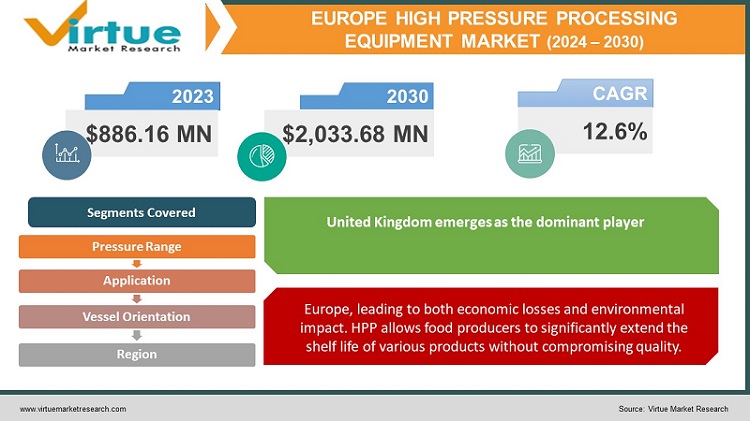

Europe High Pressure Processing Equipment Market Size (2024-2030)

The Europe High Pressure Processing Equipment Market was valued at USD 886.16 Million in 2023 and is projected to reach a market size of USD 2,033.68 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.6%.

High-Pressure Processing (HPP) is an innovative, non-thermal food processing technology. It inactivates pathogens and spoilage microorganisms by subjecting packaged food products to immense water pressures (usually 300-600MPa), extending shelf life, preserving nutrients, and maintaining sensory qualities. The European HPP Equipment Market encompasses the manufacturers and suppliers of the specialized machinery and supporting systems required to implement HPP. Rising consumer preference for minimally processed fresh-tasting foods with fewer additives and preservatives aligns well with the benefits offered by HPP. Beyond its initial success in juices and ready-to-eat meats, HPP is finding applications in a wider range of products like dips, sauces, seafood, and even pet food. HPP allows for the creation of products free from the artificial preservatives and additives consumers are increasingly trying to avoid. This is a major selling point in various health-conscious segments of the European market.

Key Market Insights:

Spain, France, Germany, and the UK collectively account for a significant share (over 50%) of the installed HPP equipment base within Europe.

Major food and beverage companies in Europe have invested heavily in HPP technology, with investments totaling over €300 million in the past five years.

The average price of a commercial HPP system can range from $500,000 to several million dollars, depending on size, pressure capacity, and automation level. This indicates a substantial investment for food processors adopting the technology.

Despite the higher upfront cost of HPP equipment compared to traditional thermal processing, its benefits are compelling to food manufacturers. Smaller and more agile food manufacturers are often at the forefront of adopting HPP, seeking differentiation and premium positioning in the market.

HPP's ability to inactivate foodborne pathogens without compromising quality is a major driver, especially for sensitive products like raw seafood and ready-to-eat meals. While HPP has potential environmental benefits due to reduced food waste and lower energy use compared to some thermal processes, the energy-intensive nature of the process remains a factor for improvement.

Europe High Pressure Processing Equipment Market Drivers:

European consumers are increasingly scrutinizing product labels, demanding foods with fewer artificial ingredients, preservatives, and additives. This translates into a powerful drive towards "clean label" trends.

European shoppers are dissecting product labels with magnifying glass. They want fewer artificial ingredients, shorter ingredient lists, and recognizable components. Consumers are becoming savvy, looking beyond simply "natural" claims and seeking genuinely wholesome, minimally processed foods. While the desire for a "clean label" is strong, no single, legally binding definition exists within Europe. This leaves room for interpretation. HPP delivers what consumers and food businesses crave – extended shelf life and food safety without relying on the chemical preservatives or heavy thermal treatments that clash with the "clean label" ethos. HPP's non-thermal nature leaves organoleptic qualities (taste, texture, color) and many heat-sensitive nutrients largely intact, a major advantage for fresh-focused products. HPP aligns seamlessly with trends like cold-pressed juices, fresh-like dips and sauces, and premium ready-to-eat meals emphasizing quality ingredients. The demand for "clean label" HPP-friendly products drives innovation in new product categories and flavor combinations previously unattainable without heavier preservation methods. Companies embracing HPP can gain a competitive edge by catering to the growing segment of consumers seeking minimally processed, additive-free foods.

