Europe Milk Replacers Market Size (2024-2030)

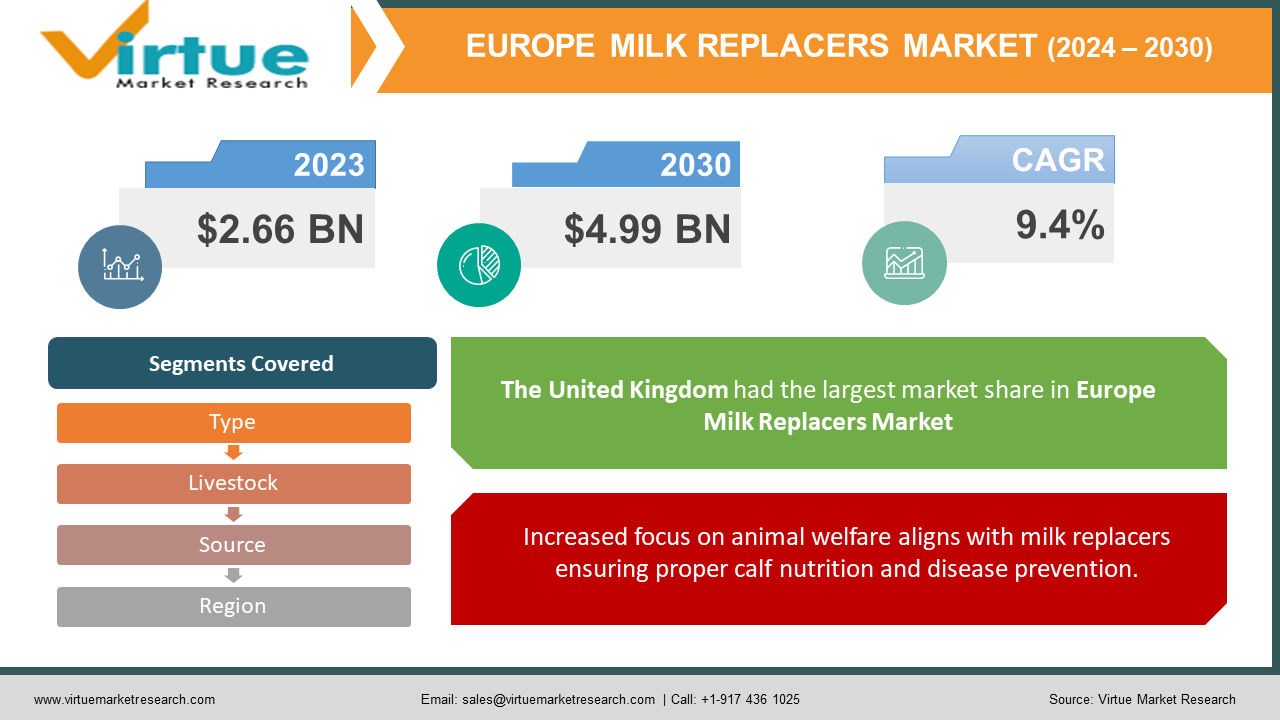

The Europe Milk Replacers Market was valued at USD 2.66 billion in 2023 and is projected to reach a market size of USD 4.99 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 9.4%.

The European milk replacers market is on a steady growth trajectory, driven by several factors. Farmers are increasingly recognizing the benefits of milk replacers, not just for their cost-effectiveness compared to whole milk feeding, but also for the essential nutrients they provide calves for healthy development. Animal welfare concerns are another growth driver, as milk replacers ensure proper calf nutrition.

Key Market Insights:

- Innovation and competition are driving the European milk replacers market forward. Established players like Royal DSM, Cargill, and Land O'Lakes face increasing competition from new entrants. This dynamic landscape fosters the continuous development of milk replacers with improved nutritional profiles.

- Medicated options are gaining traction as a way to prevent diseases in young calves, addressing the growing focus on animal welfare within the European market. Regulations also play a part, with the European Commission enforcing proper calf nutrition, a requirement that milk replacers can effectively fulfill.

The Europe Milk Replacers Market Drivers:

Surging meat consumption necessitates efficient calf rearing, making milk replacers a cost-effective solution.

The European market is witnessing a steady rise in meat consumption. This increasing appetite translates directly to a need for efficient and large-scale calf rearing. Milk replacers play a crucial role in this scenario by providing a cost-effective solution for feeding calves after separation from their mothers. This allows farmers to maximize milk production for human consumption while ensuring proper nourishment for young calves. Ultimately, this driver fuels the growth of the European milk replacers market.

Milk replacers offer a double win for farmers: affordability and essential nutrients for healthy calf development.

Milk replacers offer a significant advantage for farmers, acting as a double win. Compared to whole milk feeding, they are considerably more affordable. However, this cost-effectiveness doesn't come at the expense of nutrition. Milk replacers are meticulously formulated to deliver a balanced profile of essential nutrients that are crucial for healthy calf development. This translates to improved farm profitability and operational efficiency, making milk replacers an attractive option for farmers across Europe.

