils and conditions like hypertension and heart disease is a primary catalyst propelling the demand for nutrient-rich olive oils. Consumers are now scrutinizing product labels more closely, focusing on ingredients and nutrient content. Vegetable oils boasting health-promoting attributes such as high vitamin E and omega-3 levels are gaining traction as individuals prioritize their well-being.

Products rich in monounsaturated fatty acids (MUFA) and antioxidants are particularly sought after for their potential to support cardiovascular health. The surge in olive oil consumption for culinary purposes within households can be attributed to an increasing recognition of its numerous health benefits. Olive oil stands out for its high monounsaturated fat content and the presence of antioxidants like vitamins A, D, E, K, and beta-carotene, which aid in lowering LDL cholesterol levels and averting heart disease.

Environmental concerns, pollution, stress, and the lingering effects of the COVID-19 pandemic have further fueled consumer health consciousness. Regular usage of olive oil is perceived as a means to mitigate health risks and enhance overall well-being. Beyond its health advantages, olive oil finds utility in skincare and personal care regimens, underscoring its multifaceted appeal.

Europe Olive Oil Market Drivers:

Olive Oil Health benefits drive the market growth.

There is a notable surge in health awareness and the adoption of healthier lifestyles worldwide. Olive oils, known for their beneficial components such as omega-3 fatty acids, vitamin A, and vitamin D, are increasingly sought after for their health-promoting properties. Rich in healthy mono-unsaturated fats, olive oil contains approximately 14% saturated fat and 11% polyunsaturated fat, including omega-3 fatty acids.

Increasing benefits in skin care products helps in market growth.

Olive oil's antioxidant and anti-inflammatory properties render it highly advantageous for skincare. Utilized as a skincare product, olive oil effectively eliminates dead skin cells and impurities, providing thorough cleansing while simultaneously hydrating, moisturizing, and nourishing the skin. Additionally, olive oil's ability to combat acne by targeting acne-causing bacteria contributes to its efficacy in skincare routines. By sealing in moisture and enhancing skin hydration, olive oil further reinforces its appeal in the personal and skincare sector. Consequently, the demand for olive oil is anticipated to rise in this domain.

Europe Olive Oil Market Restraints and Challenges:

Fluctuations in Prices of Olive Oil restrain the market growth.

The pricing of olive oil is influenced by various factors, with commodity brokers playing a significant role in the market dynamics. These brokers engage in the buying and selling of bulk quantities of olive oil daily, thereby impacting the overall market prices. The availability of olives directly affects these prices, leading to fluctuations that can either raise or lower the cost of olive oil. As a result, the olive oil market is subject to fluctuations in prices, which are anticipated to pose constraints during the forecast period.

Various cooking oils available in the market challenge the market growth.

For numerous years, individuals have relied on oils such as sunflower oil and mustard oil for cooking purposes. However, in recent times, the growing awareness of the benefits of olive oil has emerged as a positive development. Despite this, a significant hindrance to market growth persists due to a lack of awareness among consumers regarding the advantages of olive oil. This lack of awareness often results in consumers continuing to use the oils they are accustomed to over an extended period.

Moreover, the market faces a major challenge stemming from the wide array of cooking oils available, including sunflower oil, mustard oil, palm oil, avocado oil, and many others. This plethora of options can be confusing and overwhelming for consumers, making it challenging for them to determine which oil offers the most benefits and best suits their preferences. Consequently, this complexity contributes to the difficulty consumers encounter in selecting the most suitable cooking oil for their needs.

Europe Olive Oil Market Opportunities:

The increasing prevalence of obesity and associated health issues is closely linked to the consumption of conventional fatty oils. As awareness regarding the adverse effects of excessive fat intake grows alongside rising obesity rates, the correlation between obesity and various diseases becomes more apparent. Obesity is strongly associated with an elevated risk of developing several serious health conditions, including diabetes, cardiovascular disease, and certain types of cancer.