Europe, leading to both economic losses and environmental impact. HPP allows food producers to significantly extend the shelf life of various products without compromising quality.

Stringent food safety regulations within the EU, such as HACCP (Hazard Analysis Critical Control Points) principles, drive food processors to utilize technologies that ensure product safety. HPP effectively inactivates a wide spectrum of harmful bacteria, yeasts, and molds without compromising the sensory qualities of food products. minimally processed items. HPP's ability to dramatically extend shelf life translates to reduced waste from spoilage throughout the supply chain (during manufacturing, transport, within retail, and at consumers' homes). By preventing losses due to premature spoilage, HPP offers direct economic benefits for food businesses, preserving the value invested in ingredients and production. Longer shelf life allows European food producers to confidently explore new markets, both domestically and internationally, boosting sales potential. HPP enables the creation of premium products with extended freshness, commanding higher prices and potentially offsetting the initial technology investment. The enhanced food safety offered by HPP minimizes the risk of costly recalls, safeguarding brand reputation – an intangible but crucial asset.

Europe High Pressure Processing Equipment Market Restraints and Challenges:

A major hurdle for many businesses is the significant upfront capital required to purchase HPP equipment. The price can range from hundreds of thousands to several million euros depending on the system size, pressure capacity, and level of automation.

This investment might be prohibitive for smaller food processors or startups, limiting their ability to adopt HPP and potentially putting them at a disadvantage. While there are financing options available, calculating the return on investment (ROI) on HPP can be complex, requiring careful consideration of potential increased sales, waste reduction, and price premiums for HPP products. Operating HPP equipment and optimizing it for different products requires specialized knowledge. This includes aspects like pressure levels, holding times, packaging considerations, and food safety validation. Investing in workforce training or attracting employees with the right skills is essential for food processors to successfully adopt and reap the full benefits of HPP technology. While growing, awareness of HPP technology and its benefits is not universal among European consumers. Some may have lingering misconceptions about processed foods or be unfamiliar with the process. While HPP has a remarkably wide range of applications, it may not be the ideal solution for all food products. Research is ongoing to expand the applicability of HPP, including potential combinations with other mild technologies to process a broader array of products. While HPP is a well-established technology, regulations and recommended practices continue to evolve, necessitating that food businesses stay up-to-date and adapt their processes as needed.

Europe High Pressure Processing Equipment Market Opportunities:

The relentless demand for "clean label," minimally processed, high-quality foods is a powerful force driving HPP adoption in Europe. The technology's ability to preserve freshness, nutrients, and taste without artificial additives aligns perfectly with this major consumer shift. HPP offers both food safety benefits (pathogen inactivation) and the potential for unique product innovations in these sectors. As plant-based alternatives to meat and dairy gain popularity, HPP can ensure their safety, extend shelf life, and maintain appealing organoleptic qualities, crucial for this growing market. Europe, like the rest of the world, is grappling with food waste. HPP offers a technological solution to extend the shelf life of perishable products. HPP could valorize fruits and vegetables unsuitable for fresh retail sale by turning them into juices, sauces, etc., with extended shelf life. HPP toll processing centers offer smaller food businesses access to the technology without the need for major capital investment in their equipment.

EUROPE HIGH PRESSURE PROCESSING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.6% |

|

Segments Covered |

By Pressure range, application, vessel orientation, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Avure Technologies , Hiperbaric, Multivac Sepp Haggenmüller SE & Co. KG, Stansted Fluid Power Ltd , NC Hyperbaric, Elmasonic |

Europe High Pressure Processing Equipment Market Segmentation:

Europe High Pressure Processing Equipment Market Segmentation: By Pressure Range

- Low-Pressure Systems (100 - 300 MPa)

- Mid-Pressure Systems (300 - 600 MPa)

- Ultra-High-Pressure Systems (600+ MPa)

Low-Pressure Systems (100 - 300 MPa): This range is suitable for certain niche applications and product types with softer textures. Mid-Pressure Systems (300 - 600 MPa): The most versatile and widely adopted range. It effectively inactivates most foodborne pathogens and spoilage organisms, offering a broad scope of applications. Ultra-High-Pressure Systems (600+ MPa): This range can induce unique changes in food textures and functionality beyond simple microbial inactivation, opening avenues for product innovation.

