Europe Liquid Fertilizers Market Size (2024-2030)

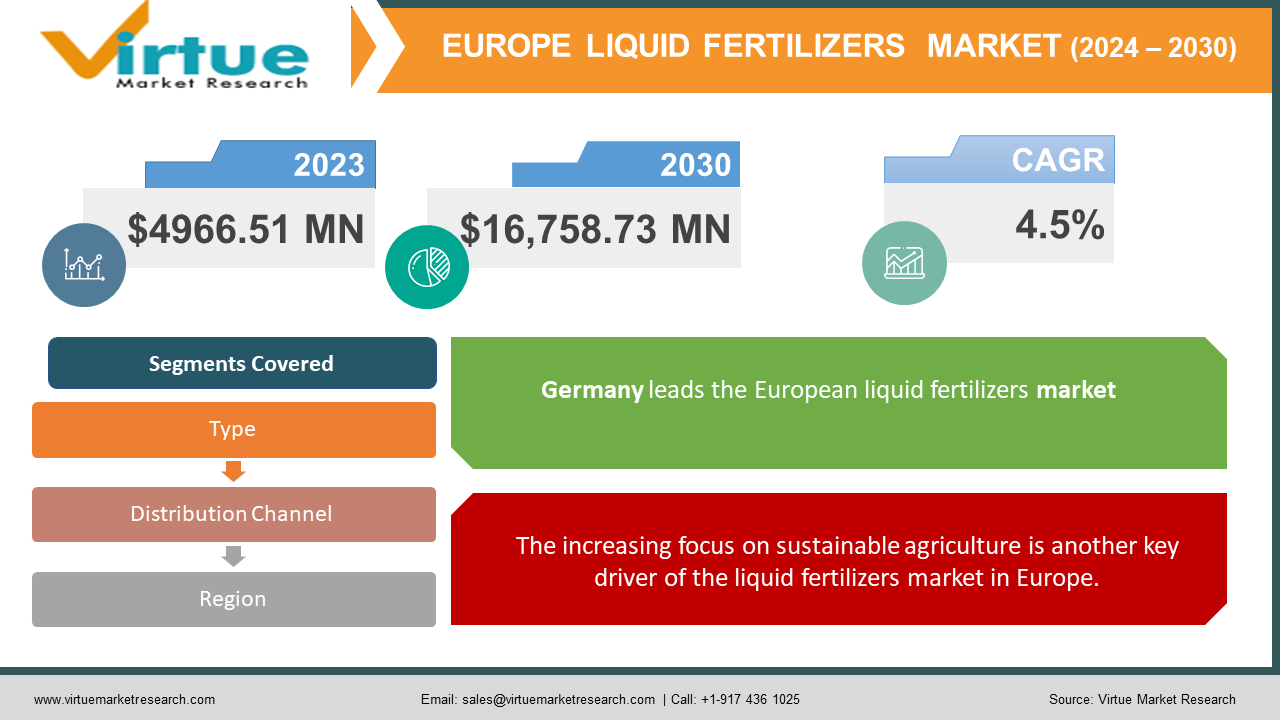

The Europe Liquid Fertilizers Market was valued at USD 4966.51 Million in 2023 and is projected to reach a market size of USD 6,758.73 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

Growing demand for effective and efficient farming methods is driving a significant expansion in the European liquid fertilizer industry. Compared to granular fertilizers, liquid fertilizers provide a number of benefits, such as faster plant absorption, simplicity of administration, and combination compatibility with other nutrients and insecticides. In Europe, where agriculture is still a crucial industry, these considerations have contributed to its increasing popularity. A large user of liquid fertilizers is Europe, with its varied agricultural industry. Many small and major companies that offer a variety of liquid fertilizer products are present on the market, which determines its characteristics. Across the continent, different crops and soil types have varying demands, which is why these products have diverse nutritional compositions.

Key Market Insights:

- The demand for nitrogen-based liquid fertilizers in Europe is expected to reach over 5 million tonnes by 2025, driven by their effectiveness in promoting crop growth.

- The adoption of precision farming practices in Europe is expected to contribute to a 30% increase in the use of liquid fertilizers by 2030, due to their compatibility with data-driven applications.

- Studies suggest that liquid fertilizers can potentially improve nutrient uptake efficiency by 15-20% compared to traditional granular options.

