Europe Guarana Market Size (2024-2030)

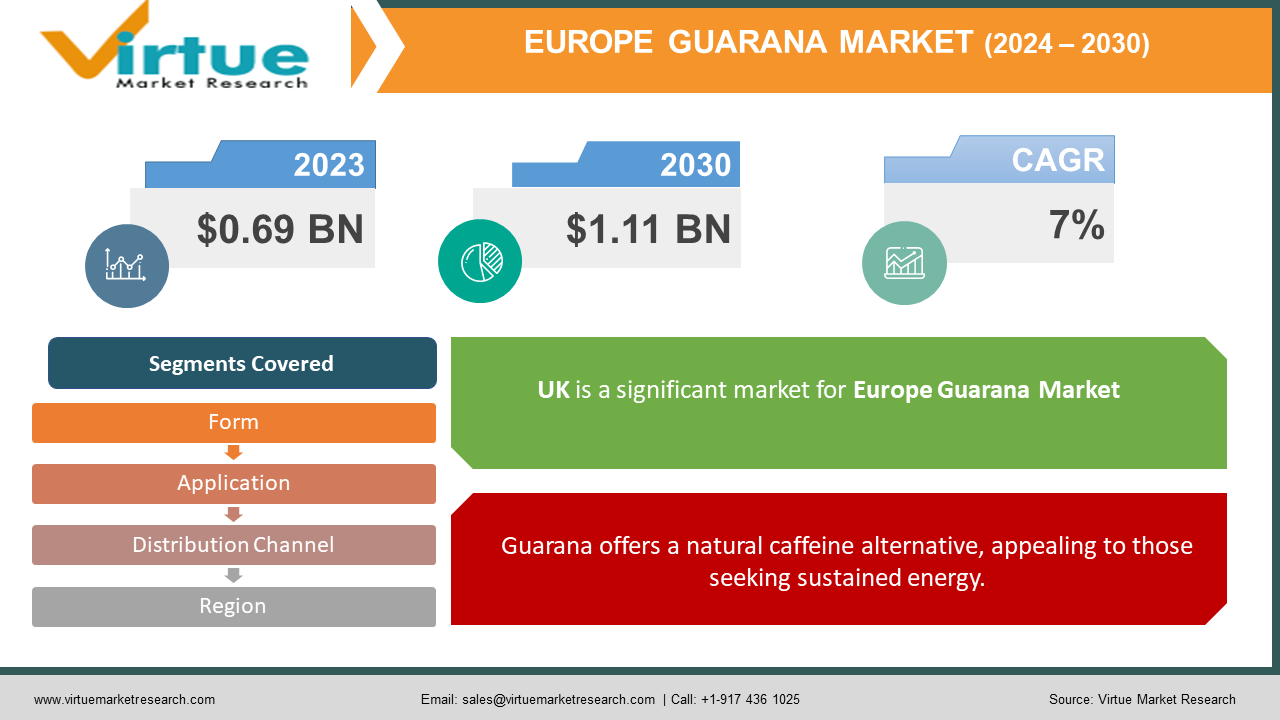

The Europe Guarana Market was valued at USD 0.69 billion in 2023 and is projected to reach a market size of USD 1.11 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 7%.

Guarana's natural caffeine content and antioxidant properties make it a popular choice, finding its way into energy drinks, dietary supplements, confectionery, and even cosmetics.

Key Market Insights:

- This focus on health and natural ingredients is reflected in the diversification of guarana products. Traditionally used in energy drinks, guarana is now finding its way into new applications. It's a popular ingredient in dietary supplements, particularly weight loss products, due to its perceived health benefits. Guarana is also used in confectionery, catering to a growing demand for functional candy options. The cosmetics industry is another emerging market for guarana, with its potential anti-aging properties attracting interest.

- Despite facing competition from other sources of caffeine and functional ingredients, the future looks bright for the European guarana market. Companies offering guarana-based products that cater to the growing demand for health-conscious and natural options are well-positioned for success.

The Europe Guarana Market Drivers:

Guarana offers a natural caffeine alternative, appealing to those seeking sustained energy.

Consumers are increasingly wary of the jitters and crashes often associated with synthetic caffeine sources. Guarana presents a compelling natural alternative, providing a sustained energy boost without the negative side effects. This growing preference for natural ingredients with a milder yet effective impact on energy levels is a key driver influencing market growth.

The Clean Label Movement's focus on transparency aligns well with guarana's natural origin.

Transparency in food and beverage ingredients is a rising concern for European consumers. The Clean Label Movement emphasizes the use of natural and recognizable ingredients, and guarana, being a naturally sourced product, resonates well with this movement. This consumer demand for transparency regarding food ingredients is a crucial driver fostering the European Guarana Market's expansion.

