Europe Masterbatch Market Size (2024-2030)

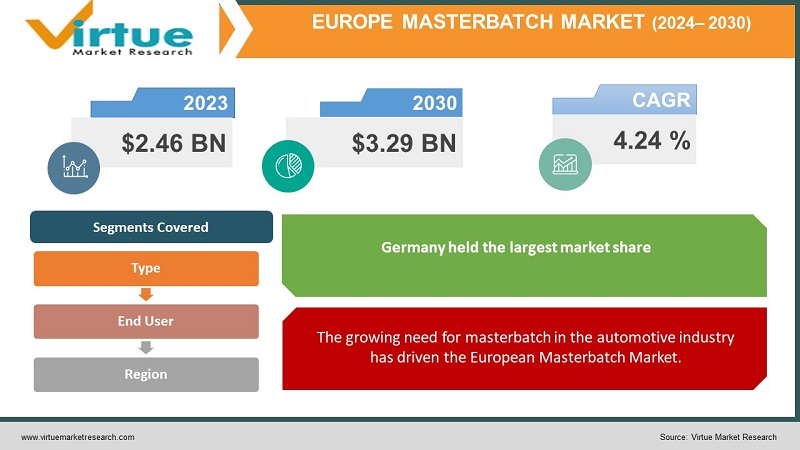

The Europe Masterbatch Market was valued at USD 2.46 Billion and is projected to reach a market size of USD 3.29 Billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4.24 % between 2024 and 2030.

Masterbatch, a highly concentrated mixture of pigments or compounds enclosed in a carrier resin, is critical to the coloration and enhancement of plastic characteristics. The masterbatch sector thrives in Europe, which is known for its technological developments and inventive solutions, thanks to market-leading raw materials and innovative equipment, making it a prominent global player. Furthermore, Europe's tough environmental regulations, which aim to reduce plastic waste and promote sustainability, have encouraged the creation and widespread use of sustainable and recyclable masterbatches. For example, the increasing acceptance of PP (polypropylene) Masterbatch, which is known for its capacity for recycling and eco-friendliness, demonstrates the region's persistent commitment to a greener future. The Masterbatch industry is built on research and development, with ongoing attempts to innovate and improve masterbatches' quality driving market growth. Furthermore, emerging trends such as the use of high-performance pigments and the introduction of smart masterbatches with color-changing properties based on temperature or light conditions are poised to transform the market landscape, creating new possibilities and opportunities for both manufacturers and end users.

Key Market Insights:

Masterbatch, a concentrated blend of pigments or additives enclosed in a carrier resin, has a wide range of industrial applications. Its adaptability and functionality have made it a popular option for a variety of production operations. However, growing usage means increased scrutiny and the requirement for regulatory compliance. To maintain environmental sustainability and public safety, regulatory authorities have imposed strict limitations on the manufacture and usage of Masterbatch. For example, in response to increased concern over plastic packaging waste, the European Union has set ambitious targets for reducing it by 2030. Compliance with these requirements requires not just conforming to particular limitations and standards, but also incorporating more sustainable methods into the manufacturing process. This includes employing bio-based or recyclable materials, reducing waste, and implementing effective recycling procedures. The demand for regulatory compliance has caused rippling effects throughout the Masterbatch sector. Manufacturers are now focusing not just on regulatory compliance, but also on meeting consumer demands for sustainable and eco-friendly products. This tendency has created new opportunities for innovation and development in the industry.

One such example is the increased demand for bio-based Masterbatch. This allows businesses to investigate and develop innovative products made from renewable resources, reducing reliance on fossil fuels and limiting environmental impact. Manufacturers who embrace the sustainability movement can not only meet regulatory requirements but also tap into a growing market segment of environmentally conscious consumers. Manufacturers who embrace this shift towards sustainability can not only meet their legal duties but also tap into a growing market sector of environmentally conscious consumers.

European Masterbatch Market Drivers:

The growing need for masterbatch in the automotive industry has driven the European Masterbatch Market.

The automotive industry relies significantly on Masterbatch, a concentrated blend of pigments or additives contained in a carrier resin, for a variety of applications. In addition to delivering brilliant colors, Masterbatch improves mechanical characteristics and provides critical UV stability to plastic components used in cars. This need is supported by the industry's quest for lightweight materials to improve fuel efficiency and minimize carbon emissions, which is exacerbated by tight CO2 emission rules in the European Union. Innovation in the Masterbatch industry has resulted in the creation of new formulations with superior heat resistance, durability, and visual appeal, which suit the demanding conditions encountered by automobile components. The increased popularity of biodegradable and recyclable Masterbatch alternatives demonstrates Europe's commitment to sustainability, which aligns with the automobile industry's desire for sustainable practices. As the automobile industry advances, the Masterbatch market will adapt to suit shifting demands and capitalize on new opportunities.