Increased focus on animal welfare aligns with milk replacers ensuring proper calf nutrition and disease prevention.

Animal welfare concerns are a significant driving force shaping the European agricultural landscape. Milk replacers play a vital role in ensuring proper nutrition for calves, which is a critical aspect of animal well-being. Furthermore, the availability of medicated milk replacers allows farmers to proactively prevent diseases in young calves. This aligns perfectly with the growing emphasis on responsible animal husbandry practices within the European market. As animal welfare concerns continue to gain traction, the demand for milk replacers is expected to rise accordingly.

The Europe Milk Replacers Market Restraints and Challenges:

The European milk replacers market, though experiencing growth, faces challenges that can curb its full potential. A significant hurdle lies in the unorganized nature of some Eastern European dairy markets. This fragmented landscape makes it difficult for manufacturers to efficiently distribute their products to farmers. Additionally, the rise of plant-based diets and growing consumer concerns about animal products could potentially decrease demand for milk replacers, particularly those derived from milk byproducts. This trend aligns with the increasing focus on environmentally friendly and ethically sourced food options.

The European Union's push to reduce food waste presents another challenge. This focus could lead to a rise in using waste milk or colostrum from cows as an alternative to commercially produced milk replacers. While this reduces waste, it could negatively impact the market for these specialized formulas. Furthermore, some farmers in price-sensitive regions might still opt for traditional whole milk feeding due to the upfront costs associated with milk replacers.

Finally, strict European regulations on antibiotic use in livestock can limit the inclusion of antibiotics in some milk replacers. While these regulations aim to prevent antibiotic resistance, a crucial public health concern, they can also make disease prevention in calves more challenging for farmers. Balancing these regulations with effective calf health management requires ongoing dialogue within the industry.

The Europe Milk Replacers Market Opportunities:

The European milk replacers market offers exciting opportunities for those who can capitalize on evolving trends. A growing focus on animal health creates a demand for milk replacers fortified with functional ingredients like probiotics and immunity boosters. These enhanced formulas can improve gut health, disease resistance, and overall calf development, appealing to farmers seeking to optimize herd health. Additionally, leveraging e-commerce platforms can be a game-changer for manufacturers, allowing them to reach geographically dispersed or underserved markets. Farmers can benefit from convenient access to a wider range of milk replacers and technical information online.

Sustainability is another key opportunity. Manufacturers can develop milk replacers made with eco-friendly ingredients and utilize sustainable production practices. This aligns perfectly with the growing demand for environmentally responsible products within Europe. Highlighting these sustainable practices can attract both environmentally conscious farmers and consumers. Furthermore, the organic food market's rise presents an opportunity for organic milk replacers catering to farmers raising organic calves. Specialty milk replacers formulated for specific breeds or addressing unique calf health needs can also be a lucrative niche market. Finally, strategic partnerships between milk replacer manufacturers, nutritionists, animal health experts, and research institutions can lead to the development of innovative and targeted milk replacer solutions, further propelling market growth.

EUROPE MILK REPLACERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.4% |

|

Segments Covered |

By Type, livestock, source, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Royal DSM, Cargill, Land O'Lakes, Nutreco N.V., Glanbia, Plc, VanDrie Group, FrieslandCampina |

The Europe Milk Replacers Market Segmentation:

Europe Milk Replacers Market Segmentation: By Type:

- Medicated Milk Replacers

- Non-Medicated Milk Replacers

The European milk replacers market is segmented by type, with non-medicated milk replacers currently dominating the market. These cater to healthy calves by providing essential nutrients for growth. However, medicated milk replacers are showing the fastest growth due to increasing concerns about animal welfare and disease prevention. Farmers are recognizing the value of medicated options for preventing illnesses in young calves.

Europe Milk Replacers Market Segmentation: By Livestock:

- Ruminants

- Swine

The European milk replacers market is segmented by livestock, with the dominant segment being ruminants (calves). Milk replacers are primarily used for orphaned or early-weaned calves in dairy production. Data on the fastest-growing segment is not readily available, but potential contenders include medicated milk replacers due to rising disease prevention concerns, or non-milk-based replacers driven by the plant-based protein trend.

Europe Milk Replacers Market Segmentation: By Source:

- Milk-Based Milk Replacers

- Non-Milk-Based Milk Replacers

- Blended Milk Replacers

Milk-based milk replacers, formulated using milk byproducts, dominate the European market due to their cost-effectiveness and ready availability. However, non-milk-based milk replacers are the fastest-growing segment, driven by concerns about animal-derived products and the rising demand for plant-based alternatives. This segment caters to environmentally conscious consumers and farmers seeking alternatives to traditional milk replacers.

