Europe Methanol Market Size (2024-2030)

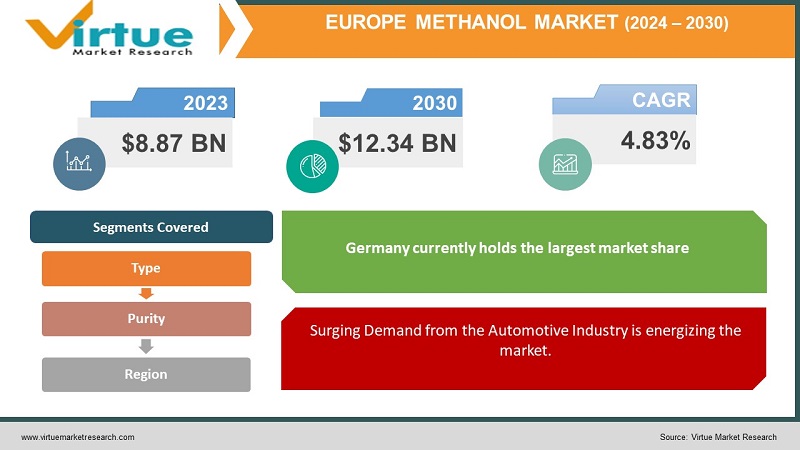

The Europe Methanol Market was valued at USD 8.87 Billion in 2023 and is projected to reach a market size of USD 12.34 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.83%.

Europe is a major methanol producer and consumer. While it represents a smaller market share compared to the Asia-Pacific, it plays a pivotal role in the global methanol trade. European methanol production is concentrated in nations like the Netherlands, Germany, and Russia, with significant facilities also located in Scandinavia and Central Europe. Chemical industries within Germany, France, Belgium, and the Netherlands drive significant methanol demand within Europe. The production of formaldehyde, a vital resin used in construction materials, adhesives, and coatings, is the single largest use of methanol globally and within Europe. Methanol is blended with gasoline in some regions as an octane booster or to meet oxygenate requirements. Methanol serves as a key feedstock for the production of MTBE (a gasoline additive), biodiesel (through transesterification), and DME (dimethyl ether, a potential diesel alternative). Methanol is gaining attention as a lower-emission fuel for the shipping industry to meet stricter environmental regulations.

Key Market Insights:

Europe is a significant methanol producer, primarily using natural gas as the feedstock. However, there's growing interest in renewable methanol production. The majority of methanol is utilized as a chemical intermediate in the production of formaldehyde, acetic acid, MTBE (a gasoline additive), and other downstream chemicals. Europe is both an importer and exporter of methanol. Trade flows fluctuate based on regional supply-demand dynamics and global pricing. The chemical industry, construction sector (formaldehyde-based resins), and energy sector (biodiesel and fuel applications) are major methanol consumers in Europe. Currently, most European methanol production relies on natural gas. However, geopolitical volatility and pricing fluctuations create uncertainty. Policies supporting a circular economy and reduced carbon footprint drive investment in methanol made from biomass, industrial waste, or captured CO2. The single largest use of methanol is in formaldehyde production, which is then vital for resins used in construction, textiles, and wood products. Europe's construction industry significantly impacts methanol demand. Economic downturns or shifts in material trends can influence the market. Methanol is used in biodiesel production and as a fuel additive. European policies on renewable fuels and decarbonization impact this demand segment. Growing interest in methanol as a cleaner-burning marine fuel, particularly for shorter routes or specialized vessels. Combining renewable methanol with green hydrogen opens a path toward synthetic fuels, creating new market opportunities. Europe relies on methanol imports from regions like the Middle East and North America. Diversification of supply is an ongoing concern.

Europe Methanol Market Drivers:

Surging Demand from the Automotive Industry is energizing the market.