- The use of liquid fertilizers can lead to a 10% reduction in overall fertilizer application rates due to their targeted delivery and minimized waste.

- Over 60% of European farmers acknowledge the potential environmental benefits of liquid fertilizers, particularly in terms of reduced water pollution.

- The market for slow-release liquid fertilizers in Europe is projected to grow at a CAGR exceeding 7% by 2024, driven by their ability to optimize nutrient delivery and minimize leaching.

- Government subsidies and incentives for sustainable agricultural practices in Europe are expected to contribute €2 billion towards the adoption of liquid fertilizers by 2026.

- The rising organic food market in Europe, valued at over €50 billion, presents a potential opportunity for certified organic liquid fertilizer options.

- Western Europe, particularly France, Germany, and the United Kingdom, is the leading consumer of liquid fertilizers in Europe, accounting for over 70% of the market share.

- Eastern Europe is expected to experience the fastest growth rate in liquid fertilizer consumption over the next five years, driven by increasing agricultural productivity efforts.

- The demand for liquid fertilizers for specialty crops such as fruits and vegetables in Europe is projected to grow at a CAGR exceeding 6% by 2025.

- The average application rate of liquid fertilizers in Europe is currently around 100 liters per hectare, with potential for further optimization through precision farming techniques.

Europe Liquid Fertilizers Market Drivers:

Technological advancements in agriculture, particularly in the field of precision farming, are a significant driver of the liquid fertilizers market in Europe.

Farmers may apply fertilizer more precisely and effectively using precision farming, which lowers waste and guarantees that crops get the precise nutrients they require. This technique reduces the negative effects of fertilizer use on the environment while simultaneously increasing agricultural yields. Because liquid fertilizers are so simple to apply and may be combined with other agricultural inputs, they are especially ideal for precision farming. Another technical trend propelling the market is the creation of novel liquid fertilizer formulations that provide improved nutrient availability and absorption. These mixtures are made to give crops a balanced supply of nutrients, enhancing their development and yield. Additionally, developments like controlled- and slow-release liquid fertilizers lessen the need for frequent applications by preserving nutrient availability over an extended period of time.

The increasing focus on sustainable agriculture is another key driver of the liquid fertilizers market in Europe.

Farmers and agricultural businesses in Europe are being compelled by strict environmental restrictions to embrace more sustainable techniques. The goal of these rules is to lessen the negative effects that agricultural practices—including fertilizer use—have on the environment. Granular fertilizers are thought to be less ecologically friendly than liquid fertilizers, especially those that are organic or bio-based. As farmers and consumers become more environmentally concerned, there is an increasing need for liquid fertilizers that are organic and bio-based. These fertilizers are created using natural ingredients and are intended to supply crops with vital nutrients without endangering the environment. They contribute to increased biodiversity, cleaner water, and healthier soil.

Europe Liquid Fertilizers Market Restraints and Challenges:

The high price of these goods is one of the main issues the European market for liquid fertilizers is dealing with. Because of the technologies used in their application and in their production processes, liquid fertilizers are often more expensive than granular fertilizers. Liquid fertilizer manufacture entails intricate procedures requiring cutting-edge machinery and technology. This raises the product's total cost and increases the cost to farmers, particularly small-scale farmers with tight finances. One of the biggest obstacles facing the European liquid fertilizer sector is adhering to strict regulations. In order to guarantee the sustainability and safety of fertilizers, the European Union has put in place a number of laws, some of which can be difficult and expensive to follow.

Europe Liquid Fertilizers Market Opportunities:

There are a lot of potential prospects due to the European emerging countries' growing need for liquid fertilizers. Eastern European nations like Poland and Romania are seeing a rise in modernization and agricultural investments, which is fostering a favorable environment for market development. To increase productivity and guarantee food security, governments and private investors in emerging nations are putting more money into the agricultural sector. The usage of liquid fertilizers is one of the sophisticated agriculture techniques that are being driven by these expenditures. The market for liquid fertilizers is expanding as a result of emerging nations' modernizing agricultural practices. In order to increase food yields and lessen their impact on the environment, farmers in these areas are implementing innovative techniques and technology. The rising demand for sustainable and organic liquid fertilizers represents a lucrative market opportunity. As consumers and farmers become more environmentally conscious, there is a growing demand for products that provide essential nutrients to crops while minimizing environmental impact.