Product diversification beyond energy drinks expands guarana's reach into new applications.

Traditionally, guarana was primarily used in energy drinks. However, the market is witnessing exciting diversification with guarana finding applications in various other product categories. This includes its incorporation into dietary supplements, particularly weight loss products, due to its perceived health benefits. Additionally, guarana is being used in functional confectionery, catering to the growing demand for candy that offers more than just sweetness. The cosmetics industry is another emerging market for guarana, with its potential anti-aging properties attracting significant interest. This ongoing product diversification across various applications is a prominent driver shaping the European Guarana Market.

The Europe Guarana Market Restraints and Challenges:

Despite its growth trajectory, the European Guarana Market faces hurdles that could restrict its full potential. A major challenge is the high cost of guarana. With over 95% of global production originating in Brazil, producers hold significant sway over pricing. This can make guarana a relatively expensive ingredient for European manufacturers, potentially limiting its use in certain product categories. Additionally, while consumers perceive guarana to offer various health benefits, there's a lack of robust scientific evidence to definitively support all its claimed properties. This can lead to consumer hesitation and restrict the market for guarana-based products positioned on specific health claims. Furthermore, regulatory restrictions pose another challenge. Guarana's potential interactions with medications and side effects at high doses necessitate close monitoring by European regulatory bodies.

The Europe Guarana Market Opportunities:

Despite challenges, the European Guarana Market offers exciting opportunities for companies capitalizing on the natural and functional ingredient trend. The booming market for functional food and beverages presents a perfect fit for guarana, with its natural caffeine content and antioxidants aligning with consumer demands for health benefits beyond basic nutrition. Manufacturers can leverage this by creating innovative guarana-infused beverages and functional foods. Additionally, exploring new delivery formats like guarana-infused chewing gum or snack bars can attract new demographics seeking convenient and functional on-the-go options. Furthermore, highlighting sustainable sourcing practices for guarana can resonate with environmentally conscious European consumers, giving guarana-based products a competitive edge. The market also presents opportunities for premiumization. Guarana's natural origin and potential health benefits can position it as a premium ingredient. Blending guarana with other functional ingredients like ginseng or B vitamins can create unique and differentiated product offerings that command premium pricing. Finally, the cosmetics industry offers intriguing possibilities. The potential anti-aging properties of guarana are attracting interest, and guarana-infused skincare products could be a promising new market segment to explore.

EUROPE GUARANA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By form, application,, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Ambev, Coca-Cola, Red Bull, Monster Beverage Corporation, Duas Rodas Industrial, Guarana Antarctica, Sambazon, Major Guarana Extract/Powder Suppliers |

Europe Guarana Market Segmentation:

Europe Guarana Market Segmentation: By Form:

- Powdered Guarana

- Liquid Guarana

The European Guarana Market is divided into two main forms: powdered and liquid. Liquid guarana holds the dominant position due to its ease of use in beverages, the largest application segment. However, the powdered guarana segment might be experiencing faster growth as it offers manufacturers more flexibility for incorporating guarana into diverse applications like dietary supplements and functional food mixes.

Europe Guarana Market Segmentation: By Application:

- Beverages

- Dietary Supplements

- Confectionery

- Cosmetics

The European Guarana Market is segmented by application, with beverages holding the dominant share. Energy drinks are the primary driver within this segment. However, dietary supplements are the fastest-growing application sector due to guarana's perceived weight loss and overall health benefits. This trend is fueled by health-conscious consumers seeking natural alternatives.

Europe Guarana Market Segmentation: By Distribution Channel:

- Online Retail

- Supermarkets and Hypermarkets

- Convenience Stores

By distribution channel, supermarkets and hypermarkets hold the dominant share in the European Guarana Market due to their wide reach and established presence. However, online retail is expected to be the fastest-growing segment. E-commerce platforms offer convenient access to a wider guarana product variety, including supplements, functional foods and beverages, and potentially even cosmetics. This caters well to the growing health-conscious consumer base and allows for easier product discovery.

Europe Guarana Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The UK is a significant market for guarana, driven by a growing health-conscious population and a strong demand for energy drinks. Guarana-infused energy drinks are particularly popular among young adults and fitness enthusiasts seeking a natural source of caffeine. Additionally, the UK market shows interest in functional confectionery and dietary supplements containing guarana.

Germany is another major player in the European Guarana Market. Similar to the UK, guarana finds success in energy drinks and functional beverages. However, Germany also exhibits a growing interest in guarana-infused dietary supplements, particularly those targeted towards weight management and pre-workout routines.

