Europe Greenhouse Horticulture Market Size (2025 – 2030)

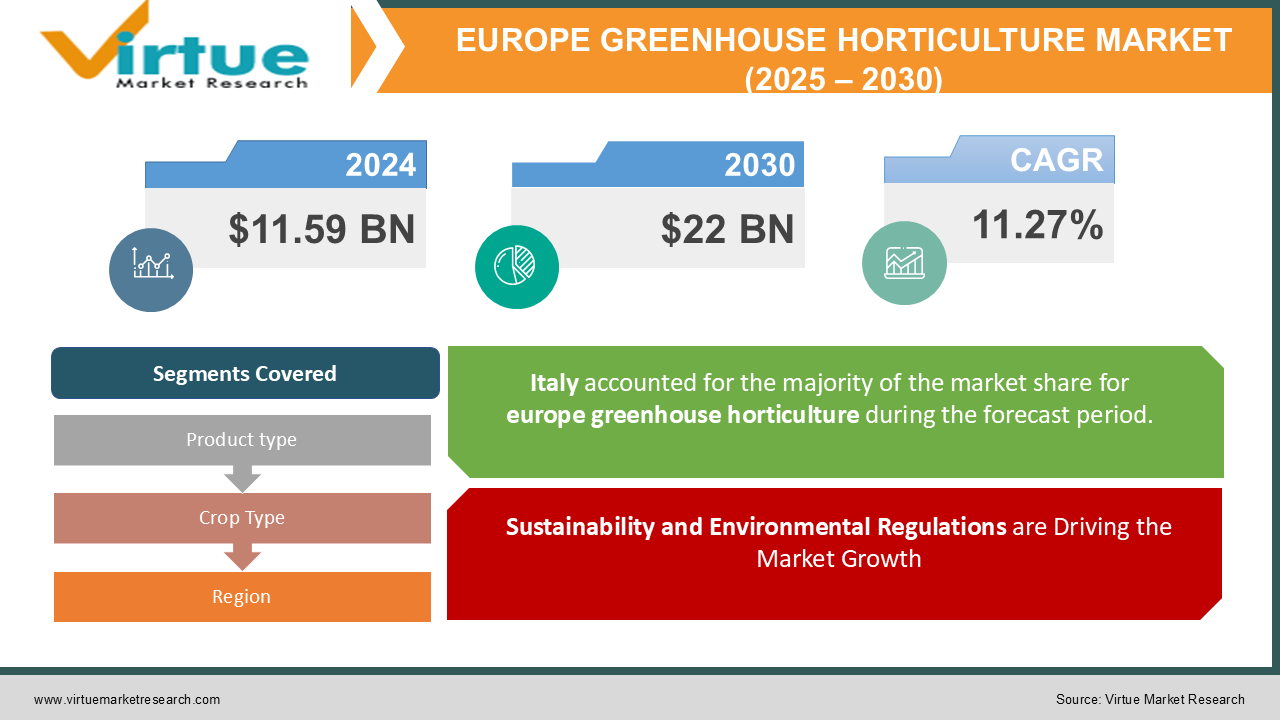

The Europe Greenhouse Horticulture Market was valued at USD 11.59 Billion and is projected to reach a market size of USD 22 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 11.27%.

Greenhouse horticulture, also known as protected cropping, is the practice of growing crops in a controlled environment. This type of farming is done by using greenhouses, shade houses, or other structures to protect plants from pests, disease, and adverse weather. The purpose of this process is to produce high-quality crops that can meet the demand for food products, that these crops cannot grow in the external environment. Greenhouses are built to ensure a controlled environment, protection of crops from pests and diseases, and protection from adverse weather. Different types of tools and integrated agricultural technologies are used in order to build and operate greenhouses. Spain, Italy, and the Netherlands are the countries in Europe with the highest number of greenhouses and horticulture produce. This practice is driven by factors like increasing consumer preference for locally grown food, technological advancements in greenhouse systems, and government initiatives promoting sustainable farming methods.

Key Market Insights:

-

European greenhouses have started to adopt advanced climate-control systems, including automatic lighting and temperature control mechanisms. These systems ensure good harvest with optimized productivity and reduced energy consumption.

-

Almost 50% of greenhouses in the region are equipped with advanced atmosphere control as well as hydroponic systems. The use of hydroponics is estimated to grow at a rate of 15% per year for the forecast period.

-

The adoption of energy-efficient solutions such as high-end LED lighting and heat recovery systems has reduced the operational cost of greenhouses by almost 20% in the last 5 years.

-

European greenhouse produce is exported worldwide including major export to North American and EU regions.

-

Netherlands and Spain account for over 60% of the region’s total greenhouse area, with the total area of greenhouse cultivation increasing day by day.

-

The European consumer market is extremely aware and concerned with technologically advanced and healthy farming, prioritizing more freshly grown and local vegetables, fruits, and flowers.

