Europe Nutraceuticals Market Size (2024-2030)

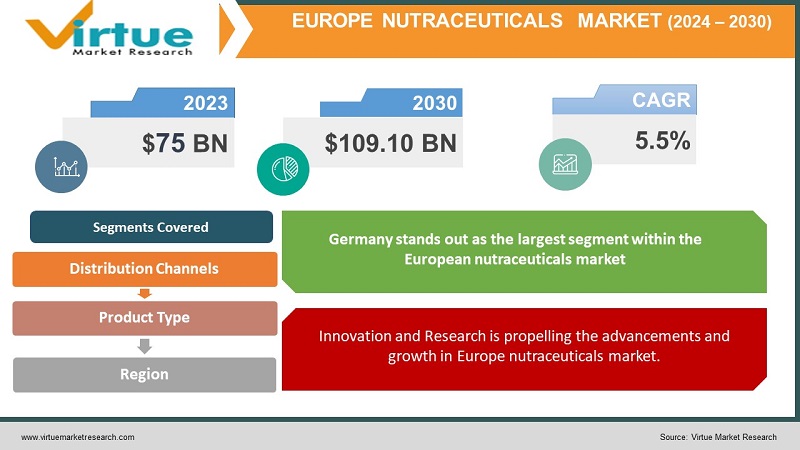

The European nutraceuticals Market was valued at USD 75 Billion in 2023 and is projected to reach a market size of USD 109.10 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.50%.

The European nutrition market represents a dynamic landscape with increasing use for functional foods, nutritional supplements, and wellness products. This market reflects growing consumer interest in preventive health care and overall wellness, leading to increased acceptance of nutraceuticals. Regulatory progress and commitment to research and development lead to innovation in product design, meeting different customer preferences. Market growth is driven by factors such as an aging population, increased health, and demand for natural and organic solutions, indicating a strong and flexible industry that is poised for expansion.

Key Market Insights:

World Bank statistics reveal that more than 21.13% of the European population is 65 years old and older, increasing Europe's demand for nutritious and functional foods. The need for probiotic supplements is also growing due to growing problems related to digestion, obesity, and related health problems.

Germany's largest shopping mall of about 108 million people makes it the largest food and beverage business in Europe. Many companies are launching new products such as probiotic yogurt and fermented milk products in Germany.

According to data from the European International Probiotic Association, 74% of fermented milk products are consumed throughout Europe.

Europe Nutraceuticals Market Drivers:

Health awareness and an aging population in Europe are greatly increasing the demand for food products in the region.

The European landscape includes a large aging population and an increased focus on health and well-being. As individuals look for ways to support their health and vitality, there is a growing awareness of preventive health care. Nutraceuticals, providing benefits beyond basic nutrition, are for the health conscious. An aging population is also driving demand for supplements that support bone health, cognitive function, cardiovascular health, and overall well-being.

Innovations and research are driving the progress and growth of the European nutrition market.

Continuous research and technological advancements in the nutritional system are the main drivers. Continuous innovation results in new product development, increased efficiency, and better delivery systems for nutraceuticals. In addition, strong standards and commitment to scientific support motivate companies to invest in research, ensuring product quality, safety, and compliance. These innovations cater to health and consumer preferences, thereby driving market growth.

Europe Nutraceuticals Market Restraints and Challenges:

Innovations and research are driving the progress and growth of the European nutrition market.

Continuous research and technological advancements in the nutritional system are the main drivers. Continuous innovation results in new product development, increased efficiency, and better delivery systems for nutraceuticals. In addition, strong standards and commitment to scientific support motivate companies to invest in research, ensuring product quality, safety, and compliance. These innovations cater to health and consumer preferences, thereby driving market growth.

Europe Nutraceuticals Market Opportunities:

The European food market offers interesting opportunities, driven by the shift in consumer preferences towards healthier options and the search for more natural ingredients. With an aging population and an increased emphasis on preventive health care, there is a growing demand for new, science-backed products that promote overall well-being. This landscape allows companies to explore new trends, enable emerging trends such as personalized nutrition, and leverage technological advances to create effective, customized solutions that meet diverse needs. of consumers in the area.