The growing need for masterbatch in the construction industry has driven the market.

Masterbatch, a powerful blend of pigments or ingredients encased in a carrier resin, has become fundamental in the construction industry, providing vibrant colors, enhancing mechanical properties, and ensuring critical UV stability for plastic materials used in a variety of construction applications. Plastics have developed as an essential component in modern construction due to their excellent durability, adaptability, and cost-effectiveness, with uses including pipelines, insulation, flooring, roofing, and window frames. As a result, the use of Masterbatch has increased dramatically because it considerably increases the value of these plastic components. Innovation continues to drive the Masterbatch market forward in the construction domain, with manufacturers constantly developing advanced formulations with superior heat resistance, increased durability, and enhanced aesthetic appeal, all of which are critical characteristics in construction materials expected to withstand harsh conditions for extended periods. In summary, the growing demand for Masterbatch in construction serves as a primary driver for the Europe Masterbatch market, which is well-positioned to adapt and capitalize on future opportunities as the building sector evolves toward sustainability. As breakthroughs and innovations continue, Masterbatch is poised to maintain its critical role in determining the future landscape of construction materials.

European Masterbatch Market Restraints and Challenges:

Masterbatch production is strongly reliant on the availability and cost of raw materials, specifically pigments, additives, and polymers, all of which are affected by the volatile variations in crude oil prices. This volatility has a direct impact on production costs, causing a ripple effect throughout the market. As a result, masterbatch manufacturers confront major hurdles in reacting to these changes, which frequently necessitate alterations in production tactics to preserve profitability in the face of demand variability. Striking a careful balance between cost management and product quality becomes increasingly important, particularly in today's intensely competitive market situation. To thrive in such an environment, manufacturers must remain vigilant, constantly monitoring raw material availability and costs while also innovating and optimizing production processes to increase efficiency and reduce costs, allowing them to maintain a strong foothold in the industry despite market volatility.

European Masterbatch Market Opportunities:

Biodegradable masterbatch is finding new applications in daily consumer items, particularly in food packaging. In the packaging sector, an additive masterbatch is combined with bio-based resins made from soybean, wood pulp, sugarcane, coffee, castor, plant seeds, and corn. The trash disposal of petroleum-based carrier polymers in conventional masterbatch is a substantial challenge. It takes several hundred years for conventional polymers to degrade. When producing food plastics, use a masterbatch that is compliant with US FDA requirements. Due to rigorous regulations and demand from Europe, the packaging industry's masterbatch market will have an opportunity.

EUROPE MASTERBATCH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Germany, UK, France, Italy, Spain, Rest of Europe |

|

Schulman GmbH, PolyOne Luxembourg Sarl, PolyPlast Muller GmbH, Clariant SE, Plastika Kritis S.A., Ampacet Europe S.A., Cabot Corporation |

European Masterbatch Market Segmentation:

European Masterbatch Market Segmentation By Type:

- White

- Black

- Additive

- Color

The Europe Masterbatch Market Segmented by Type, Black held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Black Masterbatch has approximately 50% black pigment component, making it extremely effective in giving color and opacity to plastics. This high pigment concentration results in a rich and continuous black hue, even in thin plastic pieces. Furthermore, it is less expensive than other color masterbatches, making it an appealing choice for producers trying to cut expenses without sacrificing quality. Furthermore, black Masterbatch improves the mechanical qualities of polymers in addition to adding color. It provides great UV protection, insulating the plastic from damaging sunlight and avoiding degradation. It also provides electrical conductivity, making it appropriate for applications that require static electricity regulation. Furthermore, black Masterbatch increases tensile strength in polymers, making them more durable and resistant to deformation. These characteristics make black Masterbatch a versatile and desirable alternative for a wide range of applications, including automotive, packaging, electronics, and construction industries, boosting demand.

European Masterbatch Market Segmentation By End User:

- Packaging

- Building & Construction

- Consumer Goods

- Automotive

- Textile

- Others

The Europe Masterbatch Market Segmented by End User, Packaging held the largest market share last year and is poised to maintain its dominance throughout the forecast period. As consumer product manufacturing increases, there is a greater need for effective and economical packaging solutions. Masterbatches, which can improve the visual appeal and functionality of plastic packaging, are in high demand. In today's extremely competitive consumer products industry, product differentiation is critical for attracting customers and promoting brand identification. Unique and visually appealing packaging has become an important aspect of influencing customer decisions. Masterbatches, with their diverse spectrum of brilliant colours and extraordinary effects, enable producers to create unique and eye-catching packaging designs. This, in turn, leads to greater usage in the packaging sector. Furthermore, tight regulatory regulations in Europe for packaging and waste management have increased demand for environmentally friendly and recyclable packaging solutions. Masterbatches help to achieve these standards by increasing plastic recyclability and lowering environmental impact. By integrating masterbatch additives into plastic packaging, producers can improve their products' overall sustainability profile while also assuring regulatory compliance.