Mid-range pressure systems likely hold the largest market share due to their broad suitability for numerous food and beverage products. Demand for high-pressure systems could see strong growth fueled by research and potential applications beyond traditional food preservation.

Europe High Pressure Processing Equipment Market Segmentation: By Application

- Beverages

- Meat, Poultry, and Seafood

- Fruits, Vegetables, and Ready-to-Eat (RTE) Meals

Beverages: A major segment encompassing fruit and vegetable juices, smoothies, and other liquid products where retaining fresh-like characteristics and nutrients is paramount. Juices and smoothies are a significant force due to their popularity and alignment with health trends. Innovative beverage applications like plant-based milk alternatives or functional shots could see rapid growth. Meat, Poultry, and Seafood: HPP extends shelf life, ensures safety against pathogens, and can enable product innovations (e.g., ready-to-cook marinated meats). Processed meat products (hams, sausages) hold a substantial share. Raw seafood products for premium sushi/sashimi markets are an exciting growth area. Fruits, Vegetables, and Ready-to-Eat (RTE) Meals: Includes fresh-cut produce, dips, sauces, and fully prepared meals with extended shelf life thanks to HPP. Dips, sauces, and guacamole are popular due to "clean label" compatibility. Fastest Growing: RTE meals catering to busy consumers who want freshness and quality could surge. Emerging areas like pet food (raw and gently cooked options), dairy alternatives, and even pharmaceuticals and cosmetics using HPP.

Beverages (juices in particular) likely hold a significant share due to HPP's early adoption and success within this segment. Ready-to-eat meals could exhibit strong growth potential, driven by the demand for convenient, fresh-like, "clean-label" options.

Europe High Pressure Processing Equipment Market Segmentation: By Vessel Orientation -

- Horizontal Systems

- Vertical Systems

Horizontal Systems: The most common type, offering efficient loading and unloading, particularly for larger commercial operations. Vertical Systems: Have a smaller footprint, making them potentially more suitable for businesses with space constraints or specific product handling needs.

Dominant Sub-Type: Horizontal systems are generally considered the industry standard for high-volume HPP processing.

Fastest Growing Sub-Type: While horizontal systems likely dominate, vertical systems might see niche growth driven by space optimization needs and specialized applications

Europe High Pressure Processing Equipment Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The United Kingdom has emerged as a significant player in the European HPP equipment market, driven by a strong commitment to food safety and the increasing consumer demand for fresh, minimally processed, and preservative-free food products. The UK market accounts for approximately 12% of the overall European HPP equipment market share. Germany stands as a dominant force in the European HPP equipment market, boasting a market share of approximately 18%. The country's robust food processing industry, coupled with a strong emphasis on innovation and sustainability, has driven the widespread adoption of HPP technology across various product categories. France, known for its rich culinary traditions and a thriving food processing industry, has embraced HPP technology as a means to preserve the quality and freshness of its iconic food products. The French HPP equipment market accounts for approximately 14% of the overall European market share. Italy's HPP equipment market has experienced significant growth in recent years, driven by the country's rich culinary heritage and the increasing demand for fresh, minimally processed food products. The Italian market accounts for approximately 11% of the overall European HPP equipment market share. Spain has emerged as a rapidly growing market for HPP equipment in Europe, accounting for approximately 13% of the overall market share. The country's thriving food and beverage industry, coupled with a strong focus on innovation and quality, has driven the adoption of HPP technology across various product segments. The remaining regions of Europe, collectively referred to as the "Rest of Europe," account for approximately 32% of the overall European HPP equipment market share. This diverse group includes countries such as the Netherlands, Belgium, Poland, Sweden, and Denmark, each with its unique market dynamics and growth trajectories.