EUROPE NUTRACEUTICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.50% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Nestlé Health Science, Bioiberica, Glanbia plc, Herbalife Nutrition Ltd, Archer Daniels Midland (ADM), Abbott Laboratories, Danone S.A., DuPont de Nemours, Inc., Royal DSM N.V., Lonza Group |

Europe Nutraceuticals Market Segmentation:

Europe Nutraceuticals Market Segmentation: By Product Type

- Functional Food

- Functional Beverage

- Dietary Supplements

In 2023, dietary supplements as the largest segment with a market share of 56%. This dominance stems from many factors, including convenience and the availability of supplements that meet different nutritional needs. Dietary supplements offer consumers an easy and convenient way to meet specific health needs or supplement their daily diet. Additionally, increasing health awareness and wellness trends have boosted the demand for supplements, thus strengthening their position as a leading segment in the European nutritional supplements market. The functional beverage segment is emerging as the fastest growing, expecting growth at a rate of 6.5% during the forecast period. This growth is attributed to a shift in consumer preferences toward consumption and combining health benefits with convenience. Functional drinks offer a diverse platform for incorporating a variety of health-promoting ingredients, including vitamins, probiotics, and botanical extracts, attracting health-conscious consumers who are looking for an affordable option. The transformation of these drinks to meet specific health needs, such as increased energy, immune support, or stress relief, positions them as a rapidly expanding segment of the European market, exploiting the combination of trends in consumption focuses on well-being and well-being.

Europe Nutraceuticals Market Segmentation: By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail Stores

- Others

Within the European nutraceuticals market, the largest segment among distribution channels is often the Online Retail Stores having a market share of 60%, and is the fastest-growing segment as well during the forecast period, 2024-2030. This dominance stems from the evolving consumer behavior characterized by a shift towards digital platforms for purchasing goods. Moreover, the ease of access and the rising trend of e-commerce, particularly post-pandemic, have significantly contributed to the surge in online sales of nutraceuticals. Consumers seek convenience, discreet shopping experiences, and the ability to access a diverse array of products, factors that have propelled online retail stores to the forefront of the European nutraceutical market's distribution landscape.

Shopping malls are the cornerstone of modern consumer culture, offering a wide variety of products under one roof, from new products to household essentials. Many factors are driving the growth of supermarkets, including urbanization, changing consumer lifestyles, and increasing disposable income. These companies offer beauty in different styles, meeting

Europe Nutraceuticals Market Segmentation: Regional Analysis:

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany emerged as the largest segment of the European nutrition market, with a revenue share of 28%. Germany has a strong healthcare infrastructure, a high level of health among its population, and a strong capacity for preventive healthcare practices. The country's approach to promoting quality, as well as a culture that values natural processes and other treatments, creates a huge demand for food products. In addition, Germany's advanced research and development capabilities in food science drive innovation, leading to a wide variety of reliable, high-quality food offerings. Spain emerged as the fastest-growing segment of the food market. This growth is attributed primarily to changing consumer behavior toward preventive health care and a greater focus on quality. Spain has seen a marked increase in the number of health-conscious people looking for natural and processed food alternatives. Factors such as changing food culture, rising disposable income, and growing population are fueling the demand for nutritional products. In addition, the increase in the value of food, and the introduction of Mediterranean food, make the expansion of the market in Spain continue.

Spain, a powerful European country, is not only famous for its rich history, cultural heritage, and beautiful landscape but also for its great contribution to the food market. With an increasing emphasis on health and wellness, Spain has become a major producer and exporter of nutritional products. Things like the Mediterranean diet with olive oil, fruits, vegetables, and nuts contributed to Spain's importance in this area. In addition, the good climate of the country allows the cultivation of various medicinal plants and herbs, thus strengthening its industry. Spain's commitment to research and innovation in biotechnology and medicine has played an important role in the growth of the food sector. As a result, Spain's influence extends beyond its borders, affecting the European food market by providing high-quality products and setting industry standards for quality and innovation.