The automotive industry has emerged as a significant consumer of methanol in Europe, driven by the region's commitment to reducing greenhouse gas emissions and transitioning towards a more sustainable future. Methanol has gained traction as a promising alternative fuel, offering a cleaner and more environmentally friendly option compared to traditional fossil fuels. The European Union's stringent emission regulations and ambitious targets for decarbonization have propelled automakers to explore alternative fuel sources. Methanol, with its high-octane rating and low carbon footprint, has become an attractive choice for fuel blending and as a potential replacement for gasoline and diesel. Moreover, the development of advanced methanol-based fuel cells has opened up new avenues for the automotive industry. Methanol fuel cells offer several advantages, including higher energy density, lower operating temperatures, and improved efficiency compared to traditional hydrogen fuel cells. This technology holds immense potential for electric vehicles, further fueling the demand for methanol in the region.

The creation of formaldehyde is the main motive. Reels based on formaldehyde are necessary for a variety of applications, including wood products, automobile parts, and buildings.

Methanol is a fundamental feedstock for various chemical processes. Its demand is intrinsically linked to the health and growth of downstream industries. The largest single driver is formaldehyde production. Formaldehyde-based resins are essential in construction, wood products, automotive components, and more. Thus, any shift in these sectors influences methanol demand. Methanol is used in the production of acetic acid – a versatile chemical with applications in paints, adhesives, plastics, and food additives. Reliance on a few downstream products creates vulnerability. Expanding methanol use in emerging sectors like bioplastics or energy storage helps mitigate market risk. Methanol is gaining traction as a marine fuel, especially for short-sea shipping. Stricter environmental regulations for the shipping industry support this trend. The potential for carbon-neutral methanol from renewable sources or carbon capture creates a path to a more sustainable fuel. Interest is growing in using methanol as a way to store and transport green hydrogen, playing a part in the developing European hydrogen economy.

Europe Methanol Market Restraints and Challenges:

Most European methanol relies on natural gas. Price fluctuations and supply disruptions directly impact production costs and market stability.

European reliance on imported natural gas creates vulnerability to global geopolitical instability that impacts gas prices and supply. While promising, renewable methanol production (from biomass, CO2, etc.) often has higher upfront costs compared to traditional methods. Research into less methanol-intensive formaldehyde processes or bio-based alternatives creates long-term market uncertainty. Trends toward lower formaldehyde-emitting building materials or alternative construction methods could reduce methanol demand over time. Even 'green methanol' has a carbon footprint during production. Stricter decarbonization targets could influence methanol's long-term position. REACH and other European chemical regulations can evolve, potentially impacting methanol classification, handling, or permissible uses. Methanol is toxic, requiring strict handling and labeling. Negative publicity around accidental exposure amplifies public concerns. Exaggerated claims about methanol's dangers, especially in consumer-facing products, can erode public acceptance. Clear communication is needed to distinguish renewable methanol from its fossil-derived counterpart in the public eye. Periods of global overcapacity in methanol production can lead to price volatility, impacting producers' profitability.

Europe Methanol Market Opportunities:

Europe's stringent climate goals and the decarbonization of chemical and fuel sectors create a significant demand driver for renewable methanol. Capturing CO2 and converting it into methanol offers a circular economy solution. Combining renewable hydrogen with captured CO2 for methanol synthesis opens pathways to synthetic fuels. While promising, renewable methanol needs to overcome production cost hurdles to compete with traditional fossil fuel-derived methanol. Compared to heavy fuel oil, methanol burns cleaner with fewer emissions. It's relatively easy to store and handle compared to some other alternative fuels. Widespread adoption requires investment in methanol bunkering facilities at major ports and the retrofitting or building of methanol-compatible vessels. European shipyards and technology providers can become pioneers in methanol-fueled ship design, driving export potential. Methanol's potential extends to being an energy carrier and storage medium within a future renewable energy system. Excess electricity from solar or wind power can be used to produce green methanol via electrolysis and CO2 capture, storing renewable energy chemically. Methanol can be used directly in specialized fuel cells for electricity generation, offering a cleaner alternative to diesel generators.