Europe Greenhouse Horticulture Market Drivers:

Sustainability and Environmental Regulations are Driving the Market Growth

The awareness about eco-friendly farming and technological advancements related to greenhouse horticulture is increasing in the European region. Various government regulations related to the environment and energy-efficient farming solutions are contributing the most to greenhouse horticulture. These solutions include systems designed specifically to control the internal atmosphere of greenhouses, water-saving systems, and sustainable crop protection systems.

Demand for Local and Fresh Produce is Driving the Market Growth

Due to increasing scientific research in this domain, people have started to prefer locally grown and fresh vegetable and fruit produce. Due to the controlled environment in the greenhouses, the quality of produce is good, fresh, and free from diseases. An increase in the demand and need for organic farming is contributing to this domain. Especially after COVID-19, people have started to take diet habits more seriously and have decided their preferences regarding the vegetables and fruits they eat, their origin, quality, and handling of the produce. This is resulting in increased demand for advanced agricultural practices with more quality-oriented processes and state-of-the-art technology, to maintain the freshness of the crop.

Technological Advancements in Precision Agriculture

In the past decade, advancements in agricultural equipment are consistently rising. This has resulted in advanced and efficient farming processes integrated with sensors and data acquisition systems. Advanced controls of temperature, humidity, and soil moisture are possible which has increased efficiency, and allows finer adjustments in environmental parameters, nutrient distribution, and moisture in soil according to the crop species. This has resulted in more precision in process, massive savings in water usage, and improved productivity.

Europe Greenhouse Horticulture Market Restraints and Challenges:

Higher Initial and Operational Costs

Infrastructure, technology, and energy investments are necessary for the setup and operation of greenhouses. For many prospective growers, especially smaller-scale industries and organizations, the high upfront expenditures of sophisticated systems like climate control, LED lighting, and automated systems, along with continuing operating costs (such as personnel and energy costs), can be challenging.

Energy Dependency and Costs

Most of the greenhouses are entirely closed systems, which means they have their own energy, water, and humidity cycles, precisely controlled by advanced equipment. This obviously needs a lot of extra energy to maintain parameters. Especially in colder weather, high amounts of energy are needed to maintain temperatures for the health of the crop. Considering fluctuating energy prices and dependency on energy sources, this can hamper total expected returns and reduce productivity.

Labor Shortages

Maintaining greenhouses and their internal mechanisms and operations needs a lot of labor work and thus needs a skilled workforce to perform horticulture. However, Europe is currently experiencing a shortage of labor, driven by demographic changes, migration restrictions, and the limited appeal of farm work. This labor shortage can lead to higher wages, reduced productivity, and challenges in scaling up operations efficiently.

EUROPE GREENHOUSE HORTICULTURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

11.27% |

|

Segments Covered |

By Product type, Crop Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Royal Philips, Signify (formerly Philips Lighting), KUBO (Kubo Greenhouses), Hortimax, Netafim, Priva, Sercom, Rijk Zwaan, Dümmen Orange, AG Leader Technology |

Europe Greenhouse Horticulture Market Segmentation: by Product Type

-

Greenhouses

-

Greenhouse Equipment

-

Others

Segmentation by product type includes the core distribution of the physical setup needed to run greenhouses. The greenhouse itself is the core infrastructure and hence this segment is the most popular one. They come in both traditional glass and modern polycarbonate or plastic form factors. As automation, integration with IoT, monitoring tools, data gathering systems, and climate control systems are increasing, the increase in the greenhouse equipment segment is being noticed. This is the second most popular segment. The other segment includes various supplementary products like fertilizers, plant protection products, and substrates. This segment is relatively very small.

Europe Greenhouse Horticulture Market Segmentation: by Crop Type

-

Fruits and Vegetables

-

Flowers and Ornamentals

-

Medicinal Plants

-

Others

First fruits and vegetables are the most popular segment in the horticulture market. More and more fruits and vegetables, including tomatoes, cucumbers, peppers, strawberries, and herbs, are being produced in greenhouses. Greenhouses help to extend the growing seasons of these fruits and vegetables, particularly in colder weather. The second segment particularly includes flowers such as roses, lilies, and decorative plants. This market is dominated and driven by consumer interest in home gardening, landscaping, and the floral trade. The cultivation of medicinal plants in greenhouses is also growing within the horticultural market. These plants include herbs and plants with therapeutic properties like lavender, chamomile, and cannabis considering legal status in particular countries. With an increasing interest in natural remedies, alternative medicine, and herbal wellness products, the demand for medicinal plants is increasing. The other segment includes a variety of crops such as mushrooms, microgreens, and other specialized plants that are less commonly cultivated in greenhouses.

Europe Greenhouse Horticulture Market Segmentation: Regional Analysis

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

The UK has a smaller market when it comes to horticulture. About 5% to 7% of the total market share around Europe is from the UK. Crops like lettuce, tomatoes, cucumbers, and herbs are harvested in greenhouses in the UK.

