Europe Intralogistics Automation Market Size (2024-2030)

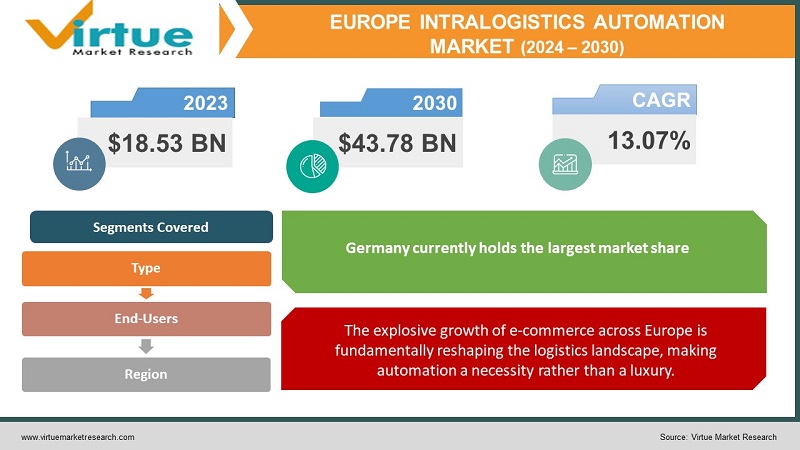

The European intralogistics automation market was valued at USD 18.53 billion in 2023 and is projected to reach a market size of USD 43.78 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 13.07%.

The relentless growth of online shopping demands lightning-fast order fulfillment. Warehouses can't scale purely with human labor; automation is the key to meeting the speed and accuracy consumers expect. Finding and retaining reliable warehouse workers is a mounting challenge in many European nations. Automation offers a solution, reducing reliance on a fluctuating labor pool. Recent global disruptions have highlighted the need for supply chains that can withstand shocks. Automated intralogistics systems offer flexibility and adaptability to cope with demand surges and unexpected events. Consumers and businesses increasingly want personalized products and unique order configurations. This complexity requires the agility that intralogistics automation provides. Warehouse Management Software (WMS), Warehouse Execution Systems (WES), and advanced analytics optimize the real-time flow of goods and information.

Key Market Insights:

Automation isn't a luxury but a necessity to handle surging order volumes, faster shipping expectations, and increased product variety. Retailers and manufacturers demand flexible intralogistics systems that can adapt to shifting consumer trends, handle seasonal fluctuations, and scale up or down based on demand. Intralogistics automation is key to blending online orders, in-store pickup, and traditional store replenishment seamlessly. Warehouses are no longer isolated units but hubs within a complex network. Intralogistics automation is key to blending online orders, in-store pickup, and traditional store replenishment seamlessly. Warehouses are no longer isolated units but hubs within a complex network. Urban warehouses closer to consumers have become a necessity, often with limited space. Automated storage and retrieval systems maximize efficiency within tight confines. The rise in products with multiple variants (sizes, colors, etc.) adds complexity to picking and packing. Automation provides both the speed and accuracy needed. Growth in online grocery and temperature-sensitive goods requires automation solutions specifically for the cold chain, ensuring product integrity. Intralogistics automation expands into manufacturing. Automated transport of components within factories and close integration with production lines optimize processes.

Europe Intralogistics Automation Market Drivers:

The explosive growth of e-commerce across Europe is fundamentally reshaping the logistics landscape, making automation a necessity rather than a luxury.

E-commerce consumers demand lightning-fast order fulfillment and delivery. Automated systems within warehouses and distribution centers significantly shorten processing times, meeting these rising expectations of rapid shipping. Unlike traditional bulk shipments to stores, e-commerce often involves countless individual, small-sized orders with diverse items. Automated picking, sorting, and packing solutions are crucial to managing this complexity efficiently. High return rates plague e-commerce. Automated systems can streamline reverse logistics processes, handling returned items quickly and reintegrating them back into saleable inventory with minimal manual intervention. E-commerce often includes options for product customization or kitting (assembling unique bundles). Automation allows businesses to manage this individualized order structure without sacrificing speed or cost-effectiveness.

