Europe Industrial Dryers Market Size (2024-2030)

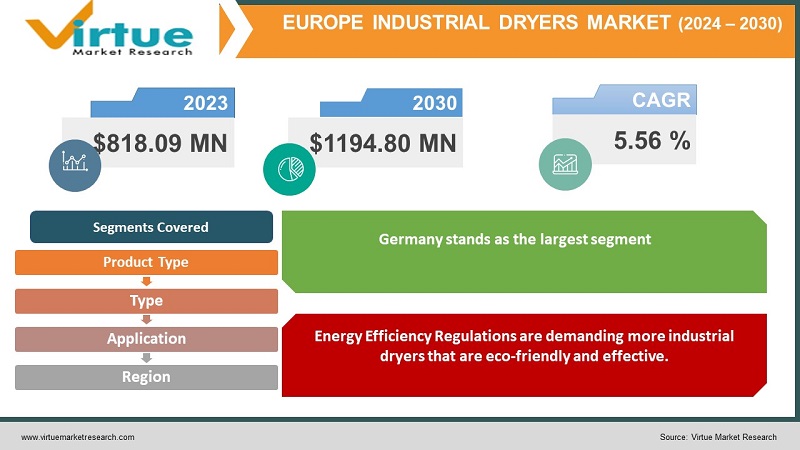

According to the report published by Virtue Market Research in Europe Industrial Dryers Market was valued at USD 818.09 million and is projected to reach a market size of USD 1194.80 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.56%.

The European industrial dryers market is a robust and dynamic sector driven by a wide range of industries, including manufacturing, food processing, pharmaceuticals, and chemicals. This market experiences steady growth due to the region's emphasis on technological advancements, energy efficiency, and environmental sustainability. European manufacturers are increasingly adopting advanced drying technologies to improve production efficiency and reduce environmental impact. Additionally, stringent regulations regarding energy consumption and emissions further propel the adoption of innovative and eco-friendly drying solutions. With a focus on optimizing processes and maintaining high-quality standards, the European industrial dryers market continues to thrive as a vital component of the region's industrial landscape.

Key Market Insights:

The European tray dryer market is poised for expansion, with an expected value of USD 290.2 million by 2023, demonstrating a steady CAGR of 4.5%. Increasing demand for efficient drying solutions across industries like pharmaceuticals, chemicals, and food processing. As these sectors continue to thrive and emphasize product quality and efficiency, the adoption of tray dryers is expected to rise steadily.

Europe is expected to be a significant contributor to the growth of the industrial food dryer market, accounting for 39% of the market's overall expansion during the forecast period. Within Europe, the United Kingdom and Germany stand out as pivotal markets for industrial food dryers.

The Europe thermal dryer market is poised to achieve a valuation of USD 298 million by the year 2023, demonstrating a steady growth rate with a CAGR of 3.3%.

Germany is a leading player in wastewater recycling and reprocessing across Europe. Over 96% of wastewater from various residences and public spaces is dumped into sewage treatment facilities. Thermal dryers are widely utilized in treatment plants to get dry material and process solid waste which might be used later.

Europe Industrial Dryers Market Drivers:

Energy Efficiency Regulations are demanding more industrial dryers that are eco-friendly and effective.

The stringent energy efficiency regulations and environmental standards imposed by European authorities drive the adoption of energy-efficient industrial dryers. Manufacturers are compelled to invest in advanced drying technologies and equipment that consume less energy and reduce emissions. This regulatory pressure encourages innovation in the industry, leading to the development of more efficient and environmentally friendly drying solutions. Companies that can meet or exceed these regulations gain a competitive edge, as customers increasingly prioritize sustainable and cost-effective drying processes.

The growing Manufacturing Sector is a long-term driver of the industrial dryers market in the Europe region.

