Europe Herbal Supplements Market Size (2024-2030)

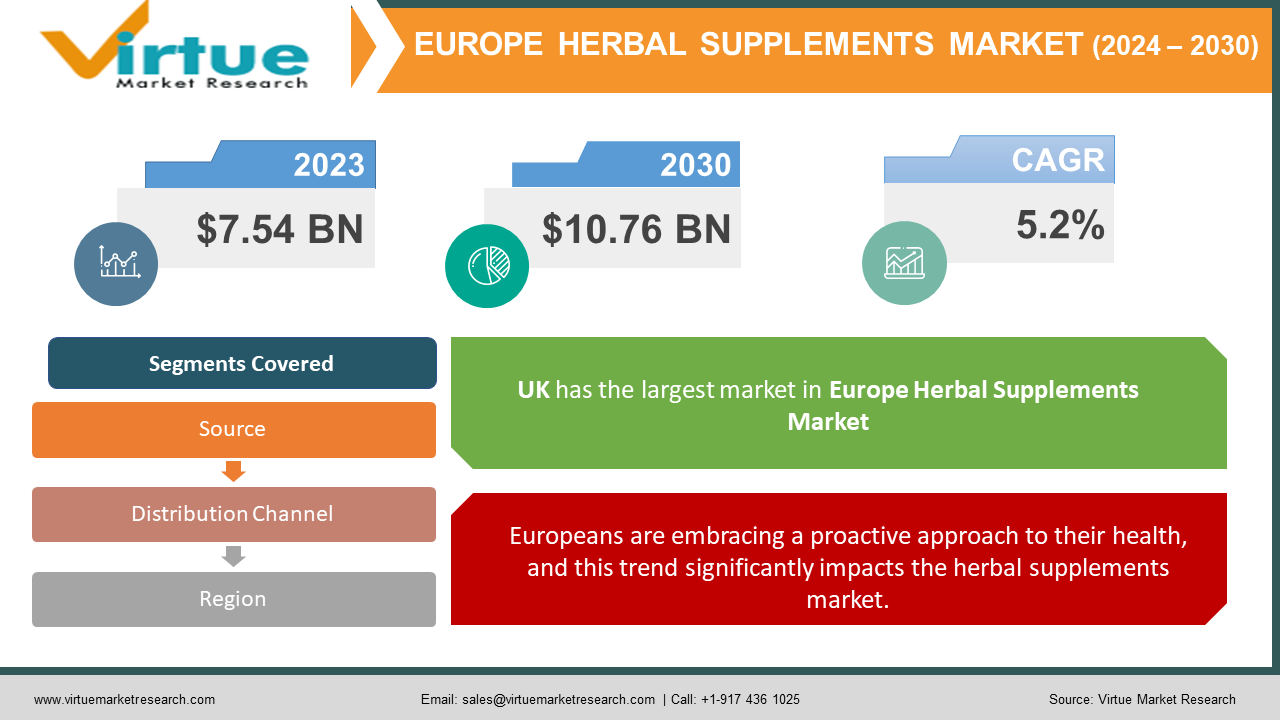

The Europe Herbal Supplements Market was valued at USD 7.54 Billion in 2023 and is projected to reach a market size of USD 10.76 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.2%.

The European Herbal Supplements Market is experiencing significant growth. Consumers are moving away from a purely reactive approach to health and embracing proactive wellness solutions and self-care. A growing interest in traditional medicine and plant-based remedies is fueled by a desire for natural alternatives to pharmaceuticals and their potential side effects. An aging population, increasingly aware of health maintenance, is a significant contributor to the demand for herbal supplements. Herbal supplements offer convenience and a sense of control over managing minor health concerns amidst hectic daily lives. A growing niche, with herbs like ashwagandha, Rhodiola, and holy basil gaining popularity for their potential in managing stress and promoting overall balance. Traditional outlets offer consumer advice and a focus on established brands with a reputation for quality. Convenience and a vast array of choices have driven online sales. This channel is crucial for niche brands and those targeting younger, tech-savvy consumers. Some brands prioritize building direct relationships with customers through their websites, emphasizing personalized product recommendations and subscription models. Consumers demand transparency, looking for herbal supplements with simple, natural ingredients that are sustainably sourced and free from artificial additives. Investments in research to substantiate the efficacy of herbal remedies will be crucial in building long-term trust and distinguishing high-quality products. Different regulations regarding herbal supplement labeling, marketing, and approved ingredients across European countries create complexity for manufacturers.