EUROPE OLIVE OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.33% |

|

Segments Covered |

By Type, Flavor, extraction method, application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

The UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Cargill Incorporated, Artajo oil, Deoleo, Avenida Rafael Ybarra, Del Monte Foods, Inc Gallo Worldwide, SOVENA, BORGES INTERNATIONAL GROUP, S.L.U., EU Olive Oil Ltd, SALOV GROUP |

Europe Olive Oil Market Segmentation:

Europe Olive Oil Market Segmentation By Type:

- Virgin Olive Oil

- Pomace Olive Oil

- Refined Olive Oil

- Common Olive Oil

- Extra Virgin Olive Oil

- Lite/Light Olive Oil

In Jaén, Spain, the world's largest olive oil-producing region, prices for extra virgin olive oil surged to €820 per 100 kilograms by the end of August, marking the highest recorded value to date and nearly tripling the average price observed over the past five years. This upward trend in prices extends to other varieties such as virgin olive oil and lampante olive oil.

The combination of escalating olive oil prices and diminished production levels is anticipated to hurt olive oil exports within Europe in the coming months.

Europe Olive Oil Market Segmentation By Flavor:

- Full-Bodied & Earthy

- Fruity & Peppery

- Fruity & Herby

- Mild & Buttery

Europe Olive Oil Market Segmentation By Extraction Method:

- First-Press

- Cold-Pressed

- Cold-Extracted

In the Extraction method segment, the cold-extracted segment is projected to hold a dominant position in the olive oil market share. This is primarily attributed to the growing demand for extra virgin olive oil, which is renowned for its ability to mitigate health-related disorders such as obesity. Additionally, extra virgin olive oil finds extensive usage in skincare routines, further bolstering its popularity and contributing to the dominance of the cold-extracted segment.

Europe Olive Oil Market Segmentation By Application:

- Food And Beverages

- Pharmaceutical

- Cosmetic and Personal Care

- Aromatherapy

- Others

The household/retail category is anticipated to witness growth throughout the forecast period. Olive oil is a staple in many households across various cuisines, owing to its versatility and distinct flavor profile. With its high smoke point, olive oil is commonly utilized for a range of cooking methods including sautéing, frying, grilling, and baking. Its preference over other cooking oils is driven by its numerous health benefits and its ability to impart depth and richness to food preparations.

Europe Olive Oil Market Segmentation By Distribution Channel:

- Store Based

- Non-Store Based

In the Distribution Channel segment, the store-based segment is projected to hold a dominant position in the olive oil market share. This is primarily attributed to the extensive range of olive oil products available in physical retail stores and the strategic decisions undertaken to bolster store-based retailing initiatives.

Europe Olive Oil Market Segmentation- by Region

- Germany

- France

- Spain

- U.K.

- Italy

- Rest of Europe

Italy and Spain stand as the largest consumers of olive oil within Europe, each boasting an annual consumption of approximately 500,000 tonnes. On the other hand, Greece holds the distinction of having the highest per capita consumption, with an average of around 12 kilograms per person per year. Collectively, Europe comprises roughly 53% of global olive oil consumption in 2023.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has indeed exerted an impact on the market to a certain extent. The imposition of lockdown measures resulted in a temporary halt in the manufacturing process, coupled with a decrease in demand from end-users. However, in the post-COVID era, there has been a notable resurgence in the demand for olive oil. This uptick can be attributed to shifts in consumer purchasing patterns and a heightened demand for olive oil across various end-user segments including food & and beverages, fine fragrance, and personal care, among others.

Latest Trends/ Developments:

- In June 2022, Certified Origins, a manufacturer of extra virgin olive oil (EVOO) based in Europe, unveiled a series of carbon-neutral Italian EVOOs under its renowned Bellucci brand. Sourced from regions including Tuscany, Apulia, and Sicily, these high-quality Italian EVOOs are tailored for global markets, aligning with the company's mission to promote exceptional and nutritious culinary experiences worldwide.

