Europe Oats Market Size (2024-2030)

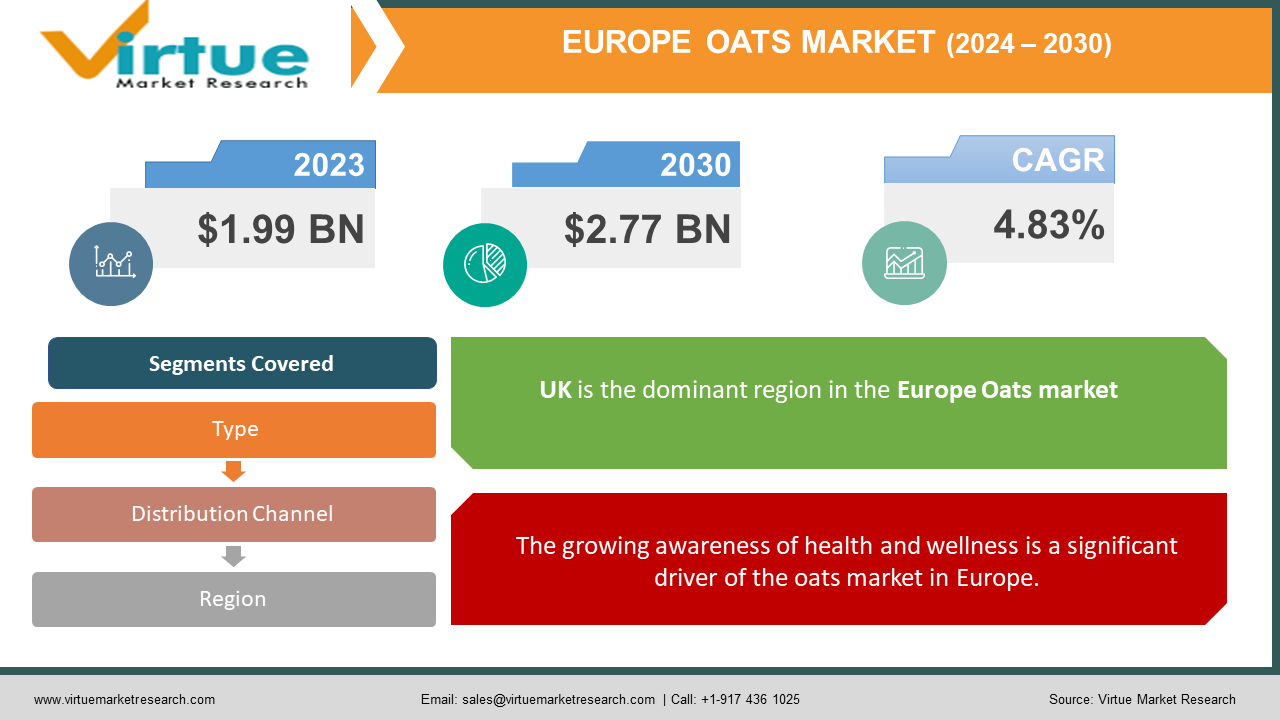

The Europe Oats Market was valued at USD 1.99 Billion in 2023 and is projected to reach a market size of USD 2.77 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.83%.

The growing demand for wholesome and convenient food items, together with growing consumer awareness of health and wellbeing, is driving a considerable increase in the European oat market. A versatile grain, oats are often eaten as oatmeal and added to a variety of baked goods, including bread, cookies, and snacks. Their popularity has increased because of their health benefits, which include their high fiber content, cholesterol-lowering potential, and compatibility with gluten-free diets. Europe is one of the major producers and consumers of oats due to its varied agricultural terrain and pleasant environment. Oats are a household staple in several nations, including the UK, Germany, and Sweden, which propel the market. The popularity of natural foods and plant-based diets has also increased the demand for oats.