Key Market Insights:

Europe has a long history of utilizing herbs for medicinal and wellness purposes. This strong foundation creates a receptive market for herbal supplements alongside modern pharmaceuticals. The European Union (EU) has established regulations specific to herbal supplements, impacting labeling, permissible ingredients, and marketing claims. While creating a unified framework, some variations exist between member nations. The desire for "natural" remedies and a focus on preventative health drive the herbal supplement sector, aligning with broader wellness trends. Aging populations with increased health awareness, and a growing interest in holistic health among younger generations, are fueling market growth. Growing research into the efficacy of specific herbs adds legitimacy to the market, though it's crucial to remember that not all herbal remedies have robust scientific backing. Especially in countries like Germany, traditional herbal medicine systems remain influential, driving demand for specific herbal products with a long history of use. Navigating the specific regulations for herbal supplements within the EU and individual countries can be a hurdle, particularly for smaller manufacturers. Inconsistent quality control and the potential for adulteration or contamination erode consumer trust in some segments of the market. The scientific basis for the efficacy of certain herbal supplements can be weak or inconclusive, making it difficult to separate marketing hype from reality.

Europe Herbal Supplements Market Drivers:

Europeans are embracing a proactive approach to their health, and this trend significantly impacts the herbal supplements market.

Instead of merely waiting for illnesses to strike, consumers are actively seeking tools and practices to optimize their well-being and reduce future risks. People desire more control over their health journey, a shift away from solely relying on traditional healthcare systems. They want actionable steps and choices within their daily lives. There's an increasing focus on investing in lifestyle habits and supplements today as a means to enhance quality of life, reduce the burden of chronic conditions, and potentially even increase lifespan. They are positioned as empowering tools within the consumer's wellness toolkit, alongside other self-care practices like nutrition, exercise, and stress reduction. Many consumers perceive herbs, with their plant origins, as a more natural and potentially gentler approach to supporting their health goals. Herbal supplements address different aspects of wellness – sleep, immunity, digestion – mirroring the consumer's holistic definition of health. Demand is surging for supplements focused on everyday wellness – boosting energy, improving sleep quality, combating stress, and enhancing overall vitality – not just treating specific illnesses. The rise of subscription services for herbal supplements suggests consumers are integrating them into their ongoing lifestyle, not just for short-term use. Responsible brands play a crucial role in providing reliable information on herb usage, dosage, and potential interactions. This builds consumer trust and helps them effectively use supplements within their self-care routine. The market must guard against overpromising. Emphasizing realistic benefits is ethical and good for long-term market health, relying on the power of positive experiences, not unrealistic "miracle" narratives.

A growing segment of European consumers seeks alternatives or complements to conventional pharmaceuticals, further fueling the herbal supplements market.

A growing segment of the European population is actively seeking options outside the realm of conventional pharmaceuticals. Apprehension about the potential long-term side effects of certain prescription medications, even when effective, fuels the desire to explore other potential remedies. Many consumers, rightfully or wrongly, associate plant-based supplements with inherent safety and a gentler impact on the body than synthetically derived medications. Pharmaceuticals are often designed to treat specific, acute conditions. Many who experience chronic issues like sleep problems, mild-moderate anxiety, or digestive concerns feel traditional medication might not be the optimal long-term solution for managing these ongoing health challenges. Europe's long tradition of utilizing herbal medicine creates a baseline of familiarity and acceptance, even if an individual consumer isn't well-versed in specific herbs. Plants create a perception of a slower, more supportive approach to health concerns than pharmaceuticals designed for fast, targeted action. Countries like Germany, with strong traditions of herbal medicine, see these remedies integrated alongside conventional healthcare, providing a model that boosts acceptance of herbal options elsewhere in Europe.

Europe Herbal Supplements Market Restraints and Challenges:

The regulatory framework surrounding herbal supplements in Europe presents a significant hurdle for manufacturers, impacting the speed of innovation and creating uncertainty.

While the European Union provides a broad regulatory structure for dietary supplements, which includes herbal products, there are variations in the interpretation and implementation of these rules across member states. Herbal supplements fall into a sometimes-ambiguous category. The lack of a harmonized, universally accepted definition compared to pharmaceuticals creates complexities in labeling, permissible ingredients, and the types of health claims that can be made. The regulations often place the onus on herbal supplement companies to substantiate safety and efficacy, particularly when making specific health claims. This can be resource-intensive, especially for smaller players. Bringing new herbal products to the European market can be a lengthy and expensive process, sometimes taking years of navigating administrative hurdles. Smaller brands with potentially innovative products might be deterred by the regulatory complexities, limiting market diversity and consumer choice. The lack of consistent labeling and marketing standards across Europe can make it difficult for consumers to compare products or understand what level of scientific evidence backs them. The cost of regulatory compliance is passed on to the consumer, potentially impacting affordability and access to some herbal supplements. The ease of selling supplements online, combined with less stringent oversight in some cases, has led to products of dubious origin and questionable ingredients entering the market. Substitution with cheaper ingredients, mislabelling of potency, or contamination with heavy metals has unfortunately been documented in some segments of the supplement market, including herbs.