Europe Milk Replacers Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The United Kingdom presents a significant market for milk replacers due to its well-established dairy industry and focus on efficient livestock rearing. Rising demand for meat products fuels the need for milk replacers to raise calves. Furthermore, growing awareness of animal welfare and regulations around proper calf nutrition further drive market growth in the UK.

Germany boasts a robust agricultural sector, with a strong dairy industry that utilizes milk replacers extensively. German farmers are increasingly adopting innovative milk replacer formulations with functional ingredients to optimize calf health and herd performance. Strict regulations on animal welfare and antibiotic use in livestock also shape the German milk replacers market.

France is another major player in the European dairy industry, and the milk replacers market reflects this strength. French farmers utilize milk replacers for efficient calf rearing and are receptive to advancements in milk replacer formulations that enhance calf development and disease resistance. Sustainability concerns are gaining traction in France, potentially influencing the demand for eco-friendly milk replacers in the future.

COVID-19 Impact Analysis on the Europe Milk Replacers Market:

The COVID-19 pandemic's impact on the European milk replacers market has been a mixed bag. Initial disruptions due to lockdowns and border restrictions caused temporary shortages and price fluctuations in the supply chain for milk replacer ingredients and finished products. Additionally, dips in meat consumption during the pandemic may have led to a decrease in demand for milk replacers used for raising calves for meat production.

However, there are also long-term opportunities. The pandemic's focus on biosecurity in livestock farming could lead to increased adoption of milk replacers as a way to reduce disease transmission between calves and mothers. While a potential rise in plant-based meat consumption could impact traditional milk replacers, this could be balanced by growth in the non-milk-based milk replacer segment.

Latest Trends/ Developments:

The European milk replacers market is pulsating with innovation and a growing emphasis on sustainability. Gone are the days of a one-size-fits-all approach. Milk replacers are now being meticulously formulated with "precision nutrition" in mind. Researchers are developing specialized formulas tailored to the specific needs of different breeds, addressing unique calf health challenges and optimizing growth. This targeted approach to calf nutrition is being fueled by advancements in research, opening doors for even more effective solutions. Sustainability is also taking center stage. Manufacturers are increasingly using eco-friendly ingredients and incorporating sustainable practices throughout the production process. This aligns perfectly with the growing demand for environmentally responsible products within the European market. Technology is another driving force. Emerging tools like near-infrared (NIR) spectroscopy are being employed for on-site analysis of milk replacer ingredients, ensuring consistent quality control and product safety. Finally, collaboration is key. Partnerships between milk replacer manufacturers, nutritionists, animal health experts, and research institutions are fostering a dynamic environment of innovation. This collaborative spirit is leading to the development of even more targeted and effective milk replacer solutions, ensuring the continued health and well-being of calves across Europe.

Key Players:

- Royal DSM

- Cargill

- Land O'Lakes

- Nutreco N.V.

- Glanbia, Plc

- VanDrie Group

- FrieslandCampina

Chapter 1. Europe Milk Replacers Market Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Milk Replacers Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Milk Replacers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Milk Replacers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Milk Replacers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Milk Replacers Market– By Type

6.1. Introduction/Key Findings

6.2. Medicated Milk Replacers

6.3. Non-Medicated Milk Replacers

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Europe Milk Replacers Market– By Livestock

7.1. Introduction/Key Findings

7.2 Ruminants

7.3. Swine

7.4. Y-O-Y Growth trend Analysis By Livestock

7.5. Absolute $ Opportunity Analysis By Livestock , 2024-2030

Chapter 8. Europe Milk Replacers Market– By Source

8.1. Introduction/Key Findings

8.2. Milk-Based Milk Replacers

8.3. Non-Milk-Based Milk Replacers

8.4. Blended Milk Replacers

8.5. Y-O-Y Growth trend Analysis Source

8.6. Absolute $ Opportunity Analysis Source , 2024-2030

Chapter 9. Europe Milk Replacers Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Type

9.1.3. By Livestock

9.1.4. By Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Milk Replacers Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Royal DSM

10.2. Cargill

10.3. Land O'Lakes

10.4. Nutreco N.V.

10.5. Glanbia, Plc

10.6. VanDrie Group

10.7. FrieslandCampina

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Europe Milk Replacers Market was valued at USD 2.66 billion in 2023 and is projected to reach a market size of USD 4.99 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 9.4%.

Surging Demand for Meat Products, Compelling Value Proposition for Farmers, Heightened Focus on Animal Welfare, and Evolving Market Landscape foster innovation

Milk-Based Milk Replacers, Non-Milk-Based Milk Replacers, Blended Milk Replacers.

Major dairy industries like Germany, France, and the UK are likely the strongest contenders in the European milk replacers market due to their established agricultural sectors and focus on efficient livestock rearing.

Royal DSM, Cargill, Land O'Lakes, Nutreco N.V., Glanbia, Plc, VanDrie Group, FrieslandCampina.