Key Market Insights:

- The organic oats segment is expected to grow at a CAGR of 6.5% from 2024 to 2030. Rolled oats represent 40% of the total oats market share.

- Instant oats hold a 25% market share in Europe. Steel-cut oats account for 12% of the market.

- Whole oats represent 18% of the total market. Oat flour constitutes 5% of the market share.

- Supermarkets and hypermarkets account for 50% of the oat's distribution channel. Convenience stores represent 15% of the distribution channel.

- The United Kingdom produces 1.1 million metric tons of oats annually.

- Oats grown in Europe cover an area of 3.2 million hectares.

- The average yield of oats in Europe is 3.5 metric tons per hectare.

- Germany exports 20% of its oats production. Sweden exports 25% of its total oats production.

- 60% of the oats produced in Europe are used for food products. 30% of oats are utilized for animal feed.

- The per capita consumption of oats in Europe is approximately 5.5 kg. 85% of European consumers are aware of the health benefits of oats.

- The oat production in Poland is approximately 700,000 metric tons annually. Denmark contributes 10% to the total oats market in Europe.

Europe Oats Market Drivers:

The growing awareness of health and wellness is a significant driver of the oats market in Europe.

By encouraging regular bowel movements and averting constipation, oats enhance digestive health. Oat fiber gives the coprolite more volume and helps it move more fluently through the digestive system. For people who want to enhance the health of their gut or have digestive problems, this is veritably helpful. Oatmeal eating on a regular base is linked to better heart health. Oats contain beta-glucan, which aids in reducing LDL (bad) cholesterol situations, a significant threat factor for heart complaints. Avenanthramides, another class of antioxidants set up in oats, offer anti-inflammatory rates and support cardiovascular health. Oats' high fiber content encourages malnutrition, which lowers total sweet input and aids in weight operation.

The shift towards plant-based diets is another significant driver of the oats market.

For those who eat a plant-based diet, getting enough protein from their sources is essential. Oats are a great complement to vegetarian and vegan diets since they include a significant quantity of plant-based protein. They may be used in recipes to make snacks and meals high in protein. Oats are quite adaptable and may be used in many different recipes, such as savory foods, baked products, smoothies, and morning cereals. They are a well-liked option for people who want to increase the number of plant-based meals in their diet because of their adaptability. Because plant-based diets have less of an impact on the environment than diets based on animals, they are frequently adopted. Because they use less water and resources than other crops, oats are seen as sustainable.

Europe Oats Market Restraints and Challenges:

The high cost of producing oats due to their processing and cultivation is one of the major issues facing the oat market. Although organic cultivation, insect management, and achieving quality requirements might come at a considerable expense, oats are a comparatively low-maintenance crop. Growing in popularity among health-conscious customers, organic oats demand particular growing methods that eschew synthetic pesticides and fertilizers. When compared to conventional farming, these methods might be more expensive and labor-intensive. Oats go through multiple steps in the processing process to become value-added goods like oat milk, oat flour, and quick oats. These steps include washing, milling, and packing. Oats and oat-based products need to be handled carefully during storage and transit to avoid contamination and spoiling.

Europe Oats Market Opportunities:

There are plenty of potential prospects due to the oat market's increase in emerging markets. Economic expansion and urbanization are occurring in Asia, Latin America, and Africa; this is resulting in higher disposable income and shifting food habits. Producing novel oat-based goods has significant market expansion prospects. There is a rising need for innovative and intriguing oat-based goods that satisfy a variety of dietary requirements and palates as customer preferences change. Producers may benefit from this trend by releasing distinctive and cutting-edge goods. Snacks made of oats are a great option for satisfying the growing need for quick and healthy snacks. When customers are searching for healthy and portable snack options, oat bars, cookies, and granola are popular selections.