Germany also has a relatively smaller market in horticulture. Vegetables (e.g., tomatoes, lettuce), herbs, and ornamental plants are grown in the greenhouses in Germany. About 8% to 10% of the European horticulture market is occupied by Germany.

France has a diverse greenhouse horticultural sector, with cultivation mainly in the southern regions. French greenhouse growers focus on a variety of crops, including vegetables, fruits, and flowers. France has about 7% to 10% market share in the European horticulture market.

Italy is a major player in the greenhouse sector, with a well-established tradition of horticulture, particularly in regions like Sicily and Puglia. Tomatoes, lettuce, cucumbers, and flowers are typically grown in Italy. 10% to 15% of the market in this domain is captured by Italy.

Spain has a large greenhouse industry, particularly in the southern regions like Almería, which is one of Europe’s most important horticultural areas. Spanish greenhouses focus on vegetables, especially tomatoes, peppers, cucumbers, and strawberries. 15%-20% of the market is captured by Spain. Several other European countries have smaller but emerging greenhouse horticulture markets, including Belgium, Denmark, Poland, and Greece. These regions share about 40% to 45% market share.

COVID-19 Impact Analysis on the Europe Greenhouse Horticulture Market:

With the emergence of the COVID-19 outbreak in 2019, it has resulted in stricter restrictions in almost all sectors to avoid the spread of the virus. Due to the shutdown of several industries and countries fighting the pandemic, this market faced a lot of challenges. Supply chain disruption was a key problem faced by this industry, along with labor shortage. Both of these issues lead to increased costs, delayed deliveries, and problems in manufacturing. Due to changing consumer patterns, the demand for locally grown leafy vegetables and fruits was found to increase, but at the same time, demand for flowers and ornamental plants decreased. Digitization of greenhouse processes was promoted in this period. Implementation of IoT-based monitoring solutions was promoted.

Latest Trends/ Developments:

Currently, the implementation of cutting technology is being done with conventional greenhouse-based farming. Development and use of Advanced materials for building greenhouses is also being promoted. All of these implementations target efficient produce as well as less energy consumption. New trends of vertical farming and hydroponics are also seen in the European region. AI and Data Analytics are also being used in greenhouse-based farming due to the integration of IoT devices. New developments in robotics and drone-based monitoring are also being implemented along with automated climate control. Studies of organic manure and fertilizers in order to maximize the use of organic material are being promoted by health-conscious people and organizations. Developments of hybrid greenhouses are also being promoted and automated climate control and monitoring systems are being developed.

Key Players:

-

Royal Philips

-

Signify (formerly Philips Lighting)

-

KUBO (Kubo Greenhouses)

-

Hortimax

-

Netafim

-

Priva

-

Sercom

-

Rijk Zwaan

-

Dümmen Orange

-

AG Leader Technology

Chapter 1. Europe Greenhouse Horticulture Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Europe Greenhouse Horticulture Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Europe Greenhouse Horticulture Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Europe Greenhouse Horticulture Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Europe Greenhouse Horticulture Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Europe Greenhouse Horticulture Market – By Product

6.1 Introduction/Key Findings

6.2 Greenhouses

6.3 Greenhouse Equipment

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Europe Greenhouse Horticulture Market – By Crop Type

7.1 Introduction/Key Findings

7.2 Fruits and Vegetables

7.3 Flowers and Ornamentals

7.4 Medicinal Plants

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Crop Type

7.7 Absolute $ Opportunity Analysis By Crop Type, 2025-2030

Chapter 8. Europe Greenhouse Horticulture Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Crop Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Crop Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Crop Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Crop Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Crop Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Greenhouse Horticulture Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Royal Philips

9.2 Signify (formerly Philips Lighting)

9.3 KUBO (Kubo Greenhouses)

9.4 Hortimax

9.5 Netafim

9.6 Priva

9.7 Sercom

9.8 Rijk Zwaan

9.9 Dümmen Orange

9.10 AG Leader Technology

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Europe Greenhouse Horticulture Market was valued at USD 11.59 Billion and is projected to reach a market size of USD 22 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 11.27%.

Increasing demand for a healthy and nutritious diet, improvements and developments in sustainable greenhouse technology, promotion through government projects and regulations, increase in demand for locally grown fresh vegetables and fruits, and precision agricultural equipment are a few key drivers in this market.

Segmentation by Product Type in the European Horticulture and Greenhouse market includes Greenhouses, Greenhouse Equipment, and other supplementary products.

Spain is the most dominant country in the Europe Greenhouse Horticulture Market.

Royal Philips, Signify (formerly Philips Lighting), KUBO (Kubo Greenhouses), Hortimax, Netafim, Priva, Sercom, Rijk Zwaan, Dümmen Orange, AG Leader Technology