European businesses are rethinking strategies, prioritizing increased resilience, and turning to intralogistics automation as a key tool to prevent supply chain disruptions.

A blockage in a distant port cascades down the chain. Warehouses designed for rapid inventory flow may struggle to hold excess stock; their processes are optimized for just-in-time rather than buffering for delays. Consumer behavior can shift abruptly. Panic buying, lockdown-induced changes in spending patterns, or rapid shifts between online and in-store shopping stress inflexible intralogistics infrastructure. Automation enables smaller and micro-fulfillment centers to achieve high throughput results. These reduce reliance on single, massive warehouses vulnerable to regional disruption. Leveraging automation to seamlessly switch production lines to handle spikes in demand for specific products or repurpose them with minimal downtime when consumer preferences change. Automation generates real-time data about inventory movement, throughput, and equipment performance. This data feeds into AI-enhanced predictive analytics to identify potential failure points before they become crises. Warehouse management systems (WMS) that can quickly integrate with supplier and freight partner systems become essential. True supply chain visibility depends on this data flow, and automation plays a vital role in accurate data generation.

Europe Intralogistics Automation Market Restraints and Challenges:

Advanced automation solutions for intralogistics operations can be expensive, making it difficult for SMEs to invest.

Implementing advanced automation solutions, especially for large-scale or complex intralogistics operations, comes with a significant upfront price tag. This can be a deterrent, especially for small and medium-sized enterprises (SMEs). The true cost includes the redesign of processes, software integration, potential facility layout changes, and employee training. These can add unforeseen expenses to initial budget calculations. Demonstrating a clear return on investment (ROI) for automation is crucial. However, it can be challenging to quantify the potential savings from disruption avoidance, increased throughput, and reduced errors in a compelling way compared to the immediate capital outlay. Many warehouses and distribution centers operate with older equipment or a patchwork of software systems. Integrating cutting-edge automation into this existing landscape can be fraught with technical complications and unexpected costs. While the situation is improving, true plug-and-play compatibility across different automation vendors remains a vision for the future. This can lead to time-consuming and costly customization to get different systems working together seamlessly. The true benefits of automation are often only realized when data flows effortlessly between Warehouse Management Systems (WMS), Enterprise Resource Planning (ERP), and the automation solutions themselves. Data silos or incompatibility issues undermine the potential gains.

Europe Intralogistics Automation Market Opportunities:

While large, centralized distribution hubs remain necessary, micro-fulfillment centers closer to consumers allow for same-day or even 2-hour delivery in densely populated areas. Intralogistics automation is key to maximizing productivity in tight spaces. Vertical AS/RS (Automated Storage and Retrieval Systems), robotic picking solutions designed for compact layouts, and AGVs navigate with extreme precision. Smart micro-fulfillment often involves automation-friendly packaging optimization for varied delivery methods (drones, traditional carriers, etc.). Automation vendors vying for market share will emphasize the low energy consumption of their systems. This includes energy-aware warehouse management software optimizations. Focus on extending equipment lifespan through predictive maintenance enabled by automation, robust refurbishment markets for pre-owned systems, and designing for ease of recycling at the eventual end of life. Cobots designed for safe co-working alongside humans open up automation to industries beyond automotive. Businesses could see the emergence of providers offering on-demand cobot and automation expertise. This further lowers the barrier, allowing quick ramp-up for seasonal peaks or experimenting with automation before large capital investment. IaaS allows businesses to quickly add or reconfigure intralogistics automation in response to shifting demand without the long lead times of traditional ownership models. Smaller businesses gain access to cutting-edge automation normally tied up in large enterprise contracts, leveling the competitive playing field within the intralogistics landscape.