EUROPE OATS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.83% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Quaker Oats Company (US), Kellogg Company (US), Nestlé S.A. (Switzerland), Unilever plc (UK/Netherlands), Fazer Group (Finland), Lantmannen (Sweden), Hain Celestial Group (US), Good Mills Group (Austria), Oatly (Sweden), Alpro (Belgium), Provamel (Netherlands), Rude Health (UK), Peter's Food Group (Netherlands), Morn flake Oat the Molk Company (UK). |

Europe Oats Market Segmentation:

Europe Oats Market Segmentation: By Types:

- Rolled Oats

- Instant Oats

- Steel-Cut Oats

- Whole Oats

- Oat Flour

One of the most popular varieties of oats is rolled oats, also referred to as old-fashioned oats. They are quickly cooked while keeping their chewy texture because they are steamed and then flattened using big rollers. Because of its versatility, rolled oats may be used in a wide range of dishes, from baked products like granola bars and cookies to classic oatmeal. Their substantial market share can be attributed to their appeal to customers looking for a nutritious breakfast choice.

In the European oat market, oat flour has the quickest rate of growth. The rise in demand for healthy and gluten-free food items has contributed to oat flour's increased appeal. In both home kitchens and professional food production, its usage in baking and cooking is growing. Oat flour is a healthier option for individuals looking for alternatives to regular wheat flour because of its flexibility and nutritional advantages.

Europe Oats Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Online Retail

- Direct Sales

- Wholesale and Distributors

In Europe, the most common distribution outlets for oats are supermarkets and hypermarkets. These big-box retailers provide a huge range of oat products, from unique oat-based goods like oat milk and oat flour to standard rolled oats. Shoppers prefer to buy at supermarkets and hypermarkets since they can conveniently find everything they need for groceries in one location. These shops draw a sizable consumer base by often offering discounts and promotions. Supermarkets and hypermarkets dominate the distribution environment because of their accessibility and variety.

In Europe, the oat distribution channel with the quickest growth is online shopping. The ease, diversity, and accessibility that internet purchasing platforms provide is what is driving the change in this direction. Due to the convenience of home delivery and the opportunity to choose a wider selection of alternatives, consumers are depending more and more on online shops to buy their food, especially oat goods. It is anticipated that the rising popularity of online grocery shopping, bolstered by developments in logistics and e-commerce technology, will continue to propel the expansion of this distribution channel.

Europe Oats Market Segmentation: Regional Analysis:

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

The UK's long-standing agricultural heritage is the foundation of its market dominance in oats. For ages, oats have been a mainstay crop in British agriculture, flourishing in the nation's temperate and humid environment. Because of its historical relevance, oats have developed sophisticated seed types, specific agricultural methods, and a strong infrastructure.

Spain is the nation with the quickest rate of growth in the European oats market, while now having an 8% share of the market. With remarkable yearly growth rates, the Spanish oats market has been surpassing its European peers and establishing itself as a prominent participant in the sector. Spain's oat industry is growing rapidly due to a number of causes. First of all, breakfast choices have significantly changed in Spain, leading to a healthier and more varied diet. Though historically underutilized in Spanish cooking, oats are becoming more and more well-liked as a healthy and adaptable ingredient. The oat industry has been expanding due in large part to consumers' increasing knowledge of the health advantages thereof.

COVID-19 Impact Analysis on the Europe Oats Market:

Lockdowns and border restrictions initially disrupted oat supplies across Europe. Transportation delays and limitations on the movement of goods posed challenges for manufacturers and distributors. As physical stores faced closures or limited capacity, online grocery shopping platforms witnessed a significant boost. This trend benefited the oat market, with consumers readily purchasing oat-based products online. Restricted movement and restaurant closures led to a rise in home cooking. Convenient and versatile oat products like quick oats and oat flour gained traction as consumers prepared meals at home. The pandemic heightened awareness of personal health and well-being. Oats, rich in fiber and potentially contributing to heart health and gut health, resonated with consumers seeking nutritious options. The oat market witnessed a surge in product innovation. Manufacturers introduced new oat milk varieties, protein-fortified oat bars, and ready-to-eat oat breakfast options catering to on-the-go consumption. The use of oats expanded beyond traditional breakfast applications. Oat flour gained popularity in baking, while oat milk emerged as a strong contender in the plant-based milk market, appealing to lactose-intolerant consumers and those seeking vegan alternatives. Some oat brands capitalized on the focus on immunity by highlighting the potential benefits of oats, such as their beta-glucan content, which some studies suggest may contribute to a healthy immune system response.