Key Players:

The top players operating in the Europe Olive Oil Market are -

- Cargill, Incorporated

- Artajo oil

- Deoleo

- Avenida Rafael Ybarra

- Del Monte Foods, Inc

- Gallo Worldwide

- SOVENA

- BORGES INTERNATIONAL GROUP, S.L.U.

- EU Olive Oil Ltd

- SALOV GROUP

Chapter 1. Europe Olive Oil Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Olive Oil Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Olive Oil Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Olive Oil Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Olive Oil Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Olive Oil Market – By Type

6.1. Introduction/Key Findings

6.2. Virgin Olive Oil

6.3. Pomace Olive Oil

6.4. Refined Olive Oil

6.5. Common Olive Oil

6.6. Extra Virgin Olive Oil

6.7. Lite/Light Olive Oil

6.8. Y-O-Y Growth trend Analysis By Type

6.9. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Olive Oil Market – By Flavor

7.1. Introduction/Key Findings

7.2 Full-Bodied & Earthy

7.3. Fruity & Peppery

7.4. Fruity & Herby

7.5. Mild & Buttery

7.6. Y-O-Y Growth trend Analysis By Flavor

7.7. Absolute $ Opportunity Analysis By Flavor , 2024-2030

Chapter 8. Europe Olive Oil Market – By Extraction Method

8.1. Introduction/Key Findings

8.2 First-Press

8.3. Cold-Pressed

8.4. Cold-Extracted

8.5. Y-O-Y Growth trend Analysis Extraction Method

8.6. Absolute $ Opportunity Analysis Extraction Method, 2024-2030

Chapter 9. Europe Olive Oil Market – By Application

9.1. Introduction/Key Findings

9.2 Food And Beverages

9.3. Pharmaceutical

9.4. Cosmetic and Personal Care

9.5. Aromatherapy

9.6. Others

9.7. Y-O-Y Growth trend Analysis Application

9.8. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 10. Europe Olive Oil Market – By Distribution Channel

10.1. Introduction/Key Findings

10.2 Store Based

10.3. Non-Store Based

10.4. Y-O-Y Growth trend Analysis Distribution Channel

10.5. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 11. Europe Olive Oil Market , By Geography – Market Size, Forecast, Trends & Insights

11.1. Europe

11.1.1. By Country

11.1.1.1. U.K.

11.1.1.2. Germany

11.1.1.3. France

11.1.1.4. Italy

11.1.1.5. Spain

11.1.1.6. Rest of Europe

11.1.2. By Extraction Method

11.1.3. By Type

11.1.4. By Flavor

11.1.5. Application

11.1.6. Distribution Channel

11.1.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Europe Olive Oil Market – Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

12.1 Cargill, Incorporated

12.2. Artajo oil

12.3. Deoleo

12.4. Avenida Rafael Ybarra

12.5. Del Monte Foods, Inc

12.6. Gallo Worldwide

12.7. SOVENA

12.8. BORGES INTERNATIONAL GROUP, S.L.U.

12.9. EU Olive Oil Ltd

12.10. SALOV GROUP

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market is witnessing expansion driven by a prevailing trend toward health and wellness, prompting a shift toward healthier oil alternatives

The top players operating in the Europe Olive Oil Market are - Cargill, Incorporated, Artajo Oil, Deoleo, Avenida Rafael Ybarra, Del Monte Foods, Inc, Gallo Worldwide, SOVENA, BORGES INTERNATIONAL GROUP, S.L.U., EU Olive Oil Ltd, and SALOV GROUP.

The COVID-19 pandemic has indeed exerted an impact on the market to a certain extent. The imposition of lockdown measures resulted in a temporary halt in the manufacturing process, coupled with a decrease in demand from end-users.

The increasing prevalence of obesity and associated health issues is closely linked to the consumption of conventional fatty oils. As awareness regarding the adverse effects of excessive fat intake grows alongside rising obesity rates, the correlation between obesity and various diseases becomes more apparent.

. Italy and Spain stand as the largest consumers of olive oil within Europe, each boasting an annual consumption of approximately 500,000 tonnes