The expanding manufacturing sector in Europe, spanning industries such as automotive, chemicals, and pharmaceuticals, fuels the demand for industrial dryers. These industries rely on efficient drying processes for various applications, including drying of components, coatings, chemicals, and pharmaceutical products. As manufacturing output continues to grow, there is a parallel need for reliable and high-performance drying equipment to meet production demands. This sustained growth in manufacturing activities acts as a significant driver for the industrial dryers market in Europe, promoting investment in advanced drying technologies and systems.

Europe Industrial Dryers Market Restraints and Challenges:

Stringent Environmental Regulations are a difficulty in the growth path of industrial dryers in Europe.

Europe has some of the world's strictest environmental regulations and emissions standards. Compliance with these regulations can be challenging for industrial dryer manufacturers. Meeting emissions limits, ensuring proper waste disposal, and minimizing energy consumption are key requirements. Adhering to these stringent standards often necessitates substantial investments in research and development to develop eco-friendly and energy-efficient drying technologies. Manufacturers must continuously adapt to evolving environmental regulations, adding complexity and cost to their operations.

Intense Competition and Price Sensitivity could pose a hindrance in the European industrial dryers market.

The Europe Industrial Dryers Market is highly competitive, with numerous local and international players vying for market share. Intense competition puts pressure on pricing, making it challenging for manufacturers to maintain healthy profit margins. Price sensitivity among customers further exacerbates this challenge. To stay competitive, manufacturers must balance the need for cost-effective solutions with the demand for advanced, energy-efficient dryers. This constant pricing pressure can hinder innovation and investment in cutting-edge technologies, potentially limiting the market's growth and profitability.

Europe Industrial Dryers Market Opportunities:

The Europe Industrial Dryers market presents significant opportunities, driven by the increasing demand for customized and technologically advanced drying solutions. As industries across the region seek to optimize production processes, there is a growing need for tailored drying systems that offer energy efficiency, automation, and precise control. Additionally, the adoption of Industry 4.0 technologies and the Internet of Things (IoT) in manufacturing is opening doors for smart and connected dryers that can provide real-time data monitoring and predictive maintenance. These opportunities encourage manufacturers to innovate and develop cutting-edge industrial dryers, catering to the evolving requirements of European industries and enhancing their global competitiveness.

EUROPE INDUSTRIAL DRYERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.56% |

|

Segments Covered |

By Product Type, Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GEA Group AG, ANDRITZ AG, Bühler Group, Carrier Vibrating Equipment, Inc., Fives Group, Metso Corporation, Mitsubishi Heavy Industries, Ltd., Thyssenkrupp AG, Comessa, Mitchell Dryers Ltd. |

Europe Industrial Dryers Market Segmentation:

Europe Industrial Dryers Market Segmentation: By Product Type:

- Direct Dryers

- Indirect Dryers

The largest segment by product type in the industrial dryers market is typically the Direct Dryers category, occupying over 75% market share. Direct dryers are favored for their simplicity and efficiency in directly heating and drying the material being processed, resulting in faster drying times and reduced energy consumption. They are widely used across industries where rapid and precise drying is essential, such as food processing, chemicals, and minerals. Their direct heating method, which minimizes heat loss, makes them a popular choice, contributing to their prominence as the largest product segment in the industrial dryers market.

The fastest-growing segment among the product types of industrial dryers is indirect dryers growing at a CAGR of 9.4%. This growth can be attributed to the increasing demand for energy-efficient and environmentally friendly drying solutions. Indirect dryers, which utilize external heat sources to transfer heat to the material being dried, are gaining popularity due to their ability to operate at lower temperatures and minimize direct contact between the heat source and the product. This not only improves energy efficiency but also allows for the drying of heat-sensitive materials, making indirect dryers a preferred choice in industries like pharmaceuticals, chemicals, and food processing.

Europe Industrial Dryers Market Segmentation: By Type

- Rotary Dryers

- Fluidized Bed Dryers

- Spray Dryers

- Tray Dryers

- Belt Dryers

- Freeze Dryers

- Others

Rotary Dryers represent the largest segment having approximately 18% of the market share among types of industrial dryers. This prominence could be attributed to the versatility of rotary dryers, which are capable of handling a wide range of materials and are widely used in various industries such as agriculture, mining, and manufacturing. Their large processing capacity, efficient heat transfer mechanisms, and adaptability to both direct and indirect drying make them a preferred choice for many applications. Additionally, rotary dryers are known for their cost-effectiveness and reliability, contributing to their status as the largest segment in the industrial dryers market.