Latest Trends/ Developments:

Fueled by the increasing popularity of vegan and flexitarian diets, oat milk offers a credible alternative to dairy milk, boasting a comparable creamy consistency and a neutral flavor profile that complements coffee, tea, and cereals. For those with lactose intolerance, oat milk provides a delicious and readily available solution, allowing them to enjoy beverages and recipes traditionally reliant on dairy milk. Oat flour is increasingly used in bread, cookies, and pastries, offering a delicious gluten-free option or adding a unique texture and subtle oat flavor to traditional baked goods. Oat groats and rolled oats are being incorporated into savory dishes like salads, veggie burgers, and stuffings, adding a satisfying heartiness and a source of fiber. Pre-packaged oatmeal pots with various flavor combinations offer a quick and hassle-free breakfast option, requiring just hot water or microwave heating. Subscription services delivering personalized oat-based breakfast boxes directly to consumers are gaining traction, providing convenience and variety.

Key Players:

- Quaker Oats Company (US)

- Kellogg Company (US)

- Nestlé S.A. (Switzerland)

- Unilever plc (UK/Netherlands)

- Fazer Group (Finland)

- Lantmannen (Sweden)

- Hain Celestial Group (US)

- Good Mills Group (Austria)

- Oatly (Sweden)

- Alpro (Belgium)

- Provamel (Netherlands)

- Rude Health (UK)

- Peter's Food Group (Netherlands)

- Morn flake Oat The Molk Company (UK)

Chapter 1. Europe Oats Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Oats Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Oats Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Oats Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Oats Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Oats Market– By Type

6.1. Introduction/Key Findings

6.2. Rolled Oats

6.3. Instant Oats

6.4. Steel-Cut Oats

6.5. Whole Oats

6.6. Oat Flour

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Oats Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets, hypermarkets and Retail stores

7.3. Direct Sales

7.4. Wholesale and Distributors

7.5. Online Retail

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Europe Oats Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Oats Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Quaker Oats Company (US)

9.2. Kellogg Company (US)

9.3. Nestlé S.A. (Switzerland)

9.4. Unilever plc (UK/Netherlands)

9.5. Fazer Group (Finland)

9.6. Lantmannen (Sweden)

9.7. Hain Celestial Group (US)

9.8. Good Mills Group (Austria)

9.9. Oatly (Sweden)

9.10. Alpro (Belgium)

9.11. Provamel (Netherlands)

9.12. Rude Health (UK)

9.13. Peter's Food Group (Netherlands)

9.14. Morn flake Oat The Molk Company (UK)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Oats are a natural source of soluble and insoluble fiber, promoting gut health, digestion, and feelings of satiety. This aligns perfectly with the growing trend towards healthy eating and weight management.

While oats themselves are generally a relatively affordable grain, the initial purchase price of some advanced oat products, particularly organic or fortified options, can be a barrier for some consumers, especially in regions with lower disposable incomes.

Quaker Oats Company (US), Kellogg Company (US), Nestlé S.A. (Switzerland), Unilever plc (UK/Netherlands), Fazer Group (Finland), Lantmannen (Sweden), Hain Celestial Group (US), Good Mills Group (Austria), Oatly (Sweden), Alpro (Belgium), Provamel (Netherlands), Rude Health (UK), Peter's Food Group (Netherlands), Morn flake Oat the Molk Company (UK).

The market is dominated by the UK, which commands a market share of around 20%.

With a market share of about 8%, Spain is expanding the quickest.