EUROPE LIQUID FERTILIZERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, Germany, France, Italy, Spain, Rest of Europe |

|

BASF SE (Germany), The Mosaic Company (US), Yara International ASA (Norway), Euro Chem Group (Switzerland), K+S Aktiengesellschaft (Germany), Borealis AG (Austria), Fertiberia S.A. (Spain), Grupa Azoty S.A. (Poland), Nutrien Agrosolutions Limited (Canada), COMPO GmbH (Germany), ICL – Israel Chemicals Ltd (Israel), Haifa Group (Israel). |

Europe Liquid Fertilizers Market Segmentation:

Europe Liquid Fertilizers Market Segmentation: By Types:

- Nitrogen-based

- Phosphorus-based

- Potassium-based

- Micronutrients

Nitrogen-based liquid fertilizers are the most dominant type in the market. Nitrogen is a crucial nutrient for plant growth, and its liquid form offers several advantages, including quicker absorption and easier application. These fertilizers are widely used for various crops, including cereals, grains, fruits, and vegetables.

The market's fastest-growing subsegment is micronutrients. Essential trace elements including iron, zinc, and manganese are provided by micronutrient liquid fertilizers. These elements are critical for the growth and development of plants. These fertilizers are intended to support good crop development by addressing particular nutritional deficits in the soil.

Europe Liquid Fertilizers Market Segmentation: By Distribution Channel:

- Supermarkets, hypermarkets and Retail stores

- online platforms

- direct-to-consumer sales

For professional farmers and large-scale agricultural businesses in particular, direct sales continue to be the most common distribution method. Through this channel, manufacturers may offer customized solutions and individualized assistance to fulfill the unique demands of their customers. Liquid fertilizers are mostly distributed through retail establishments, such as garden centers and agricultural supply stores. These shops provide a large selection of goods and knowledgeable guidance to small-scale farmers and hobbyists.

The ease of online purchasing and the abundance of items available have made online platforms the distribution channel with the quickest rate of growth. Customers may make better selections about what to buy by using e-commerce websites and specialist agricultural suppliers that provide thorough product information, user reviews, and competitive price.

Europe Liquid Fertilizers Market Segmentation: Regional Analysis:

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany leads the European liquid fertilizers industry with a dominant 23% of the market. Numerous elements, including government regulations, technical developments, and agricultural traditions profoundly embedded in German culture, are responsible for this domination. High productivity and efficiency are hallmarks of German agriculture, which may be partly attributed to the extensive use of cutting-edge farming technology and methods. With its ability to precisely administer nutrients and increase crop yields, liquid fertilizers are an essential component of any high-performance agriculture system. The advantages of liquid fertilizers, such as their uniform distribution, simplicity of administration, and quick uptake of nutrients by plants, have long been acknowledged by the nation's farmers.

While Spain currently holds a 9% market share in the European liquid fertilizers market, it has emerged as the fastest-growing country in this sector. The Spanish liquid fertilizers market has been experiencing impressive annual growth rates, outpacing its European counterparts and positioning itself as a dynamic player in the industry. Several factors contribute to Spain's rapid growth in the liquid fertilizers sector. Firstly, there has been a significant shift in agricultural practices driven by water scarcity and the need for more efficient resource use. Spain's diverse climate, with many regions experiencing arid or semi-arid conditions, has necessitated the adoption of more precise and water-efficient farming methods. Liquid fertilizers, which can be easily incorporated into irrigation systems for fertigation, align perfectly with this need for water conservation and nutrient efficiency.

COVID-19 Impact Analysis on the Europe Liquid Fertilizers Market:

Disruption of global supply systems was one of the pandemic's most direct effects. Travel restrictions and lockdowns made it difficult to transit commodities, especially the raw ingredients needed to make liquid fertilizer. Important components like potassium, phosphate, and nitrogen—which are frequently imported from nations outside of Europe—were subject to lengthy delays. For European fertilizer makers, this strain on raw material availability means production slowdowns and possible shortages. The domino effect didn't stop there. Disruptions in logistics and transportation further exacerbated the situation. Shortages of shipping containers and rising freight costs have made it more challenging and expensive to move both raw materials and finished liquid fertilizer products across borders and within Europe itself. This not only created uncertainties for manufacturers but also impacted fertilizer availability for farmers who rely on timely deliveries to maintain their crop schedules. The pandemic also casts a shadow of uncertainty on agricultural demand. With restaurants and foodservice establishments facing closures, concerns arise about a potential decline in crop needs. Farmers, accustomed to just-in-time fertilizer supplies, adopted a wait-and-see approach, potentially postponing non-essential fertilizer purchases. This cautious behaviour, coupled with the supply chain disruptions, created a temporary imbalance in the market. Despite the challenges, the pandemic also served as a catalyst for digitalization within the European liquid fertilizer market. With limitations on physical interactions, farmers increasingly turned to online platforms to source their fertilizer needs. E-commerce platforms offering liquid fertilizers witnessed a surge in activity, providing farmers with greater access and potentially more competitive pricing options.

Latest Trends/ Developments:

Compared to their granular equivalents, liquid fertilizers are more quickly and efficiently absorbed by plants. Better crop growth and production potential result from this. European agriculture places a high premium on sustainability, and liquid fertilizers are becoming more and more seen as the environmentally preferable choice. The growing desire for sustainable and healthful food items among consumers in Europe has led to an increase in the use of organic agricultural techniques. Liquid fertilizers with organic and biobased bases are growing in popularity because to this tendency. These fertilizers meet the requirements for organic certification and are made from natural substances like plant extracts and animal dung. The use of nanoparticles in fertilizer formulations allows for even more targeted nutrient delivery, potentially requiring even less fertilizer per application.

Key Players:

-

- BASF SE (Germany)

- The Mosaic Company (US)

- Yara International ASA (Norway)

- Euro Chem Group (Switzerland)

- K+S Aktiengesellschaft (Germany)

- Borealis AG (Austria)

- Fertiberia S.A. (Spain)

- Grupa Azoty S.A. (Poland)

- Nutrien Agrosolutions Limited (Canada)

- COMPO GmbH (Germany)

- ICL – Israel Chemicals Ltd (Israel)

- Haifa Group (Israel)

Chapter 1. Europe Liquid Fertilizers Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Liquid Fertilizers Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Liquid Fertilizers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Liquid Fertilizers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Liquid Fertilizers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Liquid Fertilizers Market– By Type

6.1. Introduction/Key Findings

6.2. Nitrogen-based

6.3. Phosphorus-based

6.4. Potassium-based

6.5. Micronutrients

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Liquid Fertilizers Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets, hypermarkets and Retail stores

7.3. online platforms

7.4. direct-to-consumer sales

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Europe Liquid Fertilizers Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Liquid Fertilizers Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. BASF SE (Germany)

9.2. The Mosaic Company (US)

9.3. Yara International ASA (Norway)

9.4. Euro Chem Group (Switzerland)

9.5. K+S Aktiengesellschaft (Germany)

9.6. Borealis AG (Austria)

9.7. Fertiberia S.A. (Spain)

9.8. Grupa Azoty S.A. (Poland)

9.9. Nutrien Agrosolutions Limited (Canada)

9.10. COMPO GmbH (Germany)

9.11. ICL – Israel Chemicals Ltd (Israel)

9.12. Haifa Group (Israel)

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Liquid fertilizers enable precise application, allowing farmers to deliver nutrients directly to the root zone, minimizing waste and maximizing crop uptake. This targeted approach leads to higher yields and reduces overall fertilizer use.

The European liquid fertilizer market is susceptible to price fluctuations for key raw materials like nitrogen, phosphorus, and potassium. These fluctuations can be influenced by global geopolitical events, supply chain disruptions, and energy costs, impacting fertilizer production costs and ultimately impacting farmer profitability.

BASF SE (Germany), The Mosaic Company (US), Yara International ASA (Norway), Euro Chem Group (Switzerland), K+S Aktiengesellschaft (Germany), Borealis AG (Austria), Fertiberia S.A. (Spain), Grupa Azoty S.A. (Poland), Nutrien Agrosolutions Limited (Canada), COMPO GmbH (Germany), ICL – Israel Chemicals Ltd (Israel), Haifa Group (Israel).

The market is dominated by Germany, which commands a market share of around 23%.

With a market share of about 9%, Spain is the nation that is expanding the quickest