The fastest growing segment is spray dryers expanding at a CAGR of 12.2%. This growth can be attributed to the widespread adoption of spray dryers in various industries, including food and beverage, pharmaceuticals, and chemicals. Spray dryers are favored for their ability to efficiently convert liquid or slurry feedstock into dry powder or granulated products. They are particularly well-suited for heat-sensitive materials and for achieving precise particle size control, making them essential in the production of powdered food ingredients, pharmaceuticals, and advanced materials. The demand for spray dryers has been boosted by the increasing need for instant products and improved product quality in various applications.

Europe Industrial Dryers Market Segmentation: By Application

- Food Processing

- Pharmaceuticals

- Chemicals

- Minerals and Mining

- Textiles

- Pulp and Paper

- Environmental and Waste Management

- Others

The Food Processing segment is the largest among the industrial dryer applications holding over 23% of revenue share. This dominance is primarily driven by the continuous and robust demand for drying solutions in the food processing industry. Food manufacturers extensively use industrial dryers for a wide range of applications, including drying fruits, vegetables, grains, dairy products, and more. The importance of preserving food quality, extending shelf life, and meeting strict hygiene standards has led to a consistent need for efficient and reliable drying equipment in this sector. The growth of convenience food products and the global supply chain has further fueled the demand for industrial dryers in food processing.

The fastest-growing segment by application in the industrial dryers market is the Pharmaceuticals sector. This growth was driven by several factors, including the increasing demand for pharmaceutical products, the need for precise and controlled drying processes to maintain product quality and efficacy, and stringent regulations governing pharmaceutical manufacturing. Pharmaceutical companies were investing in advanced drying technologies to ensure the uniform and consistent drying of pharmaceutical ingredients and products. The rise in biopharmaceuticals and the development of new drugs further boosted the demand for specialized drying equipment in the pharmaceutical sector.

Europe Industrial Dryers Market Segmentation: Regional Analysis:

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany stands as the largest segment holding approximately 22% market share in the industrial dryers market. This is primarily due to Germany's robust industrial and manufacturing sectors, which encompass automotive manufacturing, chemicals, pharmaceuticals, and various high-tech industries. These industries often require advanced and efficient drying solutions to maintain their production processes and product quality. Additionally, Germany's focus on innovation and sustainability drives the adoption of state-of-the-art drying technologies, further contributing to its position as the largest segment in the European industrial dryers market.

Poland is the fastest-growing European country in the industrial dryers market anticipated to grow at a CAGR of 10%. This growth was attributed to several factors, including a strong manufacturing sector, increased investments in energy-efficient technologies, and rising demand for industrial drying solutions in industries such as food processing, chemicals, and pharmaceuticals. Poland's strategic location as a central European manufacturing hub and its access to a skilled workforce made it an attractive destination for industrial dryer manufacturers and suppliers looking to expand their presence in the region.

COVID-19 Impact Analysis on the Europe Industrial Dryers Market:

The Europe Industrial Dryers market experienced a notable impact from the COVID-19 pandemic. During the initial phases of the pandemic, disruptions in supply chains and reduced industrial activities resulted in a slowdown in the market. However, as industries adapted to new operating conditions and safety measures, the market gradually rebounded. The pandemic underscored the importance of efficient drying processes, particularly in pharmaceuticals, food processing, and chemical sectors, leading to increased investments in advanced drying technologies. Furthermore, the emphasis on hygiene and sanitation drove demand for industrial dryers in applications such as the drying of personal protective equipment and disinfectant production. As Europe's manufacturing sector regained momentum, the industrial dryers market showed resilience and demonstrated its adaptability to evolving market dynamics.