COVID-19 Impact Analysis on the Europe High Pressure Processing Equipment Market:

Lockdowns and travel restrictions disrupted global supply chains, hindering the production and delivery of HPP equipment components. This led to delays in the installation and commissioning of new HPP systems. The general economic uncertainty caused by the pandemic made some food processors hesitant to invest in new equipment, including HPP systems. Existing projects might have been put on hold or delayed. With initial panic buying and a shift towards staple food items, demand for some HPP-processed products (like cold-pressed juices) might have softened temporarily. The rise of online grocery shopping potentially benefited HPP-processed products with extended shelf life, as they could reach consumers through this channel effectively. Heightened awareness of hygiene and food safety could have positively impacted the perception of HPP technology, potentially leading to a reevaluation of its benefits. The pandemic might have accelerated the existing trend towards "clean label" and minimally processed foods, potentially increasing interest in HPP as a suitable preservation method. The renewed emphasis on food safety could position HPP as a valuable tool for mitigating microbial risks, potentially attracting new adopters.

Latest Trends/ Developments:

Advancements in equipment design now allow for pressures exceeding the standard 600 MPa, opening new possibilities. At ultra-high pressures, HPP can inactivate spoilage enzymes, potentially eliminating the need for certain thermal treatments and further improving product quality. Researchers are exploring HPP's use in pharmaceuticals (e.g., enhancing drug solubility), cosmetics (for extraction and sterilization), and material processing (modifying material properties). Rising energy costs and the food industry's drive for sustainability are spurring innovation in HPP equipment with an emphasis on energy efficiency. Technologies are being developed to capture heat generated during the HPP process and reuse it, improving the overall efficiency of the operation. Real-time monitoring of pressure, temperature, and other critical parameters, integrated with data analytics, enables precise process control and optimization. The rise of plant-based food products creates new opportunities for HPP to maintain freshness, extend shelf life, and ensure the safety of plant-based dips, spreads, and alternative meat products.

Key Players:

- Avure Technologies

- Hiperbaric

- Multivac Sepp Haggenmüller SE & Co. KG

- Stansted Fluid Power Ltd

- NC Hyperbaric

- Elmasonic

Chapter 1. Europe High Pressure Processing Equipment Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe High Pressure Processing Equipment – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe High Pressure Processing Equipment Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe High Pressure Processing Equipment - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe High Pressure Processing Equipment Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe High Pressure Processing Equipment Market– By Pressure Range

6.1. Introduction/Key Findings

6.2. Low-Pressure Systems (100 - 300 MPa)

6.3. Mid-Pressure Systems (300 - 600 MPa)

6.4. Ultra-High-Pressure Systems (600+ MPa)

6.5. Y-O-Y Growth trend Analysis By Pressure Range

6.6. Absolute $ Opportunity Analysis By Pressure Range , 2024-2030

Chapter 7. Europe High Pressure Processing Equipment Market– By Application

7.1. Introduction/Key Findings

7.2 Beverages

7.3. Meat, Poultry, and Seafood

7.4. Fruits, Vegetables, and Ready-to-Eat (RTE) Meals

7.5. Y-O-Y Growth trend Analysis By Application

7.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe High Pressure Processing Equipment Market– By Vessel Orientation

8.1. Introduction/Key Findings

8.2. Horizontal Systems

8.3. Vertical Systems

8.4. Y-O-Y Growth trend Analysis Vessel Orientation

8.5. Absolute $ Opportunity Analysis Vessel Orientation , 2024-2030

Chapter 9. Europe High Pressure Processing Equipment Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Function

9.1.3. By Grade

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe High Pressure Processing Equipment Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Avure Technologies

10.2. Hiperbaric

10.3. Multivac Sepp Haggenmüller SE & Co. KG

10.4. Stansted Fluid Power Ltd

10.5. NC Hyperbaric

10.6. Elmasonic

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

European consumers are increasingly scrutinizing ingredient labels, seeking foods with fewer artificial ingredients, preservatives, and additives. This fuels a strong preference for "clean label" trends.

Purchasing HPP equipment requires a significant upfront investment, which can be a barrier to entry, particularly for smaller food businesses

Avure Technologies, Hiperbaric, Multivac Sepp Haggenmüller SE & Co.

KG, Stansted Fluid Power Ltd, NC Hyperbaric, Elmasonic.

Germany currently holds the largest market share, estimated at around 18%.

Several nations in Eastern Europe, like Poland, Hungary, Romania, etc., are experiencing economic expansion. This generally translates to increasing disposable incomes and evolving consumption patterns.