EUROPE INTRALOGISTICS AUTOMATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.07% |

|

Segments Covered |

By Type, End Users, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

KION Group, Toyota Industries Corporation, Daifuku, Honeywell Intelligrated, Knapp, SSI Schaefer , Beumer Group, Swisslog |

Europe Intralogistics Automation Market Segmentation:

Europe Intralogistics Automation Market Segmentation: By Type

- Automated Storage and Retrieval Systems (AS/RS)

- Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs)

- Robotic Picking and Sorting

- Conveyor and Sortation Systems

- Automated Identification and Data Capture (AIDC)

- Warehouse Management Systems (WMS) & Warehouse Control Systems (WCS)

Automated Storage and Retrieval Systems (AS/RS) is the largest growing segment. It is a foundational component of modern intralogistics. These offer significant space savings and faster inventory access. AS/RS holds a substantial market share, reflecting a long track record and diverse applications. Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) offer flexibility and scalability in material transport. While perhaps smaller in terms of total spending than AS/RS currently, AGVs and AMRs represent one of the fastest-growing segments due to their adaptability and broader accessibility. Robotic picking and sorting show robust growth. Still, adoption depends on factors like the average order profile item size, uniformity, etc., potentially limiting its market share compared to more universally applicable technologies Conveyor and sortation systems are a mature technology type yet remain essential and see continuous innovation. While representing a sizeable market share, growth is primarily driven by increasing sophistication rather than an entirely new adoption wave. AIDC underpins other automation systems through accurate data generation. It resembles an enabler that grows alongside increased automation overall. WCS is the software side of automation, which is where much of the current market focus lies. The growth potential is significant as data-driven optimization becomes paramount. While WMS/WCS spending alone might be less than physical equipment, their role in unlocking the potential of automation makes them increasingly influential.

Europe Intralogistics Automation Market Segmentation: By End-Users:

- E-commerce and Retail

- Automotive

- Food and Beverage

- Healthcare and Pharmaceuticals

- Manufacturing

- Others

E-commerce and retail are the largest growing end-users, driven by the need for rapid order fulfillment, complex order profiles, and handling returns efficiently. Automation of warehouses, distribution centers, and even micro-fulfillment close to consumers is crucial. The automotive industry is the fastest-growing end-user. It is a traditionally strong adopter of automation, now facing additional pressures. Disrupted supply chains necessitate rethinking intralogistics systems, and the shift toward EV manufacturing creates new automation demands. The food and beverage industries’ growth was spurred by requirements around food safety and traceability, handling diverse SKUs (sizes, packaging), and increasing demand for customization and fresh product delivery. Healthcare and pharmaceuticals need this because strict rules, the need for temperature-controlled storage, and error-free order picking make automation attractive. The rise of e-pharmacy will further accelerate this sector's adoption. Manufacturing is a vast category with diverse automation needs depending on the specific industry. Heavy manufacturing might prioritize robust material handling solutions, while consumer goods need flexible systems adaptable to shifting product lines.

Europe Intralogistics Automation Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany is the largest market for intralogistics automation and is often where cutting-edge innovations are first implemented. Germany's focus on industrial automation, substantial manufacturing base (leading automotive industry), and emphasis on supply chain efficiency drive demand for advanced intralogistics solutions. The UK is the fastest-growing market. Key drivers include its significant e-commerce sector and strong manufacturing presence, especially in the food & beverage and automotive industries. France is a well-developed market, particularly for e-commerce automation to meet rising consumer expectations. Diverse manufacturing sectors and government initiatives supporting Industry 4.0 adoption contribute to a steady growth trajectory. Italy's intralogistics automation market is bolstered by a strong manufacturing sector (fashion, food & beverage, automotive components). Smaller and medium-sized enterprises (SMEs) are increasingly considering automation solutions as they become more accessible. Spain is a market exhibiting growth potential, particularly driven by its expanding e-commerce sector and the role of intralogistics automation in ensuring competitiveness in the price-delicate retail landscape. The rest of Europe encompasses diverse countries, including Poland, the Scandinavian and Dutch nations, and growing markets in Europe's East. Growth drivers differ and include factors like rising labor costs, stimulating automation interest, and changing consumer demand patterns driving change within intralogistics operations.