Europe Herbal Supplements Market Opportunities:

Substantiating the benefits of traditional herbal blends or long-used herbs with rigorous scientific research can broaden their appeal and add a layer of legitimacy. Highlighting the historical uses, cultural origins, and time-tested nature of certain herbal preparations offers a point of differentiation in a crowded market. Taking traditional herbal remedies and making them accessible through convenient formats (ready-to-drink teas, capsules, etc.) lowers the barrier to entry for consumers who might be intimidated by brewing their decoctions at home. Collaborations between herbal supplement brands and experts in traditional medicine systems (like qualified practitioners of TCM or Ayurveda) can create compelling and credible product lines. Developing herbal supplements and marketing them around specific goals like "better sleep", "stress resilience", or "enhanced focus" resonates more strongly with this market than merely treating individual symptoms. Creating daily or weekly "wellness rituals" that incorporate herbal supplements taps into the desire for proactive self-care practices. Think soothing evening teas or immunity-boosting shots. Partnerships with yoga studios, nutritionists, or health coaches allow herbal supplement brands to become part of a larger wellness ecosystem rather than just being a product on a shelf. Subscription models offering curated herbal supplement selections tailored to different wellness goals create convenience and foster a sense of continued support for consumers.

EUROPE HERBAL SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Source, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Schwabe Pharmaceuticals, Bayer, Bio Gaia, Salus Haus, Arko Pharma, Pukka Herbs, A.Vogel, Pascoe Naturmedizin, Rabens Saloner |

Europe Herbal Supplements Market Segmentation:

Europe Herbal Supplements Market Segmentation: By Source -

- Single Herbs

- Herbal Blends

Single Herbs: Hold a significant majority share, likely in the range of 60-75% of the market. This is driven by the popularity of well-known, "star" herbs with a broad consumer awareness. These supplements feature a single, well-defined plant as their core ingredient. Examples include turmeric capsules, peppermint tea, or Echinacea tinctures. They target consumers seeking the benefits of a specific herb with a known history of use. Herbal Blends: These hold the remaining 25-40% of the market. Demand is increasing due to a focus on holistic wellness goals and consumers seeking convenient, pre-formulated solutions. These blends thoughtfully combine multiple herbs, often based on traditional formulas or synergistic principles. They target specific health concerns like sleep support, digestive health, or immune system support. While single herbs remain a mainstay, herbal blends are experiencing noteworthy growth in the European market. The preventative health focus favors blends that target overall well-being rather than just treating an illness. Think blends supporting "stress resilience" or "gut health."

Europe Herbal Supplements Market Segmentation: By Distribution Channel -

- Supermarkets and Grocery Stores

- Online Retailers

- Specialty Stores

- Farmer's Markets and Local Stores

- Restaurants and Foodservice

With an estimated 40–50% of the market, pharmacies and drugstores hold the highest market share. The sheer quantity of pharmacies in Europe offers unmatched accessibility and a greater market for herbal supplements. Since chemists are frequently seen as medical experts, the herbal supplements they sell have more legitimacy. Health food stores: Take in a large share, perhaps 20–30%, thanks to their specialized offering and ability to draw in knowledgeable customers. Educated employees and direct-to-consumer retailers thrive at catering to customers who are looking for specialized herbs or luxury, well-chosen supplements. Online retailers are growing at the fastest rate and makeup between 15 and 25 percent of the market. Online marketplaces empower consumers by providing a wide range of herbal items, including specialty, foreign, and difficult-to-find local brands. Those who appreciate the convenience and lead busy lives will find it appealing to be able to get herbal supplements from home with only a few clicks. Supermarkets: Due to their accessibility and mass appeal, they have a smaller but increasing market proportion, ranging from 5 to 15%. Consumer to Consumer (DTC): Even though it's a minor niche right now—between 5 and 10%—it has potential and appeals to customers looking for particular brands.

Europe Herbal Supplements Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

United Kingdom (UK): Holds shares in the range of 18%. shares A significant market with a relatively open regulatory landscape towards herbal supplements and a population demonstrating interest in natural health solutions. Germany: Commands the largest share, often estimated between 20-22% of the European herbal supplements market. Holds a particularly strong position due to its historical embrace of traditional herbal medicine and a generally health-conscious consumer base. France: France accounts for approximately 14% of the European herbal supplements market share. A sizable market with growing interest in botanical supplements, though navigation of regulations can sometimes be a hurdle compared to other European nations. Italy: Italy contributes around 12% to the overall European herbal supplements market share. The use of herbal remedies has a long tradition in Italy, and this market shows steady consumption of plant-based supplements. Spain: Spain accounts for approximately 10% of the European herbal supplements market share. Awareness about preventative health is rising in Spain, contributing to growth within the herbal supplements sector. Rest of Europe: The remaining European countries, collectively referred to as the "Rest of Europe," account for approximately 24% of the overall market share. Encompasses a diverse range of countries including Poland, the Netherlands, and others. While each has a unique regulatory and cultural landscape, a general trend toward greater interest in natural health remedies can be observed across many of these nations.