EUROPE METHANOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.83% |

|

Segments Covered |

By Type, Purity, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Methanex Corporation, OCI N.V., BASF, Proma, Helm AG, INEOS, AkzoNobel |

Europe Methanol Market Segmentation:

Europe Methanol Market Segmentation: By Type

- Natural Gas-Based Methanol

- Renewable Methanol

- Coal-Based Methanol

Natural Gas-Based Methanol is the dominant production method that involves steam-methane reforming, where natural gas reacts with steam under high temperatures, producing synthesis gas (a mix of hydrogen and carbon oxides), which is then converted into methanol. Estimated to hold roughly 75-85% of the current European methanol market. Renewable Methanol encompasses a variety of sustainable feedstocks and production pathways, each with its potential and challenges. Includes agricultural waste (like straw), forestry residues, dedicated energy crops, and municipal organic waste. Utilizes industrial waste streams (emissions, CO2), black liquor from paper mills, or municipal solid waste as feedstock. A growing but smaller segment, roughly 10-20% share. The potential for major expansion is dependent on policy support and technological breakthroughs. Coal-Based Methanol involves coal gasification followed by methanol synthesis. On the decline in Europe, estimated to hold a small share (<5%). Can utilize abundant coal resources in some regions. Natural gas-based methanol currently holds the largest share of the European market. Renewable methanol, driven by policies and sustainability targets, has the greatest potential for rapid expansion in the coming years.

Europe Methanol Market Segmentation: By Purity

- AA Grade (High Purity Methanol)

- A Grade (Industrial Grade Methanol)

- Fuel Grade Methanol

AA Grade (High Purity Methanol) Typically exceeds 99.85% methanol content, with minimal impurities. Used where trace impurities could interfere with chemical reactions or product quality, such as in pharmaceuticals, fine chemicals, or electronics. Employed as a solvent or reagent in sensitive laboratory applications. Represents a smaller, specialized segment of the overall methanol market. Estimates place it at around 15-20%. A Grade (Industrial Grade Methanol) slightly lower purity range compared to AA grade, usually around 99.5%. This versatile grade dominates the majority of industrial methanol applications. Formaldehyde Production is the primary use case, which then feeds into downstream resins and chemicals. The dominant segment is estimated to hold roughly 65-75% of the European methanol market. Fuel Grade Methanol: Less stringent specifications compared to A and AA grades. Impurity levels may be higher, but it must meet specific fuel-blending requirements. Gasoline Blending may still be permitted in limited amounts in some regions, though its use is declining. Marine Fuel is a growing use case, particularly in short-haul ferries and specialized vessels. A smaller but rapidly growing segment, currently estimated at around 5-10% of the market. Grade A methanol holds the largest market share due to its wide range of industrial applications. Fuel-grade methanol is experiencing the most significant growth trajectory, driven by decarbonization efforts in the transportation sector and its increasing use in marine fuels.

Europe Methanol Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

With almost 12% of the European methanol market, the United Kingdom commands a substantial market share. The UK's robust manufacturing sector and substantial presence in the chemical and petrochemical industries fuel demand for methanol. With about 18% of the European methanol market, Germany is a significant player in the industry. Germany is a global leader in manufacturing and a center of the chemical industry. Its demand for methanol comes from a variety of uses, such as the creation of formaldehyde, solvents, and fuel additives. France holds a 14% market share in methanol throughout Europe. The need for methanol is fueled by the French petrochemical and chemical industries as well as the nation's emphasis on renewable energy sources. Two of the biggest companies in the French market are Total and Air Liquide. Italy’s share of the European methanol market is approximately 10%. Methanol demand is mostly driven by the Italian industrial sector, which includes the production of adhesives, paints, and coatings. Spain: Spain's share of the European methanol market is about 8%. The need for methanol is fueled in part by Spain's emphasis on renewable energy sources and its chemical and petrochemical sectors. Three of the biggest companies in the Spanish market are Repsol, Cepsa, and Solvay. Europe's other nations, referred to as the "Rest of Europe," make up roughly 38% of the continent's total methanol market share. This section covers several nations, including the Netherlands, Belgium, Poland, Sweden, and Switzerland.