The Italian market for guarana is influenced by a growing demand for functional food and beverages. Guarana is used in energy drinks and potentially functional coffee options. Additionally, there's interest in incorporating guarana into confectionery, particularly chocolates, to offer a unique flavor profile and potential cognitive function benefits.

The Spanish market for guarana is driven by a similar trend towards health-conscious choices. Guarana-infused energy drinks are popular, and there's potential for guarana's use in functional beverages and dietary supplements targeting athletes and fitness enthusiasts.

COVID-19 Impact Analysis on the Europe Guarana Market:

The COVID-19 pandemic's impact on the European Guarana Market was a mixed bag. Initial disruptions arose from lockdowns and travel restrictions that hindered guarana imports from Brazil, potentially causing price fluctuations. Additionally, concerns about social gatherings and gym closures led to a temporary dip in demand for guarana-infused energy drinks typically consumed on-the-go or pre-workout.

However, the pandemic also presented some long-term opportunities. The heightened focus on health and immunity during this time could position guarana favorably, with its perceived antioxidant properties attracting interest in functional foods and beverages marketed towards immune health. Moreover, the surge in e-commerce provided a convenient alternative for consumers seeking guarana-based products like supplements and functional foods during lockdowns. The home fitness boom might have also driven demand for guarana-infused dietary supplements marketed for pre-workout support or energy enhancement.

Overall, while the pandemic presented initial challenges, the European Guarana Market seems to be adapting. The long-term focus on health and immunity, coupled with the rise of e-commerce and potential applications in home fitness routines, could contribute to the market's continued growth in the post-pandemic era.

Latest Trends/ Developments:

The European Guarana Market is experiencing a wave of innovation that broadens its appeal and functionality. Guarana-infused chewing gum, snack bars, and even functional powders for beverages are gaining traction, catering to busy consumers seeking convenient and on-the-go options. Furthermore, guarana is being increasingly blended with other functional ingredients. For instance, guarana combined with ginseng creates products promoting enhanced energy and focus, while blends with B vitamins target cognitive function support. This allows manufacturers to cater to specific consumer needs and potentially command premium pricing. Looking beyond traditional applications, the cosmetics industry is taking notice of guarana's potential anti-aging properties. New guarana-infused skincare products like serums or moisturizers targeting wrinkles or fatigue might soon appear on store shelves. Finally, some European companies are exploring alternative guarana sources in Africa or Southeast Asia to diversify beyond the dominant Brazilian production and potentially offer more cost-effective guarana options. These trends showcase the dynamism of the European Guarana Market, with a focus on innovation and addressing evolving consumer needs for natural and functional ingredients.

Key Players:

- Ambev

- Coca-Cola

- Red Bull

- Monster Beverage Corporation

- Duas Rodas Industrial

- Guarana Antarctica

- Sambazon

- Major Guarana Extract/Powder Suppliers

Chapter 1. Europe Guarana Market Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Guarana Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Guarana Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Guarana Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Guarana Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Guarana Market– By Form

6.1. Introduction/Key Findings

6.2. Powdered Guarana

6.3. Liquid Guarana

6.4. Y-O-Y Growth trend Analysis By Form

6.5. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 7. Europe Guarana Market– By Application

7.1. Introduction/Key Findings

7.2 Beverages

7.3. Dietary Supplements

7.4. Confectionery

7.5. Cosmetics

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Guarana Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Convenience Stores

8.4. Online Retailers

8.5. Y-O-Y Growth trend Analysis Distribution Channel

8.6. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Guarana Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Form

9.1.3. By Application

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Guarana Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Ambev

10.2. Coca-Cola

10.3. Red Bull

10.4. Monster Beverage Corporation

10.5. Duas Rodas Industrial

10.6. Guarana Antarctica

10.7. Sambazon

10.8. Major Guarana Extract/Powder Suppliers

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Europe Guarana Market was valued at USD 0.69 billion in 2023 and is projected to reach a market size of USD 1.11 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 7%.

. Surging Demand from Health-Conscious Consumers, Natural Alternative to Synthetic Caffeine, Transparency in Food and Beverages, Product Diversification Beyond Energy Drinks.

Online Retail, Supermarkets and Hypermarkets, Convenience Stores

. UK and Germany are generally considered the most dominant regions in the European Guarana Market due to their strong demand for guarana-infused products, particularly energy drinks.

Ambev, Coca-Cola, Red Bull, Monster Beverage Corporation, Duas Rodas Industrial, Guarana Antarctica, Sambazon, Major Guarana Extract/Powder Suppliers.