COVID-19 Impact Analysis on the European Intralogistics Automation Market:

Workforce illnesses or social distancing measures limited personnel, impacting warehouse and logistics center throughput. Panic buying of certain goods and the shift to online shopping stressed existing intralogistics infrastructure that was often optimized for predictability. The fragility of traditional, labor-intensive supply chains was exposed. Intralogistics automation emerged as a key component of building resilience against future disruptions. With physical stores restricted, online retail surged. Warehouses needed automation solutions to meet the accelerated demand for rapid order fulfillment. The pandemic highlighted the advantages of automation: reduced reliance on a potentially vulnerable workforce, increased efficiency, and the ability to scale up or down quickly. Uncertainty in the early stages of the pandemic led to project postponements, particularly for large-scale automation implementations. Subscription-based intralogistics automation models gained traction as businesses sought flexible solutions without heavy upfront investment during uncertain economic times.

Latest Trends/ Developments:

The idea of end-to-end supply chain visibility is getting closer. Data exchange between intralogistics automation systems, freight partners, and even smart retail shelves paints a real-time picture crucial for resilient logistics. Expect the emergence of specialized providers offering data analytics and AI-powered optimization as a subscription service, along with the physical automation solutions themselves. Intralogistics automation is now interwoven with the need for flexible manufacturing. Systems that seamlessly handle product changeovers, kitting, or just-in-sequence part supply to the production line are in high demand. Spaces might need to quickly switch between e-commerce fulfillment and store replenishment based on seasonal peaks or events. Automated reconfiguration on the fly becomes valuable. The line between traditional fixed automation and flexible robots blurs. Think AMRs delivering items to a cobot-powered picking station, combining the strengths of both for greater efficiency. Automation vendors compete on low energy consumption metrics for their systems. Software optimizations that reduce unnecessary AGV movements or optimize power-down cycles during off-peak times gain importance.

Key Players:

- KION Group

- Toyota Industries Corporation

- Daifuku

- Honeywell Intelligrated

- Knapp

- SSI Schaefer

- Beumer Group

- Swisslog

Chapter 1. Europe Intralogistics Automation Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Intralogistics Automation Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Intralogistics Automation Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Intralogistics Automation Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Intralogistics Automation Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Intralogistics Automation Market– By Type

6.1. Introduction/Key Findings

6.2. Automated Storage and Retrieval Systems (AS/RS)

6.3. Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs)

6.4. Robotic Picking and Sorting

6.5. Conveyor and Sortation Systems

6.6. Automated Identification and Data Capture (AIDC)

6.7. Warehouse Management Systems (WMS) & Warehouse Control Systems (WCS)

6.8. Y-O-Y Growth trend Analysis By Type

6.9. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Intralogistics Automation Market– By End User

7.1. Introduction/Key Findings

7.2 E-commerce and Retail

7.3. Automotive

7.4. Food and Beverage

7.5. Healthcare and Pharmaceuticals

7.6. Manufacturing

7.7. Others

7.8. Y-O-Y Growth trend Analysis By End User

7.9. Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 8. Europe Intralogistics Automation Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By End User

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Intralogistics Automation Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. KION Group

9.2. Toyota Industries Corporation

9.3. Daifuku

9.4. Honeywell Intelligrated

9.5. Knapp

9.6. SSI Schaefer

9.7. Beumer Group

9.8. Swisslog

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The explosive growth of e-commerce and businesses rethinking strategies, prioritizing increased resilience, and turning to intralogistics automation as a key tool to prevent supply chain disruptions are the main factors propelling the market.

Associated costs are the main issue that the market is currently facing.

KION Group, Toyota Industries Corporation, and Daifuku are the main players.

Germany currently holds the largest market share.

The United Kingdom is expanding at the highest rate.