COVID-19 Impact Analysis on the Europe Methanol Market:

Logistics and transport faced challenges. Border restrictions and labor shortages impacted the movement of methanol, particularly imports. Volatility in natural gas prices (a major feedstock) led to unpredictable methanol pricing. There was a surge in demand for methanol-based sanitizers and disinfectants, partially offsetting losses in other sectors. While overall fuel demand plummeted, the proportion of biofuels and methanol blends potentially increased slightly in some regions. Methanol's use as a precursor in pharmaceuticals or medical supplies may have experienced increased demand. The pandemic spurred greater adoption of digital tools for supply chain monitoring and predictive analytics within the methanol industry. The pandemic underscored the need for decarbonization, amplifying interest in renewable methanol as a potential contributor to future sustainable economies. While rebounding, the rate of construction industry recovery in various parts of Europe impacts methanol demand for formaldehyde.

Latest Trends/ Developments:

Lowering dependency on fossil fuels by using methanol as a feedstock for biodegradable polymers or plastics. Unique features of specialty methanol-based solvents may find applications in pharmaceuticals, electronics, or clean energy technologies. For specialized applications, decentralized, modular methanol production systems with collected CO2 or localized biowaste provide flexibility. The EU's aggressive climate targets and programs such as 'Fit For 55' have a direct impact on the methanol industry, providing a preference for renewable alternatives. The cost-competitiveness of conventional methanol will decline with higher carbon taxes or emissions trading systems, encouraging the use of renewable energy sources. The industry is growing due to stricter shipping emissions restrictions and possible methanol inclusion in mandates for renewable fuel blending and using methanol as a feedstock for biodegradable plastics or polymers, reduces reliance on fossil fuels. Specialty methanol-based solvents with unique properties could find use in electronics, clean energy technologies, or pharmaceuticals. Decentralized, modular methanol production units using localized biowaste or captured CO2 offer flexibility for niche applications. EU's ambitious climate goals and initiatives like 'Fit For 55' directly influence the methanol market, favoring renewable alternatives. Increasing carbon taxes or emissions trading systems will make conventional methanol less cost-competitive, incentivizing renewable options. Stricter emissions regulations for shipping and the potential inclusion of methanol in renewable fuel blending mandates drive market growth.

Key Players:

- Methanex Corporation

- OCI N.V.

- BASF

- Proma

- Helm AG

- INEOS

- AkzoNobel

Chapter 1. Europe Methanol Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Methanol Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Methanol Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Methanol Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Methanol Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Methanol Market– By Type

6.1. Introduction/Key Findings

6.2. Natural Gas-Based Methanol

6.3. Renewable Methanol

6.4. Coal-Based Methanol

6.5. Warehouse Management Systems (WMS) & Warehouse Control Systems (WCS)

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Methanol Market– By Purity

7.1. Introduction/Key Findings

7.2 AA Grade (High Purity Methanol)

7.3. A Grade (Industrial Grade Methanol)

7.4. Fuel Grade Methanol

7.5. Y-O-Y Growth trend Analysis By Purity

7.6. Absolute $ Opportunity Analysis By Purity , 2024-2030

Chapter 8. Europe Methanol Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Purity

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Methanol Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Methanex Corporation

9.2. OCI N.V.

9.3. BASF

9.4. Proma

9.5. Helm AG

9.6. INEOS

9.7 AkzoNobel

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Europe's ambitious climate goals and initiatives like the 'Green Deal' push industries to reduce emissions, driving demand for renewable methanol derived from biomass, waste, or green hydrogen.

Traditional methanol heavily relies on natural gas, exposing the market to price volatility and geopolitical risks surrounding gas supplies

Methanex Corporation, OCI N.V., BASF, Proma, Helm AG, INEOS

AkzoNobel.

Germany currently holds the largest market share, estimated at around 18%.

Several nations in Eastern Europe, like Poland, Hungary, Romania, etc., are experiencing economic expansion. This generally translates to increasing disposable incomes and evolving consumption patterns.