European Masterbatch Market Segmentation By Region:

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

The Europe Masterbatch Market Segmented by Region, Germany held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Germany has long been considered a global leader in innovative manufacturing. The country's industrial industry is well-known for its high levels of innovation and technological complexity, establishing a standard for others to follow. This reputation extends to the Masterbatch business, where German producers have garnered recognition for their excellent capacity to produce high-quality goods that meet a wide range of customer requirements. Another important aspect contributing to Germany's prominence in the Masterbatch business is its strong industrial base. The country is home to a variety of industries, including automotive, construction, and electronics, all of which rely significantly on Masterbatch for various purposes. Masterbatch's smooth integration into various industries has not only improved their performance but also aided their growth and success. As these businesses grow and expand, demand for Masterbatch is likely to continuously increase. German producers, with their consistent dedication to excellence and continual innovation, are well-positioned to fulfill rising demand while maintaining their global Masterbatch market leadership. Their ability to react to changing consumer needs and provide tailored solutions strengthens their position as industry leaders.

COVID-19 Impact Analysis on the Europe Masterbatch Market:

The COVID-19 outbreak had a substantial influence on the masterbatches business, with many countries reporting severe effects on both human and industrial activity at the start of 2020. This caused interruptions in the masterbatch production process and manufacturing, as temporary halts in production across numerous end-use industries resulted in lower demand for masterbatch applications. Colour masterbatch, which is widely used in packaging, automobile parts, consumer goods, and other products, saw a fall in demand, along with other types of masterbatch, as demand for finished goods fell. However, the market began to rebound in early 2021 as industries returned to full capacity, fuelling demand for masterbatch across a wide range of applications.

Latest Trends/ Developments:

In November 2023, Milan-based investment firm Koinos Capital formed the Impact Formulators Group by merging two significant Italian companies, Masterbatch S.r.l. and Ultrabatch S.r.l., which specialise in Masterbatch and additive manufacturing. Concurrently, TER Chemicals and Momentive extended their distribution agreement for high-performance polymer modification additives across all European countries, except Iberia and the United Kingdom, to provide customers with multifunctional masterbatches, anti-block agents, light diffusers, crosslinkers, and coupling agents. This collaboration aims to provide effective solutions for improving product performance and addressing diverse processing problems. Furthermore, in May 2023, Tosaf Colour Service introduced a new masterbatch carrier system that meets stringent food contact standards set by the German Federal Institute for Risk Assessment (BfR), the Food and Drug Administration (FDA) in the United States, and China's Food Safety Law, demonstrating a commitment to regulatory compliance and product quality.

Key Players:

- Schulman GmbH

- PolyOne Luxembourg Sarl

- PolyPlast Muller GmbH

- Clariant SE

- Plastika Kritis S.A.

- Ampacet Europe S.A.

- Cabot Corporation

Chapter 1. Europe Masterbatch Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type of Material s

1.5. Secondary Product Type of Material s

Chapter 2. Europe Masterbatch Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Masterbatch Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Masterbatch Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Masterbatch Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Masterbatch Market– By Type

6.1. Introduction/Key Findings

6.2. White

6.3. Black

6.4. Additive

6.5. Color

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Masterbatch Market– By End User

7.1. Introduction/Key Findings

7.2 Packaging

7.3. Building & Construction

7.4. Consumer Goods

7.5. Automotive

7.6. Textile

7.7. Others

7.8. Y-O-Y Growth trend Analysis By End User

7.9. Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 8. Europe Masterbatch Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By End User

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Masterbatch Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Schulman GmbH

9.2. PolyOne Luxembourg Sarl

9.3. PolyPlast Muller GmbH

9.4. Clariant SE

9.5. Plastika Kritis S.A.

9.6. Ampacet Europe S.A.

9.7. Cabot Corporation

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Masterbatch Market was valued at USD 2.46 Billion and is projected to reach a market size of USD 3.29 Billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4.24 % between 2024 and 2030.

The market is expected to reach USD 3.289 Billion by 2030.

By 2023, the market is expected to be valued at USD 2.46 Billion.

Germany dominates the European Masterbatch market

The Packaging sector drives the European Masterbatch market.