Latest Trends/ Developments:

In line with Europe's stringent environmental regulations and sustainability goals, there is a growing emphasis on energy-efficient and environmentally friendly drying solutions. Manufacturers are investing in research and development to design dryers that consume less energy and reduce carbon emissions. Heat recovery systems, advanced insulation, and innovative drying technologies are being incorporated into dryer designs to achieve higher energy efficiency. Additionally, the use of renewable energy sources to power industrial dryers is gaining traction as companies seek to minimize their environmental footprint.

Industry 4.0 and the Internet of Things (IoT) are revolutionizing the industrial drying sector in Europe. Manufacturers are incorporating IoT sensors and connectivity into their dryers, enabling real-time monitoring and control of drying processes. This data-driven approach allows for predictive maintenance, optimizing dryer performance, and minimizing downtime. Smart industrial dryers can adjust parameters automatically based on product characteristics and environmental conditions, enhancing efficiency and product quality. The integration of digital technologies is seen as a key strategy for staying competitive and meeting the demands of Industry 4.0-driven smart factories.

Key Players:

- GEA Group AG

- ANDRITZ AG

- Bühler Group

- Carrier Vibrating Equipment, Inc.

- Fives Group

- Metso Corporation

- Mitsubishi Heavy Industries, Ltd.

- Thyssenkrupp AG

- Comessa

- Mitchell Dryers Ltd.

- In September 2023, Fives, a global leader in industrial engineering, based in France, bolstered its expertise through the acquisition of ProSim, a specialist in process simulation and optimization. This strategic move will empower Fives' subsidiaries to advance equipment simulation across their customers' diverse processes, aiming to boost operational efficiency and minimize environmental footprint.

Chapter 1. Europe Industrial Dryers Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Industrial Dryers Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Industrial Dryers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Industrial Dryers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Industrial Dryers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Industrial Dryers Market– By Type

6.1. Introduction/Key Findings

6.2. Rotary Dryers

6.3. Fluidized Bed Dryers

6.4. Spray Dryers

6.5. Tray Dryers

6.6. Belt Dryers

6.7. Freeze Dryers

6.8. Others

6.9. Y-O-Y Growth trend Analysis By Type

6.10. Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Europe Industrial Dryers Market– By Product Type

7.1. Introduction/Key Findings

7.2 Direct Dryers

7.3. Indirect Dryers

7.4. Y-O-Y Growth trend Analysis By Product Type

7.5. Absolute $ Opportunity Analysis By Product Type, 2023-2030

Chapter 8. Europe Industrial Dryers Market– By Application

8.1. Introduction/Key Findings

8.2. Food Processing

8.3. Pharmaceuticals

8.4. Chemicals

8.5. Minerals and Mining

8.6. Textiles

8.7. Pulp and Paper

8.8. Environmental and Waste Management

8.9. Others

8.10. Y-O-Y Growth trend Analysis Application

8.11. Absolute $ Opportunity Analysis Application, 2023-2030

Chapter 9. Europe Industrial Dryers Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Application

9.1.3. By Product Type

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Industrial Dryers Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 GEA Group AG

10.2. ANDRITZ AG

10.3. Bühler Group

10.4. Carrier Vibrating Equipment, Inc.

10.5. Fives Group

10.6. Metso Corporation

10.7. Mitsubishi Heavy Industries, Ltd.

10.8. Thyssenkrupp AG

10.9. Comessa

10.10. Mitchell Dryers Ltd.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

According to the report published by Virtue Market Research in Europe Industrial Dryers Market was valued at USD 818.09 million and is projected to reach a market size of USD 1194.80 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.56%.

Energy Efficiency Regulations and the Growing Manufacturing Sector are helping to expand Europe Industrial Dryers market.

Based on product type, the Europe Industrial Dryers market is divided into direct dryers and indirect dryers

Germany is the most dominant region for the Europe Industrial Dryers Market

GEA Group AG, ANDRITZ AG, Bühler Group, Carrier Vibrating Equipment, Inc., and Fives Group are the key players operating in the Europe Industrial Dryers Market