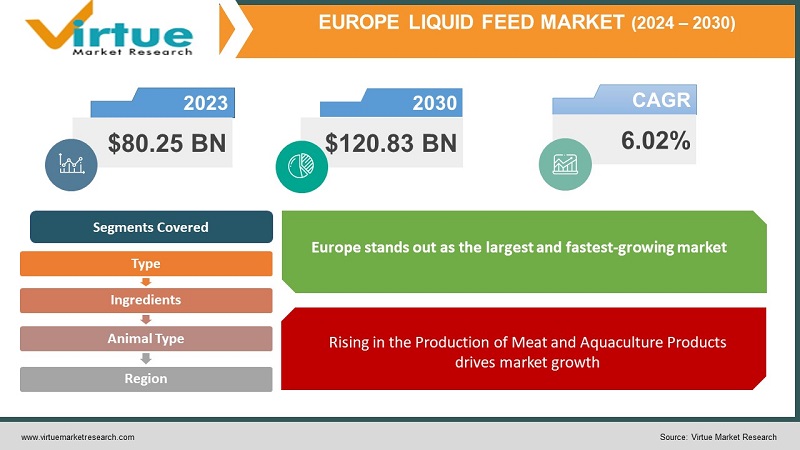

Europe Liquid Feed Market Size (2024-2030)

The Europe Liquid Feed Market was valued at USD 80.25 Billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 120.83 Billion by 2030, growing at a CAGR of 6.02%.

Liquid feed, a residual product derived from various organic sources such as plants and animals, serves as a crucial dietary component for livestock. Comprising essential minerals, proteins, vitamins, and other nutrients, it facilitates digestion and stimulates the appetite of animals. Moreover, it promotes tissue growth and development within the livestock population. Typically integrated as a supplement, liquid feed seamlessly blends with dry feed to provide vital nutrients and energy to cattle. Its versatility extends to various animals including ruminants, swine, aquaculture species, and poultry.

Moreover, the incorporation of liquid feed into livestock diets contributes to heightened dairy and meat production, thereby yielding significant benefits for animal farmers. The burgeoning recognition of liquid feed supplements' advantages in enhancing ruminant animal health and performance, coupled with the imperative for optimizing feed utilization and elevating livestock productivity, emerges as a pivotal factors propelling the expansion of the liquid feed market.

Key Market Insights:

Europe is anticipated to emerge as the second-largest market for liquid-feed supplements, capturing approximately 21.1% of the global market share.

This projection reflects the region's growing demand for meat and meat products, along with an increasing utilization of animal-based commodities. Moreover, the escalation in research and development endeavors within the animal feed industry is poised to present substantial growth prospects for the market in the foreseeable future.

Europe Liquid Feed Market Drivers:

Rising in the Production of Meat and Aquaculture Products drives market growth

The demand for premium-quality meat and meat products, driven by health-conscious consumers, has catalyzed meat production, consequently propelling the liquid feed supplement market. With advantages such as enhanced digestibility in animals, simplified additive incorporation, and fermentation potential, the demand for liquid feed supplements is witnessing rapid growth, facilitating the production of superior-quality meat.

Forecasts suggest a sustained growth trajectory for the liquid feed supplements market, with anticipated increases in both demand and market size. Factors fueling this growth include the expanding population, which drives the demand for animal protein, alongside the imperative for heightened animal productivity and health. Moreover, investments in research and development, coupled with advancements in feed manufacturing technologies, are poised to further bolster market expansion in the forecast period.

It's important to highlight that the liquid feed supplements market is characterized by intense competition, as numerous key players vie for market share with a wide array of product portfolios. These entities actively pursue product innovation, forge strategic partnerships, and engage in mergers and acquisitions to fortify their market presence and broaden their clientele. Additionally, the industry landscape is shaped by a plethora of regulations and policies governing animal welfare, feed quality, and safety, exerting significant influence on market dynamics.

Europe Liquid Feed Market Restraints and Challenges:

Anticipated regulatory interventions and frameworks governing the use of liquid food supplements in ruminants are expected to pose challenges to market expansion in the forecast period. Moreover, the potential loss of synthetic amino acids during storage presents another obstacle to market growth. Additionally, the high ownership costs associated with liquid feed supplements serve as a further deterrent to market advancement.