COVID-19 Impact Analysis on the Europe Nutraceuticals Market:

The COVID-19 pandemic has had a mixed impact on the European nutrition market. Initially, demand for immune-boosting supplements and functional foods increased as consumers prioritized health and wellness at the center of the crisis. Supply chain disruptions and logistics challenges have led to temporary shortages and fluctuations in product availability. While pandemics have highlighted the importance of preventive health care, economic uncertainty and changing consumer behavior have affected purchasing habits. In addition, regulatory reforms and increased focus on the safety and efficacy of nutraceuticals have reshaped the landscape, driving innovation and product innovation. As the region continues in the recovery process, the focus is on health consciousness and the acceptance of total quality will support the growth of the food market in Europe.

Latest Trends/ Developments:

Growing demand for phosphatidylserine is expected to drive market growth:

A popular trend in the European nutrition market is the introduction of self-sustaining nutrition. Advances in technology, especially in genetic testing and data analysis, have made it easier to tailor nutritional plans based on a person's health needs, genetic makeup, and lifestyle choices. Companies are capitalizing on this trend by offering customized supplements, meal plans, and processed foods designed to meet special dietary needs. Personalized nutrition meets growing consumer interest in improving health outcomes and represents a shift to a targeted and personalized approach to wellness. Consumers are increasingly aware of the environmental impact of the products they consume, leading to a demand for nutritional products that are sourced responsibly, use environmentally friendly packaging, and use sustainable production methods. Companies are responding by using organic, renewable crops, adopting eco-friendly packaging, and implementing eco-friendly production methods. This shift to sustainability coincides with broader consumer preferences for eco-friendly products and reflects a growing commitment within the industry to reduce its environmental footprint.

Key Players:

- Nestlé Health Science

- Bioiberica

- Glanbia plc

- Herbalife Nutrition Ltd

- Archer Daniels Midland (ADM)

- Abbott Laboratories

- Danone S.A.

- DuPont de Nemours, Inc.

- Royal DSM N.V.

- Lonza Group

- In April 2022, Bioiberica, an international life science firm headquartered in Spain, collaborated with multinational health and pharmaceutical specialist Apsen to create groundbreaking mobility solutions targeting the Brazilian market.

Chapter 1. Europe Nutraceuticals Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Nutraceuticals Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Nutraceuticals Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Nutraceuticals Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Nutraceuticals Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Nutraceuticals Market– By Product Type

6.1. Introduction/Key Findings

6.2. Functional Food

6.3. Functional Beverage

6.4. Dietary Supplements

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Europe Nutraceuticals Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3. Convenience Stores

7.4. Specialty Stores

7.5. Online Retail Stores

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Europe Nutraceuticals Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Product Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Nutraceuticals Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Nestlé Health Science

9.2. Bioiberica

9.3. Glanbia plc

9.4. Herbalife Nutrition Ltd

9.5. Archer Daniels Midland (ADM)

9.6. Abbott Laboratories

9.7. Danone S.A.

9.8. DuPont de Nemours, Inc.

9.9. Royal DSM N.V.

9.10. Lonza Group

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The European nutraceuticals Market was valued at USD 75 billion and is projected to reach a market size of USD 109.10 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.50%.

Health Awareness and the Aging Population in Europe along with Innovation and Research are drivers of the Europe Nutraceuticals market

Based on product type, the European nutraceuticals Market is segmented into Functional Food, Functional Beverage, and Dietary Supplements

Germany is the most dominant region for the European nutraceuticals Market.

Nestlé Health Science, Bioiberica, Glanbia plc, Herbalife Nutrition Ltd, Archer Daniels Midland (ADM), Abbott Laboratories, Danone S.A., DuPont de Nemours, Inc., Royal DSM N.V., Lonza Group