COVID-19 Impact Analysis on the Europe Herbal Supplements Market:

With an invisible virus posing a global health threat, consumers turned their attention to anything that might bolster their immune systems. This led to a surge in demand for immune-supporting herbal supplements like elderberry, Echinacea, and astragalus. Lockdowns, social isolation, and anxieties surrounding the pandemic significantly impacted mental wellbeing. Herbal remedies traditionally associated with promoting relaxation and sleep, such as valerian root, lavender, and chamomile, saw increased sales. As physical stores faced closures or limited access, online retailers became the primary channel for purchasing supplements. This trend benefitted established online players and agile brands that pivoted effectively to e-commerce. In the initial stages of the pandemic, some consumers engaged in panic-buying of immune-supporting supplements, leading to temporary stock shortages for certain products. A flood of unverified information online about the efficacy of certain herbal remedies against COVID-19 led some consumers to become more skeptical about such claims. The experience of a global health crisis might have heightened awareness of the importance of preventive healthcare. This could lead to a sustained rise in overall use of herbal supplements for general health and well-being. Consumers are likely to be more discerning in the future, demanding transparency and evidence-based claims from herbal supplement brands. The e-commerce boom is likely to continue, permanently altering how consumers discover, purchase, and learn about herbal products. Investing in clinical trials and research that validate the efficacy and safety of specific herbal remedies for various conditions will be critical to building trust with consumers in the post-pandemic era.

Latest Trends/ Developments:

Brands investing in clinical research validating the efficacy of specific herbs or herbal blends for targeted health concerns will gain a significant competitive edge. Supplements backed by studies showing measurable benefits for conditions like sleep improvement, stress reduction, or cognitive function support will find a receptive audience. Partnerships between herbal supplement brands and research institutions lend credibility. The willingness to share study results openly builds trust. The focus is shifting towards using standardized extracts with known quantities of active compounds, ensuring consistency and allowing for more targeted dosing. Online questionnaires and apps that analyze individual health profiles, lifestyle factors, and goals can help create personalized herbal blends or recommend tailored regimens. While still nascent, the potential to incorporate genetic data (with careful ethical considerations) to understand how an individual might respond to certain herbs is an exciting area of exploration. AI-powered platforms that can analyze vast databases of traditional herbal knowledge alongside modern research findings could unlock personalized recommendations like never before. Collaborations with qualified practitioners of Traditional Chinese Medicine, Ayurveda, or European herbalists add a layer of personalization and cater to consumers seeking expertise.

Key Players:

- Schwabe Pharmaceuticals

- Bayer

- Bio Gaia

- Salus Haus

- Arko Pharma

- Pukka Herbs

- A.Vogel

- Pascoe Naturmedizin

- Rabens Saloner

Chapter 1. Europe Herbal Supplements Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Source

1.5. Secondary Product Source

Chapter 2. Europe Herbal Supplements Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Herbal Supplements Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Herbal Supplements Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Herbal Supplements Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Herbal Supplements Market– By Source

6.1. Introduction/Key Findings

6.2. Single Herbs

6.3. Herbal Blends

6.4. Y-O-Y Growth trend Analysis By Source

6.5. Absolute $ Opportunity Analysis By Source , 2024-2030

Chapter 7. Europe Herbal Supplements Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets and Grocery Stores

7.3. Online Retailers

7.4. Specialty Stores

7.5. Farmer's Markets and Local Stores

7.6. Restaurants and Foodservice

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Europe Herbal Supplements Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Source

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Herbal Supplements Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Schwabe Pharmaceuticals

9.2. Bayer

9.3. Bio Gaia

9.4. Salus Haus

9.5. Arko Pharma

9.6. Pukka Herbs

9.7. A.Vogel

9.8. Pascoe Naturmedizin

9.9. Rabens Saloner

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Consumers see value in supplementing their lifestyles to prevent ailments, optimize well-being, and enhance their quality of life long-term

The quality of herbal supplements can vary widely. Factors like plant sourcing, extraction methods, and manufacturing practices can impact the potency and purity of the final product.

Schwabe Pharmaceuticals, Bayer, Bio Gaia, Salus Haus, Arko Pharma

Pukka Herbs.

Germany currently holds the largest market share estimated at around 22%.

The UK market, while mature, has significant room for growth in specific segments, like online sales of herbal supplements and formats targeting stress and sleep support.