Europe Liquid Feed Market Opportunities:

Multinational Players Is Likely to Create Significant Opportunities for The Market

Dedication to innovation holds the potential to introduce novel formulations of liquid feed, enriched with essential nutrients and additives. Such advancements not only augment the nutritional content of the feed but also effectively address specific health and performance concerns within livestock populations.

Additionally, the expansive presence of multinational corporations facilitates efficient distribution networks and streamlined supply chains. This, in turn, enhances the accessibility of liquid feed products across diverse regions, thereby benefiting farmers and livestock producers worldwide. The heightened availability of premium liquid feed options can significantly contribute to enhancing animal health, productivity, and ultimately, the quality of derived products such as meat and dairy.

Furthermore, the entrance of multinational entities often stimulates healthy competition within the market. This dynamic fosters an environment where local players are encouraged to enhance their standards and product offerings. As a result, continuous improvement and a heightened focus on customer satisfaction become central tenets, ultimately enriching the experience for end-users.

EUROPE LIQUID FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.02% |

|

Segments Covered |

By Type, Ingrdients, animal type , and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Agridyne LLC, Archer Daniels Midland, Midwest Liquid Feeds, Westway Feed Products, Dallas Keith Ltd, GrainCorp, Cargill Inc, Land O’ Lakes, Bundaberg Molasses, Ridley Corporation |

Europe Liquid Feed Market Segmentation:

Europe Liquid Feed Market Segmentation By Type:

- Proteins

- Minerals

- Vitamins

- Other Types

In the forthcoming years, the minerals segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) within the liquid feed industry. Minerals play a pivotal role as essential micronutrients necessary for numerous physiological functions in ruminant animals. With livestock farmers aiming to enhance animal nutrition and health, there is a growing demand for liquid feed supplements enriched with vital minerals, including calcium, phosphorus, zinc, and selenium. These minerals play critical roles in bone development, immune function, reproduction, and overall animal performance.

Europe Liquid Feed Market Segmentation By Ingredients:

- Molasses

- Corn

- Urea

- Other Ingredients

The molasses segment maintained the leading share in the liquid feed market. Derived as a byproduct of sugar refining, molasses boasts a wealth of essential nutrients including carbohydrates, vitamins, and minerals, rendering it an appealing component for liquid animal feed formulations. Its widespread popularity stems from its cost-effectiveness and nutritional advantages, serving as a readily available energy source for livestock. Moreover, molasses enhances palatability, thereby facilitating improved feed intake and digestion among animals.

The escalating demand for high-quality and nutritionally balanced animal feed fuels increased adoption within the molasses segment, aligning with a broader industry trend toward optimizing animal nutrition to enhance overall health and productivity.

Europe Liquid Feed Market Segmentation By Animal Type:

- Ruminant

- Poultry

- Swine

- Aquaculture

- Other Animal Types

The category of ruminant animals accounted for the highest income share at 30%. This is attributed to the growing demand for dairy and meat products, which has driven an upsurge in ruminant livestock production. Liquid feed supplements play a pivotal role in meeting the nutritional requirements of ruminant animals. They offer a concentrated source of vital nutrients, encompassing proteins, minerals, vitamins, and energy, thereby enhancing feed efficiency, weight gain, and overall performance. Furthermore, liquid feed solutions often boast enhanced palatability, rendering them more appealing to ruminant animals.

Europe Liquid Feed Market Segmentation- by Region

- France

- Germany

- Italy

- Spain

- United Kingdom

- Rest of Europe

The European Liquid Feed Market exhibits high price sensitivity owing to the substantial presence of suppliers. Major markets such as Germany, Spain, and Russia collectively hold approximately 40% of the total market share. Forecasts indicate that the European market is poised to grow at a Compound Annual Growth Rate (CAGR) of 4.1%. This growth can be attributed to the increasing awareness among farmers regarding the advantages of liquid feed, including reduced labor requirements and the relatively cost-effective availability of nutrients.

COVID-19 Pandemic: Impact Analysis

The market faced significant disruption due to the COVID-19 outbreak, with widespread lockdowns leading to chronic disruptions in production, demand, and manufacturing capabilities across industries. This resulted in increased cost prices of raw materials. Additionally, strict restrictions on export-import facilities and reduced demand for liquid feed, stemming from financial challenges among growers, hindered market expansion. The pandemic also witnessed a downturn in the consumption and demand for animal-based products due to concerns about virus transmission through poultry and other animal products.

Latest Trends/ Developments:

In December 2022, BASF SE introduced Natupulse TS, a novel enzyme product designed for animal feed. Natupulse TS, categorized as a non-starch polysaccharide (NSP) enzyme, incorporates ß-mannanase into the feed, reducing digesta viscosity, enhancing feed digestibility, and promoting sustainable production practices. Available in both powder and liquid forms, this product offers exceptional stability throughout storage, premixing, and even under challenging conditions during the pelleting process.

In April 2022, the Eastman Chemical Company completed the acquisition of 3F Feed & Food, a prominent European entity renowned for its expertise in developing additives for both animal feed and human food markets, particularly in Spain. This strategic acquisition further strengthens Eastman Chemical Company's position in the additives industry, reinforcing its commitment to innovation and market expansion.

Key Players:

These are the top 10 players in the Europe Liquid Feed Market:-

- Agridyne LLC

- Archer Daniels Midland

- Midwest Liquid Feeds

- Westway Feed Products

- Dallas Keith Ltd

- GrainCorp

- Cargill Inc

- Land O’ Lakes

- Bundaberg Molasses

- Ridley Corporation

Chapter 1. Europe Liquid Feed Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Liquid Feed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Liquid Feed Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Liquid Feed Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Liquid Feed Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Liquid Feed Market– By Type

6.1. Introduction/Key Findings

6.2. Proteins

6.3. Minerals

6.4. Vitamins

6.5. Other Types

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Liquid Feed Market– By Ingredients

7.1. Introduction/Key Findings

7.2 Molasses

7.3. Corn

7.4. Urea

7.5. Other Ingredients

7.6. Y-O-Y Growth trend Analysis By Ingredients

7.7. Absolute $ Opportunity Analysis By Ingredients , 2024-2030

Chapter 8. Europe Liquid Feed Market– By Animal Type

8.1. Introduction/Key Findings

8.2. Ruminant

8.3. Poultry

8.4. Swine

8.5. Aquaculture

8.6. Other Animal Types

8.7. Y-O-Y Growth trend Analysis Animal Type

8.8. Absolute $ Opportunity Analysis Animal Type , 2024-2030

Chapter 9. Europe Liquid Feed Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Type

9.1.3. By Ingredients

9.1.4. By Animal Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Liquid Feed Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Agridyne LLC

10.2. Archer Daniels Midland

10.3. Midwest Liquid Feeds

10.4. Westway Feed Products

10.5. Dallas Keith Ltd

10.6. GrainCorp

10.7. Cargill Inc

10.8. Land O’ Lakes

10.9. Bundaberg Molasses

10.10. Ridley Corporation

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The demand for premium-quality meat and meat products, driven by health-conscious consumers, has catalyzed meat production, consequently propelling the liquid feed supplement market. With advantages such as enhanced digestibility in animals, simplified additive incorporation, and fermentation potential, the demand for liquid feed supplements is witnessing rapid growth, facilitating the production of superior-quality meat.

The top players operating in the Europe Liquid Feed Market are - Agridyne LLC, Archer Daniels Midland, Midwest Liquid Feeds, Westway Feed Products, Dallas Keith Ltd, GrainCorp, Cargill Inc, Land O’ Lakes, Bundaberg Molasses, Ridley Corporation, and others.

The market faced significant disruption due to the COVID-19 outbreak, with widespread lockdowns leading to chronic disruptions in production, demand, and manufacturing capabilities across industries. This resulted in increased cost prices of raw materials. Additionally, strict restrictions on export-import facilities and reduced demand for liquid feed, stemming from financial challenges among growers, hindered market expansion.

The entrance of multinational entities often stimulates healthy competition within the market. This dynamic fosters an environment where local players are encouraged to enhance their standards and product offerings. As a result, continuous improvement and a heightened focus on customer satisfaction become central tenets, ultimately enriching the experience for end-users.

The European Liquid Feed Market exhibits high price sensitivity owing to the substantial presence of suppliers. Major markets such as Germany, Spain, and Russia collectively hold approximately 40% of the total market share. Forecasts indicate that the European market is poised to grow at a Compound Annual Growth Rate (CAGR) of 4.1%. This growth can be attributed to the increasing awareness among farmers regarding the advantages of liquid feed, including reduced labor requirements and the relatively cost-effective availability of nutrients.